Elevate Your Private Equity Operations with Powerful CRM Software

The Case for CRM in Private Equity Firms

Managing private equity without a dedicated CRM is like navigating complex deals with no map—critical details slip through the cracks.

Here’s what often goes wrong when firms rely on spreadsheets and fragmented tools:

- Investor relations become disjointed — tracking commitments, communications, and updates gets overwhelming.

- Deal pipeline visibility fades — missing key milestones and deadlines delays decisions.

- Portfolio company monitoring lacks cohesion — performance metrics and communications scatter across channels.

- Fundraising efforts lose momentum — no centralized tracking of prospects and outreach.

- Due diligence processes become chaotic — documents, notes, and tasks get lost or duplicated.

- Cross-team collaboration suffers — inconsistent updates and handoffs create bottlenecks.

- Compliance and reporting get complicated — no unified system to ensure timely, accurate disclosures.

- Onboarding new team members is inefficient — no centralized history to get them up to speed quickly.

Unlock Clear Advantages Over Traditional Private Equity Tools

Traditional Methods

- Investor info scattered across emails and spreadsheets

- No real-time deal tracking or status updates

- Limited visibility into portfolio company performance

- Manual follow-ups prone to oversight

- Disjointed due diligence documentation

- Collaboration across teams is slow and error-prone

- Compliance tracking is reactive and cumbersome

- No automated reminders for critical deadlines

ClickUp CRM

- Centralize all investor and deal data in one platform

- Visual pipelines track every stage of deals and fundraising

- Monitor portfolio KPIs with customizable dashboards

- Automate follow-up tasks and communications

- Consolidate due diligence materials and notes

- Seamless cross-team collaboration with comments and mentions

- Integrated compliance checklists and reporting tools

- Smart reminders ensure no deadline is missed

How CRM Software Empowers Private Equity Firms

Centralized Investor and LP Management

Streamlined Deal Pipeline Tracking

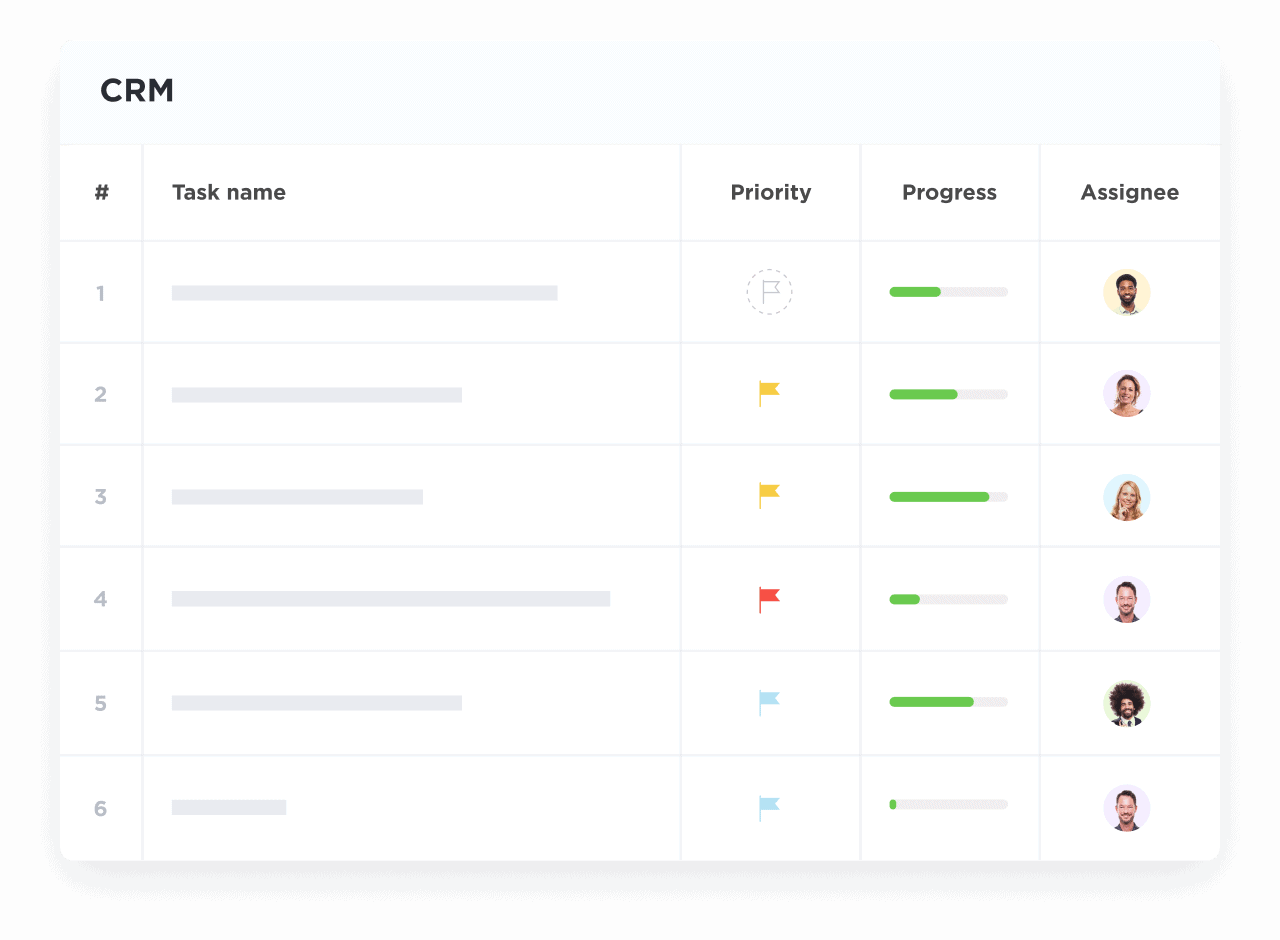

Portfolio Company Performance Monitoring

Efficient Fundraising Coordination

Organized Due Diligence Processes

Enhanced Compliance and Reporting

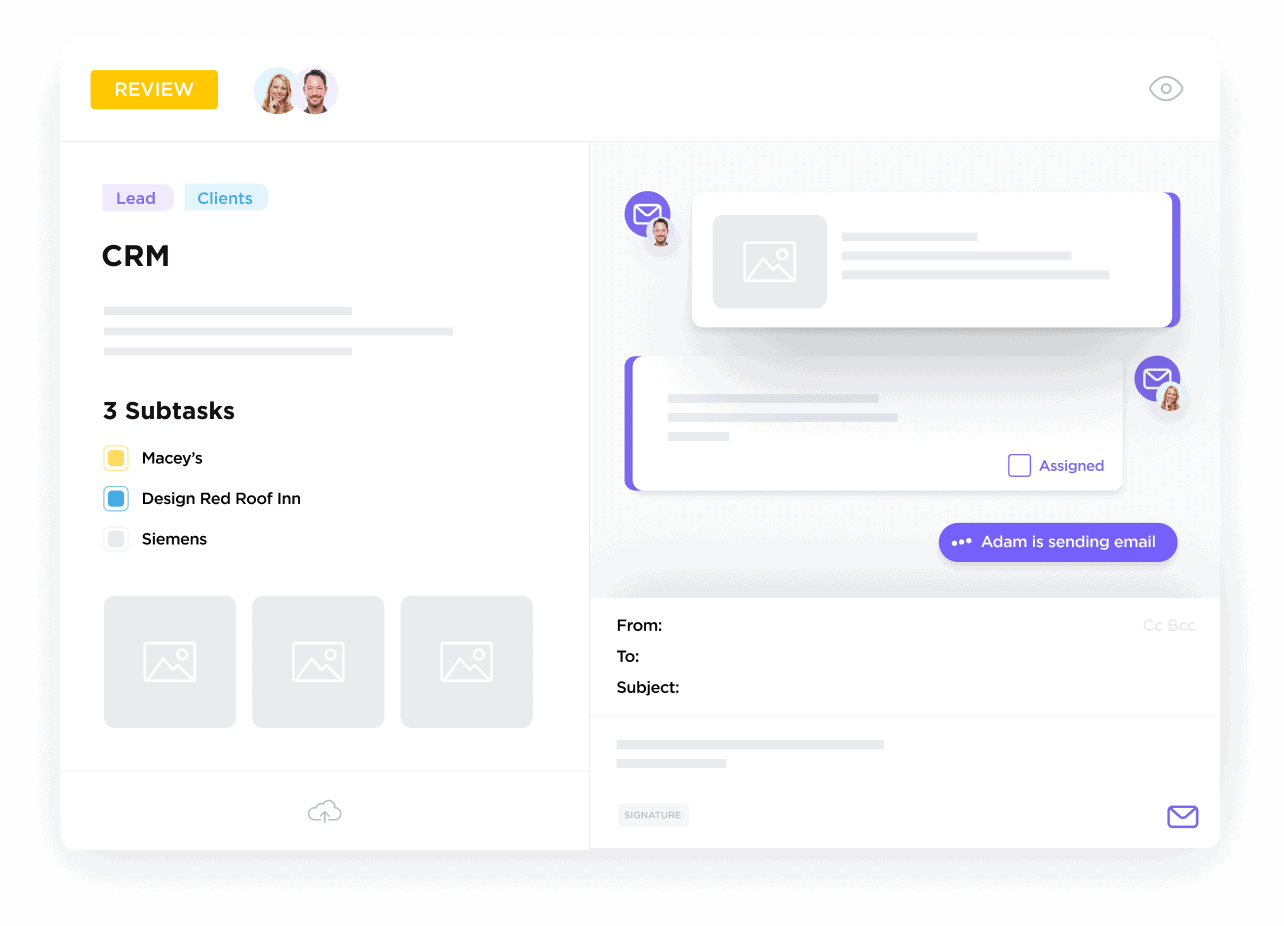

Cross-Functional Team Collaboration

Actionable Insights with ClickUp Brain

Automated Workflow Management

Who Benefits Most from ClickUp CRM in Private Equity

If You’re a Managing Partner

If You’re an Investment Associate

If You’re an Investor Relations Manager

How ClickUp CRM Optimizes Private Equity Management

Build a Comprehensive Investor Database

Consolidate all contact info, commitments, and interactions with customizable fields and activity logs.

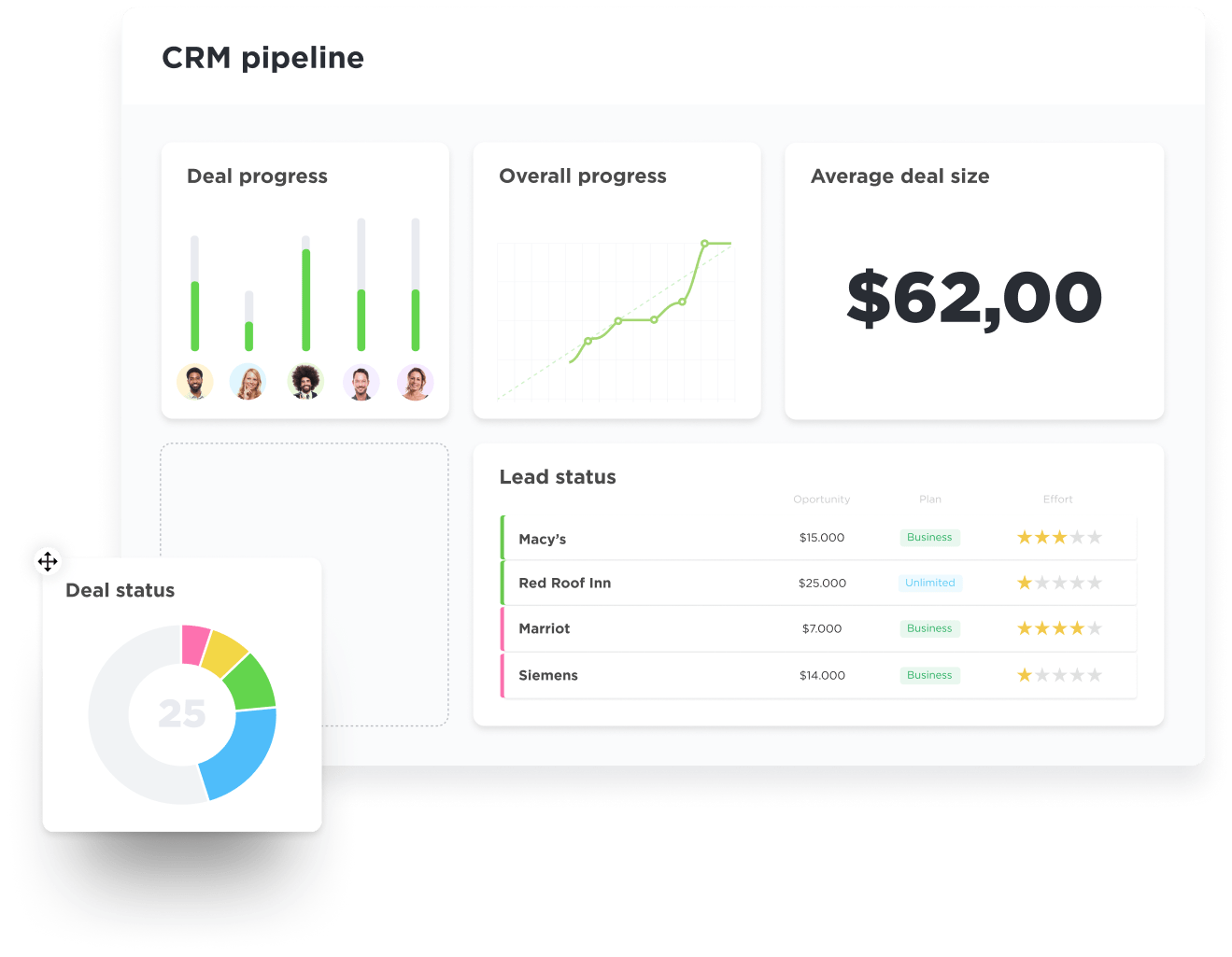

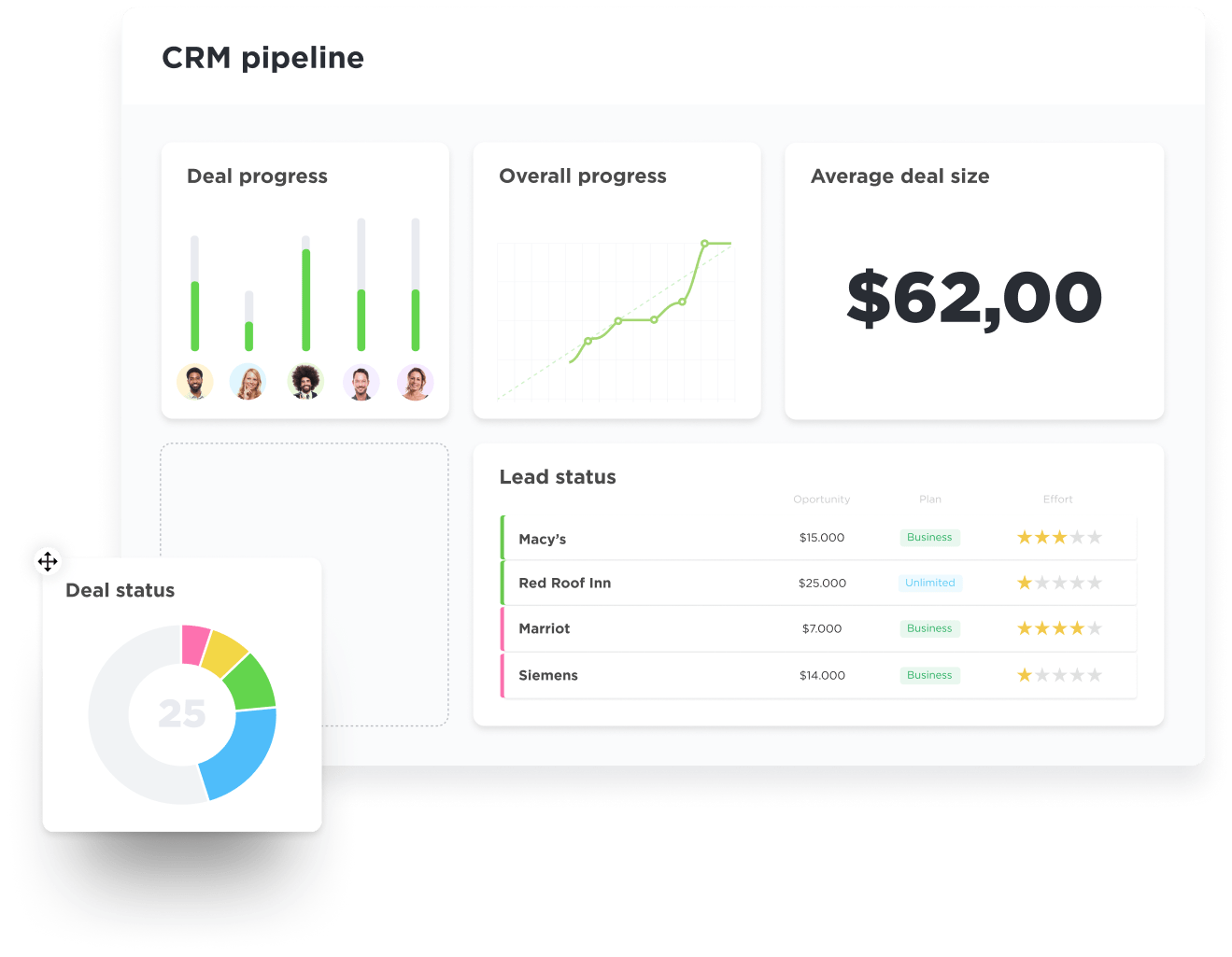

Visualize Deal Pipelines Clearly

Track every opportunity’s status, stage, and owner with intuitive boards and dashboards.

Log Communications and Documents

Attach emails, call notes, contracts, and reports directly to relevant deals and contacts.

Automate Follow-Ups and Tasks

Convert conversations into actionable tasks with deadlines, owners, and automated reminders.

Integrate Financial and Compliance Data

Keep all critical documents and regulatory info centralized and easily accessible.

Get Real-Time Insights with Dashboards

Monitor portfolio health, fundraising progress, and team performance at a glance.