Top AI Prompts for Insurance Claims Processing

AI Prompts Revolutionizing Insurance Claims Processing

Handling insurance claims efficiently requires more than just paperwork—it demands precision, speed, and coordination.

From initial claim intake to damage assessment, fraud detection, and settlement approvals, insurance claims processing involves numerous steps—and countless documents, communications, and deadlines. AI prompts are now playing a pivotal role.

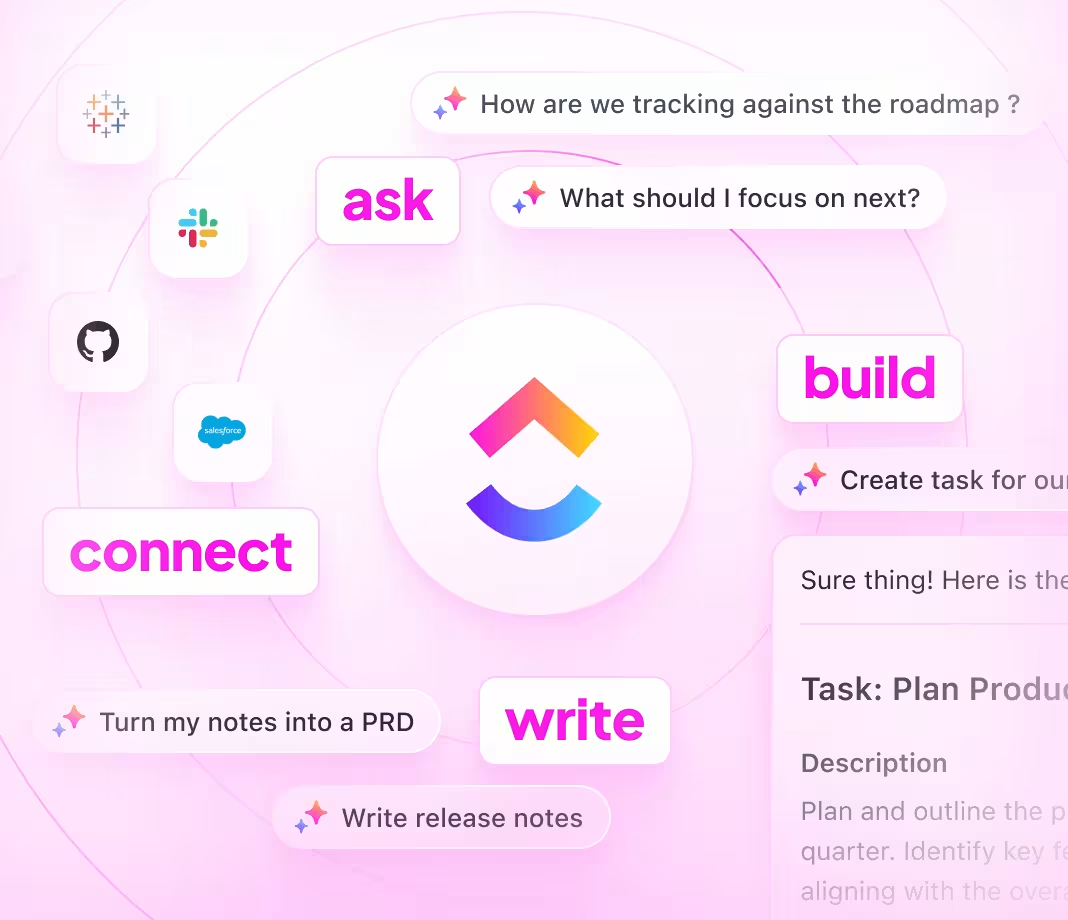

Claims teams are leveraging AI to:

- Quickly identify relevant policy details and claim history

- Generate initial claim summaries and assessment reports with ease

- Extract key information from complex legal and medical documents

- Transform unstructured claim notes into clear action plans and task lists

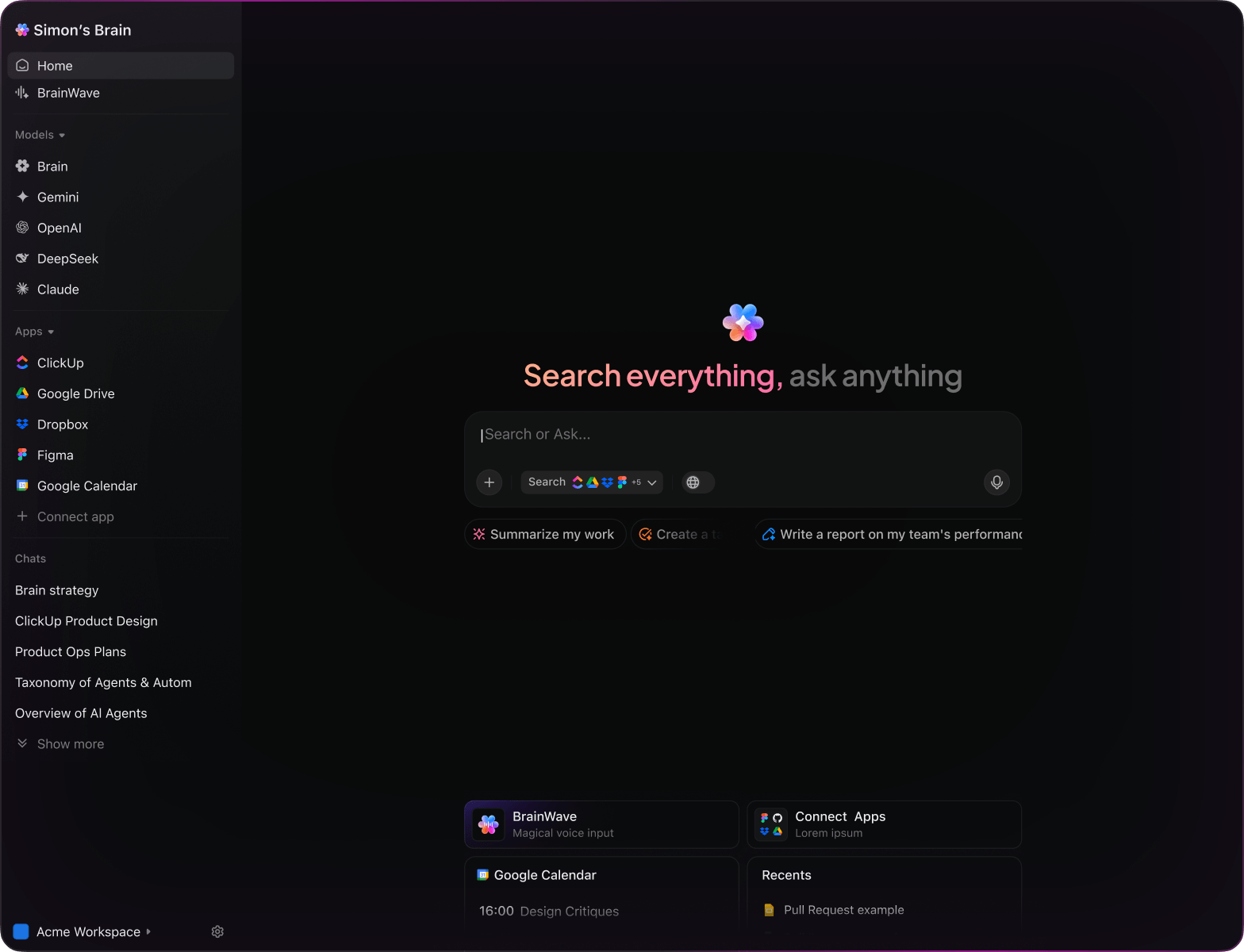

Integrated into daily tools—such as documents, dashboards, and workflows—AI in platforms like ClickUp Brain acts as a proactive partner, converting scattered inputs into streamlined, actionable processes.

Why ClickUp Brain Stands Out

Conventional AI Solutions

- Constantly switching apps to collect information

- Repeating your objectives with every query

- Responses that miss your specific needs

- Hunting through multiple platforms for a single document

- Interacting with AI that only processes input

- Manually toggling between different AI engines

- Merely a browser add-on without deep integration

ClickUp Brain

- Instantly accesses your claims, documents, and team updates

- Retains your previous interactions and objectives

- Provides detailed, relevant guidance

- Searches across all your resources in one place

- Supports voice commands with Talk to Text

- Automatically selects the optimal AI model: GPT, Claude, Gemini

- Dedicated desktop app for Mac & Windows designed for efficiency

15 Essential AI Prompts for Insurance Claims Teams

List 5 typical fraud patterns found in recent automobile insurance claims, based on the ‘Auto Claims Q1’ report.

ClickUp Brain Behavior: Analyzes linked documents to highlight recurring suspicious activities and red flags.

Summarize recent compliance changes impacting health insurance claims processing in the US.

ClickUp Brain Behavior: Reviews internal policy documents and integrates public regulatory updates if accessible.

Create a detailed checklist for evaluating property damage claims, using the ‘Property Claims Manual’ and prior assessment notes.

ClickUp Brain Behavior: Extracts key evaluation criteria and formats them into an actionable checklist.

Summarize average processing times for manual versus automated claims workflows using the ‘Claims Efficiency’ dataset.

ClickUp Brain Behavior: Pulls data from internal reports and presents a concise comparison of timelines.

Identify essential documents needed to process commercial vehicle insurance claims, referencing claims policy and supplier guidelines.

ClickUp Brain Behavior: Scans relevant documents to compile a comprehensive list of required paperwork.

From the ‘High-Value Claims Audit’ report, develop a structured risk assessment protocol.

ClickUp Brain Behavior: Extracts audit criteria and organizes them into a clear, step-by-step evaluation process.

Identify recent trends in how claims teams communicate with customers, based on post-2023 feedback and communication audits.

ClickUp Brain Behavior: Detects patterns and best practices from linked communication records and surveys.

Analyze survey responses to highlight main challenges claims processors face during adjudication.

ClickUp Brain Behavior: Extracts recurring themes and presents prioritized issues for team review.

Craft concise, customer-friendly messages for claim status alerts, guided by the ‘Communication Tone Guide’.

ClickUp Brain Behavior: Uses tone references to suggest multiple empathetic phrasing options.

Outline key updates in data protection laws relevant to insurance claims processing and their operational impact.

ClickUp Brain Behavior: Reviews compliance documents and highlights critical adjustments for claims teams.

Extract documentation standards for injury claims from regional compliance files and internal protocols.

ClickUp Brain Behavior: Compiles measurement criteria and legal requirements into a practical reference guide.

Develop a comprehensive damage evaluation checklist using US insurer standards and recent assessment reports.

ClickUp Brain Behavior: Identifies key inspection points and organizes them by damage severity and vehicle area.

Summarize eco-friendly practices adopted by leading insurance companies, referencing competitive analysis documents.

ClickUp Brain Behavior: Converts comparative data into an easy-to-read summary highlighting green initiatives.

Identify new automation technologies and workflows adopted in claims adjudication from recent research and reports.

ClickUp Brain Behavior: Synthesizes insights from internal studies and industry updates.

Extract and prioritize frequent issues reported by customers in Southeast Asia regarding claims experience.

ClickUp Brain Behavior: Analyzes survey data, feedback notes, and support tickets to highlight key pain points.

AI Prompts Tailored for Insurance Claims with ClickUp Brain

ChatGPT Insurance Claims Prompts

- Outline a 5-step claims assessment summary focusing on damage severity and policy coverage.

- Compose customer communication templates for claim status updates emphasizing clarity and empathy.

- Generate 3 alternative fraud detection scenarios and explain their impact on claim validation.

- Draft a detailed workflow for processing auto accident claims from report to payout.

- Compare recent claim case studies and highlight common delays and resolution strategies.

Gemini Claims Processing Prompts

- Develop 3 alternative claim form layouts optimized for user ease and data accuracy.

- List innovative ways to automate document verification with a focus on reducing manual errors.

- Create a mood board description for a claims portal interface emphasizing trust and simplicity.

- Suggest prioritization criteria for high-value claims and rank them by urgency and risk.

- Build a comparison table for three claims management software options focusing on features and scalability.

Perplexity Claims Insights Prompts

- Identify 5 emerging regulations affecting insurance claims and rank them by impact.

- Provide a comparison of fraud detection algorithms highlighting accuracy and processing speed.

- Summarize global trends in claims automation and their adoption rates among insurers.

- Generate a list of 5 customer pain points during claims submission and rank by frequency.

- Analyze past claims processing failures and summarize top 3 lessons for improvement.

ClickUp Brain Claims Prompts

- Transform this claims adjuster feedback into prioritized action items with deadlines.

- Condense meeting notes from the claims team and assign follow-up tasks with responsible parties.

- Review annotated claim documents and generate a checklist for compliance verification.

- Create a task list from interdepartmental discussions on claims workflow enhancements, including urgency levels.

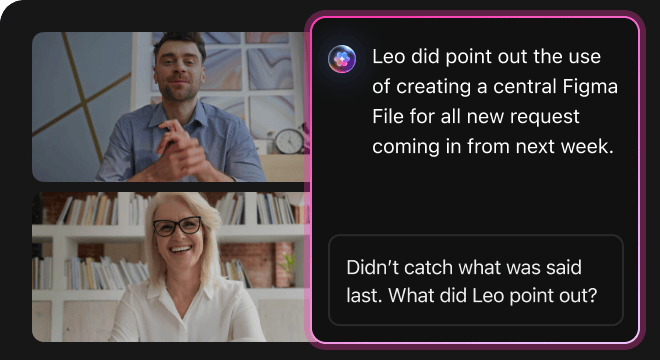

- Summarize customer interview transcripts on claims experience and produce actionable improvements in ClickUp.

Transform Initial Thoughts Into Clear Plans

- Convert scattered notes into polished claim reports swiftly.

- Generate innovative solutions by analyzing previous case data.

- Develop standard templates to accelerate claim processing.

Brain Max Boost: Quickly access historical claims, evaluations, and documentation to guide your next assessment.

Accelerate Claims Review and Resolution

- Break down detailed claim information into manageable tasks.

- Transform adjuster notes into actionable assignments.

- Automatically compile claim summaries and status reports—no extra effort.

Brain Max Boost: Instantly access historical claim data, policy details, or prior settlement info across cases.

How AI Prompts Enhance Every Phase of Insurance Claims

Quickly Produce Accurate Claim Assessments

Claims adjusters evaluate cases swiftly, improve judgment accuracy, and prevent processing delays.