Top AI Prompts Tailored for Financial Markets

AI Prompts Revolutionizing Financial Market Analysis

Navigating the complexities of financial markets demands more than just data—it requires sharp insights and swift decisions.

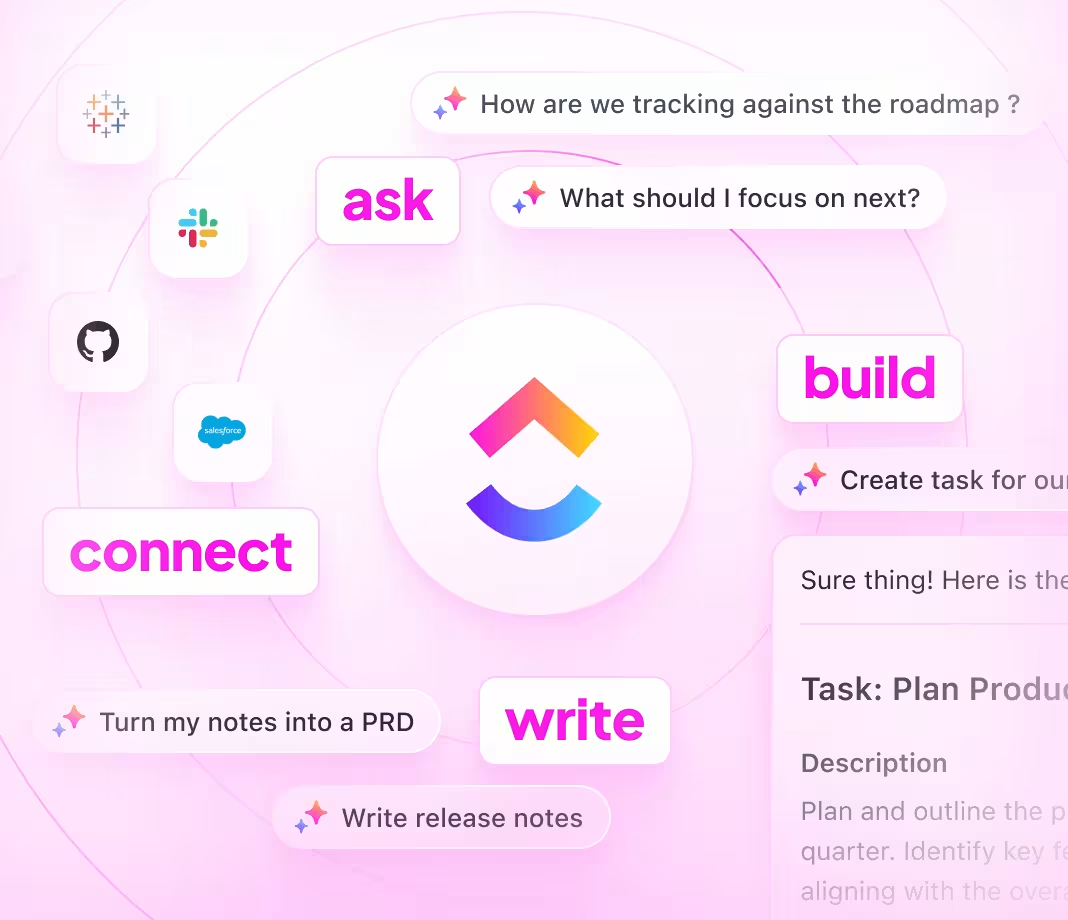

From market trend analysis to portfolio optimization, risk assessment, and compliance monitoring, financial teams juggle countless variables alongside tight deadlines. AI prompts are now pivotal in managing this complexity.

Financial teams leverage AI to:

- Instantly identify emerging market patterns and relevant news

- Generate detailed reports, forecasts, and investment strategies with minimal input

- Simplify dense regulatory documents and compliance requirements

- Transform unstructured data into clear action plans, risk checklists, or trading tasks

Integrated into daily tools like spreadsheets, dashboards, and project trackers, AI in platforms such as ClickUp Brain acts as a powerful ally—turning raw data into structured, actionable insights that drive smarter financial decisions.

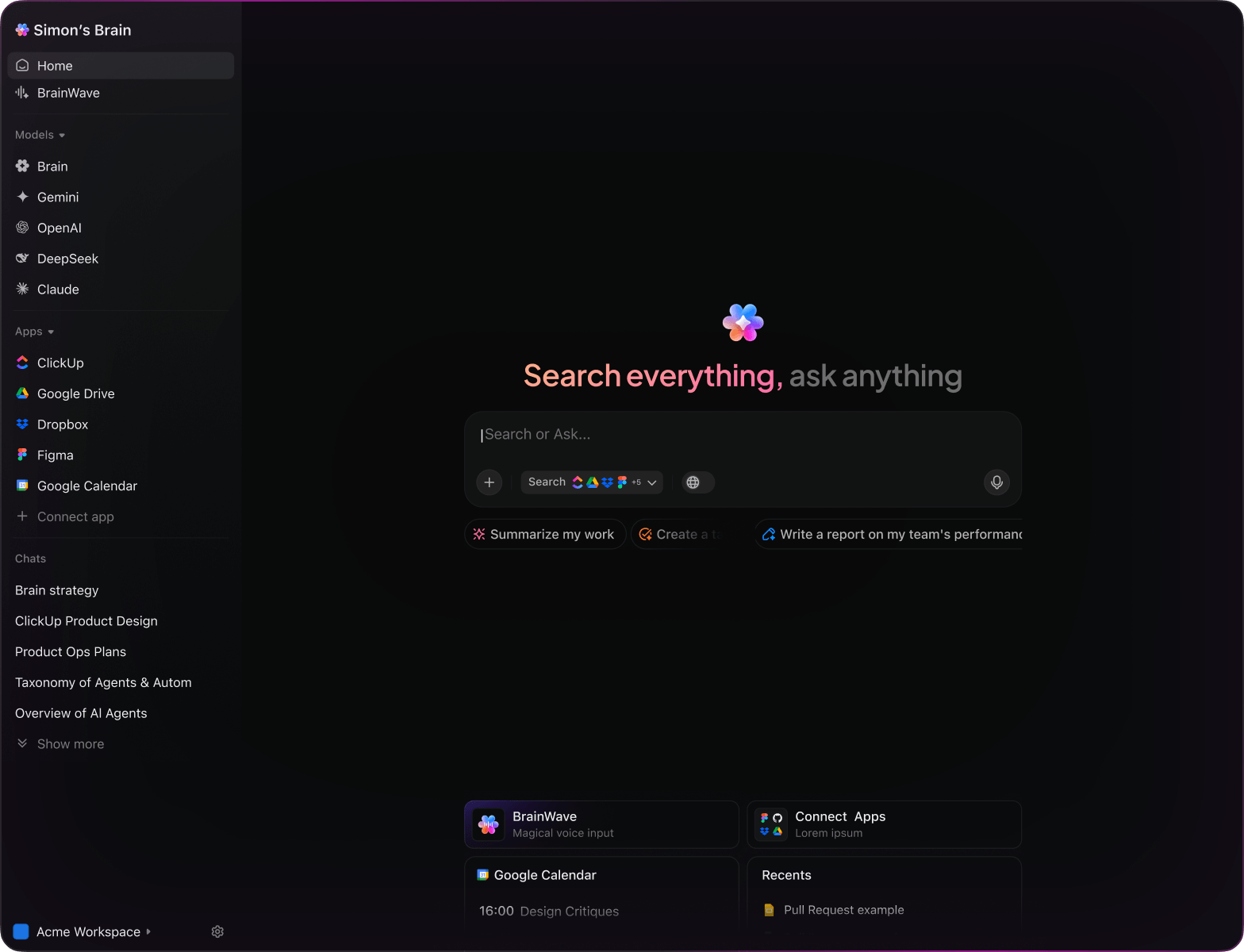

Why ClickUp Brain Stands Out

Standard AI Platforms

- Constantly toggling between apps to collect data

- Repeating your investment objectives in every query

- Receiving generic, irrelevant suggestions

- Hunting through multiple platforms for a single report

- Interacting with AI that lacks initiative

- Manually switching between AI models and tools

- Merely a browser add-on without integration

ClickUp Brain

- Intimately familiar with your portfolios, analyses, and team communications

- Retains your project history and strategic aims

- Delivers precise, context-aware recommendations

- Comprehensive search spanning all your financial documents

- Hands-free commands with Talk to Text

- Automatically selects the optimal AI engine: GPT, Claude, Gemini

- Dedicated Mac & Windows app optimized for performance

15 Powerful AI Prompts Tailored for Financial Markets

Identify 5 emerging investment themes for sustainable energy stocks, based on the ‘Q2 Market Trends’ report.

ClickUp Brain Behavior: Analyzes linked documents to extract key themes and suggests actionable investment directions.

What are the latest regulatory changes affecting fintech startups in the US market?

ClickUp Brain Behavior: Aggregates information from internal compliance files; Brain Max can supplement with current public regulations if accessible.

Draft a risk assessment summary for a diversified portfolio focused on emerging markets, referencing ‘Portfolio Review’ notes and past analyses.

ClickUp Brain Behavior: Pulls relevant data from documents to create a structured risk overview with clear insights.

Compare bond yield trends between US Treasury and corporate bonds using the ‘Fixed Income Q3’ dataset.

ClickUp Brain Behavior: Extracts and summarizes tabular data and commentary from internal reports for a concise comparison.

List top-performing algorithmic trading strategies in volatile markets, referencing R&D findings and backtesting reports.

ClickUp Brain Behavior: Scans internal documents to highlight recurring strategy features and performance notes.

From the ‘Compliance Audit 2024’ report, generate a checklist for regulatory adherence verification.

ClickUp Brain Behavior: Identifies key compliance points and formats them into a clear, actionable checklist within a task or document.

Summarize 3 emerging trends in client portfolio diversification from recent market research and advisory reports.

ClickUp Brain Behavior: Extracts common patterns and insights from linked research documents and notes.

From the ‘Investor Sentiment Survey Q1’ report, summarize main preferences and concerns regarding digital asset investments.

ClickUp Brain Behavior: Analyzes survey data to identify recurring themes and investor feedback.

Write engaging and clear client communication copy explaining the benefits of automated rebalancing, using the tone guide in ‘ClientVoice.pdf’.

ClickUp Brain Behavior: References tone and style guides to propose varied messaging options for client outreach.

Summarize key updates in SEC reporting requirements for 2025 and their potential impact on fund disclosures.

ClickUp Brain Behavior: Reviews internal compliance documents and can incorporate public updates if available to provide a concise summary.

Generate guidelines for risk indicator placement on client dashboards, referencing regional compliance documents specific to Europe.

ClickUp Brain Behavior: Extracts measurement standards and positioning rules from internal files to create a compliance checklist.

Create a due diligence checklist for new investment opportunities using SEC filings and internal research folders.

ClickUp Brain Behavior: Identifies key criteria from document content and organizes them into grouped tasks by risk category or sector.

Compare ESG scoring methodologies used by major rating agencies, referencing our competitive analysis reports.

ClickUp Brain Behavior: Summarizes documented differences into a clear, easy-to-understand format (table or brief).

What are the latest trends in robo-advisor user experience since 2023?

ClickUp Brain Behavior: Synthesizes insights from internal UX research, market reports, and client feedback documents.

Summarize main usability challenges reported by Southeast Asia retail investors in our feedback database (platform navigation, reporting clarity, support).

ClickUp Brain Behavior: Extracts and ranks user issues from surveys, support tickets, and feedback notes.

LLMs vs. Workflow Intelligence: How ClickUp Brain Transforms Finance

Prompts for ChatGPT

- Condense these quarterly earnings reports into a 5-point investment summary highlighting key financial metrics.

- Craft client communication emphasizing portfolio diversification and risk management strategies.

- Generate 3 alternative asset allocation models for a balanced portfolio and explain expected returns.

- Outline a step-by-step workflow for integrating real-time market data into trading strategies.

- Compare last 3 fiscal year performances of tech stocks and summarize top growth drivers for future investments.

Prompts for Gemini

- Develop 3 dashboard layouts for portfolio monitoring based on trader feedback.

- List innovative risk assessment methods focusing on market volatility.

- Create a mood board description for a fintech app interface highlighting colors, fonts, and user flow.

- Suggest client segmentation strategies for wealth management and rank by profitability.

- Produce a comparison table for three investment products focusing on fees, returns, and liquidity.

Prompts for Perplexity

- List 5 emerging financial instruments and rank them by market potential.

- Provide a comparison of algorithmic trading strategies, highlighting speed, accuracy, and risk.

- Summarize global trends in ESG investing and their impact on portfolio performance.

- Generate a list of 5 innovative fintech solutions for retail investors and rank by adoption rate.

- Compare past market crash responses and summarize top 3 lessons for risk mitigation.

Prompts for ClickUp Brain

- Transform this client feedback into prioritized action items for portfolio managers.

- Summarize strategy meeting notes and assign follow-up tasks with deadlines and owners.

- Analyze annotated financial models and create a checklist for compliance review.

- Develop a task list from cross-department discussions on trading platform enhancements, including urgency levels.

- Summarize client interview transcripts for service improvements and generate actionable tasks in ClickUp.

Transform Initial Thoughts Into Polished Plans

- Convert scattered notes into detailed financial strategies swiftly.

- Generate innovative approaches by analyzing previous market trends.

- Develop reusable frameworks that accelerate every investment cycle.

Brain Max Boost: Quickly access historical analyses, client feedback, and market data to fuel your upcoming financial models.

Accelerate Financial Market Analysis and Execution

- Break down intricate market insights into precise, actionable tasks.

- Transform analyst notes into assignable workflows effortlessly.

- Generate comprehensive trade summaries and performance reports automatically.

Brain Max Boost: Instantly access historical trade data, asset comparisons, and strategy rationales across portfolios.

Harness AI Prompts to Elevate Financial Market Strategies

Instantly Craft Market Scenarios

Traders explore diverse strategies rapidly, refine investment choices, and avoid analysis paralysis.

Enhance Investment Decisions

Make informed trades, minimize exposure, and align portfolios with market trends and compliance.

Identify Risks Before They Escalate

Prevents costly errors, improves portfolio resilience, and shortens reaction times to market shifts.

Align Teams with Clear Market Insights

Strengthens communication, removes misunderstandings, and accelerates consensus among analysts, traders, and managers.

Drive Innovation in Financial Analysis

Ignite fresh perspectives, develop advanced models, and maintain a competitive edge.

Integrated AI Workflows within ClickUp

Transforms AI-generated insights into actionable tasks, propelling projects from concept to execution.