Top AI Prompts for Financial Forecasting

AI Prompts Revolutionizing Financial Forecasting Workflows

Forecasting your company’s financial future goes beyond spreadsheets—it’s about mastering complex data and market variables.

From revenue projections to risk assessments and budget planning, financial forecasting requires juggling numerous data points and constant updates. That’s where AI prompts make a real difference.

Finance teams leverage AI to:

- Quickly identify market patterns and economic indicators

- Generate detailed forecast models with minimal manual effort

- Interpret regulatory changes and compliance requirements

- Transform scattered financial notes into clear reports, action plans, or budget tasks

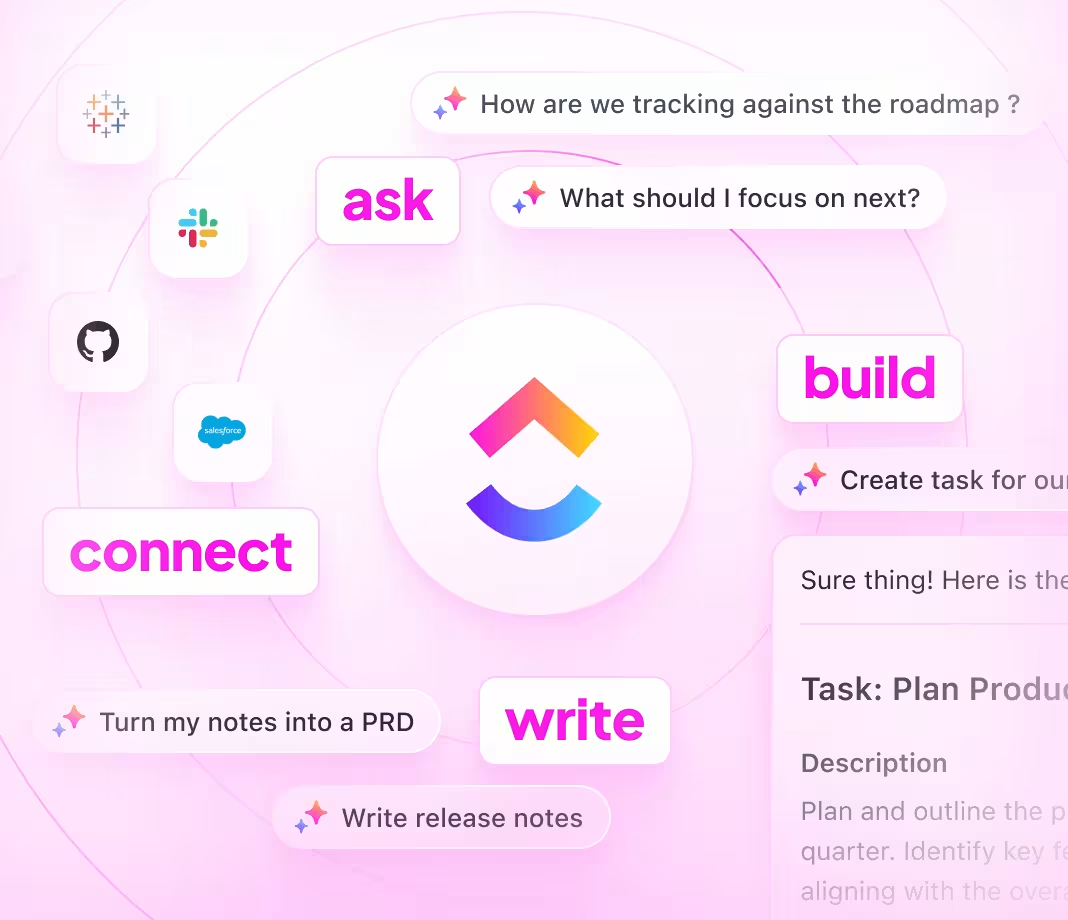

Integrated into daily tools—such as docs, dashboards, and project trackers—AI does more than assist. In ClickUp Brain, it operates seamlessly to convert financial insights into structured, executable strategies.

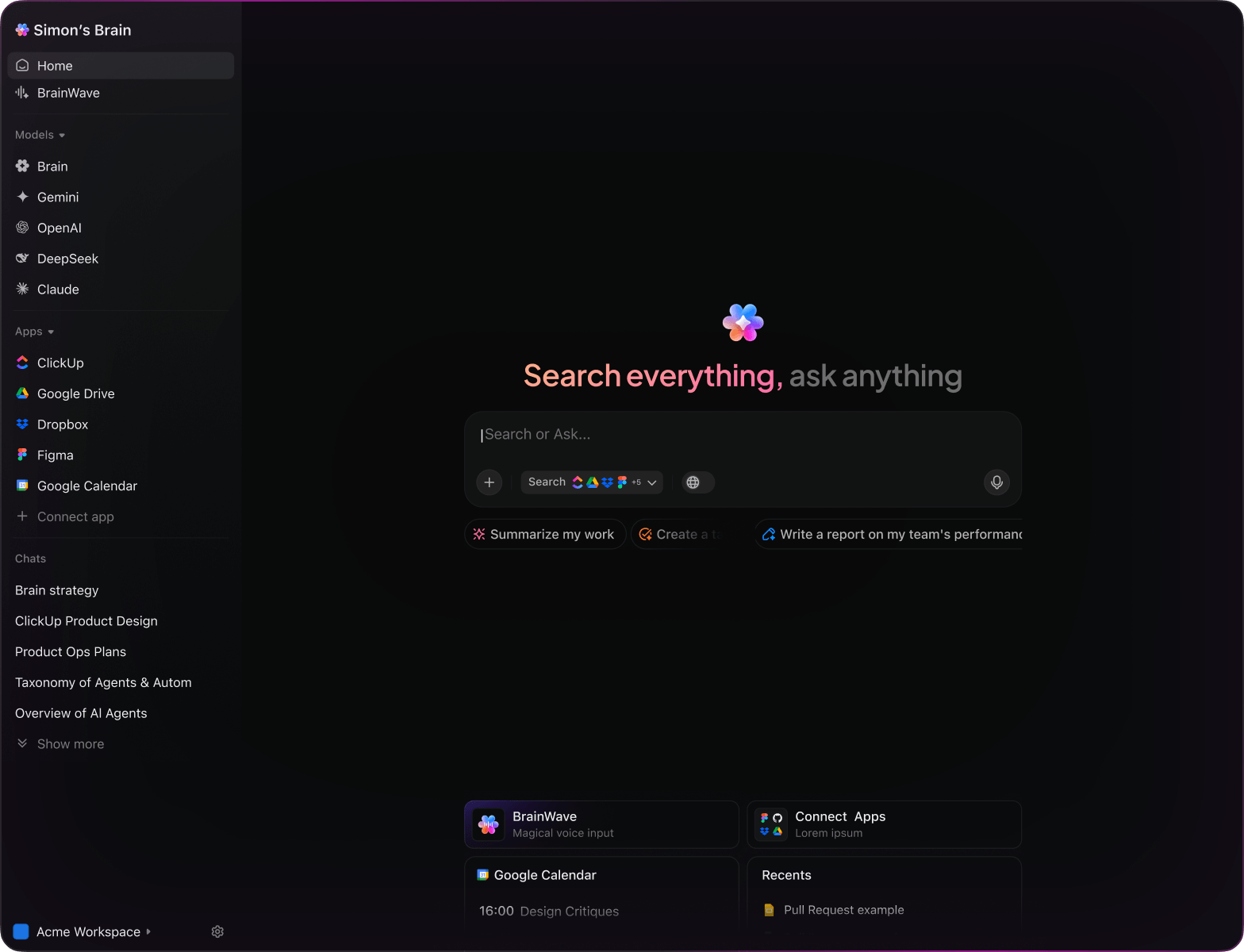

Why ClickUp Brain Excels in Financial Forecasting

Conventional AI Platforms

- Constantly switching apps to collect financial data

- Repeatedly clarifying forecasting objectives

- Receiving generic, irrelevant suggestions

- Hunting through numerous tools for specific reports

- Interacting with AI that lacks proactive input

- Manually toggling between different AI engines

- Merely an add-on extension with limited scope

ClickUp Brain

- Deeply connected to your budgets, forecasts, and team notes

- Tracks your past analyses and financial targets

- Delivers precise, context-driven guidance

- Searches across all your financial documents instantly

- Supports voice commands for hands-free operation

- Automatically selects optimal AI models like GPT, Claude, Gemini

- Dedicated Mac & Windows apps optimized for performance

15 Essential AI Prompts for Financial Forecasting

Identify 5 forecasting models suitable for quarterly revenue projections in SaaS companies, based on the ‘Q1 2024 Financial Reports’ doc.

ClickUp Brain Behaviour: Analyzes financial data and trends from the linked document to recommend forecasting approaches.

What are the prevailing cost reduction strategies in mid-sized manufacturing firms under $50M revenue?

ClickUp Brain Behavior: Gathers insights from internal financial reviews; Brain Max can supplement with relevant market data if accessible.

Draft a financial summary report template focused on cash flow analysis, referencing ‘Cash Flow Guidelines’ and prior quarterly reports.

ClickUp Brain Behavior: Extracts key financial metrics and formats them into a structured report outline from linked documents.

Compare budgeting approaches between retail chains and e-commerce platforms using the ‘Budgeting 2023’ doc.

ClickUp Brain Behavior: Pulls comparative data and summarizes key differences in budgeting strategies from internal files.

List top financial KPIs tracked by high-growth startups, referencing investor pitch decks and financial dashboards.

ClickUp Brain Behavior: Scans internal documents to identify commonly monitored performance indicators and their definitions.

From the ‘Audit Checklist 2024’ doc, generate a task list for compliance verification in financial reporting.

ClickUp Brain Behavior: Extracts audit criteria and transforms them into an actionable checklist within a task or document.

Summarize 3 emerging trends in predictive analytics for financial risk management from recent research papers.

ClickUp Brain Behavior: Identifies recurring themes and insights from linked academic and industry reports.

From the ‘Investor Sentiment Survey Q2’ doc, summarize key concerns and priorities expressed by stakeholders.

ClickUp Brain Behavior: Analyzes survey data to highlight common investor feedback and expectations.

Write clear and engaging copy for the financial dashboard’s alert notifications using the style guide in ‘BrandVoice.pdf’.

ClickUp Brain Behavior: Extracts tone and style cues from the guide to propose concise notification messages.

Summarize upcoming regulatory changes in tax laws for 2025 and their potential impact on corporate budgeting.

ClickUp Brain Behavior: Reviews linked compliance documents and summarizes key updates affecting financial planning.

Generate guidelines for expense categorization aligned with GAAP standards, referencing internal policy docs.

ClickUp Brain Behavior: Extracts classification rules and compiles them into a clear reference checklist.

Create a risk assessment checklist for new investment opportunities using ‘Investment Criteria 2024’ and portfolio analysis files.

ClickUp Brain Behavior: Identifies evaluation factors and organizes them into a structured task list grouped by risk category.

Compare cash reserve policies across fintech companies using competitive analysis documents.

ClickUp Brain Behavior: Summarizes documented policies into an easy-to-read comparison chart or brief.

What financial reporting innovations have emerged in the fintech sector since 2023?

ClickUp Brain Behavior: Synthesizes trends from internal research notes, whitepapers, and uploaded industry reports.

Summarize key challenges in forecasting accuracy reported by Southeast Asia SMEs, focusing on data quality and market volatility.

ClickUp Brain Behavior: Extracts and prioritizes user feedback from surveys, financial reviews, and support tickets.

AI Prompts for Financial Forecasting with ClickUp Brain

ChatGPT Financial Forecasting Prompts

- Summarize quarterly revenue projections into a concise 5-point financial overview highlighting growth drivers.

- Draft investor update copy focusing on profitability, risk management, and market expansion.

- Generate 3 alternative budget allocation scenarios for the upcoming fiscal year with impact analysis.

- Outline a step-by-step workflow for integrating predictive analytics into cash flow management.

- Compare last 3 financial reports and summarize key performance indicators for executive review.

Gemini Financial Forecasting Prompts

- Generate 3 alternative financial dashboard layouts based on stakeholder feedback.

- List innovative forecasting models emphasizing accuracy and scenario planning.

- Produce a mood board description for a financial report design highlighting clarity, color coding, and data visualization.

- Suggest portfolio diversification strategies ranked by risk and return metrics.

- Create a comparison table of three forecasting software tools focusing on features, scalability, and integration.

Perplexity Financial Forecasting Prompts

- List 5 emerging economic indicators relevant to financial forecasting and rank by predictive power.

- Provide a comparison of forecasting algorithms highlighting accuracy, complexity, and computational cost.

- Summarize global trends in financial risk assessment and their adoption in forecasting models.

- Generate a list of 5 innovative data sources for forecasting and rank by reliability.

- Compare past forecasting errors and summarize top 3 lessons for improving model precision.

ClickUp Brain Financial Forecasting Prompts

- Transform this financial analysis discussion into prioritized forecasting tasks with assigned owners.

- Summarize budget review meeting notes and generate follow-up action items with deadlines.

- Analyze annotated financial models and produce a checklist for validation and approval.

- Create a task list from cross-departmental input on forecasting assumptions, including urgency levels.

- Summarize client feedback on forecasts and generate actionable improvements and review tasks in ClickUp.

Transform Initial Thoughts Into Solid Plans

- Convert scattered financial data into clear forecasting reports swiftly.

- Generate innovative budget scenarios informed by historical trends.

- Develop standardized templates that accelerate every financial review.

Brain Max Boost: Quickly access previous forecasts, market analyses, and financial models to guide your upcoming projections.

Accelerate Financial Forecasting Accuracy

- Break down intricate financial data into actionable insights.

- Transform forecasting assumptions into assignable tasks.

- Automatically create summary reports and forecast reviews without extra effort.

Brain Max Boost: Instantly access historical financial trends, scenario analyses, or budget comparisons across your portfolios.

Harness AI Prompts to Elevate Financial Forecasting

Create Accurate Forecasts Quickly

Financial analysts explore diverse scenarios rapidly, enhance prediction accuracy, and avoid decision delays.

Enhance Decision-Making Confidence

Strengthen budgeting choices, reduce financial risks, and build forecasts trusted by stakeholders and auditors.

Identify Errors Early in the Process

Prevents expensive revisions late in the cycle, improves forecast reliability, and shortens reporting timelines.

Align Teams Around Clear Financial Goals

Improves communication, removes misunderstandings, and accelerates consensus among finance, operations, and leadership.

Drive Innovative Financial Strategies

Inspires creative budgeting, uncovers growth opportunities, and keeps your forecasts ahead of market shifts.

Integrated AI Workflows Within ClickUp

Transforms AI-generated insights into actionable tasks, ensuring forecasts translate into effective financial plans.