Top AI Prompts for Budgeting and Cost Control

AI Prompts Revolutionizing Budgeting and Cost Control

Managing budgets and controlling expenses go beyond just numbers—they're about strategic planning and real-time adjustments.

From forecasting to expense tracking, invoice processing, and compliance monitoring, effective budgeting involves juggling multiple data points and deadlines. AI prompts are now a vital part of this process.

Finance teams leverage AI to:

- Quickly identify spending patterns and budget variances

- Generate detailed financial reports and forecasts with minimal effort

- Interpret complex regulatory requirements and compliance standards

- Transform scattered financial notes into clear action plans, checklists, or budget tasks

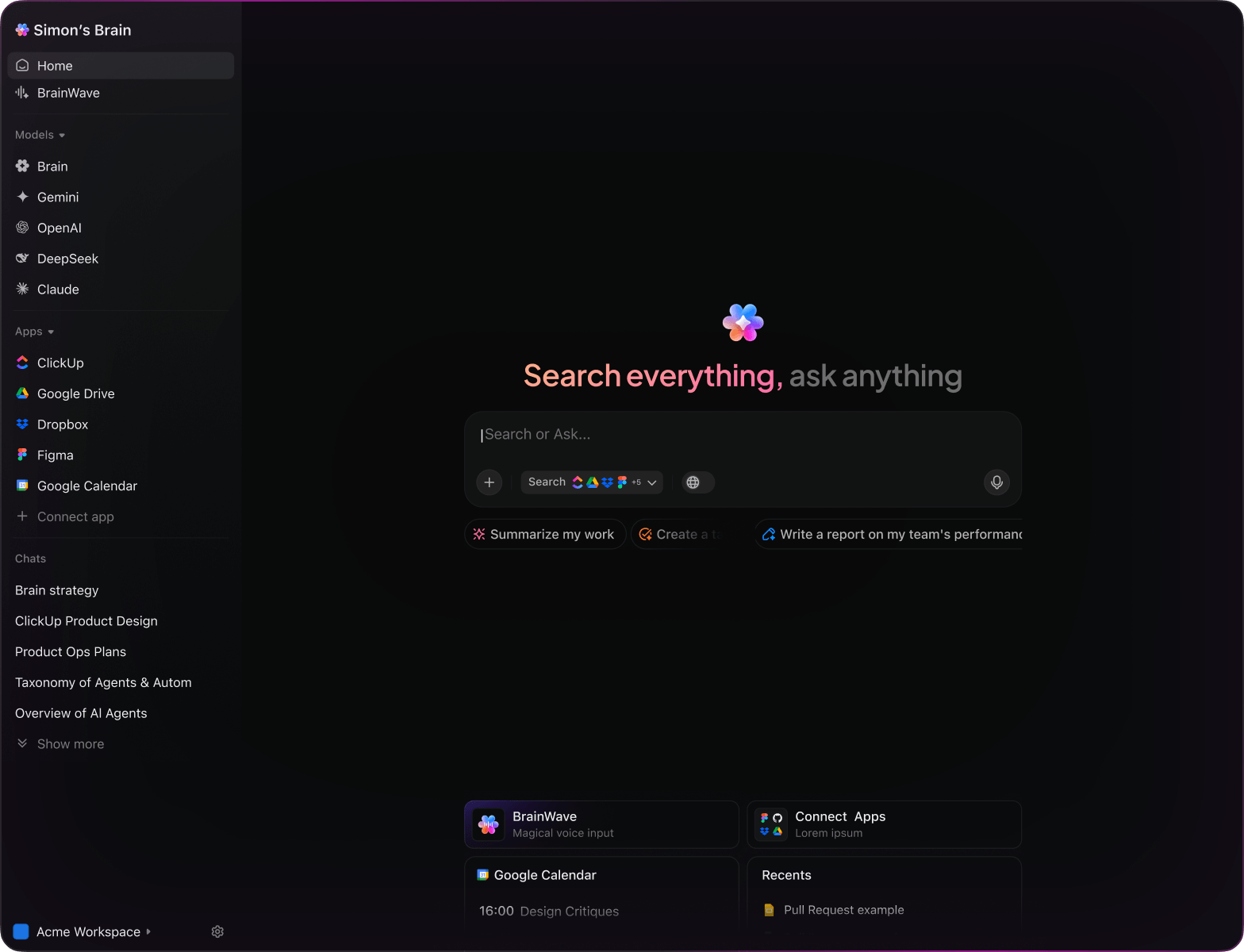

Integrated within daily tools—such as spreadsheets, dashboards, and project trackers—AI in platforms like ClickUp Brain acts as a smart partner, converting financial insights into structured, manageable workflows.

Why ClickUp Brain Stands Out

Conventional AI Platforms

- Constantly toggling between apps to collect financial data

- Repeating budget objectives with every query

- Responses that miss your specific cost control needs

- Hunting through multiple systems for a single report

- AI that only processes input without proactive help

- Manually switching between different AI engines

- Merely a browser add-on with limited integration

ClickUp Brain

- Instantly accesses your budgeting tasks, documents, and updates

- Retains your financial goals and past interactions

- Provides detailed, budget-focused insights

- Searches across all your financial tools in one place

- Supports voice commands with Talk to Text

- Automatically selects the ideal AI model: GPT, Claude, Gemini

- Dedicated Mac & Windows app optimized for performance

15 Essential AI Prompts for Budgeting and Cost Control

Identify 5 cost-saving strategies for a mid-sized project based on the ‘Q2 Budget Review’ document.

ClickUp Brain Behavior: Analyzes financial reports and highlights actionable savings opportunities tailored to your project.

What are the current expense trends for marketing campaigns under $50K in North America?

ClickUp Brain Behavior: Integrates data from internal budget sheets; Brain Max can supplement with relevant market benchmarks if accessible.

Draft a budget proposal for a lean startup, inspired by principles in the ‘Startup Finance Guide’ and previous funding rounds.

ClickUp Brain Behavior: Extracts key financial guidelines and compiles a structured proposal aligned with startup goals.

Summarize cost variances between planned and actual spending for the ‘Product Launch Q1’ using the linked financial documents.

ClickUp Brain Behavior: Reviews spreadsheets and reports to deliver a concise variance analysis highlighting key discrepancies.

List top expense categories impacting operational budgets, referencing recent audit reports and supplier invoices.

ClickUp Brain Behavior: Scans documents to identify major cost drivers and summarizes their financial impact.

From the ‘Vendor Payment Terms’ doc, create a checklist for timely invoice processing and approval.

ClickUp Brain Behavior: Extracts procedural steps and compiles them into an organized task list for efficient payment workflows.

Summarize 3 emerging cost control techniques from recent finance team workshops and industry reports.

ClickUp Brain Behavior: Gathers insights from meeting notes and external sources to outline effective budgeting methods.

From the ‘Client Billing Feedback’ doc, summarize key concerns affecting invoice accuracy and payment delays.

ClickUp Brain Behavior: Analyzes feedback to highlight recurring issues and suggests focus areas for improvement.

Compose clear and concise communication templates for budget approval requests using the tone guide in ‘FinanceTone.pdf’.

ClickUp Brain Behavior: Adapts style references to generate professional and persuasive messaging for stakeholders.

Summarize upcoming regulatory changes in tax laws for 2025 and their potential effects on budgeting processes.

ClickUp Brain Behavior: Reviews compliance documents and forecasts impacts to help adjust financial plans accordingly.

Generate guidelines for expense report submissions, referencing company policy documents specific to the APAC region.

ClickUp Brain Behavior: Extracts key rules and formats them into an easy-to-follow checklist for employees.

Create a risk assessment checklist for budget overruns using data from recent project audits and financial reviews.

ClickUp Brain Behavior: Identifies risk factors and organizes them into actionable items to monitor during project execution.

Compare cost efficiency measures across departments like Sales, R&D, and Operations using internal benchmarking reports.

ClickUp Brain Behavior: Summarizes comparative data into a clear overview highlighting strengths and improvement areas.

What budgeting trends are emerging in remote work environments since 2023?

ClickUp Brain Behavior: Synthesizes findings from internal surveys, industry analyses, and recent financial reports.

Summarize key financial challenges reported by Southeast Asia regional offices, focusing on currency fluctuations and vendor payments.

ClickUp Brain Behavior: Extracts and prioritizes issues from feedback forms, expense reports, and support tickets.

AI Prompts for Budgeting and Cost Control with ClickUp Brain

Prompts for ChatGPT

- Outline a 5-step budget plan focusing on reducing operational expenses without compromising quality.

- Draft a financial report summary highlighting cost-saving measures and budget variances.

- Generate 3 alternative cost allocation strategies for project teams and explain their impact on cash flow.

- Write a detailed workflow for implementing expense approval processes within a finance department.

- Compare last quarter's budget vs. actual spending and summarize key areas for improvement.

Prompts for Gemini

- Develop 3 budget forecasting models for the upcoming fiscal year based on historical data.

- List innovative cost control techniques tailored for small to medium-sized enterprises.

- Create a visual mood board description for a financial dashboard emphasizing clarity and actionable insights.

- Suggest expense categorization methods for multi-department organizations and rank them by effectiveness.

- Construct a comparison table of budgeting software features focusing on automation, reporting, and scalability.

Prompts for Perplexity

- Identify 5 emerging trends in corporate budgeting and evaluate their potential benefits.

- Provide a comparison of cost control methodologies used across various industries, highlighting efficiency and implementation challenges.

- Summarize global economic factors influencing budgeting strategies in 2024.

- Generate a list of 5 practical tips for managing unexpected expenses and rank them by impact.

- Compare traditional vs. modern budgeting approaches and summarize the top 3 advantages of each.

Prompts for ClickUp Brain

- Transform this budget review discussion into prioritized action items with assigned team members and deadlines.

- Summarize expense report feedback and create follow-up tasks to address discrepancies.

- Analyze annotated financial documents and generate a checklist for audit preparation.

- Compile a task list from this cross-department meeting on cost reduction strategies, including urgency levels.

- Summarize client billing issue transcripts and produce actionable tasks for finance and support teams within ClickUp.

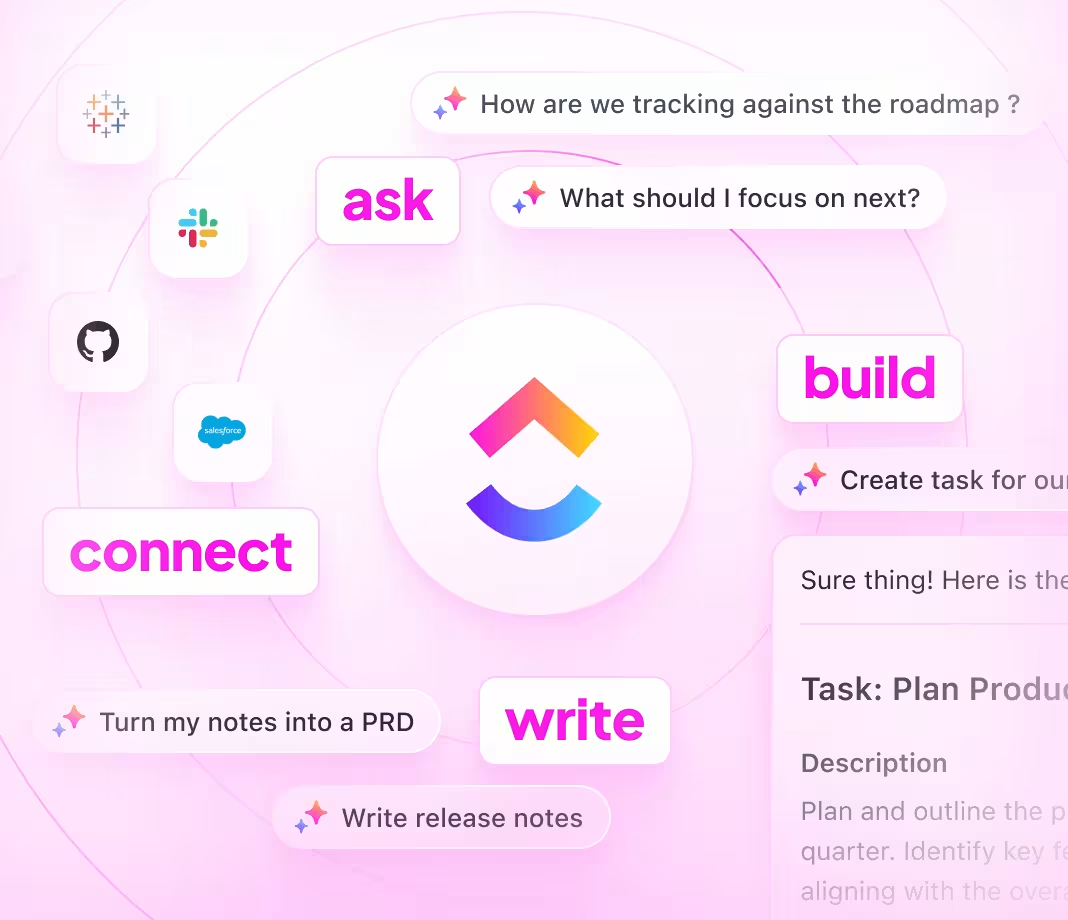

Transform Budget Plans Into Actionable Strategies

- Convert scattered budget notes into clear, detailed financial plans swiftly.

- Generate innovative cost-saving ideas by analyzing historical spending.

- Build customizable templates that accelerate every budgeting cycle.

Brain Max Boost: Quickly access previous budgets, expense reports, and financial insights to guide your next cost control initiative.

Accelerate Budgeting and Cost Control

- Break down complicated budget talks into straightforward tasks.

- Transform financial notes into actionable assignments.

- Automatically create expense reports and budget summaries without extra effort.

Brain Max Boost: Instantly access historical spending data, vendor comparisons, or cost-saving decisions across your projects.

Harness AI Prompts to Master Budgeting and Cost Control

Quickly Develop Accurate Budgets

Finance teams craft precise budgets faster, reduce guesswork, and prevent costly oversights.