AI Cash Flow Management

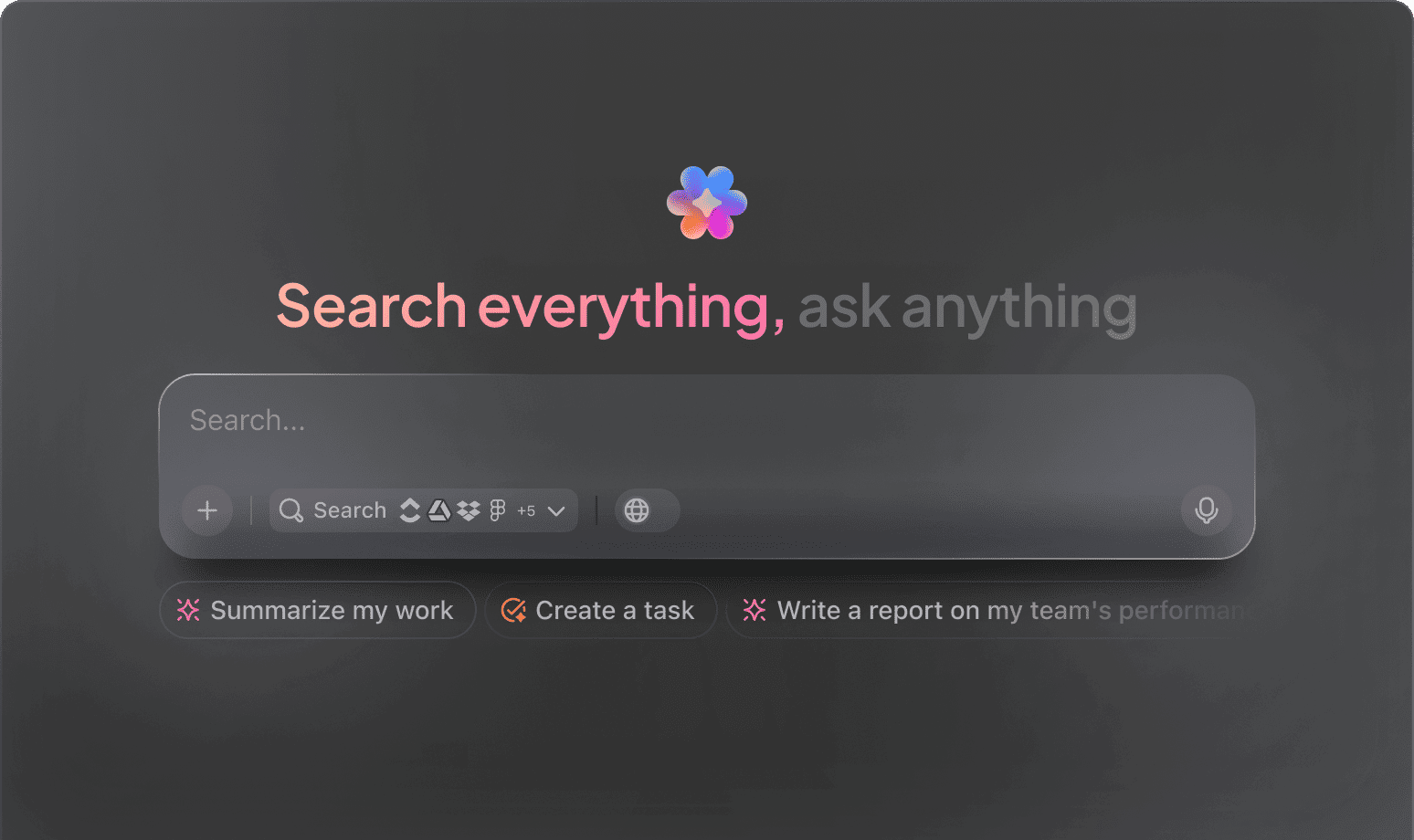

Top AI Prompts for Managing Cash Flow with ClickUp Brain

Gain clear insights, automate financial tracking, and master your cash flow effortlessly using ClickUp Brain's intelligent prompts.

Trusted by the world’s leading businesses

AI Empowering Financial Control

Harnessing AI Prompts to Optimize Cash Flow Management

Managing your company's cash flow goes beyond tracking numbers—it's about gaining clarity and control over your financial future.

From forecasting income and expenses to monitoring payment schedules and identifying liquidity risks, effective cash flow management requires juggling numerous details and deadlines. This is where AI prompts make a significant difference.

Finance teams leverage AI to:

- Quickly identify cash flow trends and potential bottlenecks

- Generate detailed forecasts and budget scenarios with minimal effort

- Summarize financial reports and payment terms efficiently

- Transform scattered financial notes into clear action plans, reminders, or task lists

Integrated within familiar tools like spreadsheets, dashboards, and project trackers, AI moves beyond simple assistance. In solutions such as ClickUp Brain, it operates seamlessly to convert financial data into structured, actionable insights.

ClickUp Brain Compared to Conventional Solutions

Discover Why ClickUp Brain Stands Apart

ClickUp Brain integrates seamlessly, understands your workflow, and empowers you to focus on managing cash flow efficiently.

Conventional AI Platforms

- Constantly toggling between apps to collect financial data

- Repeating your cash flow objectives with every query

- Receiving generic, irrelevant financial advice

- Hunting through multiple software to locate reports

- Interacting with AI that lacks proactive engagement

- Manually switching between different AI models

- Merely another add-on without deep integration

ClickUp Brain

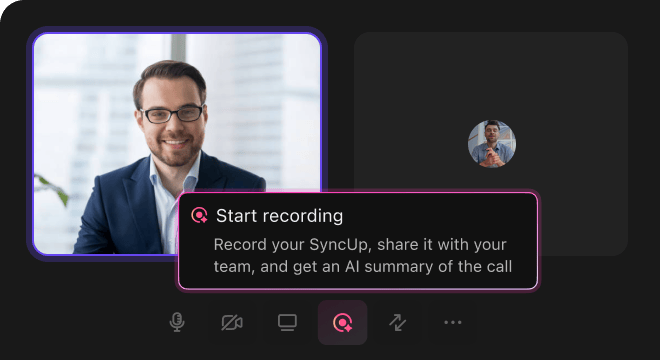

- Instantly accesses your cash flow tasks, budgets, and updates

- Retains your financial goals and past interactions

- Provides detailed, context-driven financial insights

- Searches all your financial documents and tools in one place

- Allows hands-free input with voice commands

- Automatically selects the optimal AI engine: GPT, Claude, Gemini

- Dedicated Mac & Windows app designed for high performance

Cash Flow Management Prompts

15 Powerful AI Prompts for Managing Cash Flow with ClickUp Brain

Simplify your cash flow tracking—forecasting, analysis, and optimization made straightforward.

Identify 5 cash inflow strategies from the ‘Q2 Revenue Streams’ document.

Use Case: Accelerates discovery of revenue opportunities using historical data.

ClickUp Brain Behaviour: Analyzes linked documents to extract and suggest actionable income sources.

What are the latest expense reduction trends for SMBs in the ‘2024 Cost Optimization’ report?

Use Case: Supports budget management with current cost-saving insights.

ClickUp Brain Behaviour: Summarizes internal research and can integrate external data for comprehensive trends.

Draft a cash flow forecast summary based on the ‘Monthly Financials’ and ‘Sales Pipeline’ docs.

Use Case: Aligns finance and operations teams with clear projections.

ClickUp Brain Behaviour: Extracts key figures and trends to generate a concise forecast report.

Compare payment terms and collections efficiency between clients A and B using ‘Receivables Q1’ data.

Use Case: Facilitates quick evaluation of client payment behaviors.

ClickUp Brain Behaviour: Processes tabular data and notes to produce a summarized comparison.

List top cash flow risks identified in recent audit reports and supplier contracts.

Use Case: Highlights potential financial vulnerabilities for proactive management.

ClickUp Brain Behavior: Scans documents to pinpoint recurring risk factors and their implications.

From the ‘Invoice Processing’ doc, generate a task checklist for timely payment follow-ups.

Use Case: Improves accounts receivable workflows with structured reminders.

ClickUp Brain Behavior: Transforms procedural details into actionable task lists within ClickUp.

Summarize 3 emerging technologies impacting cash flow automation from recent finance tech reviews.

Use Case: Keeps finance teams informed on tools that enhance cash management.

ClickUp Brain Behavior: Extracts key insights and patterns from linked technology assessments.

From the ‘Client Payment Preferences Survey’ doc, summarize key trends influencing payment methods.

Use Case: Aligns billing processes with customer expectations.

ClickUp Brain Behavior: Analyzes survey data to identify dominant payment behaviors and preferences.

Write concise and clear notification text for overdue invoice alerts using the tone guide in ‘FinanceTone.pdf’.

Use Case: Speeds up communication with clients while maintaining brand voice.

ClickUp Brain Behavior: References tone guidelines to suggest effective message variations.

Summarize new tax regulations affecting cash flow for Q3 2024 and their implications.

Use Case: Ensures compliance and anticipates financial impact.

ClickUp Brain Behavior: Synthesizes regulatory documents and highlights key changes relevant to cash management.

Generate guidelines for cash reserve levels based on industry benchmarks and internal financial policies.

Use Case: Supports strategic planning with data-driven reserve recommendations.

ClickUp Brain Behavior: Extracts and consolidates criteria into a clear, actionable checklist.

Create a risk assessment checklist for vendor payment delays using recent contract reviews.

Use Case: Helps finance teams proactively manage supplier-related cash flow risks.

ClickUp Brain Behavior: Identifies risk factors and formats them into a structured evaluation list.

Compare cash flow management practices across competitors using market analysis documents.

Use Case: Informs strategy with competitive insights.

ClickUp Brain Behavior: Summarizes comparative data into an easy-to-digest report or table.

What cash flow forecasting techniques have gained traction since 2023?

Use Case: Equips finance teams with up-to-date methodologies.

ClickUp Brain Behavior: Synthesizes recent research and internal notes to highlight trending approaches.

Summarize key cash flow challenges reported by regional offices in Southeast Asia.

Use Case: Drives targeted financial support and process improvements.

ClickUp Brain Behavior: Extracts and prioritizes issues from feedback, surveys, and financial reports.

Optimize Cash Flow Effortlessly with ClickUp Brain

Cut down on financial guesswork, align your team’s efforts, and produce smarter cash management strategies powered by AI-driven workflows.

AI Applications

Key Ways AI Prompts Enhance Cash Flow Management with ClickUp Brain

Boost financial oversight, reduce errors, and discover smarter cash flow strategies using AI-powered prompts in ClickUp Brain

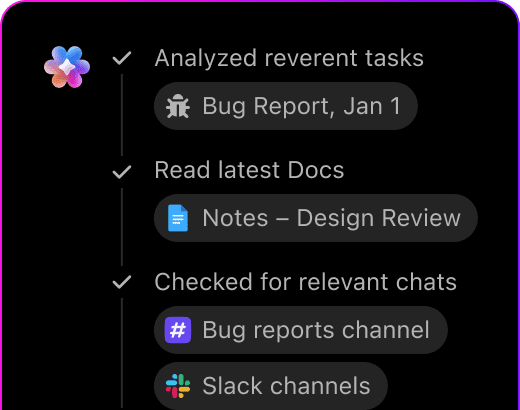

From Financial Notes to Cash Flow Plans

Managing cash flow starts with fragmented spreadsheets and scattered receipts. ClickUp Brain organizes these into clear, actionable financial plans—right within ClickUp Docs.

Leverage ClickUp Brain to:

- Convert raw financial data into comprehensive cash flow templates

- Produce fresh budgeting strategies informed by previous financial records (using context-sensitive AI assistance)

- With Brain Max, instantly explore historical cash flow reports, expense logs, and payment histories to inform your next financial move.

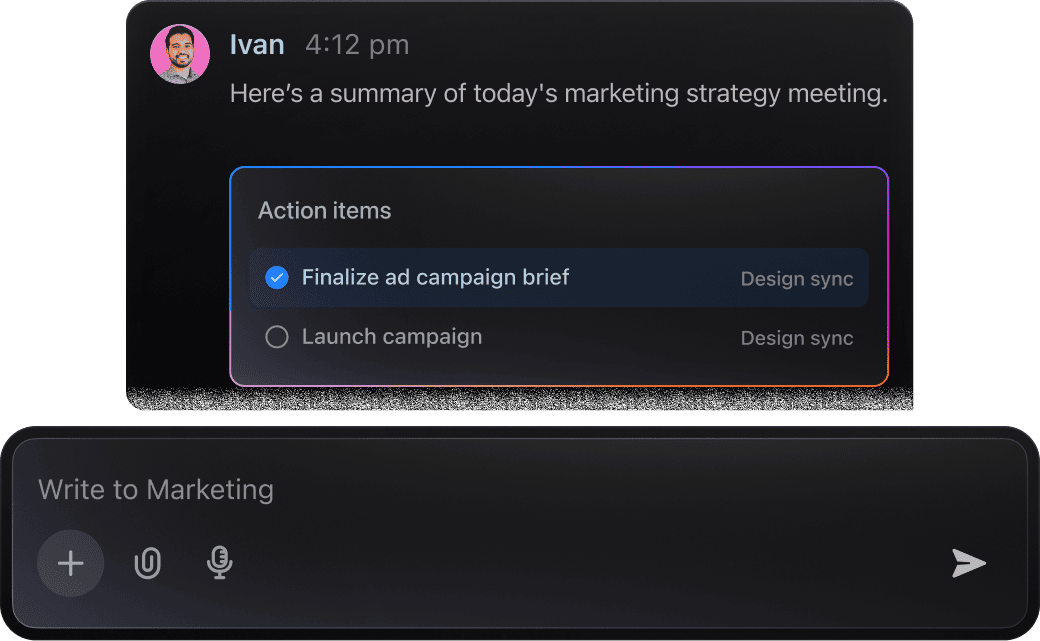

Cash Flow Management

Managing your company's cash flow involves tracking numerous transactions and forecasting future balances. ClickUp Brain simplifies this by analyzing your financial notes and reports to highlight key action points, flag potential cash shortages, and suggest next steps.

Leverage ClickUp Brain to:

- Condense detailed financial conversations from tasks or Docs into clear summaries

- Convert annotated budget reviews into actionable cash flow tasks

- Automatically generate cash flow statements or financial summaries

- With Brain Max, instantly retrieve past payment decisions, invoice comparisons, or budget discussions across your workspace—eliminating tedious searches through spreadsheets.

Managing Cash Flow with ClickUp Brain

Handling your company's cash flow involves tracking payments, forecasting expenses, and adjusting budgets constantly. ClickUp Brain simplifies this complexity by extracting key financial insights and crafting clear communication for your team.

Leverage ClickUp Brain to:

- Analyze transaction records and highlight critical cash flow trends

- Create precise financial summaries tailored to stakeholders

- Convert discussion threads into actionable budget adjustments or payment reminders

- Brain Max enhances this by providing quick access to past financial reports or similar fiscal scenarios, even over extended periods.

AI Advantages

How AI Prompts Revolutionize Cash Flow Management

Leveraging AI prompt workflows transforms your cash flow processes:

- Accelerate forecasting: Quickly generate accurate cash flow projections and scenarios

- Reduce errors: Identify discrepancies by analyzing transaction histories and budgets

- Align your finance team: AI-crafted reports and summaries ensure everyone stays informed

- Make informed choices: Use prompts to uncover financial trends and compliance alerts

- Plan confidently: Test various financial strategies beyond traditional models.

Every output integrates directly within ClickUp, turning your AI-driven insights into actionable tasks, reports, and dashboards that drive financial success.

Prompt Guidance

Crafting Effective Prompts for Cash Flow Management

Clear prompts lead to actionable financial insights.

Define the financial scenario clearly

Vague prompts yield broad suggestions. Specify details like business size (e.g., “small retail store” or “mid-sized SaaS company”), cash flow challenges (e.g., “seasonal revenue fluctuations” or “delayed client payments”), or financial goals (e.g., “maintain positive cash balance” or “optimize invoice cycles”).

Example: “Provide strategies to improve cash flow for a subscription-based startup facing monthly revenue dips.”

Use comparative prompts to evaluate options

AI excels at contrasting different financial approaches. Use prompts like “compare A vs B” to assess payment terms, budgeting methods, or financing alternatives.

Example: “Compare benefits of extending payment terms versus offering early payment discounts for a manufacturing business.”

Frame prompts as specific tasks

Approach your prompt as a clear objective you want AI to accomplish. Instead of “Suggest cash flow improvements,” focus on precise outcomes:

Example: “Develop a cash flow forecast template for a seasonal retail business emphasizing peak and off-peak periods.”

Specify desired output format

Need a step-by-step plan, financial model, risk assessment, or summary report? Indicate it explicitly. AI delivers better when the response format is clear.

Example: “Outline 5 actionable steps to reduce accounts receivable delays in bullet points with explanations.”

Optimize Cash Flow with ClickUp Brain

ClickUp Brain goes beyond basic tracking—it’s your strategic partner for mastering every phase of cash flow management.