AI Investing Insights

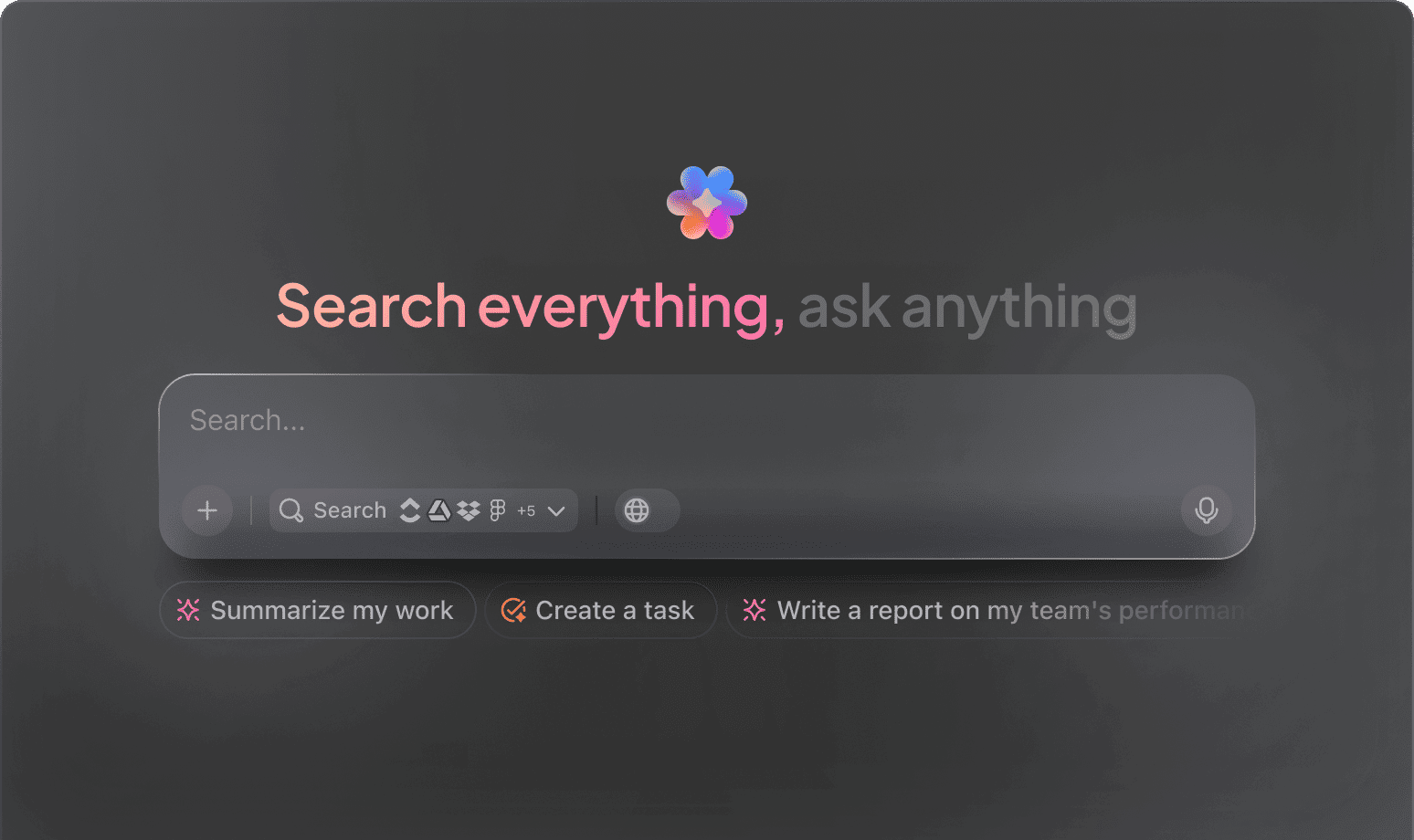

Top AI Prompts for Smarter Investing

Unlock data-driven investment strategies, simplify analysis, and elevate your portfolio management with ClickUp AI.

Trusted by the world’s leading businesses

AI Empowering Investment Teams

Revolutionizing Investment Strategies with AI Prompts in ClickUp Brain

Navigating the investment landscape demands more than intuition—it requires precision, speed, and clarity.

From market analysis and portfolio planning to risk assessment and compliance monitoring, investment teams juggle countless data points, reports, and deadlines. AI prompts are now pivotal in managing this complexity.

Investment professionals leverage AI to:

- Quickly identify emerging market trends and investment opportunities

- Generate detailed financial models and scenario analyses with ease

- Distill dense regulatory updates into clear, actionable summaries

- Transform scattered research notes into organized strategies, checklists, or project plans

Integrated seamlessly into familiar tools—such as documents, dashboards, and task trackers—AI in platforms like ClickUp Brain acts as a strategic partner, converting raw insights into structured, executable investment actions.

Comparing ClickUp Brain with Conventional Solutions

Why ClickUp Brain Stands Out

ClickUp Brain integrates seamlessly, understands your investing context, and acts swiftly—so you focus on decisions, not explanations.

Conventional AI Platforms

- Constantly toggling between apps to collect investment data

- Reiterating your portfolio objectives with every query

- Receiving generic, irrelevant advice

- Hunting through multiple platforms for a single report

- Interacting with AI that only processes commands

- Manually switching between different AI engines

- Merely a browser add-on without deep integration

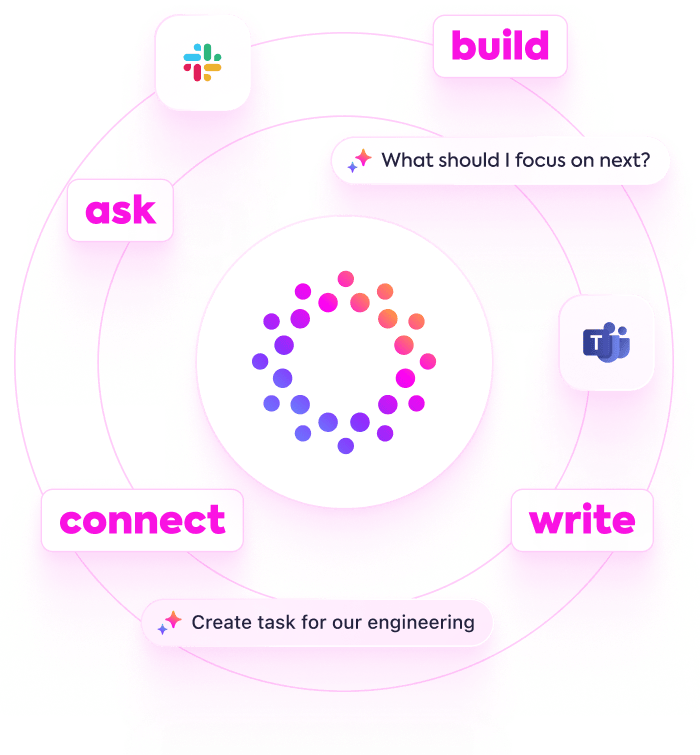

ClickUp Brain

- Deeply connected to your investment tasks, notes, and team insights

- Remembers your strategy and past analyses

- Provides tailored, actionable investment guidance

- Searches across all your financial documents and tools

- Supports hands-free input with voice commands

- Automatically selects the optimal AI model: GPT, Claude, Gemini

- Dedicated desktop app for Mac & Windows designed for efficiency

Investing Intelligence Prompts

15 Powerful AI Prompts for Investing Strategies (Tested in ClickUp Brain)

Enhance investment planning—research, analysis, and portfolio management simplified.

Identify 5 promising investment themes for sustainable energy stocks, based on the ‘Q2 Market Trends’ report.

Use Case: Accelerates idea generation by leveraging recent market insights.

ClickUp Brain Behaviour: Analyzes linked documents to extract key themes and suggest actionable investment angles.

What are the current valuation benchmarks for mid-cap tech companies in the US market?

Use case: Supports data-driven decisions with up-to-date financial metrics.

ClickUp Brain Behaviour: Compiles and summarizes relevant financial data from internal reports; Brain Max can augment with public market data if accessible.

Draft a concise investment thesis for emerging fintech startups, referencing ‘Fintech Innovations’ notes and recent pitch decks.

Use Case: Aligns investment teams with a clear, research-backed rationale.

ClickUp Brain Behaviour: Extracts and organizes key points from linked files to create a structured thesis document.

Summarize risk and return profiles comparing index funds vs. actively managed funds using our ‘Portfolio Analysis Q1’ doc.

Use Case: Facilitates comparative evaluation without manual data review.

ClickUp Brain Behaviour: Processes tabular and narrative data to deliver a concise side-by-side summary.

List top ESG criteria prioritized by institutional investors, referencing recent survey results and policy documents.

Use Case: Guides portfolio adjustments to meet evolving investor expectations.

ClickUp Brain Behavior: Scans internal data to highlight frequently cited ESG factors and their implications.

From the ‘Due Diligence Checklist’ doc, generate a task list for evaluating new investment opportunities.

Use Case: Simplifies evaluation workflows with a ready-to-use checklist.

ClickUp Brain Behavior: Identifies key assessment points and formats them into actionable tasks or documents.

Summarize 3 emerging trends in algorithmic trading from recent market analysis and research papers.

Use Case: Keeps trading strategies aligned with the latest technological advances.

ClickUp Brain Behavior: Extracts recurring themes and insights from linked research materials.

From the ‘Millennial Investor Survey 2024’ doc, summarize key preferences for mobile investment platforms.

Use Case: Helps product teams tailor features to younger investor behaviors.

ClickUp Brain Behavior: Analyzes survey data to identify common user expectations and design cues.

Write clear and engaging copy for a portfolio risk dashboard tooltip, using the style guide in ‘BrandVoice.pdf.’

Use Case: Accelerates UI content creation with consistent brand tone.

ClickUp Brain Behavior: References tone guidelines to suggest multiple copy options for interface elements.

Summarize recent regulatory changes affecting cryptocurrency investments and their potential impact on portfolio compliance.

Use Case: Ensures investment strategies remain aligned with legal requirements.

ClickUp Brain Behavior: Condenses linked compliance documents; Brain Max can integrate updates from public sources if available.

Generate guidelines for reporting ESG metrics in quarterly investment reports, referencing regional compliance documents.

Use Case: Supports accurate and compliant sustainability disclosures.

ClickUp Brain Behavior: Extracts key reporting standards and formats them into a clear checklist.

Create a checklist for portfolio rebalancing based on US market volatility indicators and our internal strategy docs.

Use Case: Helps portfolio managers maintain optimal asset allocation.

ClickUp Brain Behavior: Identifies relevant criteria and organizes them into a structured task list.

Compare dividend yield trends across major utility companies using our competitive analysis reports.

Use Case: Informs income-focused investment decisions with up-to-date data.

ClickUp Brain Behavior: Summarizes comparative data into an easy-to-read format, such as tables or briefs.

What investment strategies have gained traction in emerging markets since 2022?

Use Case: Provides research teams with forward-looking insights to guide portfolio diversification.

ClickUp Brain Behavior: Synthesizes trends from internal analyses, market summaries, and uploaded reports.

Summarize client feedback on our robo-advisor platform from the Asia-Pacific region, focusing on usability and feature requests.

Use Case: Drives targeted product enhancements based on regional user input.

ClickUp Brain Behavior: Extracts and prioritizes feedback themes from surveys, support tickets, and review notes.

Invest Wisely, Quicker with ClickUp Brain

Cut down on guesswork, unify your investment team, and produce sharper strategies using AI-driven workflows.

AI Applications

Leading 3 Applications of AI Prompts in Investment Strategies

Enhance decision-making, boost precision, and discover innovative investment opportunities with AI assistance

From Ideas to Investment Plans

Investment strategies usually start as fragmented thoughts and unorganized data. ClickUp Brain reshapes these into clear, collaborative investment documents—right within ClickUp Docs.

Leverage ClickUp Brain to:

- Convert initial market observations into actionable investment templates

- Create fresh portfolio ideas informed by historical investment insights (through context-aware AI writing)

- With Brain Max, instantly explore previous market analyses, client feedback, and financial reports to inspire your next move.

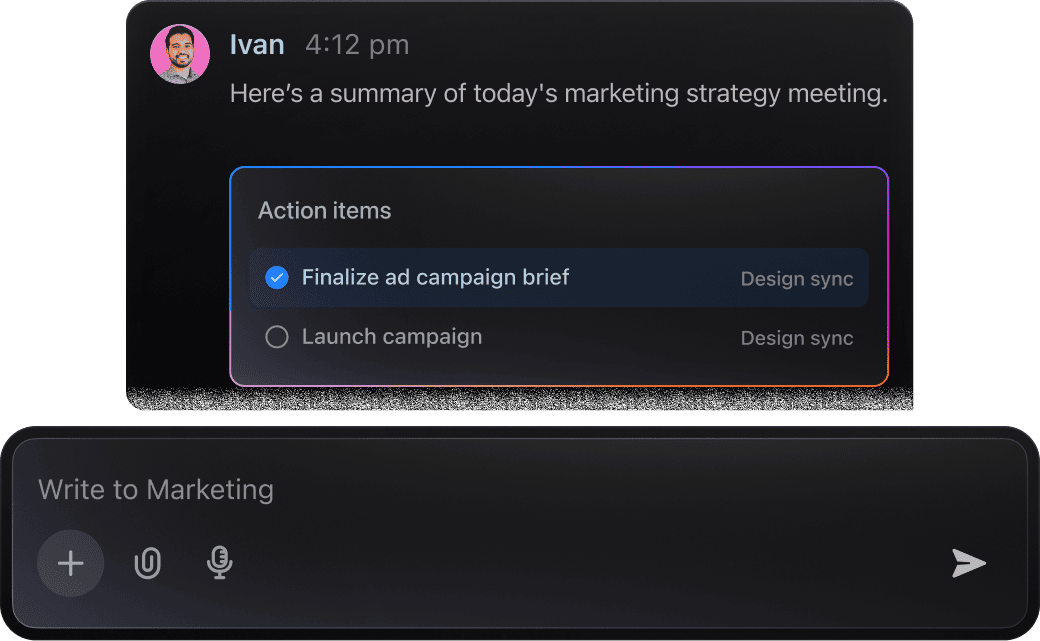

Investing Insights to Action

Investors handle complex data and market analyses daily. ClickUp Brain transforms your investment notes into clear next steps, highlights risks, and crafts strategic follow-ups.

Leverage ClickUp Brain to:

- Condense financial reports and meeting notes into concise summaries

- Convert annotated market research into actionable investment tasks

- Generate risk assessments or portfolio review briefs effortlessly

- With Brain Max, instantly retrieve past investment decisions, asset comparisons, or strategy discussions across your workspace—eliminating tedious searches through financial documents.

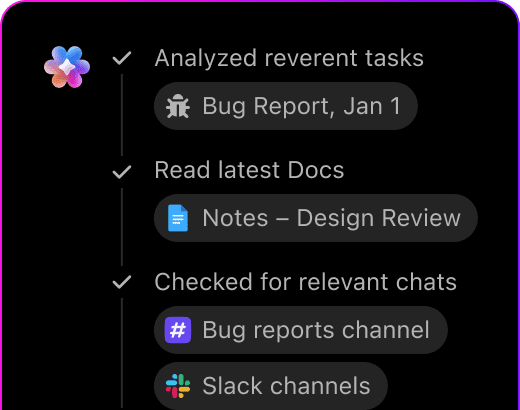

Investing Insights with ClickUp Brain

Crafting investment strategies requires analyzing market data, client goals, and risk factors simultaneously. ClickUp Brain simplifies this process—extracting key takeaways and drafting communications that resonate with stakeholders.

Leverage ClickUp Brain to:

- Analyze meeting notes into clear action points

- Create client-ready reports with tailored messaging

- Convert market feedback into portfolio adjustments or task lists

- Brain Max enhances this by retrieving relevant past analyses or comparable investment cases, even over extended timeframes.

AI Advantages

How AI Prompts Revolutionize Investment Strategies

Integrating AI prompt workflows reshapes your investment process completely:

- Accelerate research: Transform raw data into actionable insights and portfolio plans swiftly

- Reduce errors: Detect anomalies by cross-referencing historical trends and analyst notes

- Align your team: AI-crafted summaries and reports ensure everyone shares the same vision

- Make informed choices: Generate prompts that uncover market intelligence and regulatory updates

- Innovate investing: Discover untapped opportunities beyond traditional strategies.

Everything integrates directly within ClickUp, turning your AI-generated content into documents, tasks, and dashboards that drive tangible investment results.

Investment Prompt Tips

Crafting Effective Prompts for Investing

Clear prompts lead to smarter financial strategies.

Define the investment scenario clearly

Vague prompts generate broad suggestions. Specify details like asset type (e.g., “growth stocks” or “municipal bonds”), investment goals (e.g., “long-term wealth building” or “short-term income”), or risk tolerance (e.g., “moderate risk for retirement fund”).

Example: “Recommend portfolio diversification strategies for aggressive investors focusing on tech startups.”

Use comparative prompts to evaluate options

AI excels at distinguishing nuances between choices. Use prompts like “compare X vs Y” to assess different funds, market sectors, or investment vehicles.

Example: “Compare dividend yields and volatility between S&P 500 ETFs and REITs.”

Frame prompts around investment objectives

Treat your prompt as a goal-oriented request. Instead of “Suggest investments,” focus on outcomes:

Example: “Design a balanced portfolio for a 40-year-old aiming for steady growth with low risk.”

Specify the desired output format

Need a risk assessment table, asset allocation chart, or step-by-step plan? Make it clear. AI delivers better when the output style is defined.

Example: “Provide a bullet list of five tax-efficient investment options with brief explanations.”

Elevate Investment Strategies with ClickUp Brain

ClickUp Brain goes beyond basic task tracking—it's your strategic partner throughout every phase of investment planning and execution.