AI Budget Planning

Top AI Prompts for Crafting Your Budget

Build accurate budgets, organize your finances, and empower your team’s financial goals effortlessly using ClickUp AI.

Trusted by the world’s leading businesses

AI in Budget Management

Revolutionizing Budget Planning with AI-Powered Prompts

Crafting a solid budget goes beyond numbers—it's about aligning resources with your team's goals efficiently.

From gathering expense data to forecasting and tracking, budgeting involves juggling multiple details and deadlines. AI prompts are now key to simplifying this complexity.

Teams leverage AI to:

- Quickly identify spending patterns and cost-saving opportunities

- Generate detailed budget drafts and financial summaries with minimal effort

- Interpret financial policies and compliance requirements clearly

- Transform scattered notes into organized budget plans, checklists, or action items

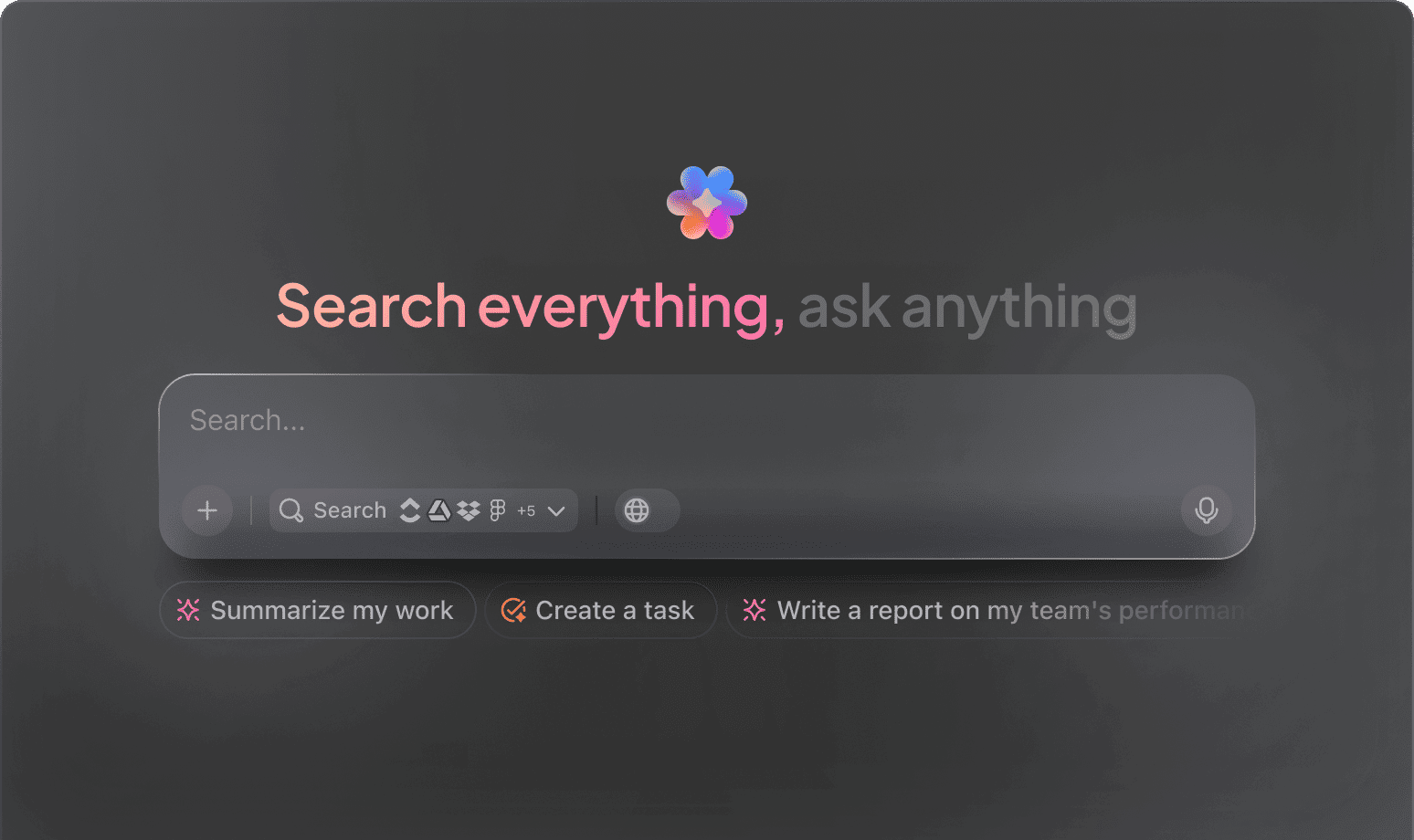

Integrated into familiar tools like documents, spreadsheets, and project boards, AI does more than assist. In solutions like ClickUp Brain, it seamlessly converts your financial inputs into structured, manageable workflows.

Comparing ClickUp Brain with Conventional Solutions

Why ClickUp Brain Stands Apart

ClickUp Brain integrates seamlessly, understands your context, and empowers you to act swiftly—cutting down on needless explanations.

Conventional AI Platforms

- Constantly toggling between apps to collect information

- Repeating your objectives with every new prompt

- Receiving generic, irrelevant replies

- Hunting through multiple platforms to locate a single document

- Interacting with AI that only processes input passively

- Manually switching among different AI engines

- Merely an additional browser add-on

ClickUp Brain

- Deeply connected to your tasks, documents, and team communications

- Retains your project history and objectives

- Provides detailed, context-aware guidance

- Offers a consolidated search across your workspace

- Enables voice commands through Talk to Text

- Automatically selects the optimal AI model: GPT, Claude, Gemini

- Available as a native app on Mac & Windows—designed for efficiency

Budgeting Made Simple

15 Essential AI Prompts for Crafting Budgets with ClickUp Brain

Transform your budgeting process—plan, analyze, and optimize effortlessly.

List 5 budget allocation strategies for a small business startup, drawing insights from the ‘Q1 Financial Overview’ document.

Use Case: Accelerates financial planning by leveraging previous fiscal data.

ClickUp Brain Behaviour: Analyzes financial reports and highlights effective budget distribution methods.

What cost-saving measures are trending in marketing budgets under $50K across North America?

Use Case: Guides budget-conscious marketing teams with up-to-date saving tactics.

ClickUp Brain Behaviour: Compiles insights from internal marketing reports; Brain Max can supplement with relevant external data if accessible.

Create a budget proposal tailored for a lean project management team referencing Project Plan #12 and past budget notes.

Use Case: Aligns finance and project teams with a clear, structured budget outline.

ClickUp Brain Behaviour: Extracts pertinent details from linked documents to generate a comprehensive budget plan.

Summarize expense differences between remote and in-office teams using data from the ‘Team Expenses Q2’ document.

Use Case: Facilitates cost-benefit analysis without manual data review.

ClickUp Brain Behaviour: Pulls tabular and narrative data from internal files to produce a concise expense comparison.

Identify the main software subscription expenses affecting small business budgets, based on R&D notes and vendor agreements.

Use Case: Helps pinpoint major recurring costs for budget optimization.

ClickUp Brain Behaviour: Scans internal documents to list frequent software expenses along with performance notes.

From the ‘Finance Audit’ document, produce a monthly budget review checklist.

Use Case: Simplifies regular financial oversight with a ready-to-use task list.

ClickUp Brain Behaviour: Identifies key review points and formats them into an actionable checklist within a task or document.

Outline 3 new budgeting tools gaining popularity among startups, based on recent industry analyses.

Use Case: Keeps finance teams informed about innovative budgeting solutions.

ClickUp Brain Behaviour: Extracts trends and recurring mentions from linked industry reports and notes.

Summarize primary user preferences for budget tracking applications from the ‘User Feedback Q1’ document.

Use Case: Helps product teams tailor budgeting tools to user needs.

ClickUp Brain Behaviour: Analyzes survey responses to identify common themes and feature requests.

Craft clear and friendly copy for budget alert notifications, guided by the ‘BrandVoice.pdf’ tone document.

Use Case: Accelerates UI text creation while maintaining brand consistency.

ClickUp Brain Behaviour: References tone guidelines to suggest multiple notification text options.

Summarize key tax regulation updates for 2025 and their impact on small business budgeting.

Use Case: Ensures budgets reflect evolving compliance requirements.

ClickUp Brain Behaviour: Condenses internal compliance documents; Brain Max can incorporate public updates if available.

Create guidelines for budget reporting formats that meet regional financial compliance standards.

Use Case: Guarantees adherence to local financial reporting rules.

ClickUp Brain Behaviour: Extracts formatting rules and compliance notes from internal documents to form a checklist.

Develop a risk assessment checklist for potential budget overruns based on ‘Project Finance’ PDFs and expense records.

Use Case: Supports finance teams in proactive budget monitoring.

ClickUp Brain Behaviour: Identifies risk factors from PDFs and organizes them into task groups by severity or category.

Compare zero-based and incremental budgeting approaches using insights from competitive analysis documents.

Use Case: Aids decision-making for selecting effective budgeting strategies.

ClickUp Brain Behaviour: Summarizes documented comparisons into clear, digestible formats such as briefs or tables.

Highlight recent trends in personal budgeting applications observed since 2023.

Use Case: Provides R&D teams with insights to guide product development.

ClickUp Brain Behaviour: Synthesizes trends from internal research notes, market summaries, and uploaded reports.

Extract and prioritize frequent budget management issues reported by small businesses in Southeast Asia.

Use Case: Drives targeted improvements for regional financial tools.

ClickUp Brain Behaviour: Analyzes survey data, feedback notes, and tagged tickets to highlight key pain points.

Plan Budgets Confidently with ClickUp Brain

Cut down on guesswork, align your team effortlessly, and produce accurate budgets using AI-driven planning tools.

AI Applications

Leading 3 Ways AI Prompts Enhance Budget Planning with ClickUp Brain

Speed up budgeting, boost precision, and discover smarter financial strategies using AI

From Budget Ideas to Clear Financial Plans

Budget planning usually starts with scattered numbers and unclear goals. ClickUp Brain organizes these fragments into clear, actionable budget documents—right inside ClickUp Docs.

Leverage ClickUp Brain to:

- Convert initial expense notes into detailed budget templates

- Create fresh budget strategies informed by previous financial data (using context-aware AI writing)

- With Brain Max, quickly explore past budgets, expense reports, and financial notes to inspire your next plan.

Budget Planning to Execution

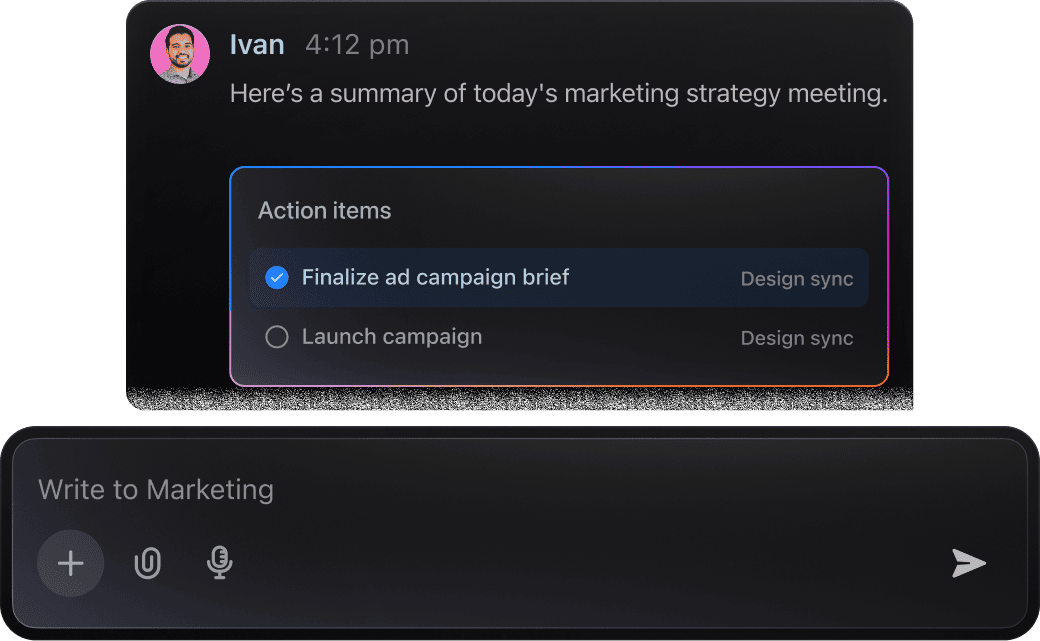

Managing budgets involves sifting through complex spreadsheets and scattered notes. ClickUp Brain empowers you to pinpoint key financial details, identify discrepancies, and create actionable budget tasks from your data.

Leverage ClickUp Brain to:

- Condense lengthy budget discussions within tasks or Docs into clear summaries

- Convert annotated financial plans into precise budget allocation tasks

- Generate expense reports or budget review briefs effortlessly

- With Brain Max, instantly retrieve past budget decisions, vendor comparisons, or spending trends across your workspace—eliminating tedious manual searches.

Budget Planning with ClickUp Brain

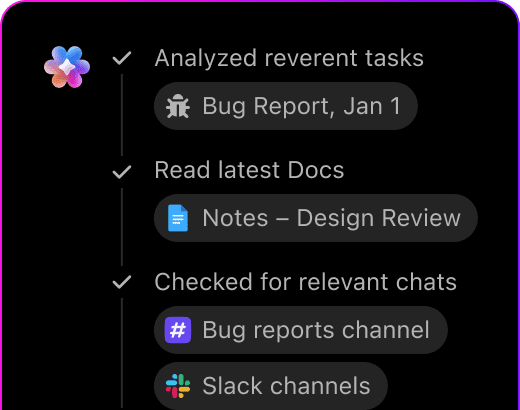

Crafting a detailed budget involves balancing expenses, forecasts, and team inputs. ClickUp Brain simplifies this process by extracting key data and producing clear financial summaries tailored to your goals.

Leverage ClickUp Brain to:

- Analyze financial notes and highlight critical budget points

- Create budget descriptions and category labels with consistent language

- Convert discussion threads into actionable budget adjustments or approval tasks

- Brain Max enhances this by easily referencing past budget versions or comparable financial plans, supporting long-term fiscal management.

AI Advantages

How AI Prompts Revolutionize Budget Planning with ClickUp Brain

Harness AI-driven prompts to transform your budgeting process:

- Kick off planning swiftly: Transition from rough estimates to detailed budget outlines and forecasts effortlessly

- Minimize errors: Detect discrepancies by reviewing historical budgets and expense reports

- Align your team: AI-crafted summaries and updates ensure everyone stays informed

- Make informed choices: Generate insights on spending trends and compliance requirements

- Shape financial goals: Experiment with scenarios beyond standard budget constraints.

Every output integrates directly within ClickUp, turning prompts into actionable documents, tasks, and visual reports that drive your financial projects forward.

Prompt Advice

How to Craft Effective Budgeting Prompts

Clear prompts unlock precise financial plans.

Specify the financial context

Vague prompts yield broad suggestions. Include details like budget type (e.g., "monthly household" or "project capital"), financial goals (e.g., "reduce expenses" or "allocate marketing funds"), or audience (e.g., "small business owners" or "freelancers").

Example: "Outline a monthly budget plan for a startup aiming to control operational costs."

Ask for side-by-side budget analyses

AI excels at contrasting alternatives. Use prompts like “compare X vs Y” to assess spending categories, funding scenarios, or cost-saving strategies.

Example: "Compare budget allocations between digital marketing and traditional advertising for a mid-size company."

Frame prompts as actionable budgeting steps

Treat your prompt as a clear task for AI. Instead of vague requests like “Create a budget,” focus on outcomes:

Example: "Develop a quarterly budget emphasizing cash flow stability and expense tracking for a nonprofit."

Request structured budget details

Need a spreadsheet layout, expense categories list, or summary report? Specify it. AI delivers better when the output format is clear.

Example: "Provide a categorized expense breakdown in bullet points with estimated amounts."

Simplify Budget Planning with ClickUp Brain

ClickUp Brain goes beyond managing tasks—it's your strategic partner in crafting and managing budgets effortlessly.