AI Budgeting Insights

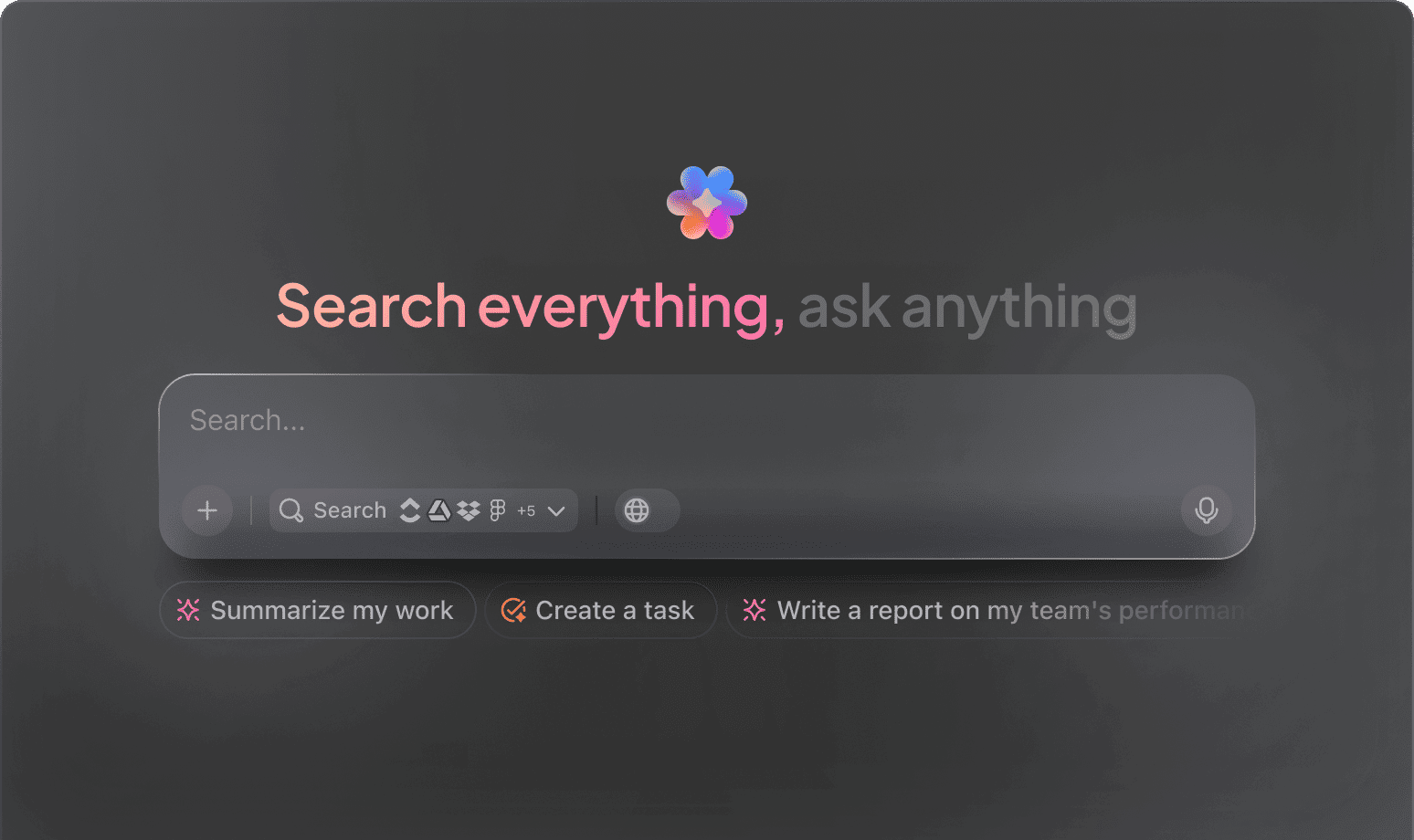

Top AI Prompts for Budgeting and Cost Control

Master your finances, simplify budget tracking, and elevate your cost management with ClickUp Brain.

Trusted by the world’s leading businesses

AI Empowering Financial Management

Revolutionizing Budgeting and Cost Control with AI Prompts in ClickUp Brain

Managing budgets and controlling expenses goes beyond spreadsheets—it's about orchestrating every financial detail precisely.

From initial budget planning to expense tracking, forecasting, and compliance monitoring, effective cost control demands juggling numerous variables—and countless reports, approvals, and deadlines. This is where AI prompts become invaluable.

Finance teams leverage AI to:

- Quickly identify spending patterns and budget variances

- Generate detailed budget proposals and cost analyses with ease

- Interpret complex financial regulations and audit requirements

- Transform scattered financial notes into clear action plans, checklists, or task assignments

Integrated into daily tools like documents, dashboards, and project trackers, AI transcends basic assistance. Within platforms such as ClickUp Brain, it operates seamlessly to convert financial insights into structured, executable plans.

Comparing ClickUp Brain with Conventional Solutions

Why ClickUp Brain Leads in Budgeting and Cost Control

Designed to understand your financial workflows deeply, ClickUp Brain lets you focus on managing budgets, not explaining them.

Standard AI Assistants

- Constantly switching apps to collect financial data

- Repeating budget objectives with every query

- Responses that miss your specific cost control needs

- Hunting through multiple platforms for expense reports

- Interacting with AI that lacks proactive insights

- Manually toggling between different AI engines

- Limited to browser add-ons without integration

ClickUp Brain

- Instantly accesses your budgets, expenses, and financial notes

- Keeps track of your spending goals and past decisions

- Provides tailored, practical advice for cost management

- Searches seamlessly across all your financial documents

- Supports hands-free input with voice commands

- Automatically selects the optimal AI model for your task

- Available as a fast, dedicated desktop app for Mac & Windows

Budgeting & Cost Control Prompts

15 Powerful AI Prompts for Budgeting and Cost Control (Optimized for ClickUp Brain)

Master your financial planning—forecasting, expense tracking, and cost optimization simplified.

Identify 5 cost-saving strategies for a mid-sized marketing campaign, based on the ‘Q3 Budget Review’ document.

Use Case: Accelerates budget refinement using historical spending data.

ClickUp Brain Behaviour: Analyzes financial reports and highlights actionable savings opportunities from linked documents.

What are the latest expense management trends for startups under $1M annual revenue in North America?

Use case: Supports lean budgeting decisions with up-to-date market insights.

ClickUp Brain Behaviour: Aggregates findings from internal financial analyses; Brain Max can supplement with relevant external data if accessible.

Draft a budget proposal for a new product launch emphasizing cost efficiency, referencing ‘Launch Plan #3’ and previous budget notes.

Use Case: Aligns finance and project teams with a clear, cost-conscious plan.

ClickUp Brain Behaviour: Extracts key budget parameters and contextual notes from linked files to generate a structured proposal.

Summarize comparative cost analyses between vendor A and vendor B using our ‘Supplier Costs Q2’ document.

Use Case: Facilitates vendor selection without manual data review.

ClickUp Brain Behaviour: Pulls tabular and narrative data from internal files to produce a concise cost comparison.

List top 5 budgeting software tools favored by finance teams in mid-sized firms, referencing recent market research and user feedback docs.

Use Case: Helps identify suitable tools for expense tracking and reporting.

ClickUp Brain Behavior: Scans internal and external documents to compile a ranked list with feature highlights.

From the ‘Quarterly Audit Checklist’ doc, generate a task list for budget compliance reviews.

Use Case: Simplifies audit preparation with automated checklist creation.

ClickUp Brain Behavior: Extracts compliance criteria and formats them into actionable review tasks.

Summarize 3 emerging cost control techniques from recent financial strategy reports.

Use Case: Keeps budgeting approaches innovative and evidence-based.

ClickUp Brain Behavior: Identifies recurring themes and best practices from linked strategy documents.

From the ‘Employee Expense Survey Q1’ doc, summarize key spending habits and preferences.

Use Case: Helps finance teams tailor policies to actual employee behavior.

ClickUp Brain Behavior: Analyzes survey data to extract common expense patterns and feedback.

Write clear and engaging policy text for the new travel expense guidelines using the tone outlined in ‘FinanceTone.pdf.’

Use Case: Accelerates policy rollout with consistent and approachable language.

ClickUp Brain Behavior: Pulls style cues from the document and generates multiple phrasing options for approval.

Summarize recent changes in tax regulations affecting small businesses and their impact on budgeting.

Use Case: Ensures financial plans comply with updated legal requirements.

ClickUp Brain Behavior: Reviews linked regulatory documents and provides a digestible summary; Brain Max can add public updates if available.

Generate guidelines for allocating contingency funds in project budgets, referencing internal financial policies.

Use Case: Promotes consistent risk management across teams.

ClickUp Brain Behavior: Extracts rules and best practices from policy documents to produce clear allocation instructions.

Create a checklist for monthly expense reconciliation using the ‘Finance Operations’ folder.

Use Case: Helps accounting teams maintain accurate financial records.

ClickUp Brain Behavior: Identifies key reconciliation steps from internal documents and formats them into a task list.

Compare budgeting approaches between agile startups and traditional enterprises using our competitive finance analysis docs.

Use Case: Supports strategic planning with insights into diverse financial models.

ClickUp Brain Behavior: Summarizes documented differences into an easy-to-understand comparison chart.

What cost control challenges are emerging in remote work setups since 2023?

Use Case: Guides finance teams in adapting policies to new work environments.

ClickUp Brain Behavior: Synthesizes trends from internal reports, surveys, and external research files.

Summarize key budget overruns and root causes from the ‘Project X Expense Reports’ folder.

Use Case: Drives targeted improvements in cost monitoring and control.

ClickUp Brain Behavior: Extracts and prioritizes issues from expense data, feedback notes, and audit findings.

Optimize Budgets Instantly with ClickUp Brain

Cut down costly errors, unify your finance team, and produce precise budget plans using AI-driven processes.

AI Applications

Key Ways AI Prompts Enhance Budgeting and Cost Control with ClickUp Brain

Speed up financial planning, boost precision, and discover smarter budgeting strategies using AI prompts in ClickUp Brain

From Budget Ideas to Financial Plans

Budget planning usually starts with fragmented numbers and unclear expense notes. ClickUp Brain organizes these into clear, collaborative budgeting documents—right inside ClickUp Docs.

Leverage ClickUp Brain to:

- Convert preliminary cost estimates into detailed budget templates

- Create fresh budgeting strategies informed by previous financial data (through context-aware AI assistance)

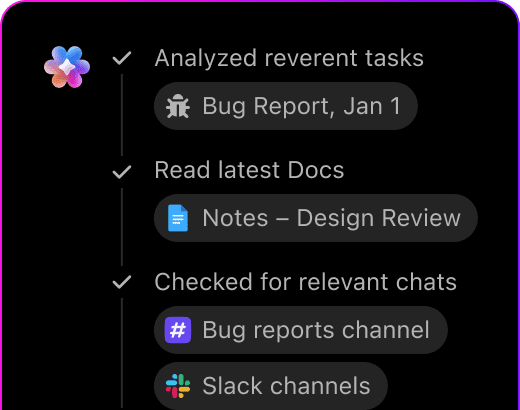

- With Brain Max, quickly explore past budgets, expense reports, and cost analyses to inform your next financial plan.

Budgeting to Cost Control

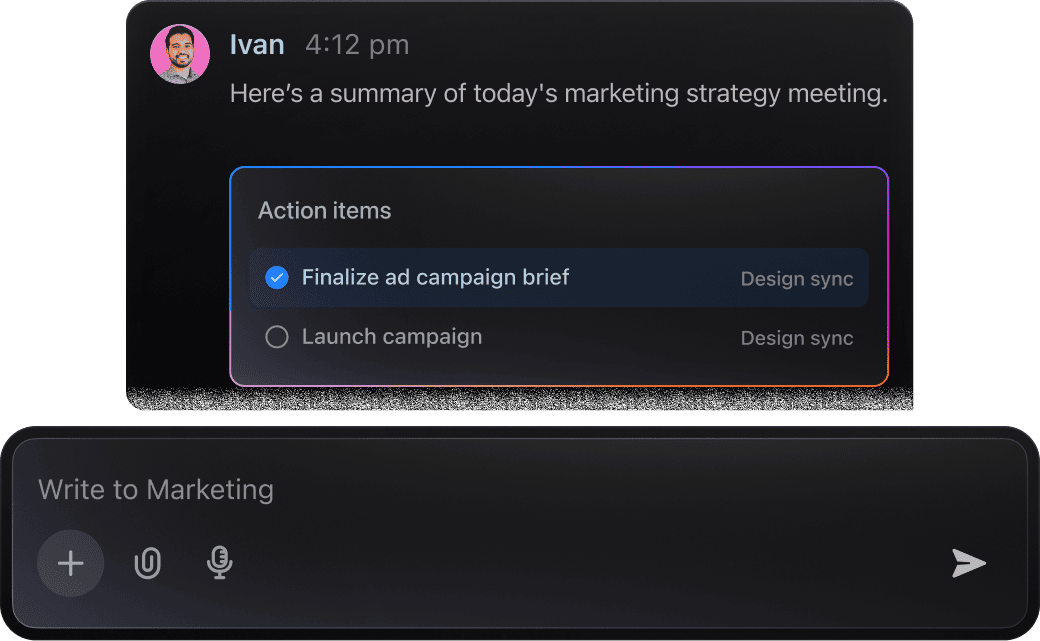

Financial teams manage extensive expense records and budget reviews. ClickUp Brain assists by pinpointing key budget actions, highlighting potential overspending, and crafting follow-up tasks from financial notes.

Leverage ClickUp Brain to:

- Condense detailed budget meetings and expense reports stored in tasks or Docs

- Convert annotated financial plans into actionable cost control tasks

- Generate variance analyses or budget summaries automatically

- With Brain Max, swiftly retrieve past budget approvals, vendor comparisons, or cost-saving discussions across your workspace—eliminating tedious searches through spreadsheets.

Budgeting and Cost Control with ClickUp Brain

Managing budgets and tracking expenses can feel overwhelming with scattered data and constant updates. ClickUp Brain simplifies your financial oversight by extracting key points from reports and crafting clear budget summaries tailored to your team's style.

Leverage ClickUp Brain to:

- Analyze financial documents and highlight critical cost factors

- Create budget narratives that communicate clearly across departments

- Convert expense discussions into actionable budget adjustments or approval tasks

- Brain Max enhances this by referencing past budget cycles and similar project expenditures, ensuring consistency throughout extended financial planning periods.

AI Advantages

How AI Prompts Revolutionize Budgeting and Cost Control Processes

Harness AI-driven prompts to enhance every stage of your budgeting and expense management:

- Accelerate planning: Quickly generate detailed budgets, forecasts, and cost analyses

- Reduce errors: Identify discrepancies by cross-checking historical spending and projections

- Align your team: AI-crafted summaries and reports ensure everyone stays informed

- Make informed choices: Use prompts to gather market data and compliance updates

- Drive financial growth: Uncover cost-saving opportunities beyond standard budgets.

All these capabilities integrate directly within ClickUp, turning AI outputs into actionable documents, tasks, and dashboards that push your financial goals forward.

Prompt Guidance

Crafting Effective Budgeting Prompts

Clear prompts unlock precise financial insights.

Define your budgeting scenario clearly

Vague prompts yield broad suggestions. Specify details like budget type (e.g., “monthly marketing budget” or “annual operational costs”), financial goals (e.g., “reduce overhead by 10%” or “allocate funds for new hires”), or department focus (e.g., “small business finance team”).

Example: “Outline cost-saving strategies for a mid-sized retail chain aiming to cut expenses by 15% this fiscal year.”

Use comparative prompts to evaluate options

AI excels at contrasting financial plans. Use prompts like “compare X vs Y” to assess budget allocations, vendor pricing, or cost control methods.

Example: “Compare the cost-effectiveness of in-house accounting versus outsourcing for a startup.”

Frame prompts around financial objectives

Approach your prompt as a specific budgeting task. Instead of “Generate budget ideas,” focus on desired outcomes:

Example: “Develop a quarterly budget plan for a nonprofit prioritizing program funding and administrative efficiency.”

Specify the output format you need

Looking for a budget breakdown, expense forecast, or savings checklist? Make it clear. AI delivers better when the expected format is outlined.

Example: “Provide a bullet-point list of five cost reduction tactics for a manufacturing department with explanations.”

Optimize Budget Planning with ClickUp Brain

ClickUp Brain goes beyond basic budgeting—it’s your strategic partner for mastering every phase of cost control and financial planning.