AI Solutions for Banking

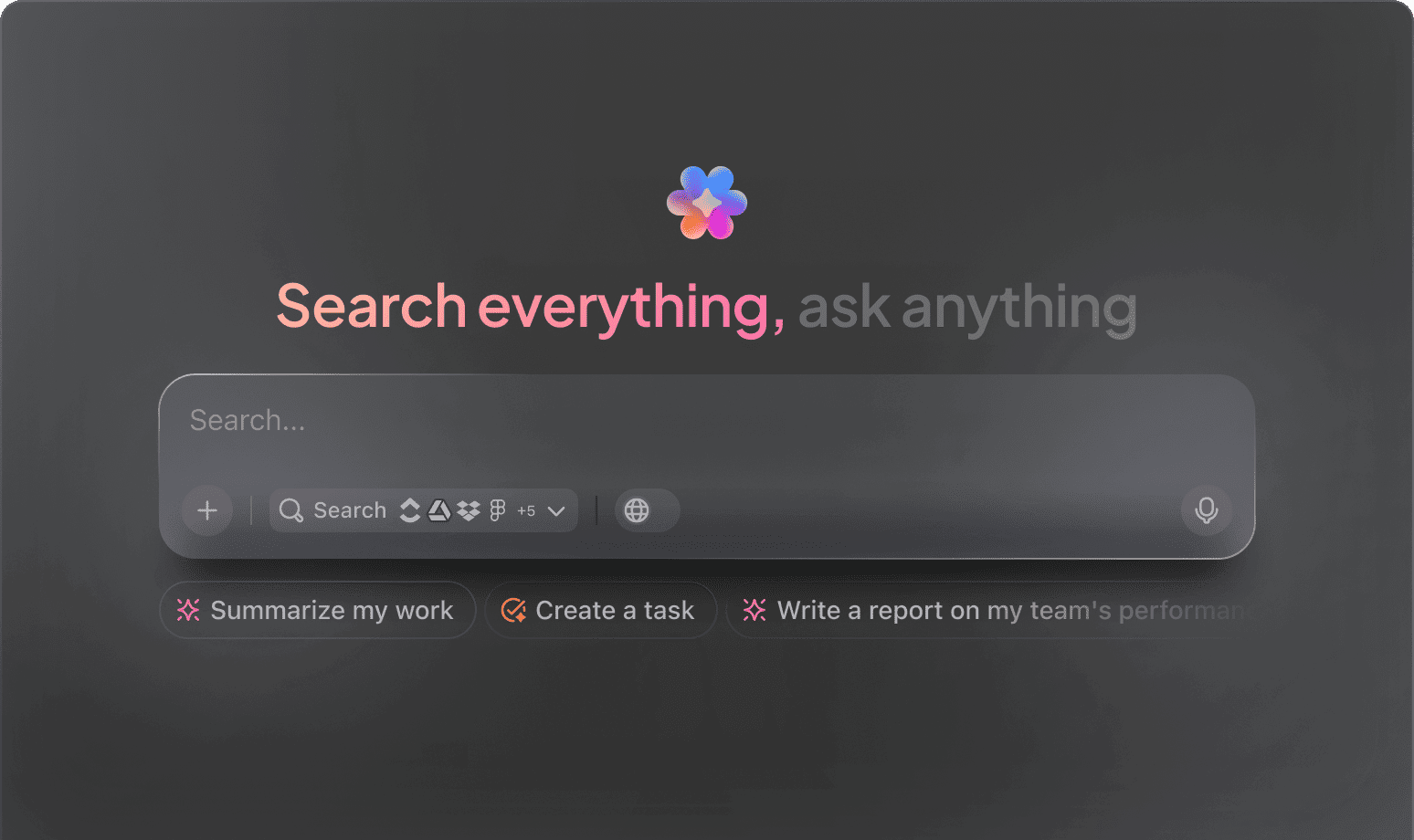

Top AI Prompts Tailored for Banking Teams

Enhance your banking operations, simplify complex processes, and elevate client services effortlessly with ClickUp AI.

Trusted by the world’s leading businesses

AI Empowering Banking Teams

Revolutionizing Banking Operations with AI Prompts in ClickUp Brain

Banking today is more than transactions—it's about managing complex workflows, compliance, and customer needs efficiently.

From loan processing to risk assessment, fraud detection, and regulatory reporting, banking teams juggle numerous tasks and data streams daily. AI prompts are now crucial in simplifying these challenges.

Banking professionals leverage AI to:

- Quickly identify market trends and financial insights

- Generate detailed reports, loan documents, and customer communications effortlessly

- Interpret regulatory guidelines and compliance requirements

- Transform scattered notes into clear action plans, checklists, or project tasks

Integrated within familiar tools like documents, dashboards, and task managers, AI in ClickUp Brain acts as a powerful partner—turning complex banking inputs into streamlined, actionable workflows.

ClickUp Brain Compared to Conventional Solutions

Why ClickUp Brain Stands Out

Designed to understand your banking workflows deeply, ClickUp Brain lets you focus on results instead of explanations.

Conventional AI Platforms

- Constantly toggling between apps to collect information

- Repeating your objectives with every query

- Receiving generic, irrelevant suggestions

- Hunting through numerous systems for a single document

- Interacting with AI that only processes input passively

- Manually switching among different AI engines

- Merely another add-on in your browser

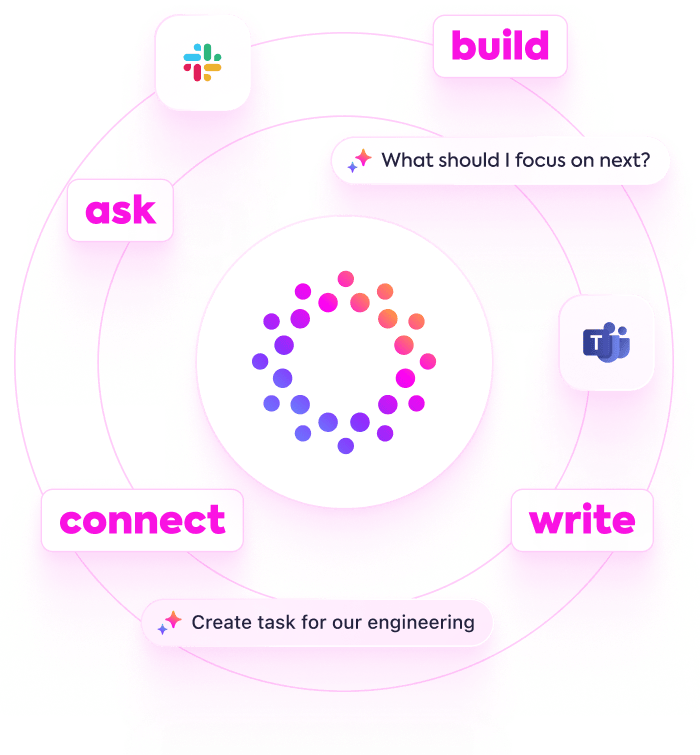

ClickUp Brain

- Seamlessly integrates with your banking tasks, files, and team communications

- Retains your project history and strategic aims

- Provides detailed, context-driven recommendations

- Consolidates search across all your banking tools

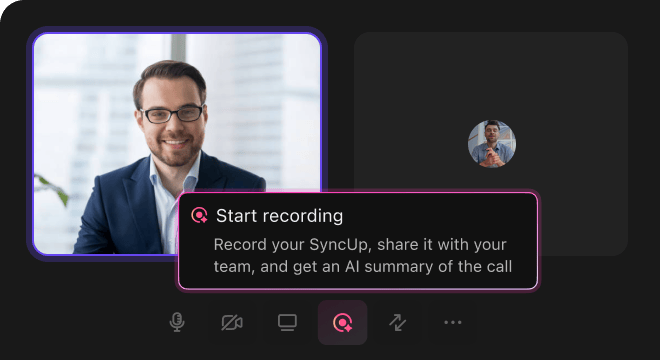

- Enables voice commands with Talk to Text

- Automatically selects the optimal AI model: GPT, Claude, Gemini

- Offers a dedicated Mac & Windows app optimized for performance

Prompts for Banking Innovation

15 Powerful AI Prompts for Banking Teams (Tested in ClickUp Brain)

Accelerate banking workflows—customer insights, risk analysis, and compliance simplified.

Identify 5 emerging digital banking trends from the ‘Q2 Market Analysis’ report.

Use Case: Speeds up strategic planning by highlighting recent industry shifts.

ClickUp Brain Behaviour: Analyzes linked documents to extract key trend themes and summarize insights.

What are the top security features adopted by retail banks under $1B in assets?

Use Case: Supports risk teams in benchmarking security protocols.

ClickUp Brain Behaviour: Synthesizes internal research and can incorporate public data for comprehensive insights.

Draft a customer onboarding checklist based on regulatory guidelines and internal policies from the ‘Compliance Handbook’.

Use Case: Ensures consistent and compliant onboarding processes.

ClickUp Brain Behaviour: Extracts relevant rules and procedures to create a structured, easy-to-follow checklist.

Summarize loan approval criteria differences between personal and small business loans using the ‘Loan Policies’ doc.

Use Case: Facilitates quick comparison for credit officers.

ClickUp Brain Behaviour: Pulls data from policies and presents a clear side-by-side summary.

List key performance indicators (KPIs) tracked by retail banking branches, referencing recent quarterly reports.

Use Case: Helps branch managers focus on impactful metrics.

ClickUp Brain Behavior: Scans reports to identify and compile frequently monitored KPIs with explanations.

From the ‘Fraud Detection Procedures’ doc, generate a task checklist for transaction monitoring activities.

Use Case: Streamlines fraud prevention workflows.

ClickUp Brain Behavior: Identifies critical steps and formats them into actionable tasks.

Summarize 3 customer engagement strategies proven effective in digital banking post-2023, based on recent campaign reviews.

Use Case: Keeps marketing teams informed with data-backed tactics.

ClickUp Brain Behavior: Extracts recurring themes and successful approaches from linked documents.

From the ‘Millennial Banking Preferences’ survey, summarize key insights on mobile app features.

Use Case: Aligns product development with user expectations.

ClickUp Brain Behavior: Analyzes survey data to highlight common preferences and pain points.

Write clear, friendly notification messages for balance alerts using the tone guidelines in ‘BrandVoice.pdf’.

Use Case: Speeds up communication content creation while maintaining brand personality.

ClickUp Brain Behavior: References tone documents to generate varied message options.

Summarize upcoming changes in GDPR regulations and their impact on customer data handling.

Use Case: Prepares compliance teams for regulatory updates.

ClickUp Brain Behavior: Condenses legal documents into actionable summaries; Brain Max can pull public updates if available.

Generate guidelines for secure online transaction limits, referencing regional compliance documents.

Use Case: Ensures adherence to local banking regulations.

ClickUp Brain Behavior: Extracts rules and compiles them into a clear compliance checklist.

Create a checklist for audit readiness based on internal control standards and recent audit reports.

Use Case: Supports audit teams in preparing documentation and processes.

ClickUp Brain Behavior: Identifies key audit criteria and organizes them into actionable steps.

Compare digital wallet features across major banks using competitive analysis reports.

Use Case: Informs product strategy and feature prioritization.

ClickUp Brain Behavior: Summarizes comparisons into concise, easy-to-digest formats.

What customer service trends are emerging in banking since 2023?

Use Case: Guides service teams to adopt innovative support methods.

ClickUp Brain Behavior: Synthesizes insights from internal feedback, research notes, and industry reports.

Summarize key pain points from Southeast Asia retail banking customer feedback (service speed, digital access, fees).

Use Case: Drives targeted improvements for regional teams.

ClickUp Brain Behavior: Extracts and prioritizes issues from surveys, support tickets, and feedback forms.

Innovate Banking Workflows Effortlessly with ClickUp Brain

Cut down redundant tasks, unify your banking team, and produce superior results through AI-driven processes.

AI Applications

Leading 3 Applications of AI Prompts in Banking Operations

Enhance efficiency, boost precision, and discover innovative strategies with AI in banking workflows

From Initial Ideas to Formal Design Documents

Designing starts with scattered thoughts and unorganized jottings. ClickUp Brain organizes these into clear, collaborative design briefs—right inside ClickUp Docs.

Leverage ClickUp Brain to:

- Convert informal sketches and notes into polished, actionable templates

- Develop fresh concepts informed by previous design history (powered by context-sensitive AI writing)

- With Brain Max, instantly explore past banking product designs, client feedback, and creative assets to inspire your next project.

From Blueprint to Build

Banking teams handle complex project details and compliance reviews daily. ClickUp Brain simplifies this by pinpointing key action points, highlighting compliance risks, and creating task reminders from your notes.

Leverage ClickUp Brain to:

- Condense regulatory discussions captured in tasks or Docs

- Convert annotated audit notes into actionable follow-up assignments

- Automatically generate compliance reports or project handoff briefs

- With Brain Max, effortlessly retrieve past decisions, policy comparisons, or client case discussions across your workspace—eliminating endless document searches.

Banking UX Innovation

Crafting user interfaces for banking apps or online platforms involves balancing customer feedback, compliance needs, and design standards. ClickUp Brain simplifies this complexity—extracting key findings and creating consistent, on-brand UX content.

Leverage ClickUp Brain to:

- Analyze customer interviews and highlight critical points

- Produce tailored UI text that fits diverse banking services

- Convert user comments into prioritized design improvements or issue tickets

- Brain Max enhances this by providing quick access to past research or comparable banking product launches, supporting long-term development cycles.

AI Advantages

How AI Prompts Revolutionize Banking Operations

Integrating AI prompt workflows reshapes your banking processes end-to-end:

- Accelerate analysis: Transform raw data into actionable reports and risk assessments swiftly

- Reduce errors: Detect discrepancies by cross-referencing transaction histories and audit trails

- Align your team: AI-crafted summaries and updates keep everyone informed and coordinated

- Enhance decisions: Generate insights on market trends and regulatory compliance with precision

- Innovate banking services: Uncover new financial products and customer engagement strategies.

All these capabilities integrate directly within ClickUp, turning AI outputs into actionable documents, tasks, and dashboards that drive your banking projects forward.

Prompt Guidance

Crafting Effective Prompts for Banking

Clear prompts unlock precise financial solutions.

Define the banking scenario clearly

Vague prompts yield broad responses. Specify details like banking segment (e.g., “retail banking” or “investment services”), customer profile (e.g., “young professionals” or “high-net-worth clients”), or product focus (e.g., “mobile deposits” or “loan approvals”).

Example: “Generate ideas for a mobile app feature that helps millennials manage personal budgets.”

Use comparative prompts to evaluate options

AI excels at drawing distinctions between financial products or strategies. Use prompts like “compare X and Y” to assess loan terms, investment plans, or customer service approaches.

Example: “Compare interest rate benefits of fixed vs variable mortgages for first-time buyers.”

Frame prompts around banking objectives

Treat your prompt as a goal-oriented request. Instead of “Suggest marketing ideas,” focus on outcomes:

Example: “Design a customer onboarding process that reduces drop-off rates for online account opening.”

Specify the desired output format

Need a risk assessment table, compliance checklist, or customer journey map? Clarify the format to get structured, actionable results.

Example: “Provide a bullet list of five fraud detection techniques suitable for mobile banking platforms with brief explanations.”

Accelerate Banking Innovation with ClickUp Brain

ClickUp Brain goes beyond managing tasks—it's your strategic partner throughout every phase of banking innovation and operations.