AI Budget Management

Top AI Prompts for Budget Tracking with ClickUp Brain

Master your finances, simplify expense monitoring, and elevate your budget planning using ClickUp Brain’s intelligent assistance.

Trusted by the world’s leading businesses

AI Empowering Budget Management

Harnessing AI Prompts to Simplify Budget Tracking with ClickUp Brain

Managing budgets effectively goes beyond just numbers—it's about clarity, control, and collaboration.

From expense logging to forecasting and compliance monitoring, budget tracking requires juggling multiple data points, approvals, and reports. AI prompts are revolutionizing how teams handle these complexities.

With AI support, teams can now:

- Quickly identify spending patterns and anomalies

- Generate detailed budget reports and forecasts with ease

- Interpret financial policies and compliance requirements swiftly

- Transform scattered expense notes into organized budgets, action items, or approval workflows

Integrated seamlessly into daily tools like docs, spreadsheets, and project boards, AI in platforms such as ClickUp Brain becomes a proactive partner, turning financial data into clear, manageable tasks.

ClickUp Brain Compared to Conventional Solutions

Why ClickUp Brain Stands Out

ClickUp Brain integrates seamlessly, understands your context, and acts instantly—so you focus more on managing budgets, less on setup.

Conventional Budgeting Tools

- Constantly toggling between spreadsheets and apps

- Repeatedly inputting the same financial details

- Receiving generic budget advice lacking relevance

- Hunting through multiple platforms for reports

- Interacting with AI that doesn’t grasp your unique needs

- Manually switching between different AI assistants

- Just another add-on that slows your workflow

ClickUp Brain

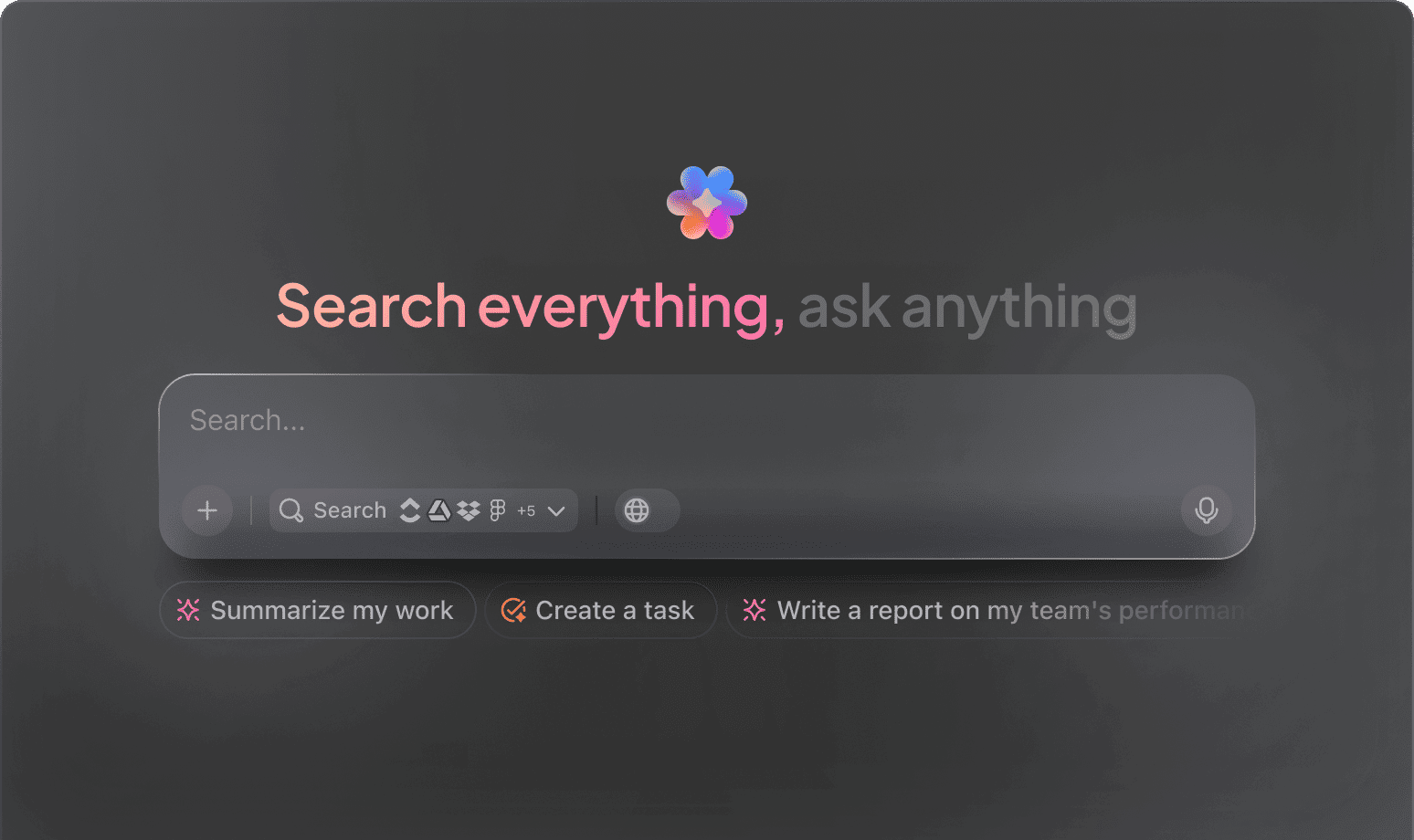

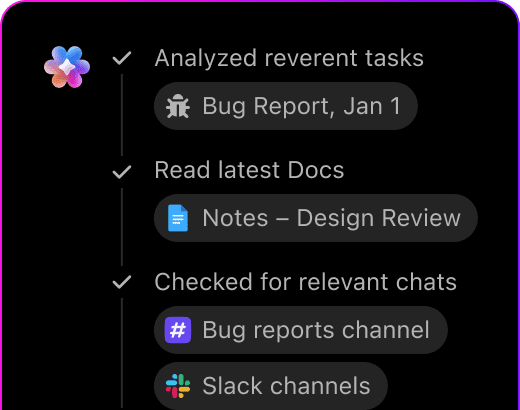

- Instantly accesses your budget tasks, documents, and updates

- Keeps track of your financial goals and past actions

- Provides tailored, practical budget insights

- Searches all your financial data in one place

- Allows hands-free input with voice commands

- Automatically selects the optimal AI model for your queries

- Available as a fast, native app on Mac & Windows

Prompts for Budget Tracking Support

15 Powerful AI Prompts for Budget Tracking with ClickUp Brain (Validated)

Simplify budget management—monitor expenses, forecast costs, and optimize spending effortlessly.

Identify 5 budget allocation strategies for a small marketing team, based on the ‘Q2 Budget Review’ document.

Use Case: Accelerates budget planning by leveraging historical allocation data.

ClickUp Brain Behaviour: Analyzes financial reports and past budgets from linked docs to propose effective allocation methods.

What are the latest cost-saving trends in SaaS subscriptions for startups under $50K annual spend?

Use case: Guides teams to optimize software expenses with current market insights.

ClickUp Brain Behaviour: Combines internal expense data with external industry reports to highlight saving opportunities.

Draft a budget overview for a remote team’s quarterly expenses, referencing ‘Expense Tracker Q1’ and previous financial summaries.

Use Case: Ensures clear communication of spending plans across departments.

ClickUp Brain Behaviour: Extracts key figures and notes from documents to generate a concise budget summary.

Compare monthly utility expenses between office locations using the ‘Facilities Costs’ spreadsheet.

Use Case: Supports cost analysis to identify high-spend areas.

ClickUp Brain Behaviour: Pulls data from tables and text to create a summarized comparison report.

List top 5 recurring expense categories impacting cash flow, based on ‘Financial Statements’ and vendor invoices.

Use Case: Helps pinpoint major cost drivers for better financial control.

ClickUp Brain Behavior: Scans documents to identify frequent expense types and their impact notes.

From the ‘Budget Approval Process’ doc, generate a step-by-step checklist for expense authorization.

Use Case: Streamlines approval workflows and reduces delays.

ClickUp Brain Behavior: Extracts procedural steps and formats them into an actionable checklist.

Summarize 3 emerging budgeting tools or methods from recent finance team reviews.

Use Case: Keeps budgeting practices current and efficient.

ClickUp Brain Behavior: Identifies key points and trends from linked meeting notes and reports.

From the ‘Employee Reimbursement Survey’ doc, summarize common pain points and suggestions.

Use Case: Improves reimbursement policies aligned with staff feedback.

ClickUp Brain Behavior: Analyzes survey data to highlight frequent issues and proposed solutions.

Write clear and friendly expense reminder messages using the tone guidelines in ‘Communication Style Guide.pdf’.

Use Case: Enhances timely submissions with consistent messaging.

ClickUp Brain Behavior: Draws on tone references to craft varied reminder templates.

Summarize updates in tax regulations for 2025 and their effects on budgeting.

Use Case: Keeps financial plans compliant with new legal requirements.

ClickUp Brain Behavior: Reviews linked tax documents and highlights key changes relevant to budgeting.

Generate guidelines for categorizing expenses according to company policy, referencing internal finance manuals.

Use Case: Ensures uniform expense tracking across teams.

ClickUp Brain Behavior: Extracts classification rules and compiles them into a clear reference list.

Create a checklist for quarterly budget review meetings using notes from past sessions.

Use Case: Helps finance teams prepare thorough and consistent reviews.

ClickUp Brain Behavior: Summarizes agenda items and action points into a structured checklist.

Compare subscription renewal dates and costs across departments using ‘Subscription Tracker’ docs.

Use Case: Supports proactive management of recurring payments.

ClickUp Brain Behavior: Extracts and organizes renewal data into an easy-to-read summary.

What budgeting challenges are most reported by remote teams since 2023?

Use Case: Guides targeted improvements in budget processes for distributed teams.

ClickUp Brain Behavior: Synthesizes feedback from internal surveys and support tickets.

Summarize key expense approval bottlenecks from the ‘Finance Feedback’ folder.

Use Case: Identifies process inefficiencies to speed up approvals.

ClickUp Brain Behavior: Extracts and prioritizes common issues from feedback documents and comments.

Master Budgeting Effortlessly with ClickUp Brain

Cut down on manual tracking, unify your financial team, and produce accurate budget insights through AI-enhanced processes.

AI Applications

Essential AI Prompts for Streamlining Budget Tracking with ClickUp Brain

Enhance financial oversight, reduce errors, and gain actionable insights through AI-powered budget management with ClickUp Brain

From Budget Notes to Financial Plans

Managing budgets usually starts with fragmented spreadsheets and scattered receipts. ClickUp Brain organizes these into clear, actionable financial plans—right inside ClickUp Docs.

Leverage ClickUp Brain to:

- Convert disorganized expense notes into structured budget templates

- Create fresh budgeting strategies informed by previous financial data (using context-aware AI assistance)

- With Brain Max, instantly explore historical budgets, expense reports, and financial documents to inspire your upcoming fiscal decisions.

Budget Tracking with ClickUp Brain

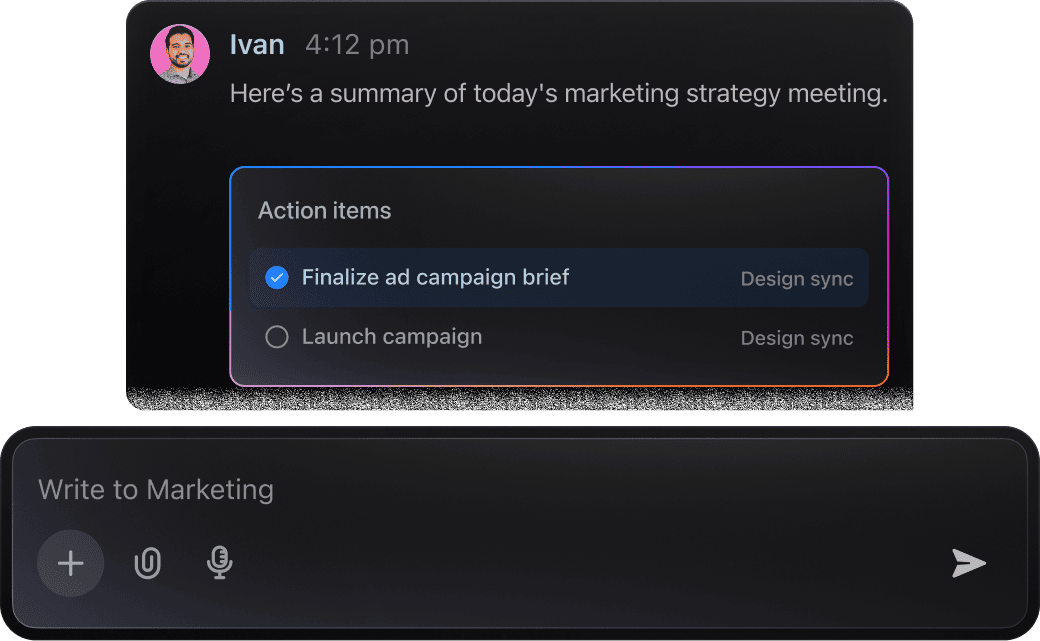

Managing budgets involves sifting through numerous financial entries and updates. ClickUp Brain simplifies this by pinpointing key expenses, highlighting discrepancies, and crafting budget summaries automatically.

Leverage ClickUp Brain to:

- Condense detailed budget reports and expense logs

- Convert annotated financial notes into actionable budget tasks

- Generate variance analyses or spending summaries effortlessly

- With Brain Max, swiftly retrieve past budget decisions, expense comparisons, or financial discussions across your workspace—eliminating tedious manual searches.

Budget Tracking Made Simple with ClickUp Brain

Managing budgets involves sifting through spreadsheets, receipts, and team inputs. ClickUp Brain simplifies this—extracting key financial details and crafting clear budget summaries.

Leverage ClickUp Brain to:

- Analyze expense reports and highlight critical variances

- Create budget overviews tailored to different departments

- Convert financial discussions into precise action items or reminders

- Brain Max enhances this by recalling past budget cycles and related financial documents, supporting long-term fiscal planning.

AI Advantages

How AI Prompts Revolutionize Budget Tracking with ClickUp Brain

Harness AI-driven prompts to transform your budgeting process:

- Kick off budgeting swiftly: Shift from scattered numbers to organized forecasts and expense plans in moments

- Minimize errors: Detect discrepancies by analyzing historical spending and approvals

- Align your finance team: AI-crafted summaries and reports ensure everyone stays informed

- Make informed choices: Generate insights on cost trends and compliance requirements

- Plan confidently: Uncover innovative budgeting strategies beyond standard templates.

All these features integrate directly within ClickUp, turning your AI-generated content into actionable tasks, reports, and dashboards that drive financial success.

Prompt Tips

Crafting Effective Prompts for Budget Tracking

Clear prompts lead to precise financial insights.

Define your budgeting scenario clearly

Vague prompts yield vague advice. Specify details like budget type (e.g., “monthly marketing budget” or “annual IT expenses”), financial goals (e.g., “reduce overhead by 10%” or “allocate funds for new hires”), or department focus (e.g., “small business operations” or “nonprofit fundraising”).

Example: “Outline expense categories for a startup’s Q2 operational budget targeting cost efficiency.”

Use comparison prompts to evaluate spending

AI excels at contrasting financial options. Use “compare X vs Y” prompts to assess vendor costs, budget allocations, or expense trends.

Example: “Compare software subscription costs between Adobe Creative Cloud and Affinity Suite for a design team.”

Phrase prompts as financial tasks

Treat your prompt like a specific budgeting task. Instead of “Generate budget ideas,” focus on outcomes:

Example: “Develop a quarterly budget plan for a remote team, emphasizing travel and equipment expenses.”

Specify the desired output format

Need a categorized expense list, budget summary table, or forecast chart? Make it clear. AI delivers better when you define the structure.

Example: “Provide a bullet-point list of five cost-saving measures for office supplies with brief explanations.”

Simplify Budget Tracking with ClickUp Brain

ClickUp Brain goes beyond basic budgeting—it’s your smart partner for managing finances effortlessly throughout your projects.