AI Financial Analysis

Top AI Prompts for Analyzing Financial Statements

Unlock deeper insights, simplify complex data, and elevate your financial reviews with ClickUp Brain.

Trusted by the world’s leading businesses

AI in Financial Analysis

Revolutionizing Financial Statement Analysis with AI Prompts

Understanding financial health goes beyond numbers—it's about uncovering insights that drive smarter decisions.

From parsing balance sheets to interpreting cash flow statements and compliance reviews, analyzing financial reports involves juggling numerous details and deadlines. AI prompts are now pivotal in this process.

Financial teams leverage AI to:

- Quickly identify key financial trends and anomalies

- Generate concise summaries of complex financial data

- Translate raw figures into clear, actionable reports

- Organize scattered notes into structured analyses, checklists, or follow-up tasks

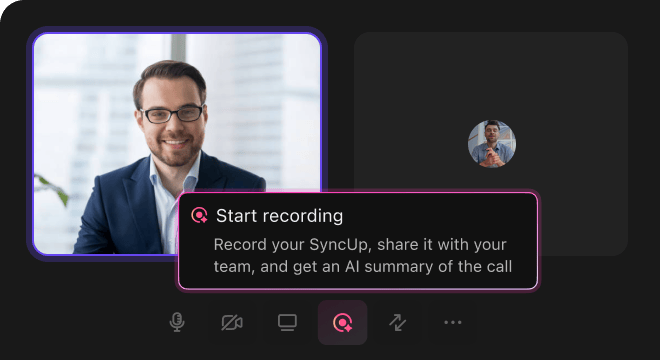

Integrated within familiar tools like documents, whiteboards, and project trackers, AI evolves from a simple helper to a strategic partner. In solutions such as ClickUp Brain, it seamlessly transforms financial inputs into well-organized, executable plans.

Comparing ClickUp Brain to Conventional Solutions

Why ClickUp Brain Stands Out

ClickUp Brain integrates seamlessly with your workflow, understanding your context so you can focus on insights, not explanations.

Conventional AI Platforms

- Constantly toggling between apps to compile data

- Repeating your analysis objectives with each query

- Receiving generic, irrelevant feedback

- Hunting through multiple systems to locate reports

- Engaging with AI that lacks proactive input

- Manually switching between different AI engines

- Merely another add-on without deep integration

ClickUp Brain

- Instantly accesses your financial reports, notes, and team comments

- Retains your analysis preferences and objectives

- Delivers detailed, context-driven financial insights

- Searches across all your documents and data sources

- Allows hands-free interaction through voice commands

- Automatically selects the optimal AI model for your task

- Available as a fast, native app on Mac and Windows

Financial Statement Analysis Prompts

15 Powerful AI Prompts for Financial Statement Analysis (Tested in ClickUp Brain)

Accelerate your financial reviews—insights, comparisons, and compliance simplified.

Identify 5 key financial ratios from the ‘Q4 2023 Financial Summary’ document.

Use Case: Quickly extracts crucial metrics to evaluate company health.

ClickUp Brain Behaviour: Analyzes the linked report to highlight and explain important ratios relevant to financial assessment.

What are the recent trends in liquidity ratios for mid-sized tech firms in North America?

Use Case: Supports data-driven decisions with up-to-date industry benchmarks.

ClickUp Brain Behaviour: Compiles insights from internal market research; Brain Max can supplement with external financial data if accessible.

Draft a summary report on cash flow statement analysis based on ‘Annual Report 2023’ and previous audit notes.

Use Case: Aligns finance teams with a clear, concise overview.

ClickUp Brain Behaviour: Extracts and organizes relevant textual information from linked documents into a structured summary.

Compare profitability margins between Company A and Company B using the ‘Profitability Q2’ dataset.

Use Case: Facilitates side-by-side financial performance evaluation.

ClickUp Brain Behaviour: Processes tabular and narrative data from internal files to generate a comparative analysis.

List top cost control measures identified in recent manufacturing sector financial reports.

Use Case: Helps pinpoint effective expense management strategies.

ClickUp Brain Behavior: Scans documents to extract frequently mentioned cost-saving initiatives and their impact notes.

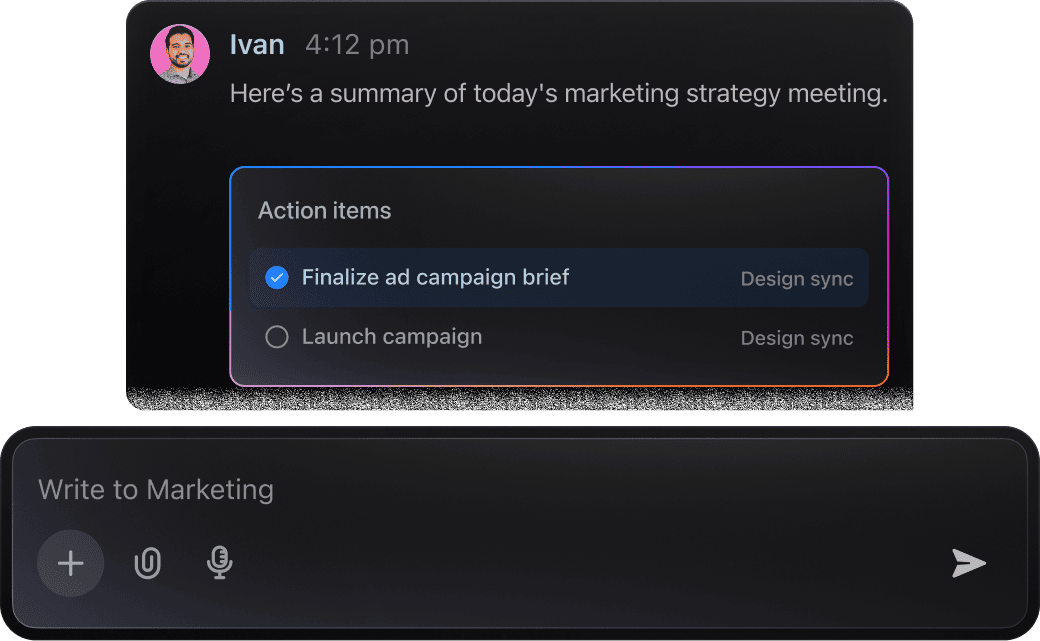

From the ‘Audit Checklist 2023’ file, create a detailed compliance checklist for financial statement review.

Use Case: Simplifies audit preparation with a ready-to-use task list.

ClickUp Brain Behavior: Identifies key audit points and formats them into an actionable checklist within a task or document.

Summarize 3 emerging trends in revenue recognition standards from recent accounting updates.

Use Case: Keeps finance teams informed on evolving compliance requirements.

ClickUp Brain Behavior: Extracts and condenses recurring themes from linked regulatory documents and expert analyses.

From the ‘Investor Survey Q1’ document, summarize main concerns regarding financial disclosures.

Use Case: Guides transparency improvements aligned with stakeholder expectations.

ClickUp Brain Behavior: Reads survey feedback to identify common themes and priorities in investor communications.

Write clear and concise explanatory notes for the ‘Equity Changes’ section using the style guide in ‘FinanceTone.pdf.’

Use Case: Accelerates preparation of financial statements with consistent language.

ClickUp Brain Behavior: References tone guidelines to suggest polished text variations for disclosure notes.

Summarize upcoming changes in IFRS 2025 standards and their potential effects on asset valuation.

Use Case: Prepares accounting teams for regulatory updates impacting reporting.

ClickUp Brain Behavior: Condenses linked compliance documents; Brain Max can integrate public updates if available.

Generate guidelines for segment reporting disclosures based on regional compliance documents in our workspace.

Use Case: Ensures adherence to local financial reporting requirements.

ClickUp Brain Behavior: Extracts rules and formatting instructions from internal files to create a compliance checklist.

Create a risk assessment checklist for financial statement audits using US GAAP 2025 PDFs and internal risk management folders.

Use Case: Supports audit teams in identifying critical review areas.

ClickUp Brain Behavior: Identifies key risk factors from documents and organizes them by priority and category.

Compare debt management strategies across competitors using our financial benchmarking reports.

Use Case: Informs strategic planning with competitive insights.

ClickUp Brain Behavior: Summarizes comparative data into a clear and concise format, including tables and highlights.

What are the emerging trends in financial statement disclosures for ESG reporting since 2023?

Use Case: Guides sustainability reporting with current best practices.

ClickUp Brain Behavior: Synthesizes information from research notes, regulatory updates, and industry reports.

Summarize key audit findings and recurring issues from the Southeast Asia financial review folder (disclosures, controls, compliance).

Use Case: Drives targeted improvements in regional financial reporting.

ClickUp Brain Behavior: Extracts and prioritizes common audit observations from reports, feedback, and issue logs.

Analyze Financial Data Effortlessly with ClickUp Brain

Cut down on manual reviews, unify your finance team, and produce sharper insights using AI-driven analysis.

AI Applications

Key Applications of AI Prompts in Financial Statement Analysis

Enhance accuracy, speed up insights, and uncover deeper financial understanding with AI-powered prompts

From Raw Data to Financial Insights

Financial analysis starts with piles of numbers and fragmented reports. ClickUp Brain organizes these into clear, actionable financial summaries—right within your ClickUp workspace.

Leverage ClickUp Brain to:

- Convert unstructured financial data into comprehensive analysis templates

- Produce fresh insights informed by previous financial reports (using context-sensitive AI assistance)

- With Brain Max, quickly explore historical financial statements, audit notes, and market data to inform your next evaluation.

Financial Statement Analysis with ClickUp Brain

Financial analysts often face overwhelming data and complex reports. ClickUp Brain simplifies this by pinpointing key insights, highlighting risks, and suggesting next steps from your financial documents.

Leverage ClickUp Brain to:

- Extract concise summaries from detailed financial statements and reports

- Convert annotated balance sheets and income statements into actionable review tasks

- Automatically generate risk assessments or executive summaries without manual drafting

- With Brain Max, instantly retrieve past financial decisions, trend analyses, or audit notes across your workspace—eliminating tedious searches through spreadsheets and reports.

Financial Statement Analysis Made Simple

Evaluating financial reports involves sifting through complex data, notes, and ratios. ClickUp Brain simplifies this process—extracting key findings and crafting clear summaries tailored to your team's style.

Leverage ClickUp Brain to:

- Decode lengthy financial disclosures into clear action points

- Produce concise, consistent commentary for stakeholder reports

- Convert analyst discussions into prioritized follow-up tasks

- Brain Max enhances this by seamlessly referencing past analyses or comparable fiscal periods, supporting thorough reviews over extended timelines.

AI Advantages

Why AI Prompts Are Revolutionizing Financial Statement Analysis

Integrating AI prompt workflows enhances every step of your financial review process:

- Accelerate insights: Quickly transform raw data into clear, actionable summaries

- Reduce errors: Detect discrepancies by cross-referencing historical reports and notes

- Align your team: AI-crafted reports and summaries ensure everyone shares the same understanding

- Make informed choices: Use prompts to uncover market trends and regulatory updates

- Drive strategic growth: Generate forward-looking scenarios beyond standard forecasts.

All of this integrates directly within ClickUp, turning your AI-generated outputs into documents, tasks, and dashboards that keep your financial projects advancing.

Prompt Guidance

Crafting Effective Prompts for Financial Statement Analysis

Clear prompts unlock precise insights.

Define the financial analysis context clearly

Vague prompts yield broad responses. Specify details like company size (e.g., “mid-cap tech firm” or “small retail chain”), statement type (e.g., “cash flow statement” or “balance sheet”), or analysis goal (e.g., “assess liquidity” or “evaluate debt levels”).

Example: “Provide ratio analysis for a mid-sized manufacturing company’s 2023 balance sheet.”

Use comparative prompts to uncover differences

AI excels at contrasting financial data. Employ prompts like “compare X vs Y” to evaluate performance across periods, benchmark against competitors, or highlight trend shifts.

Example: “Compare gross profit margins of Company A and Company B over the last three years.”

Frame prompts around specific financial tasks

Treat your prompt as a clear assignment for AI. Instead of “Analyze financials,” focus on actionable objectives:

Example: “Summarize key liquidity risks in the latest quarterly cash flow statement for a retail business.”

Specify desired output formats

Need a summary, ratio table, trend chart description, or risk assessment? Indicate it explicitly. AI delivers better when the output style is defined.

Example: “List 5 financial ratios indicating solvency in bullet points with brief explanations.”

Simplify Financial Statement Analysis with ClickUp Brain

ClickUp Brain goes beyond basic organization—it's your strategic partner for decoding complex financial reports with ease.