Time Estimated

Estimate and plan your time at a glance.

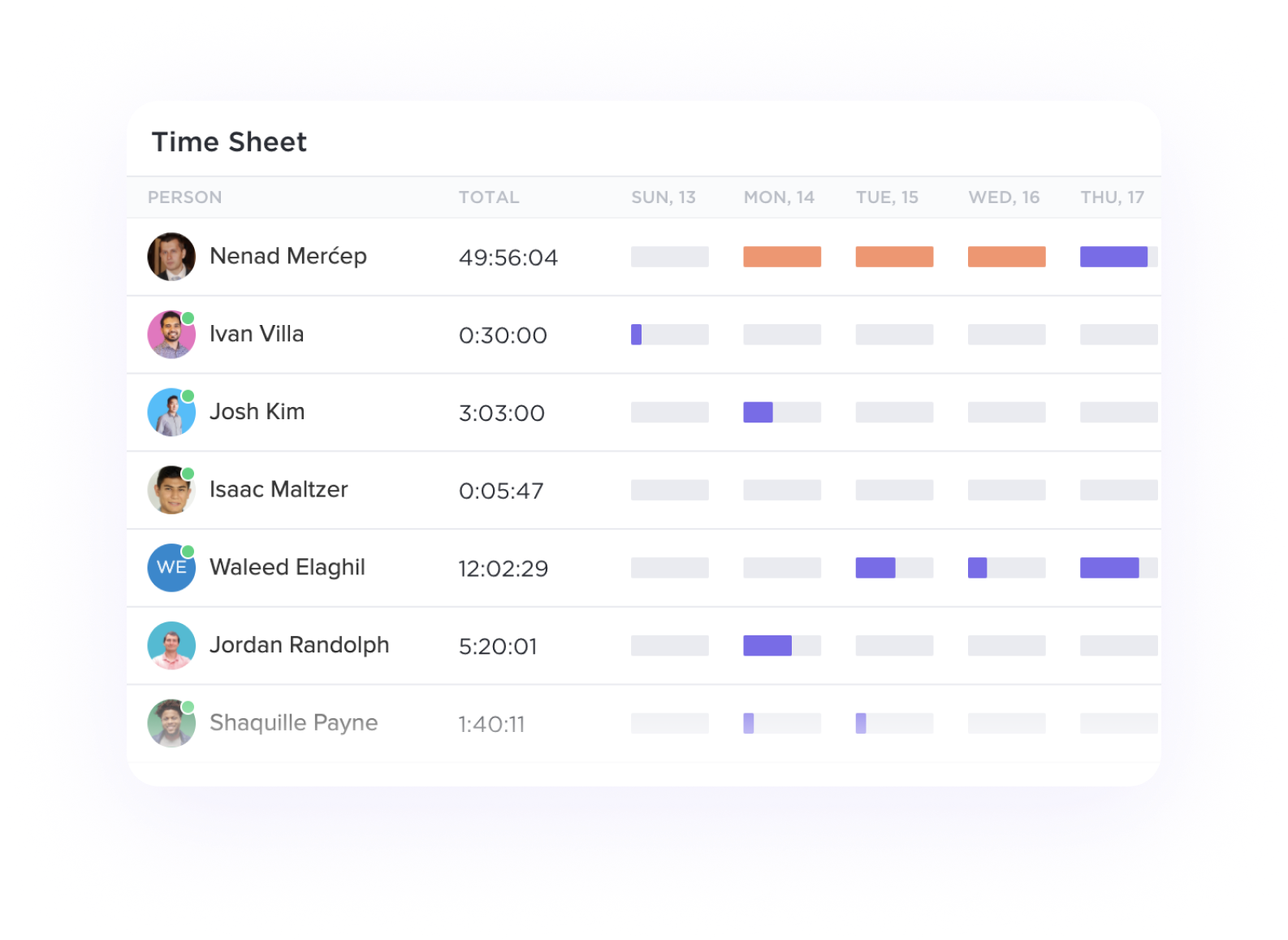

Get a high level view of your team's time tracking and compare it against the time estimated. See the amount of time remaining for each person's task to determine if you're on schedule to hit your goals.