Integrations

Sync your time into ClickUp.

Connect your favorite time tracking app to ClickUp to sync time tracked directly within ClickUp. Integrate your time tracking with Toggl, Harvest, and many more of today's most popular time tracking apps.

Gantt Charts

Track every minute of your work efficiently with the best time tracking software for Financial Advisors, powered by ClickUp. Easily log billable hours, monitor project progress, and streamline client invoicing all in one place. Stay organized, productive, and profitable with ClickUp's time tracking solution.

Free forever. No credit card.

Integrations

Connect your favorite time tracking app to ClickUp to sync time tracked directly within ClickUp. Integrate your time tracking with Toggl, Harvest, and many more of today's most popular time tracking apps.

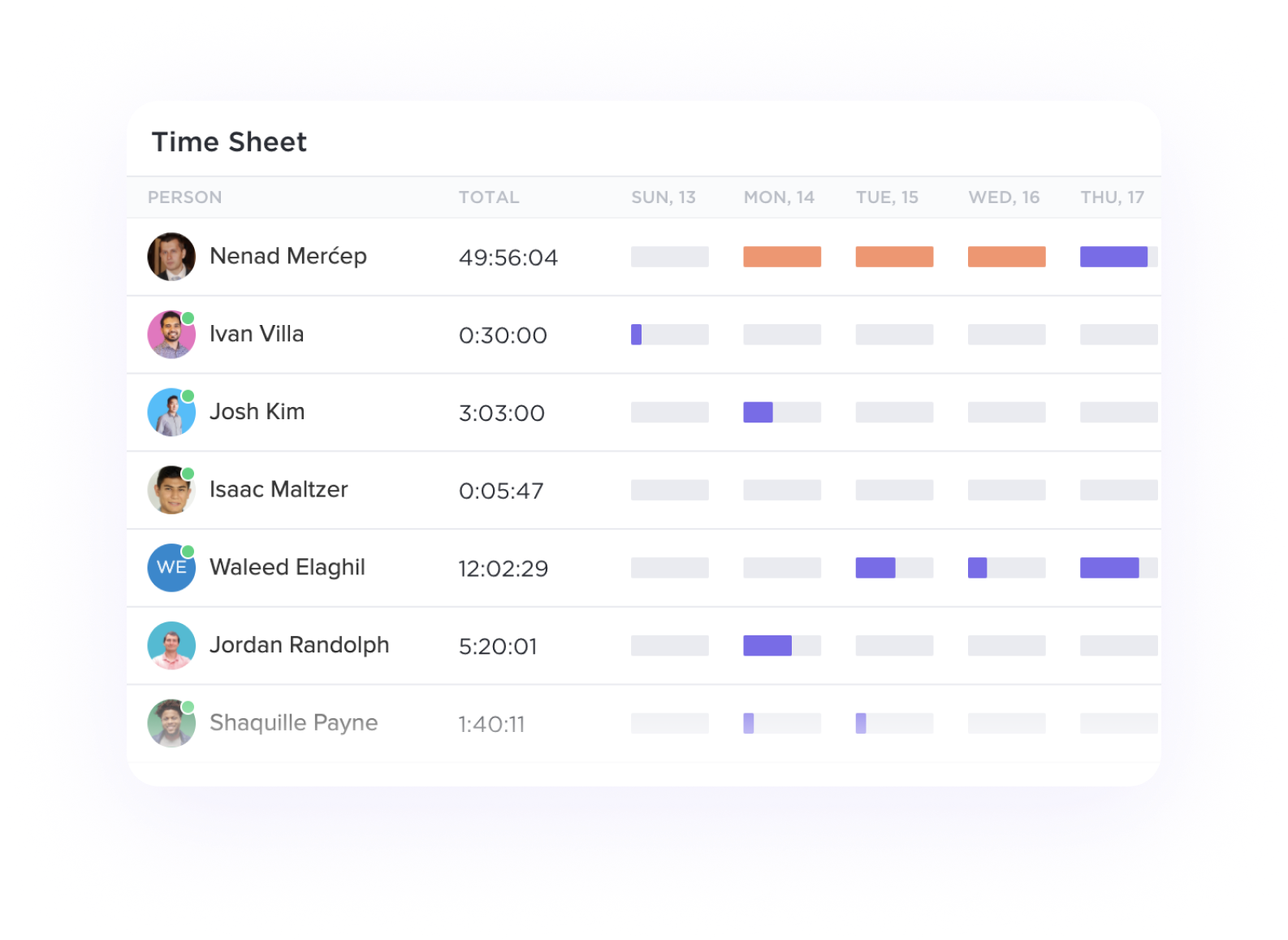

Time Sheets

View your time tracked by day, week, month, or any custom range with detailed time sheets. Show time totals grouped by dates and see individual tasks and time entries for a deeper look at where time was spent.

Time tracking software helps financial advisors improve productivity and efficiency by providing insights into time spent on different tasks, identifying areas for optimization, streamlining client billing based on accurate time records, and facilitating better time management strategies.

Financial advisors should look for time tracking software that offers robust time tracking capabilities, invoicing and billing integration, project management tools, reporting and analytics features, multi-device accessibility, and customizable settings for client billing and internal tracking purposes.

Yes, time tracking software can integrate with tools commonly used by financial advisors, such as accounting software or CRM systems, to streamline workflows, improve accuracy in tracking billable hours, and enhance overall efficiency in client management and financial reporting processes.