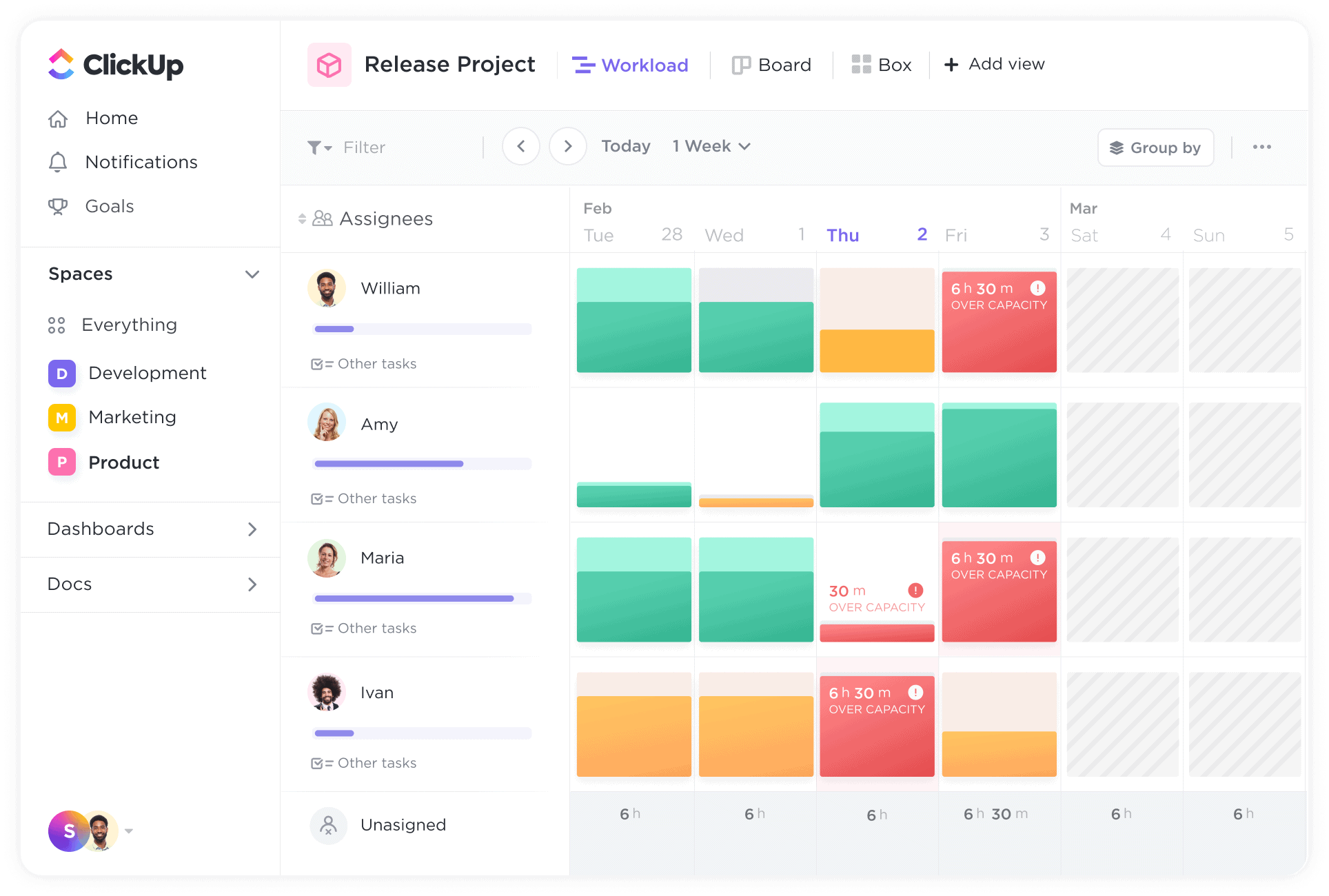

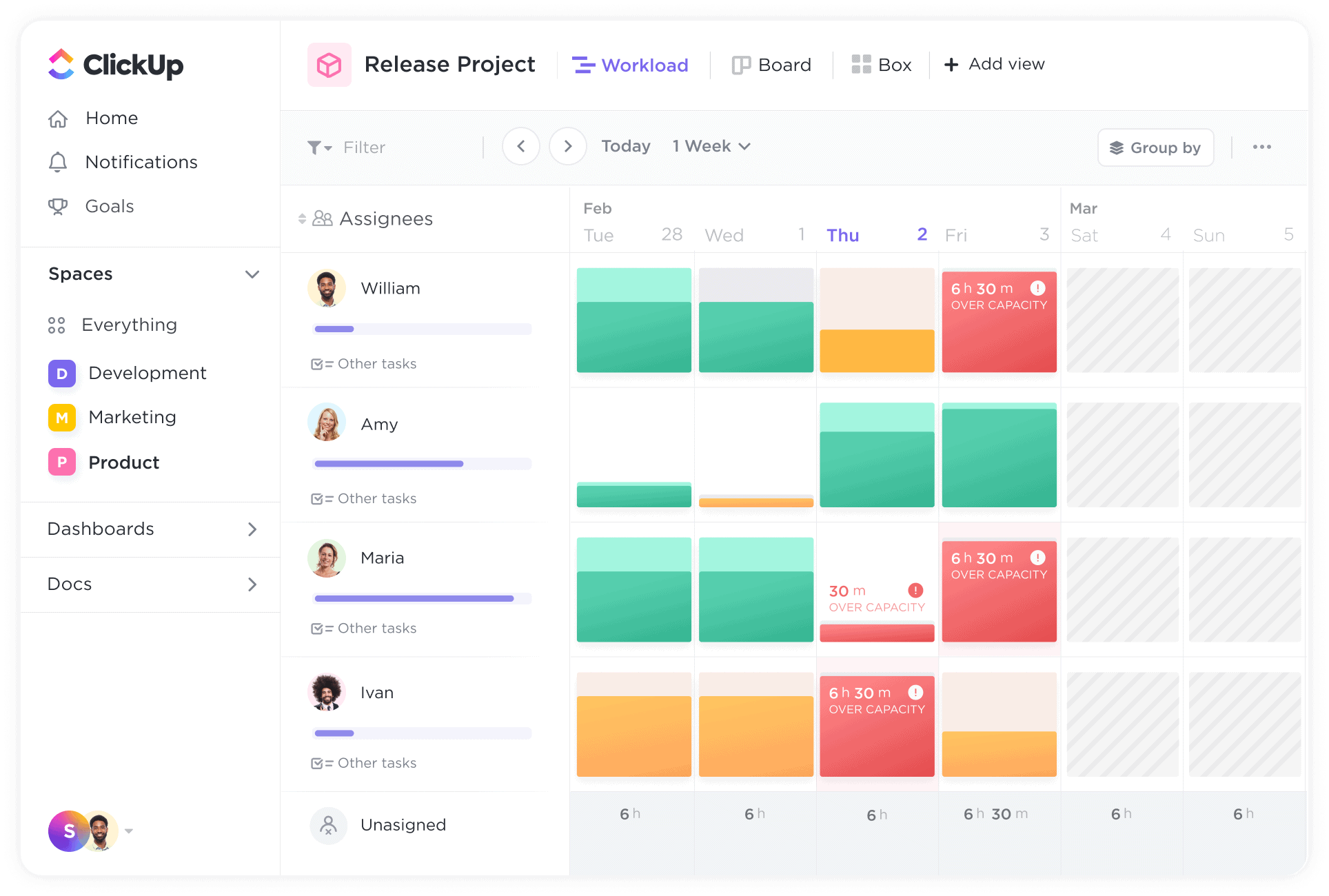

Time Management

Keep perfect track of your team's time.

Assess your team's workload using time estimates. Test and refine your estimates using ClickUp's time tracker to effectively gauge productivity.

Gantt Charts

Streamline your workflow with the best task management software for Mortgage Brokers, powered by ClickUp. Organize your tasks efficiently, collaborate with your team effortlessly, and stay on top of deadlines like never before. Boost your productivity and close more deals with ClickUp's intuitive features designed to simplify your workload. Try it now and experience the difference in your productivity!

Free forever. No credit card.

Time Management

Assess your team's workload using time estimates. Test and refine your estimates using ClickUp's time tracker to effectively gauge productivity.

Recurring Tasks

From weekly meetings to daily reminders, stay on top of it all with recurring tasks. They take just seconds to set and can save you hours of setting the same reminder over and over.

Task management software helps you stay organized and on top of your mortgage broker tasks by providing a centralized platform to list and prioritize tasks, set deadlines, track progress, and collaborate with team members, ensuring nothing falls through the cracks and all tasks are completed efficiently and on time.

Key features to look for in a task management software for mortgage brokers include customizable task lists, deadline reminders, document management capabilities, client communication tools, and integration with mortgage-specific software for seamless workflow management.

Yes, task management software can integrate with CRM software and document management systems commonly used by mortgage brokers, streamlining workflows, improving collaboration, and enhancing productivity by allowing for seamless data sharing, automated task assignments, and centralized document storage.