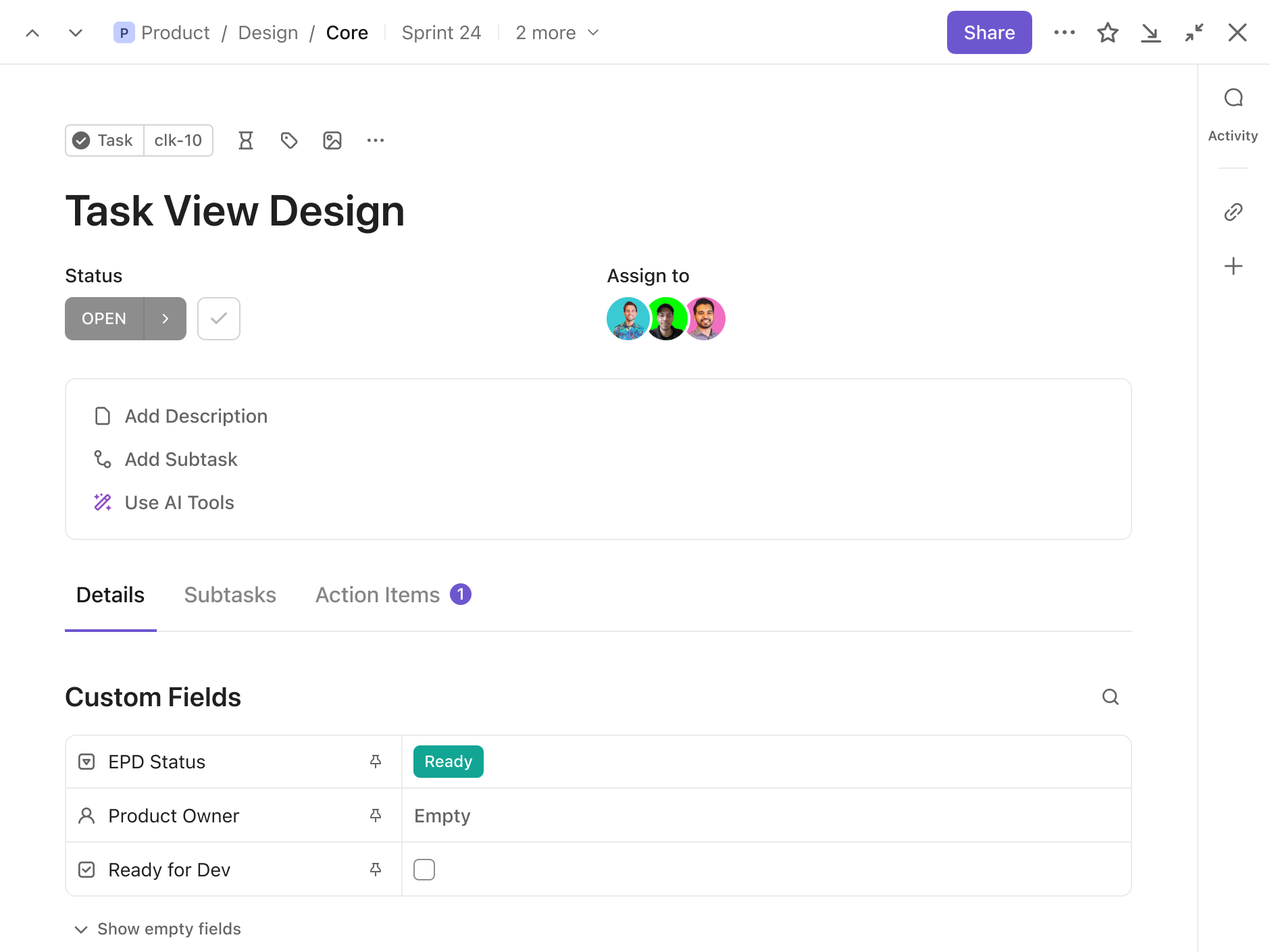

Custom Statuses

Customize your ideal workflow.

Build clear workflows for everything from feature launches to issue tracking. Use templates to save time or create your own to reuse later.

Gantt Charts

Supercharge your productivity with the ultimate task management software for Hedge Fund Managers, powered by ClickUp. Streamline your workflow, track progress effortlessly, and collaborate seamlessly with your team. Say goodbye to missed deadlines and disorganized tasks - ClickUp has got you covered. Try it now and take your productivity to the next level.

Free forever. No credit card.

Custom Statuses

Build clear workflows for everything from feature launches to issue tracking. Use templates to save time or create your own to reuse later.

Structure

Quickly navigate to any task or subtask within your project, and visualize your work in multiple views. Customizable subtasks allow you to surface the information you need at the right time!

Task management software offers hedge fund managers features like task assignment and tracking, priority setting, deadline management, collaboration tools, and reporting capabilities to enhance organization, efficiency, and productivity in their day-to-day operations.

Task management software helps hedge fund managers by providing a centralized platform to track and prioritize investment opportunities, allocate tasks to team members, set deadlines, monitor progress, and ensure timely completion of due diligence tasks for efficient decision-making and portfolio management.

Yes, task management software can integrate with financial software and platforms like portfolio management systems or trading platforms, enabling hedge fund managers to streamline workflows, track tasks related to investments, and improve overall operational efficiency.