Multiple Lists

Get greater visibility across projects.

Never lose sight of a task that spans several projects or is used by multiple people. Include the task in multiple Lists so it can be referenced anywhere.

Gantt Charts

Maximize productivity and streamline tasks effortlessly with the top task management software for Corporate Finance Advisors - ClickUp! Easily assign, track, and prioritize tasks to ensure seamless collaboration and project success. Stay organized and focused on achieving your financial goals with ClickUp's intuitive features tailored to suit the unique needs of Corporate Finance Advisors.

Free forever. No credit card.

Multiple Lists

Never lose sight of a task that spans several projects or is used by multiple people. Include the task in multiple Lists so it can be referenced anywhere.

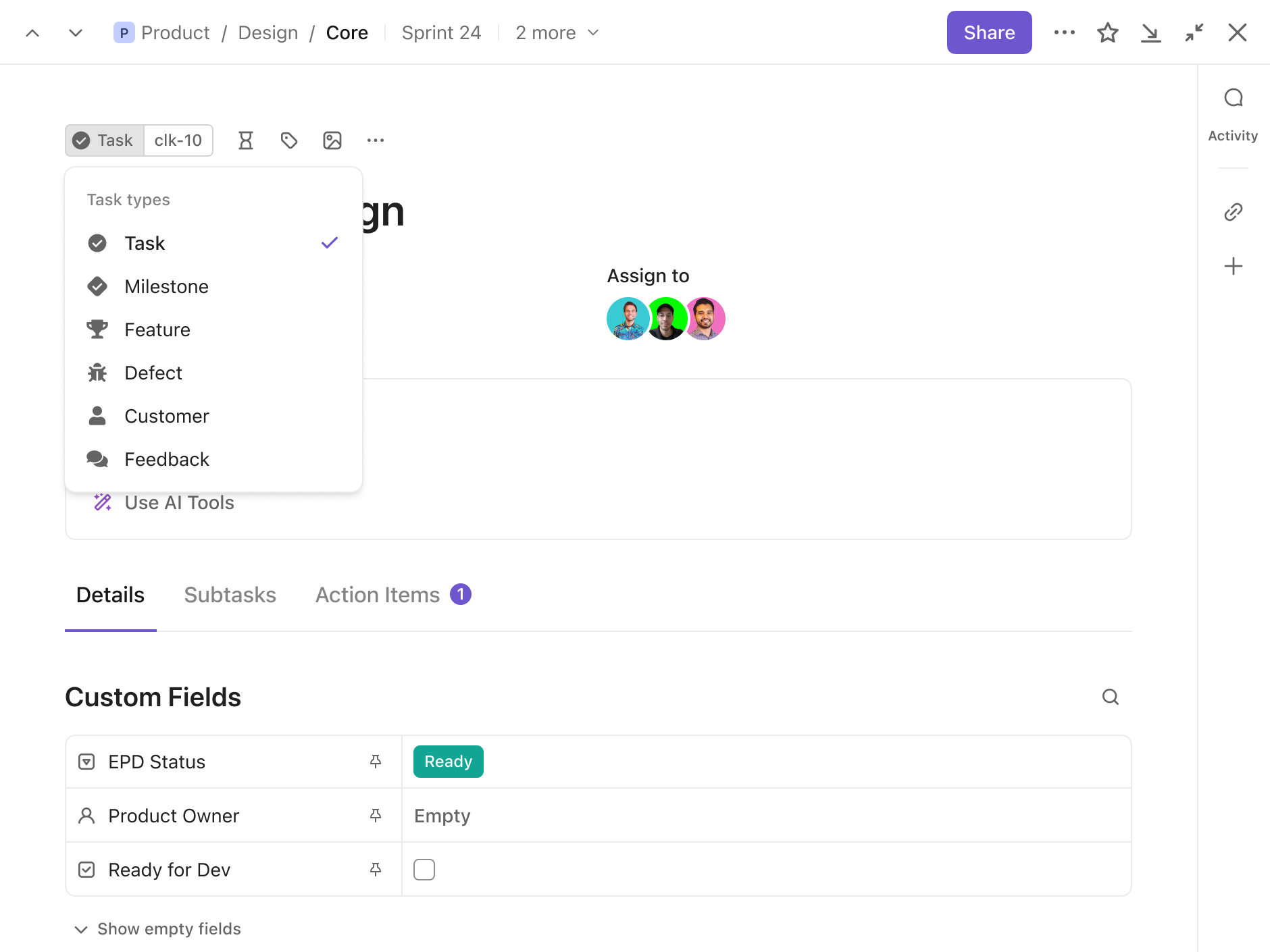

Custom Task Types

Customize your Workspace and manage any type of work in ClickUp. Use your own naming conventions and define the task types that make the most sense for your team.

Task management software can help corporate finance advisors streamline their workflow and increase productivity by organizing tasks, setting priorities, tracking progress, facilitating collaboration, and ensuring deadlines are met efficiently.

Corporate finance advisors should look for task management software that offers features such as task prioritization, deadline tracking, collaboration tools, reporting capabilities, integration with other tools, and customization options to meet their specific workflow needs.

Yes, task management software can integrate with finance-related tools like accounting software and financial modeling tools, enabling seamless collaboration, data sharing, and streamlined workflows for corporate finance advisors.