Tracking

Eliminate bottlenecks before they happen.

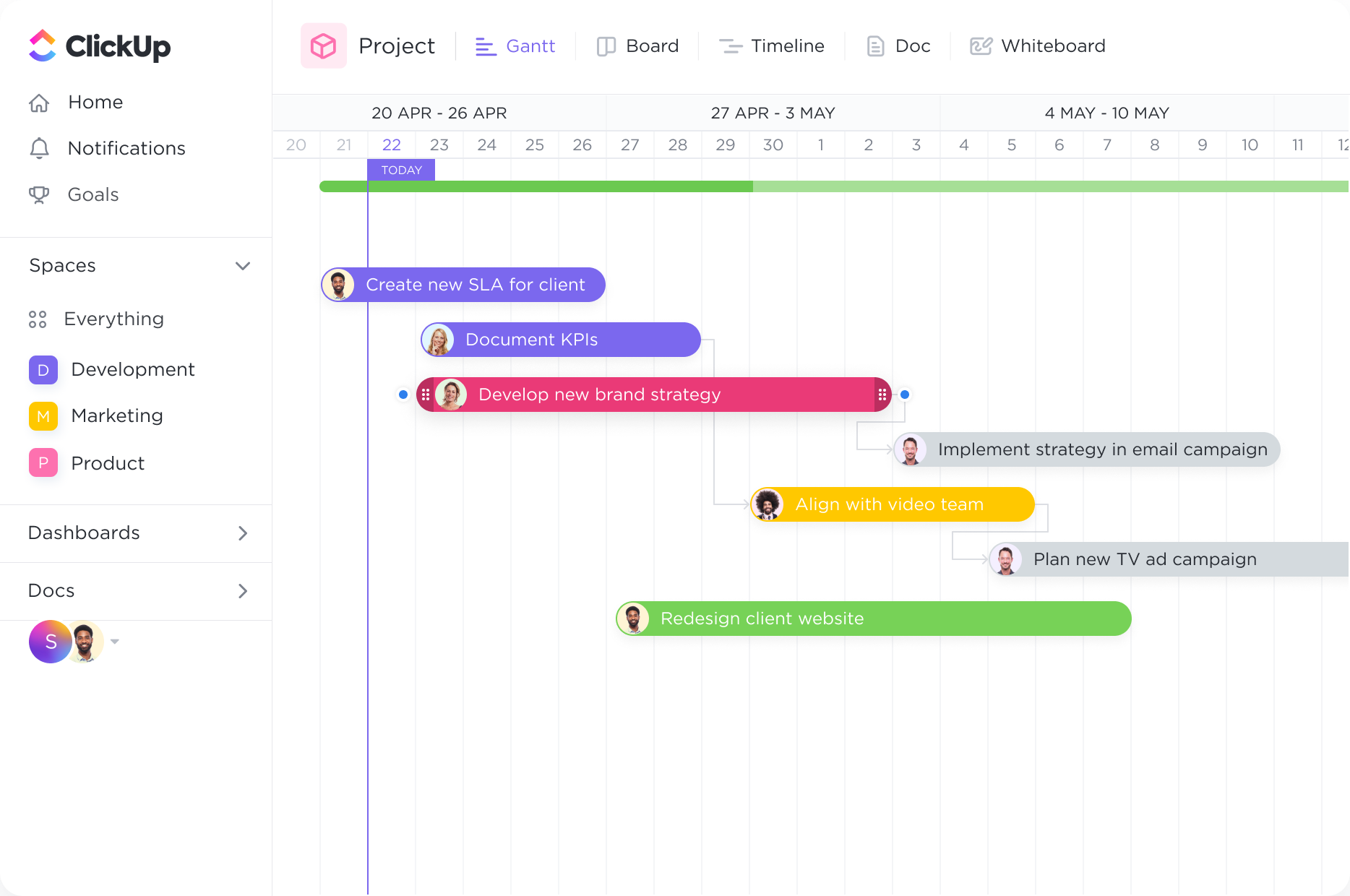

Intelligent dependency-path tracking shows you where potential bottlenecks might exist to prevent inefficiencies.

Gantt Charts

Streamline your mortgage broker business with ClickUp's powerful Gantt Chart software. Plan, track, and manage your projects with ease, using ClickUp's intuitive interface and comprehensive features. With ClickUp, you can create customized Gantt Charts that perfectly align with the unique needs of mortgage brokers, helping you stay organized and focused on delivering exceptional results. Say goodbye to complex spreadsheets and hello to ClickUp's user-friendly Gantt Chart software for mortgage brokers.

Free forever. No credit card.

Tracking

Intelligent dependency-path tracking shows you where potential bottlenecks might exist to prevent inefficiencies.

Timelines

With the Gantt chart's dynamic timeline, you can easily schedule tasks, keep up with project progress, manage deadlines, and handle bottlenecks.

Managing the loan application process is a crucial aspect of mortgage brokerage. A Gantt chart can be used to outline the various stages of the application process, such as document collection, verification, underwriting, and approval. This visual representation helps brokers track the progress of each application, identify bottlenecks, and ensure that all necessary steps are completed within the desired timeframe.

Maintaining effective communication with clients is essential in the mortgage brokerage industry. A Gantt chart can be utilized to schedule and track client interactions, including initial consultations, document requests, and follow-up meetings. This helps brokers stay organized, ensure timely communication, and provide excellent customer service throughout the mortgage process.

Assessing the value of a property is a critical step in mortgage brokerage. A Gantt chart can be used to schedule property evaluations, appraisals, and inspections. By visualizing these activities, brokers can ensure that they are completed within the required timeframe and coordinate with appraisers and inspectors accordingly.

The mortgage approval and closing process involve multiple stakeholders and tasks that need to be coordinated efficiently. A Gantt chart can be used to outline the various steps involved, such as loan approval, title searches, insurance verification, and closing document preparation. This visual representation helps brokers track the progress of each task, identify potential delays, and ensure a smooth and timely closing process for their clients.

Mortgage brokers must adhere to various compliance and regulatory requirements. A Gantt chart can be utilized to track and manage these obligations, such as licensing renewals, training programs, and audits. By visualizing these requirements, brokers can ensure that they are met within the specified deadlines and avoid any penalties or legal issues.

Marketing and lead generation are essential for mortgage brokers to attract potential clients. A Gantt chart can be used to plan and schedule marketing campaigns, including social media posts, email newsletters, and advertising initiatives. This visual representation helps brokers stay organized, ensure consistent marketing efforts, and track the effectiveness of different strategies.

By utilizing Gantt charts in these various aspects of mortgage brokerage, brokers can enhance their productivity, improve organization and coordination, and ultimately provide a better experience for their clients.

A Gantt chart can help mortgage brokers keep track of multiple applications and their respective timelines, ensuring that each application is processed efficiently and within the required timeframe.

A Gantt chart can serve as a central platform for collaboration, allowing mortgage brokers to visually track tasks and deadlines for each stakeholder involved in the mortgage process, ensuring timely communication and coordination.

By visualizing the progression of tasks and milestones in a Gantt chart, mortgage brokers can easily identify areas where the approval process is slowing down or where tasks are being delayed, enabling them to take proactive measures to address these issues and ensure smooth processing.

A Gantt chart can help mortgage brokers prioritize tasks and allocate resources effectively, ensuring that critical tasks are completed first and that there is a clear understanding of what needs to be done at each stage of the mortgage process.

A Gantt chart can be shared with clients to provide a clear visual representation of the mortgage process, allowing brokers to communicate progress, milestones, and potential delays in a transparent and easily understandable manner, thus maintaining client satisfaction and trust.

Gantt chart software can assist mortgage brokers in managing their projects efficiently by providing a visual representation of project timelines, tasks, and dependencies. This allows brokers to track the progress of each project, identify potential bottlenecks, and adjust resources and deadlines accordingly. Additionally, Gantt charts enable effective communication and collaboration among team members, ensuring smoother project coordination and improved decision-making.

Gantt chart software offers features such as task dependencies, resource allocation, and deadline tracking, which can help mortgage brokers effectively manage their client's loan application process. It enables them to visualize the workflow, identify bottlenecks, and prioritize tasks accordingly. Additionally, it facilitates collaboration among team members and enhances communication with clients, resulting in improved efficiency and timely completion of mortgage applications.

Yes, Gantt chart software can assist mortgage brokers in tracking and managing multiple client applications simultaneously by providing a visual representation of each application's progress, deadlines, and dependencies. It enables the allocation of resources and identification of potential scheduling conflicts, ensuring efficient management of client applications and timely communication with clients.