Dependencies

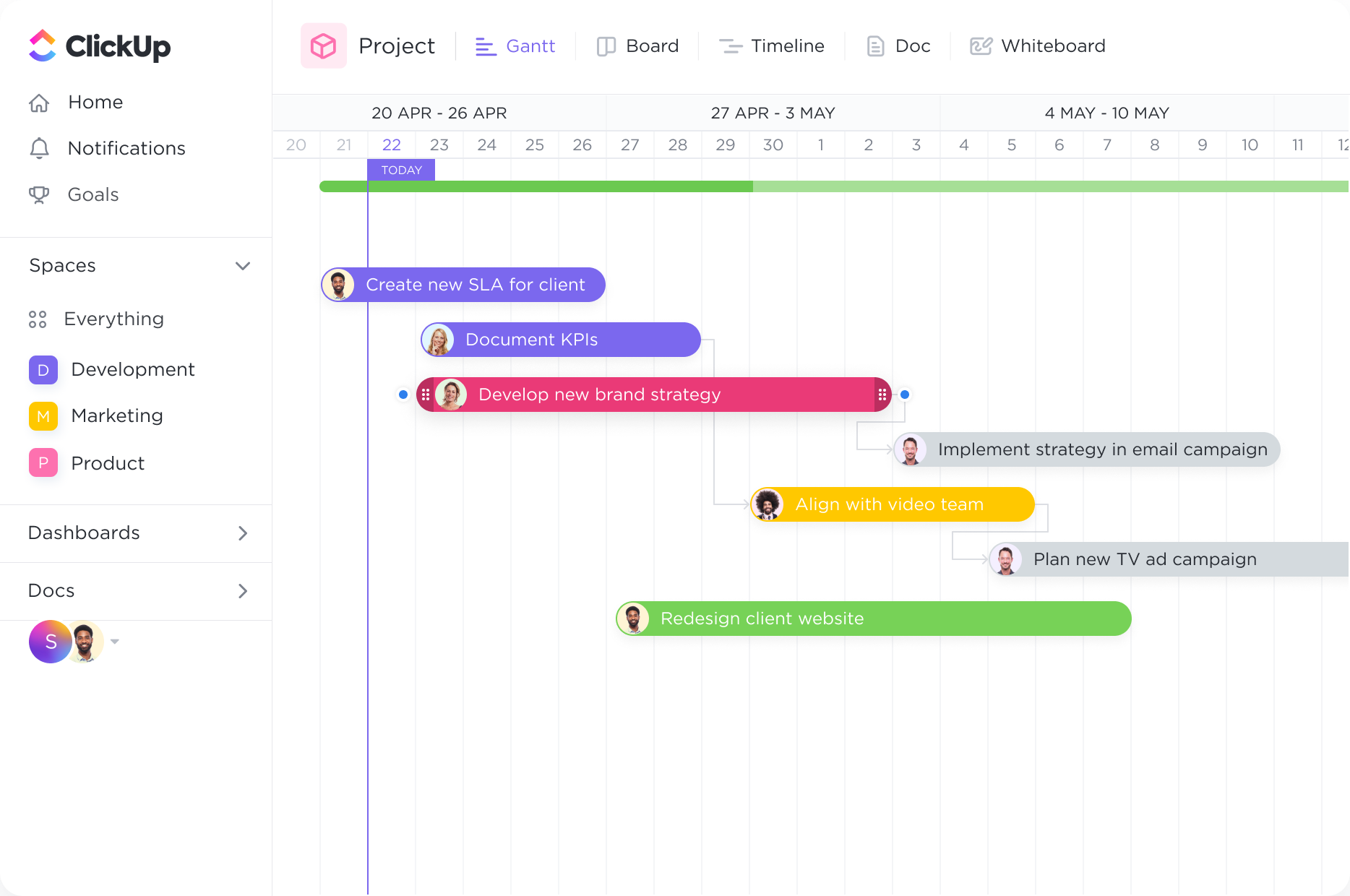

Set task dependencies.

Create tasks and link them with dependencies. Dragging a task with dependencies will automatically reschedule tasks in the chain

Gantt Charts

Optimize your loan officer workflow with ClickUp's powerful Gantt Chart software. Streamline your tasks, track progress, and meet deadlines effortlessly. Visualize your project timeline, allocate resources efficiently, and achieve maximum productivity. With ClickUp, loan officers can now easily create customized Gantt Charts to stay organized and on top of their projects. Take control of your tasks and elevate your loan officer game with ClickUp's Gantt Chart software.

Free forever. No credit card.

Dependencies

Create tasks and link them with dependencies. Dragging a task with dependencies will automatically reschedule tasks in the chain

Activity

Easily update projects with a simple drag-and-drop action to collaborate amongst your team in real-time. Dynamic progress percentages provide a detailed snapshot.

Loan officers can use Gantt charts to effectively manage the loan application process. By visualizing the various stages of the process, such as application submission, document verification, credit check, and approval, loan officers can track progress and ensure that each step is completed within the specified timeframe. Gantt charts help identify bottlenecks and streamline the loan application process, ultimately improving efficiency and customer satisfaction.

Loan officers often handle multiple loans simultaneously. Gantt charts can be used to track the status and progress of each loan in the portfolio. By assigning tasks and milestones to each loan, loan officers can easily monitor the repayment schedules, payment history, and upcoming deadlines. This helps in proactive planning, identifying potential risks, and ensuring timely follow-ups with borrowers.

Collaboration between loan officers, underwriters, and legal teams is crucial for a successful loan approval process. Gantt charts can be used to allocate tasks and responsibilities among team members, ensuring clear communication and accountability. By visualizing dependencies and timelines, loan officers can coordinate with underwriters and legal teams, streamlining the decision-making process and reducing delays.

Loan officers are often responsible for preparing reports and meeting compliance deadlines. Gantt charts can be utilized to schedule and monitor these reporting requirements, ensuring timely submission and adherence to regulatory guidelines. By visualizing the reporting deadlines alongside other loan-related tasks, loan officers can prioritize their workload and avoid any compliance-related issues.

A Gantt chart can display the various stages of the loan application process, from initial application submission to final approval, allowing loan officers to track the progress of each application and identify any bottlenecks or delays.

Loan officers often handle multiple loan applications at once. A Gantt chart can help them visualize and prioritize their workload, ensuring they allocate sufficient time and resources to each application.

Loan officers need to coordinate with various departments and stakeholders, such as underwriters, appraisers, and legal teams. A Gantt chart can facilitate communication and collaboration by clearly displaying the tasks and deadlines for each party involved in the loan process.

Loan officers must adhere to specific timelines and regulations throughout the loan application process. A Gantt chart can serve as a visual reminder and help ensure that loan officers stay on track and meet all necessary deadlines.

A Gantt chart can be shared with clients to provide transparency and updates on the progress of their loan application. This visual representation can help manage client expectations and provide a clear understanding of where their application stands in the process.

By visualizing the various tasks and dependencies in a Gantt chart, loan officers can easily identify potential risks or issues that may arise during the loan processing stages. This allows them to proactively address these challenges and minimize any negative impact on the overall timeline.

You can use Gantt chart software to visually map out the loan application process, including all required tasks and their dependencies. This allows you to track the progress of each application, identify potential bottlenecks, and allocate resources accordingly. By monitoring the timeline and milestones on the Gantt chart, you can ensure timely completion of each task and enable prompt disbursement of funds to borrowers.

Yes, integrating Gantt chart software with loan management systems can streamline the loan approval process by providing a visual representation of tasks, timelines, and dependencies. This improves collaboration among loan officers by facilitating clear communication, task assignment, and tracking of loan application progress, resulting in more efficient loan processing and faster decision-making.

Loan officers should look for Gantt chart software that offers features such as task dependencies, resource management, and milestone tracking. It should also provide the ability to set deadlines and allocate resources efficiently. Additionally, integration with other project management tools and the ability to generate reports and analyze project progress are important functionalities to optimize project planning and execution for loan disbursement.