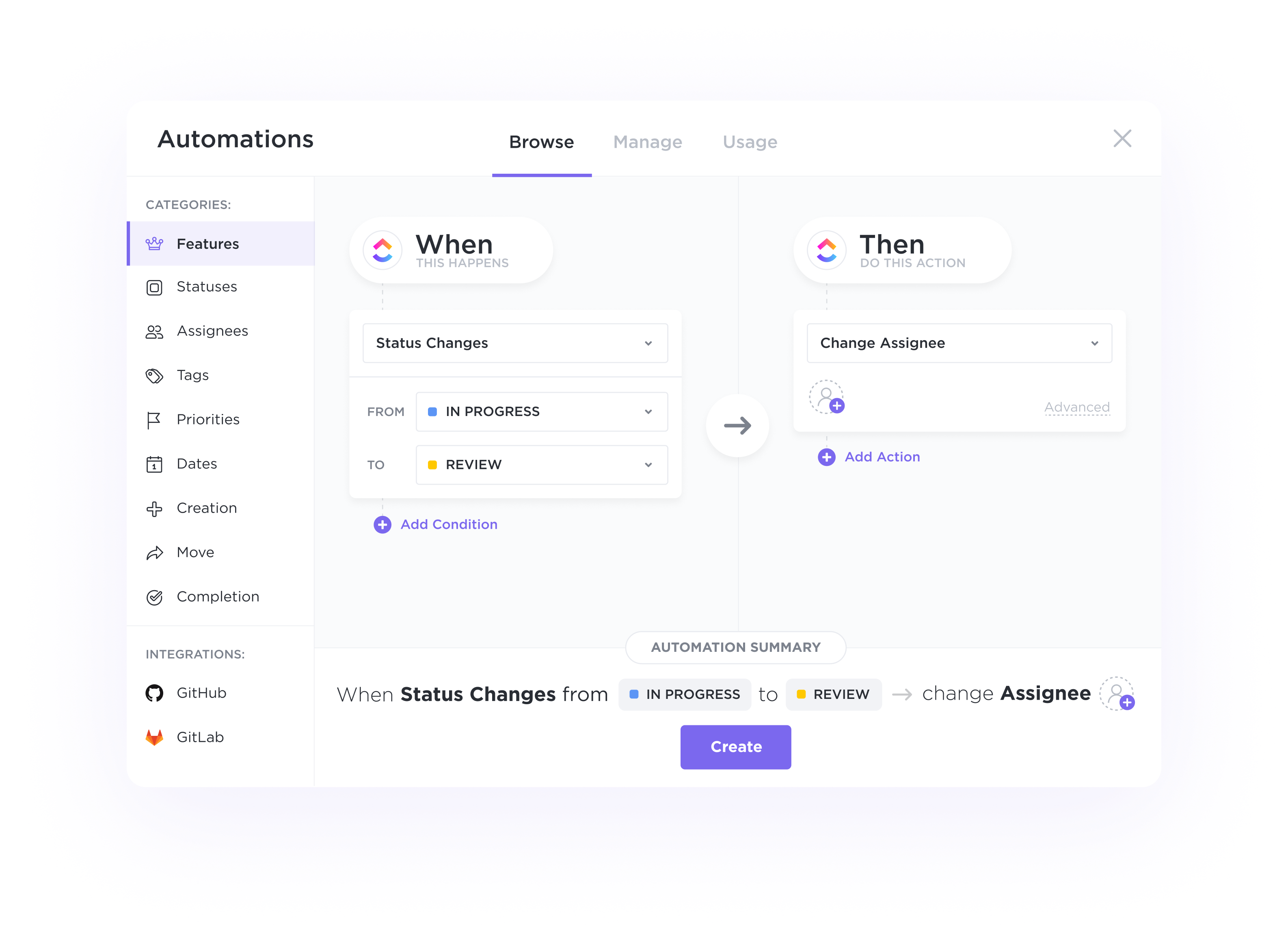

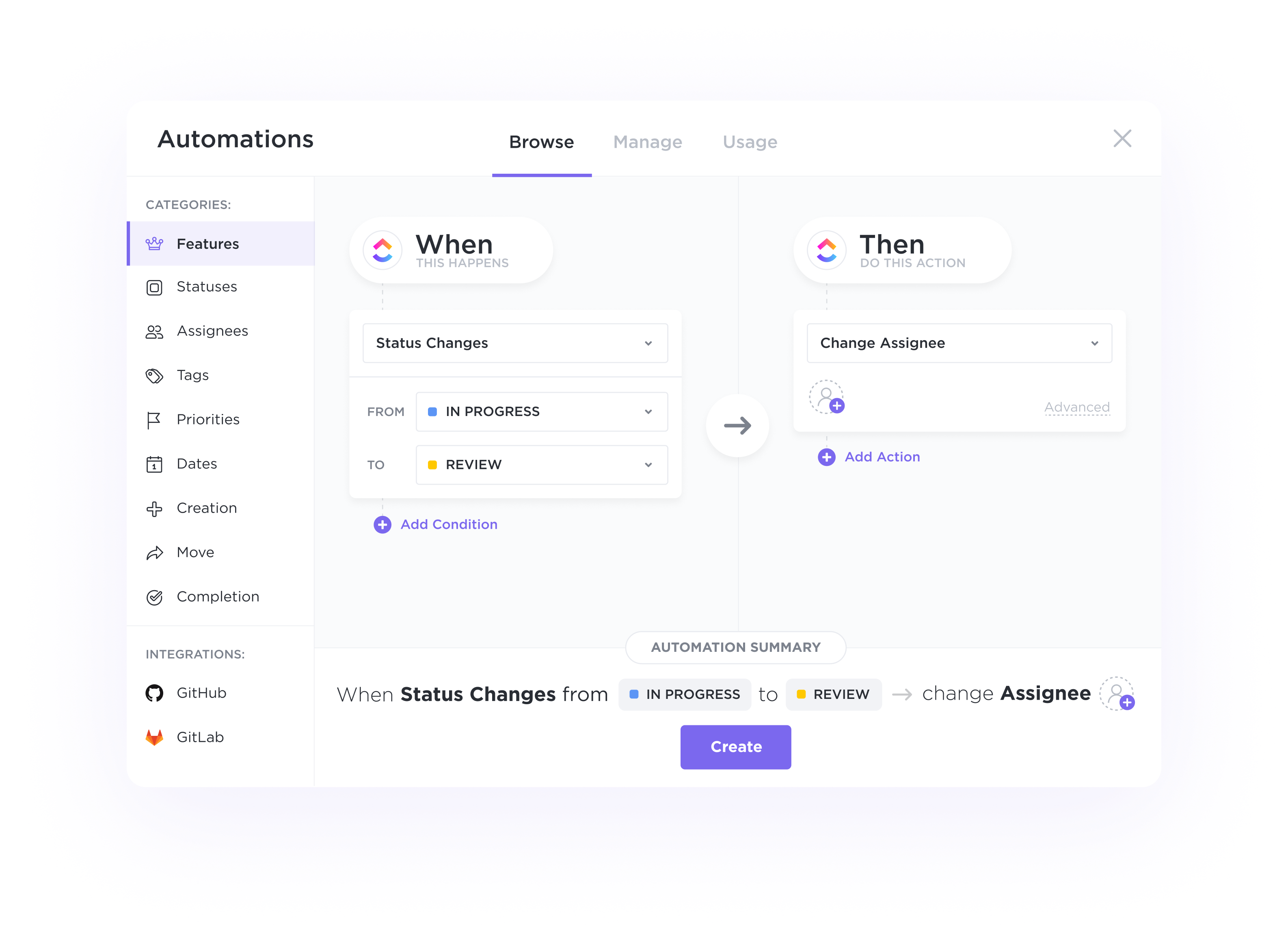

Automations

Automate handoffs, status updates, and more.

Automatically assign tasks for each stage of your pipeline, trigger status updates based on activity, and switch priorities to alert your team on where to focus next.

Gantt Charts

Supercharge your portfolio management with a customized CRM system powered by ClickUp. Streamline client interactions, track investments, and optimize your workflow all in one place. Take your portfolio management to the next level with ClickUp's powerful CRM tools designed specifically for portfolio managers.

Free forever. No credit card.

Automations

Automatically assign tasks for each stage of your pipeline, trigger status updates based on activity, and switch priorities to alert your team on where to focus next.

CRM Views

Manage everything from sales pipelines, customer engagement, and orders with ClickUp's 10+ highly flexible views. Easily track and manage your accounts on a List, Kanban Board, Table view, and more.

A CRM for portfolio managers centralizes all client information including investment preferences, risk tolerance, financial goals, and communication history. This prevents the scattering of client data across multiple platforms and ensures that all team members have access to up-to-date information.

CRMs can automate client onboarding processes by setting up workflows for document collection, risk assessments, and account setup. This streamlines the onboarding process, reduces manual errors, and ensures a smooth transition for new clients.

A CRM can track and analyze investment performance for each client's portfolio over time. This allows portfolio managers to monitor trends, assess the effectiveness of their strategies, and make data-driven decisions to optimize client outcomes.

CRMs designed for portfolio managers often include features to help manage compliance with industry regulations and client agreements. This ensures that all client interactions and investment decisions align with legal requirements, reducing compliance risks for the firm.

A CRM facilitates better client communication by storing all interactions, emails, and meeting notes in one place. This enables portfolio managers to provide timely updates, address client inquiries efficiently, and strengthen client relationships through personalized communication.

CRM software for portfolio managers offers features like comprehensive client profiles, investment tracking, performance reporting, goal setting, risk management tools, and secure document management. These functionalities help portfolio managers organize client information, track investments, analyze performance, set financial goals, manage risks, and securely store and access important documents.

CRM software can help portfolio managers track and analyze investment performance by centralizing data, providing real-time insights, and enabling customized reporting for better decision-making.

CRM software enhances collaboration and communication among portfolio managers and clients by providing a centralized platform for sharing real-time information, tracking interactions, and managing tasks efficiently.