CRM Views

See client relationships at a glance.

Manage everything from sales pipelines, customer engagement, and orders with ClickUp's 10+ highly flexible views. Easily track and manage your accounts on a List, Kanban Board, Table view, and more.

Gantt Charts

Streamline your client relationships with ClickUp's customizable CRM software designed specifically for Investment Advisors. Organize client data, track interactions, and manage tasks efficiently to enhance customer satisfaction and grow your business. Start maximizing your productivity and client retention today with ClickUp's user-friendly CRM system.

Free forever. No credit card.

CRM Views

Manage everything from sales pipelines, customer engagement, and orders with ClickUp's 10+ highly flexible views. Easily track and manage your accounts on a List, Kanban Board, Table view, and more.

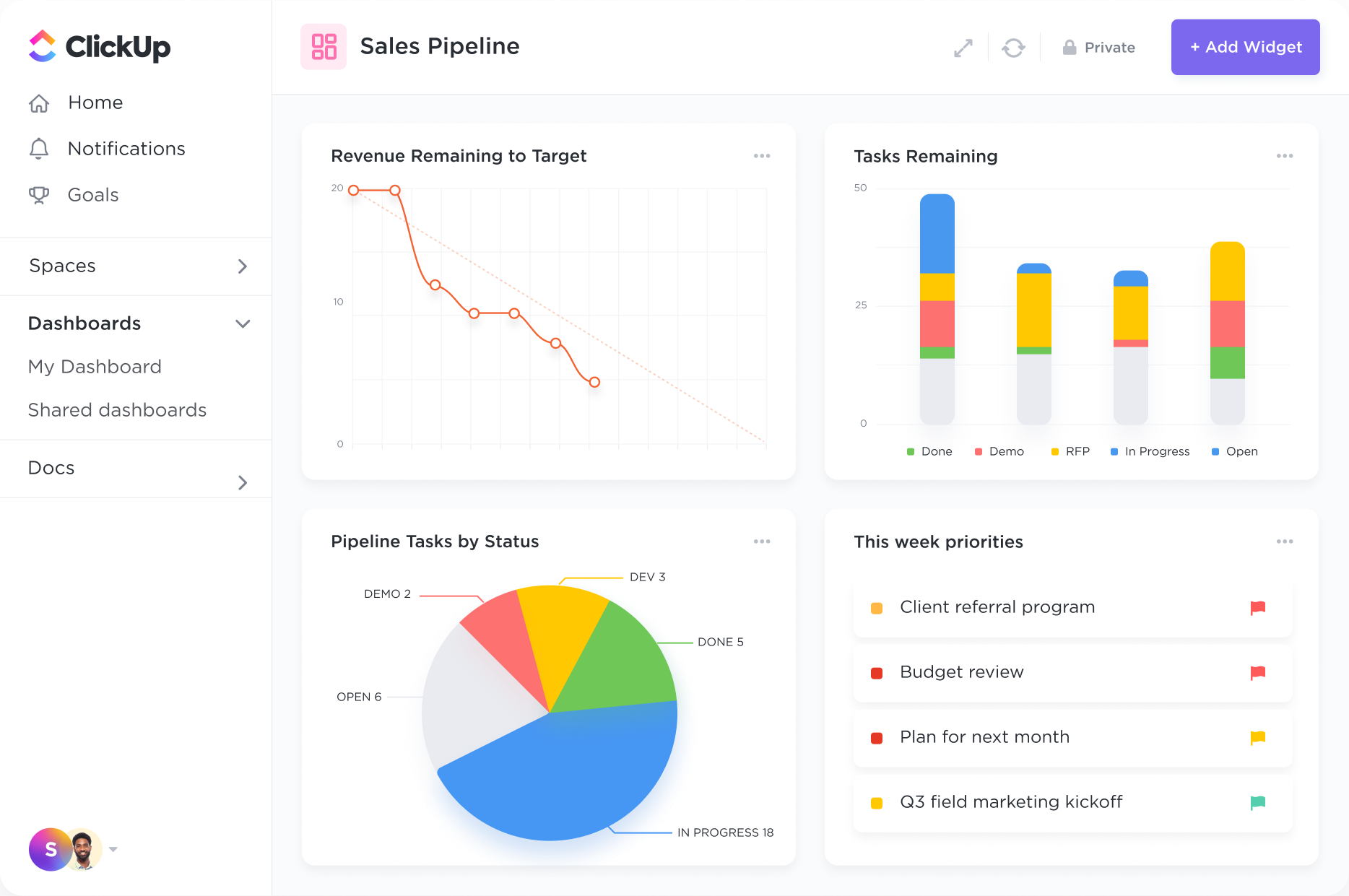

Performance Dashboards

Create high-level views to monitor customer lifetime value, average deal sizes, and more. ClickUp's 50+ Dashboard widgets make it easy to visualize all of your customer data in one place.

A CRM system helps investment advisors to keep track of client interactions, investment preferences, risk tolerance levels, and financial goals in one centralized platform. This enables advisors to provide personalized recommendations and services, ultimately strengthening client relationships.

CRMs allow advisors to monitor and analyze client investment portfolios, track performance metrics, and generate reports on a regular basis. This helps in making data-driven investment decisions, identifying trends, and ensuring that client portfolios align with their financial objectives.

For investment advisors, compliance with regulations and maintaining accurate records is crucial. A CRM system can assist in documenting client communications, investment recommendations, and regulatory disclosures, ensuring that all compliance requirements are met and easily accessible when needed.

CRMs streamline the client onboarding process by automating tasks such as account setup, document collection, and risk assessment. Additionally, automated reporting features enable advisors to generate client reports efficiently, saving time and ensuring timely updates on investment performance.

Effective communication is key in the investment advisory industry. A CRM facilitates seamless communication with clients through integrated email systems, alerts for important milestones, and secure document sharing. This transparency builds trust and keeps clients informed about their investments.

By automating repetitive tasks, organizing client data, and providing insights through analytics, a CRM system helps investment advisors optimize their time and focus on high-value activities such as client consultations, portfolio analysis, and strategic planning.

CRM software can help investment advisors streamline client management processes by centralizing client information, automating administrative tasks, tracking interactions and transactions, and providing insights for personalized and targeted client communication.

Key features and functionalities that investment advisors should look for in CRM software include robust contact management, integration with financial planning tools, compliance tracking capabilities, customizable reporting, and secure data management to ensure client confidentiality and regulatory adherence.

CRM software can assist investment advisors by centralizing client portfolio data, tracking investment performance, and providing insights to make informed decisions and personalized recommendations.