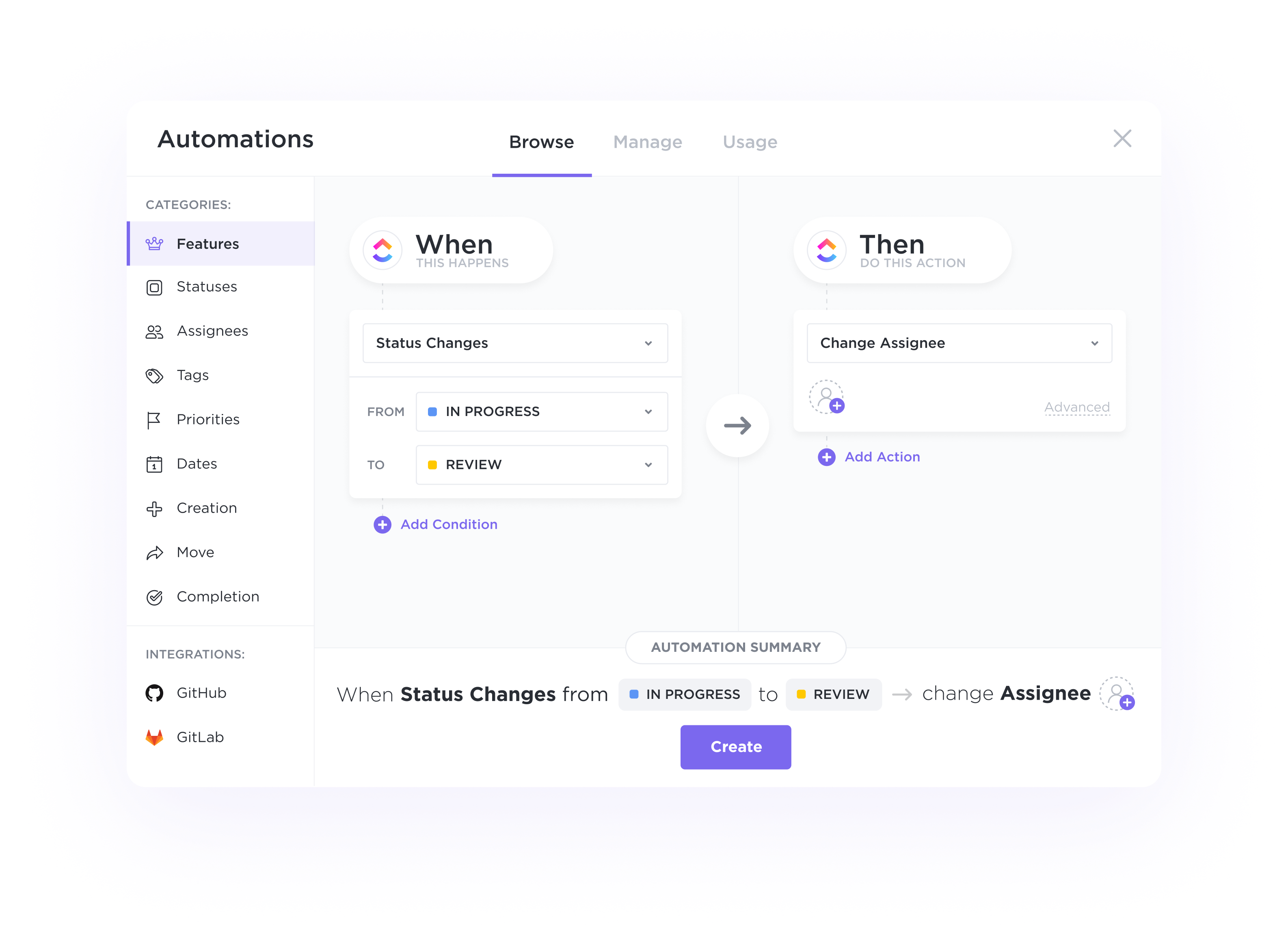

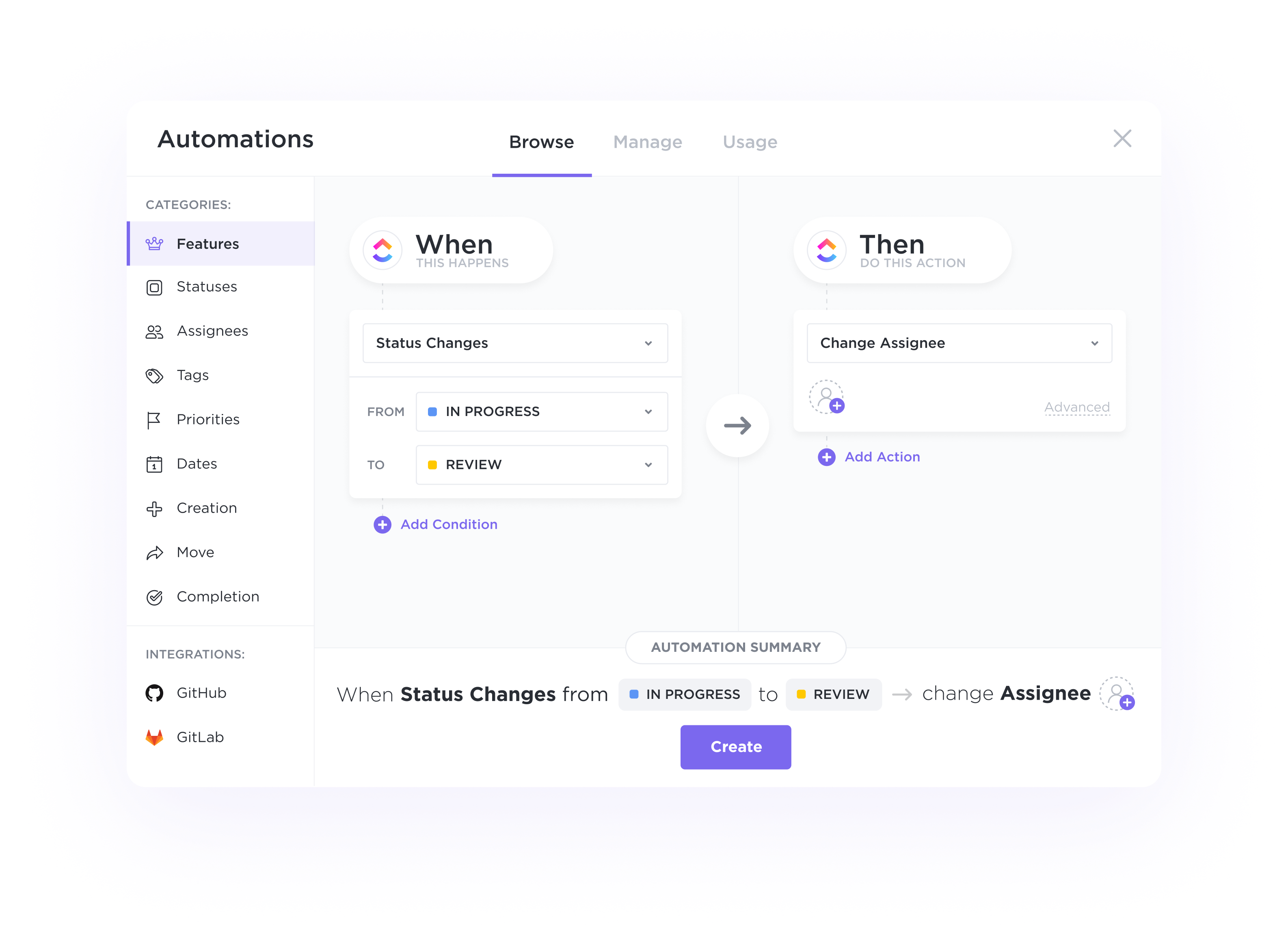

Automations

Automate handoffs, status updates, and more.

Automatically assign tasks for each stage of your pipeline, trigger status updates based on activity, and switch priorities to alert your team on where to focus next.

Gantt Charts

Revamp your workflow with ClickUp's customizable CRM software designed specifically for Financial Analysts. Streamline your client interactions, track leads efficiently, and stay on top of deadlines effortlessly. Elevate your productivity and boost your business success with ClickUp's user-friendly CRM system today.

Free forever. No credit card.

Automations

Automatically assign tasks for each stage of your pipeline, trigger status updates based on activity, and switch priorities to alert your team on where to focus next.

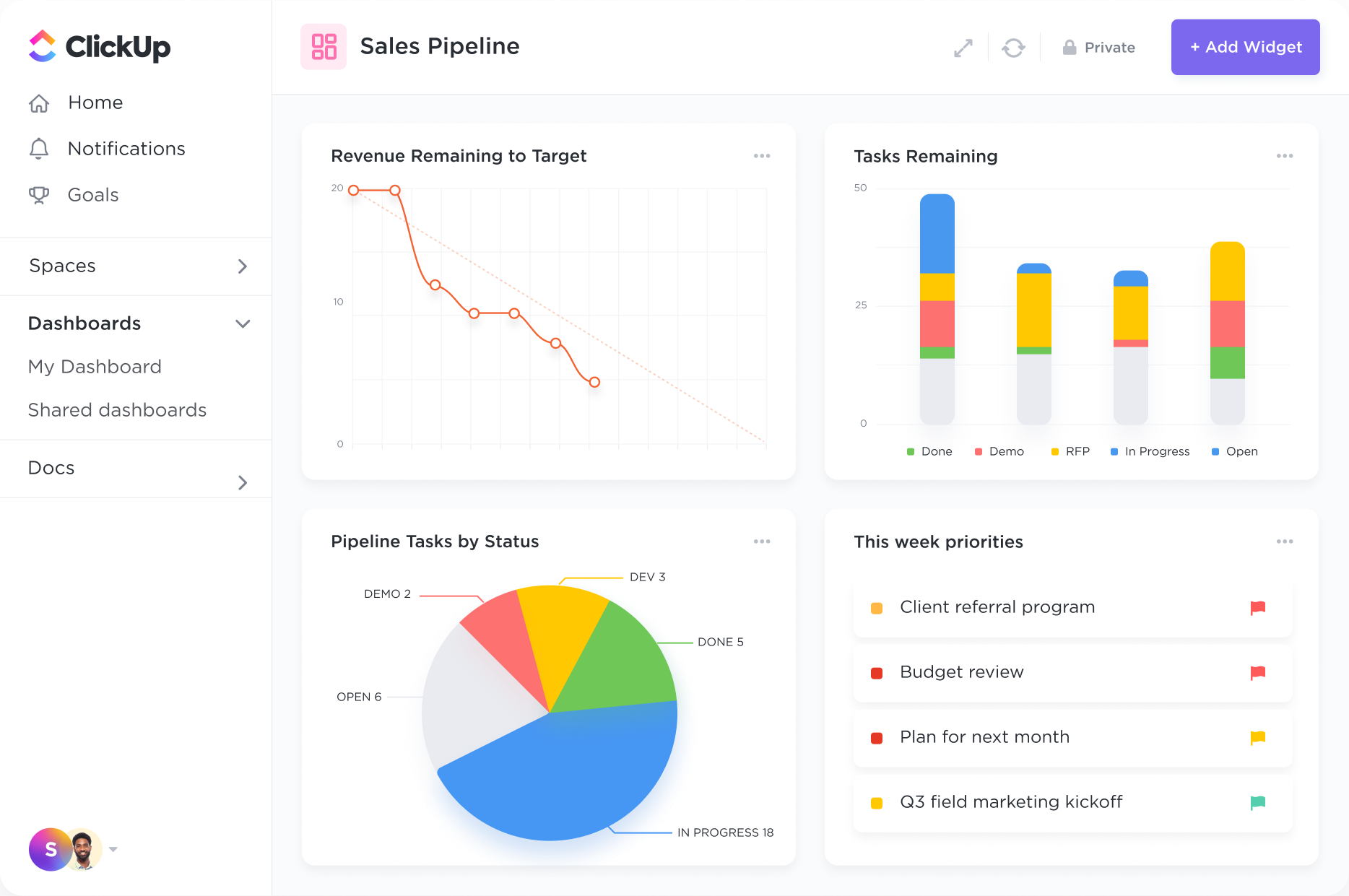

Performance Dashboards

Create high-level views to monitor customer lifetime value, average deal sizes, and more. ClickUp's 50+ Dashboard widgets make it easy to visualize all of your customer data in one place.

A CRM provides a centralized platform to store and organize client financial information, investment portfolios, transaction history, and communication records. This eliminates the need to search through multiple systems or spreadsheets, ensuring all information is easily accessible in one place.

CRMs can automate client onboarding processes by creating standardized workflows for collecting client data, risk profiles, compliance documents, and account setup. This automation saves time, reduces manual errors, and ensures a smooth onboarding experience for clients.

CRMs enable financial analysts to track potential investment opportunities, market research, and client investment preferences. They can also record investment recommendations, track their performance, and set up alerts for key events or market changes, aiding in informed decision-making.

CRMs help financial analysts stay compliant with regulations by securely storing client data, documenting communication for audits, and providing tools for monitoring and addressing compliance requirements. This reduces the risk of non-compliance and ensures that regulatory standards are met.

CRMs facilitate better client communication by tracking interactions, scheduling follow-ups, and storing client preferences. They also provide insights into client behavior and engagement, allowing financial analysts to tailor their communication and services to build stronger, long-lasting relationships.

CRM software offers features like contact management, lead tracking, pipeline management, and reporting capabilities that can benefit financial analysts by providing a centralized platform to organize client information, track opportunities, manage interactions, and generate insights for informed decision-making.

CRM software streamlines client data management, enhances communication through automated reminders and personalized messaging, and provides insights for tailored recommendations, ultimately improving client relationships and communication for financial analysts.

CRM software offers integrations and plugins that are beneficial for financial analysts, providing tools for advanced financial analysis, forecasting, budgeting, and reporting to support data-driven decision-making and strategic planning.