CRM Views

See client relationships at a glance.

Manage everything from sales pipelines, customer engagement, and orders with ClickUp's 10+ highly flexible views. Easily track and manage your accounts on a List, Kanban Board, Table view, and more.

Gantt Charts

Streamline client communication, track financial data, and enhance productivity with a customized CRM system for Accounting Firms, powered by ClickUp. Manage client relationships more effectively, increase efficiency in project management, and boost overall business performance. Try ClickUp today and revolutionize the way your Accounting Firm operates.

Free forever. No credit card.

CRM Views

Manage everything from sales pipelines, customer engagement, and orders with ClickUp's 10+ highly flexible views. Easily track and manage your accounts on a List, Kanban Board, Table view, and more.

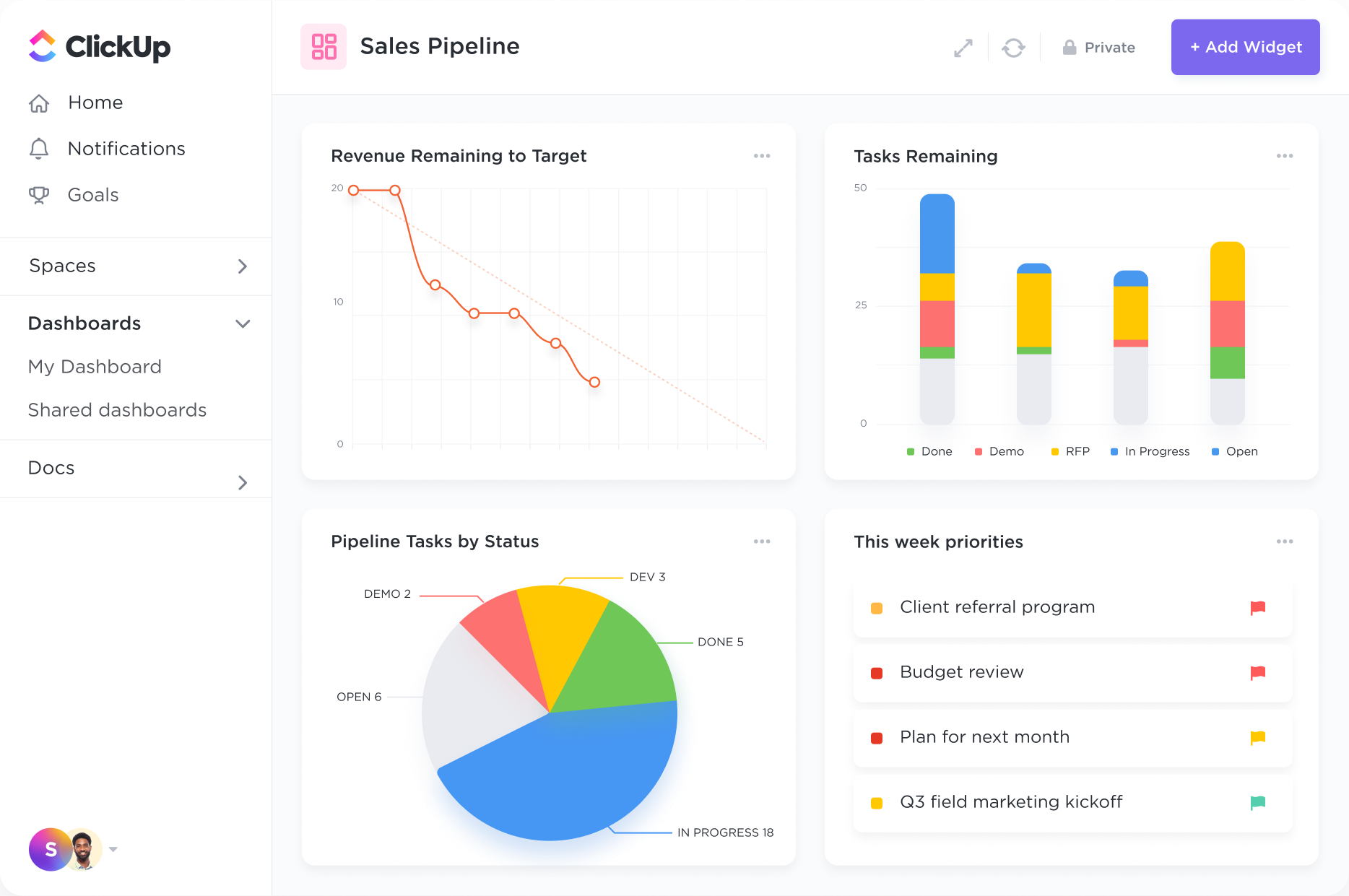

Performance Dashboards

Create high-level views to monitor customer lifetime value, average deal sizes, and more. ClickUp's 50+ Dashboard widgets make it easy to visualize all of your customer data in one place.

A CRM provides a centralized platform to store all client information, including contact details, service history, communication logs, and important documents. This eliminates the need for scattered client data across multiple systems or spreadsheets, ensuring all team members have access to up-to-date information.

CRMs can automate client onboarding tasks such as sending welcome emails, collecting necessary documents, setting up meetings, and assigning tasks to team members. This automation streamlines the onboarding process, reduces manual errors, and ensures a smooth transition for new clients.

Accounting firms deal with multiple deadlines and tasks for various clients. A CRM can help in organizing and prioritizing tasks, setting reminders for key deadlines, and tracking the progress of each task. This ensures that no important deadline is missed and improves overall task efficiency.

Effective communication with clients is crucial for accounting firms. A CRM can track all client interactions, including emails, calls, and meetings, providing a holistic view of communication history. This ensures that team members are well-informed before client interactions and helps in maintaining strong client relationships.

CRMs offer reporting features that can generate financial reports, analyze client data, track revenue trends, and provide insights into the firm's financial performance. These reports aid in making informed business decisions, identifying areas for improvement, and tracking the profitability of different client engagements.

Accounting firms deal with sensitive client data and must adhere to strict compliance regulations. A CRM can help in maintaining data security, restricting access to confidential information, and ensuring compliance with data protection laws. This enhances data security measures and mitigates the risk of data breaches.

CRM software can help streamline accounting processes for your firm by providing a centralized platform for managing financial data, automating invoicing and payment reminders, tracking expenses, and generating financial reports.

When choosing a CRM software for accounting firms, look for features like client relationship tracking, lead management, task automation, financial data integration, and customizable reporting tools to effectively manage client relationships and streamline business processes.

Yes, CRM software can integrate with existing accounting software to ensure seamless data transfer and accuracy, improving overall efficiency and financial transparency.