Top AI Prompts for VC Pitch Success

Revolutionizing Venture Capital Pitch Prep with AI Prompts

Crafting compelling venture capital pitches goes beyond the slide deck—it's about orchestrating insights, data, and storytelling seamlessly.

From market analysis and financial modeling to investor targeting and risk assessment, preparing for VC presentations involves juggling numerous elements—and countless revisions and deadlines. This is where AI prompts prove invaluable.

VC teams leverage AI to:

- Quickly identify key market trends and competitive landscapes

- Generate clear, persuasive pitch narratives and financial summaries

- Distill complex data into digestible insights

- Transform brainstorming notes into structured agendas, action items, or follow-up tasks

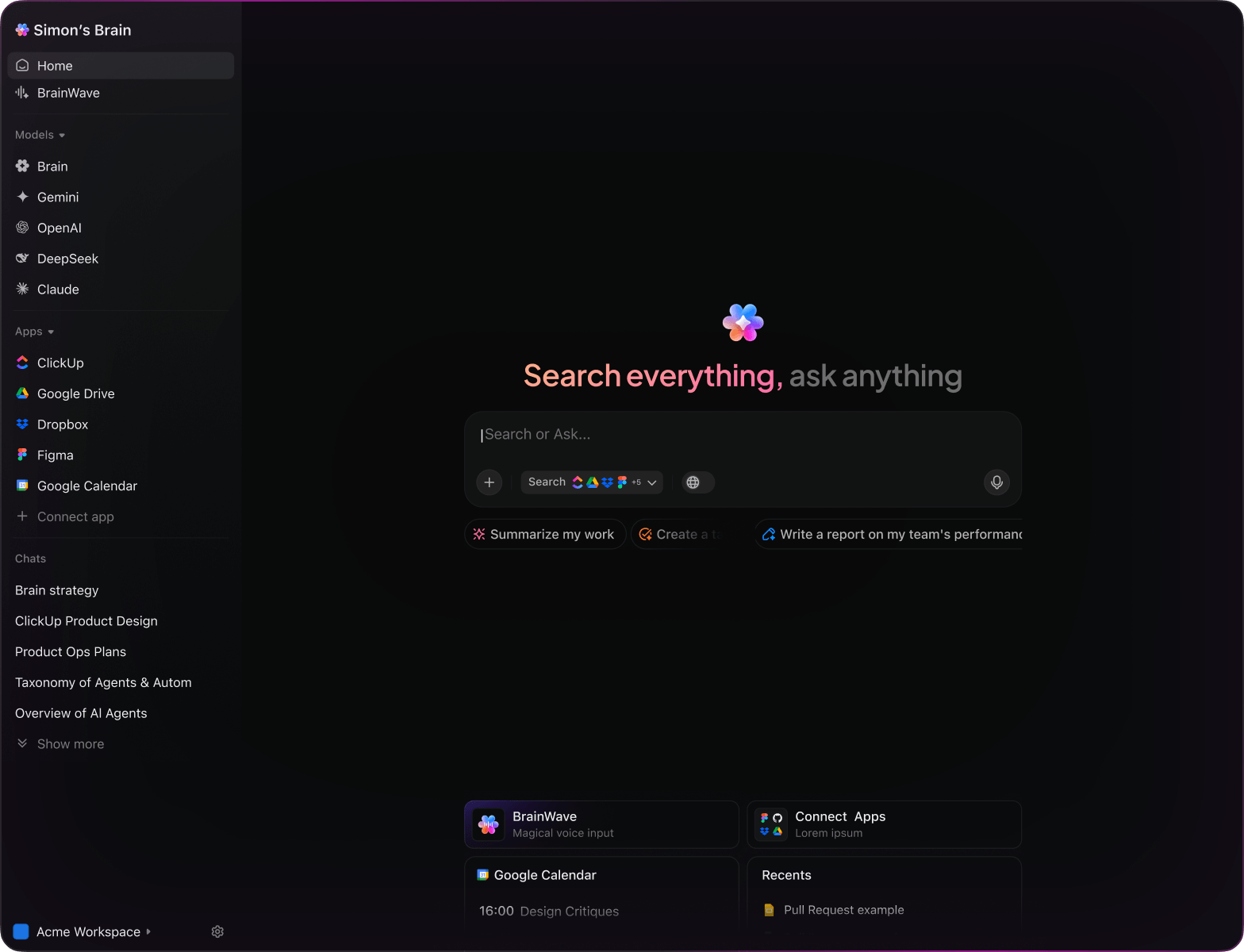

Integrated into daily tools like docs, whiteboards, and project trackers, AI in ClickUp Brain doesn’t just assist—it actively shapes your pitch process into a focused, efficient workflow.

Why ClickUp Brain Stands Out

Conventional AI Platforms

- Constantly toggling between apps to collect information

- Reiterating your objectives with every input

- Receiving generic, irrelevant suggestions

- Hunting through numerous platforms for a single document

- Interacting with AI that lacks initiative

- Manually switching between different AI engines

- Merely a browser add-on without deep integration

ClickUp Brain

- Deeply integrated with your pitch decks, notes, and team feedback

- Tracks your progress and investment goals over time

- Provides tailored, actionable insights

- Offers a centralized search across all your venture data

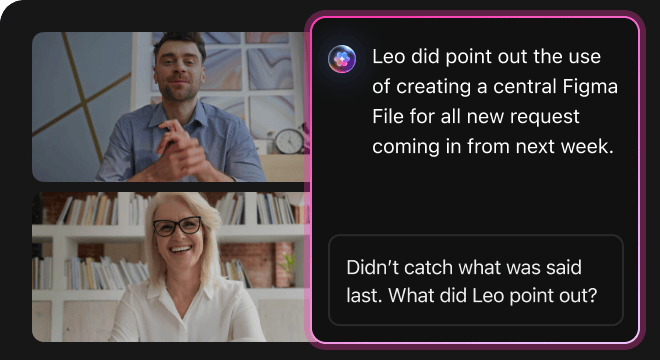

- Supports voice commands for hands-free operation

- Automatically selects the optimal AI model for each task

- Available as a dedicated app on Mac & Windows for peak performance

15 Strategic AI Prompts for VC Pitch Excellence

Outline 5 compelling value propositions for a fintech startup, based on the ‘Q2 Market Analysis’ document.

ClickUp Brain Behavior: Analyzes market insights and startup data from the linked document to generate persuasive pitch angles.

Identify key investor concerns for early-stage biotech ventures in North America.

ClickUp Brain Behavior: Aggregates findings from internal reports; Brain Max can supplement with relevant public investor sentiment data.

Draft an executive summary for a pitch deck focused on sustainable energy solutions, referencing ‘Sustainability Trends 2024’ and prior funding notes.

ClickUp Brain Behavior: Extracts critical points and formats a concise, impactful summary for investor presentations.

Compare competitive advantages of two AI startups using data from the ‘Competitive Landscape Q1’ report.

ClickUp Brain Behavior: Synthesizes tabular and narrative data to produce a clear side-by-side analysis.

List top market entry strategies for consumer tech startups, referencing strategic planning documents and industry whitepapers.

ClickUp Brain Behavior: Reviews internal materials to highlight effective approaches and associated outcomes.

From the ‘Due Diligence Checklist’ doc, generate a task list for pre-investment evaluation.

ClickUp Brain Behavior: Extracts essential criteria and organizes them into actionable steps within a task or document.

Summarize 3 emerging funding trends in health tech from recent investor reports and market analyses.

ClickUp Brain Behavior: Identifies patterns and recurring themes from linked research and financial documents.

From the ‘Founder Feedback Survey Q1’ doc, summarize key preferences and concerns expressed by startup founders.

ClickUp Brain Behavior: Analyzes survey data to highlight common themes and actionable insights.

Write concise, persuasive copy for the pitch deck’s problem statement slide using tone guidelines from ‘InvestorCommunication.pdf’.

ClickUp Brain Behavior: Extracts style cues and generates multiple variations tailored for investor engagement.

Summarize recent regulatory changes impacting fintech startups and their implications for fundraising.

ClickUp Brain Behavior: Reviews compliance documents and public updates to provide a clear overview of relevant shifts.

Generate guidelines for financial projections presentation, referencing regional investment standards and internal best practices.

ClickUp Brain Behavior: Extracts formatting rules and key metrics to create a structured compliance checklist.

Create a risk assessment checklist for early-stage investments using ‘Risk Management Framework’ PDFs and portfolio data.

ClickUp Brain Behavior: Identifies critical risk factors and organizes them into categorized tasks for review.

Compare sustainability initiatives across portfolio companies using data from recent impact reports.

ClickUp Brain Behavior: Summarizes comparative data into an easy-to-read format highlighting strengths and gaps.

What are the latest trends in pitch deck design and storytelling for tech startups since 2023?

ClickUp Brain Behavior: Synthesizes insights from design guidelines, investor feedback, and market research documents.

Summarize key feedback themes from investor meetings in Southeast Asia, focusing on valuation, market fit, and growth potential.

ClickUp Brain Behavior: Extracts and prioritizes investor comments from meeting notes, surveys, and tagged communications.

AI Prompts for Venture Capital Pitches Using ClickUp Brain

Prompts for ChatGPT

- Condense these startup pitch decks into a 5-point investor summary highlighting market potential.

- Craft persuasive investor outreach emails focusing on scalability and ROI.

- Generate 3 alternative value proposition statements tailored for early-stage tech ventures.

- Outline a stepwise investor presentation plan emphasizing traction and growth metrics.

- Compare recent funding rounds and summarize key investor concerns for upcoming pitches.

Prompts for Gemini

- Develop 3 innovative pitch deck slide designs focusing on financial projections and market analysis.

- Suggest compelling storytelling angles for startup founders to engage venture capitalists.

- Create a mood board description for brand identity that resonates with VC audiences.

- Propose investor-friendly cap table structures and rank them by appeal and simplicity.

- Build a competitive landscape comparison table highlighting startup differentiators and risks.

Prompts for Perplexity

- List 5 emerging sectors attracting VC funding and rank them by growth potential.

- Provide a comparison of term sheet clauses focusing on founder-friendly vs investor-friendly terms.

- Summarize global trends in venture capital investment strategies and their success rates.

- Generate a list of 5 common pitch mistakes and rank them by impact on funding outcomes.

- Compare past successful pitch strategies and extract top 3 best practices for new founders.

Prompts for ClickUp Brain

- Transform investor feedback threads into clear, prioritized action items for the startup team.

- Summarize pitch rehearsal notes and assign follow-up tasks with deadlines and responsible members.

- Analyze financial model annotations and generate a checklist for CFO review and adjustments.

- Create a task list from cross-functional discussions on investor Q&A prep, including urgency levels.

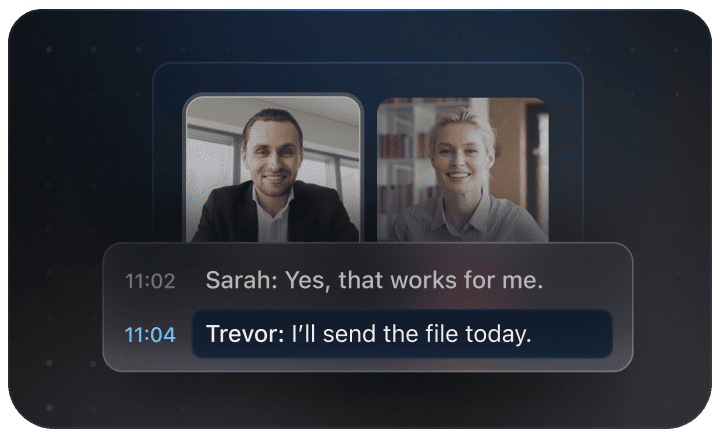

- Summarize post-pitch debrief transcripts and produce actionable improvements and investor relations tasks in ClickUp.

Transform Initial Thoughts Into Polished Pitches

- Convert scattered notes into clear, compelling pitch decks swiftly.

- Generate innovative angles by analyzing previous successful investments.

- Build customizable templates that accelerate your fundraising process.

Brain Max Boost: Quickly access past pitch materials, investor feedback, and market research to fuel your upcoming presentations.

Accelerate Your Venture Capital Pitch Process

- Break down intricate investor feedback into straightforward next steps.

- Transform pitch ideas into concrete, assignable tasks effortlessly.

- Automatically produce detailed pitch decks and follow-up summaries without extra effort.

Brain Max Boost: Instantly access historical pitch data, investor profiles, or funding milestones across all your deals.

How AI Prompts Elevate Every Phase of Venture Capital Pitching

Craft Persuasive Pitches Quickly

Founders develop impactful narratives faster, refine messaging effectively, and overcome writer’s block.