Top AI Prompts for Managing Your Money

Revolutionizing Personal Finance with AI Prompts in ClickUp Brain

Managing your money effectively goes beyond tracking expenses—it’s about creating a clear path to your financial goals.

From budgeting and investment planning to debt management and savings strategies, personal finance involves juggling numerous details—and countless decisions. This is where AI prompts become invaluable.

Users now leverage AI to:

- Quickly identify spending patterns and saving opportunities

- Generate tailored budget plans and financial forecasts with ease

- Simplify complex financial documents and terms

- Transform scattered notes into organized action plans and reminders

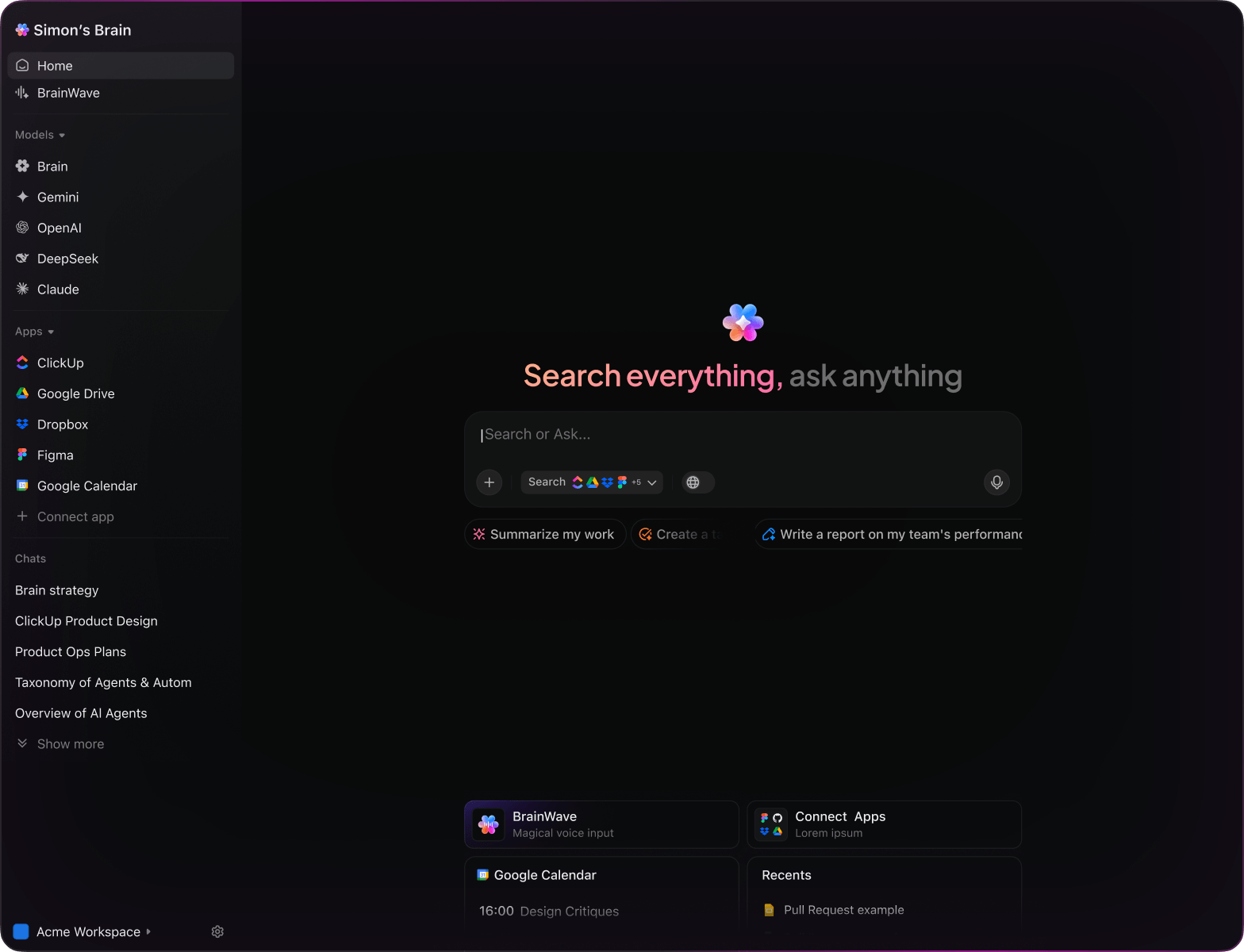

Integrated into familiar tools like documents, boards, and task lists, AI in ClickUp Brain acts as your financial co-pilot—turning your insights into structured, achievable steps.

Why ClickUp Brain Stands Apart

Common AI Finance Tools

- Constantly toggling between apps to collect data

- Repeating your financial objectives with each query

- Receiving vague, irrelevant advice

- Hunting through multiple platforms for one budget file

- Interacting with AI that only processes input

- Manually switching between different AI engines

- Merely another add-on without deep integration

ClickUp Brain

- Instantly accesses your budgets, expenses, and financial plans

- Keeps track of your past queries and goals

- Delivers tailored, practical financial guidance

- Searches all your finance documents in one place

- Supports hands-free input with Talk to Text

- Automatically selects the optimal AI model: GPT, Claude, Gemini

- Available as a native app on Mac & Windows for fast performance

15 Powerful AI Prompts for Personal Finance Management

Identify 5 effective budgeting approaches tailored for young professionals starting their careers, based on the ‘Budgeting Basics 2024’ doc.

ClickUp Brain Behavior: Analyzes key points and recommendations from the linked document to suggest practical budgeting methods.

Summarize popular sustainable investment options for portfolios under $50K in North America.

ClickUp Brain Behavior: Gathers insights from internal market analysis and can incorporate public data via Brain Max if accessible.

Create a clear savings plan outline inspired by the ‘Emergency Fund Guidelines’ doc and previous financial advice notes.

ClickUp Brain Behavior: Extracts relevant advice and structures it into an actionable savings plan format.

Summarize reward program features between Chase Sapphire and American Express Platinum using our ‘Credit Cards Q1’ doc.

ClickUp Brain Behavior: Pulls data from internal documents and presents a concise comparison of benefits and drawbacks.

Identify leading expense tracking apps and highlight their key functionalities, referencing R&D notes and user reviews.

ClickUp Brain Behavior: Scans internal documents and compiles a list of popular tools with feature summaries.

From the ‘Monthly Finance Review’ doc, produce a detailed checklist for reviewing income, expenses, and investments.

ClickUp Brain Behavior: Extracts criteria from the document and formats them into a structured checklist task.

Identify recent developments in digital wallet technology from post-2023 market research and tech reports.

ClickUp Brain Behavior: Extracts recurring themes and innovations from linked research files.

Summarize user feedback on mobile banking app interfaces from the ‘User Experience Survey 2024’ doc.

ClickUp Brain Behavior: Analyzes survey data to identify common design preferences and pain points.

Create engaging and clear interface text for a savings goal tracker, using tone guidelines from ‘BrandVoice.pdf’.

ClickUp Brain Behavior: References tone documents to suggest friendly and motivating copy variations.

Outline key modifications in tax regulations for 2025 and their impact on personal finance planning.

ClickUp Brain Behavior: Reviews internal compliance updates; Brain Max can add public tax code changes if available.

Extract rules and recommendations for retirement savings contributions, referencing IRS docs and workspace notes.

ClickUp Brain Behavior: Compiles contribution limits and best practices into a clear compliance checklist.

Using US debt management guidelines and personal finance folders, produce a step-by-step debt repayment checklist.

ClickUp Brain Behavior: Identifies key actions and groups them by priority and debt type.

Summarize fee structures for platforms like Vanguard, Fidelity, and Robinhood using competitive analysis docs.

ClickUp Brain Behavior: Presents a clear comparison table highlighting costs and service differences.

Synthesize recent developments in robo-advisor services from internal reports and market summaries since 2023.

ClickUp Brain Behavior: Extracts key features and user benefits from linked research materials.

Identify frequent issues faced by users in budgeting apps from the ‘User Feedback Southeast Asia’ folder.

ClickUp Brain Behavior: Prioritizes reported problems across surveys, support tickets, and feedback notes.

AI Prompts for Personal Finance with ClickUp Brain

Prompts for ChatGPT

- Outline a 5-step budget plan based on monthly income and expenses to improve savings.

- Craft persuasive copy for a personal finance app highlighting ease of use and security.

- Suggest 3 investment portfolio strategies tailored for risk tolerance and long-term growth.

- Develop a detailed workflow for automating bill payments and tracking due dates.

- Compare recent credit card offers and summarize key benefits for cashback and rewards.

Prompts for Gemini

- Propose 3 dashboard layouts for a finance tracker app focusing on clarity and user engagement.

- List creative ideas for visualizing spending habits to encourage mindful budgeting.

- Generate a mood board description for a finance app interface using calming colors and intuitive icons.

- Recommend ergonomic mobile app navigation flows for quick access to account summaries.

- Create a comparison chart of savings account options emphasizing interest rates and fees.

Prompts for Perplexity

- Identify 5 emerging fintech tools for personal budgeting and rank them by user-friendliness.

- Compare different retirement savings plans, highlighting tax benefits and contribution limits.

- Summarize recent trends in digital payment methods and their adoption among millennials.

- List 5 innovative expense tracking techniques and evaluate their effectiveness.

- Analyze past financial planning mistakes and extract top lessons for better money management.

Prompts for ClickUp Brain

- Transform this client’s financial goals into prioritized budgeting and investment tasks.

- Summarize recent financial advisor meeting notes and assign follow-up actions with deadlines.

- Review annotated expense reports and generate a checklist of areas needing cost optimization.

- Create a task list from team discussions on improving personal finance app features, including priority tags.

- Summarize user feedback on budgeting tools and produce actionable design and development tasks in ClickUp.

Transform Your Financial Plans Into Actionable Steps

- Convert scattered budget notes into clear financial strategies quickly.

- Generate innovative saving and investment ideas from your historical data.

- Build custom templates that accelerate your money management routines.

Brain Max Boost: Effortlessly explore previous budgets, expense reports, and financial goals to fuel your upcoming plans.

Accelerate Your Financial Planning Process

- Break down complicated financial goals into manageable tasks.

- Transform budgeting insights into actionable to-dos.

- Automatically create summaries and progress reports without lifting a finger.

Brain Max Boost: Instantly access historical spending patterns, investment comparisons, or savings milestones across your financial plans.

How AI Prompts Elevate Every Phase of Personal Finance Planning

Create Budget Plans in Moments

You craft tailored budgets quickly, make informed spending choices, and avoid financial overwhelm.