Top AI Prompts to Boost M&A Success

AI Prompts Revolutionizing M&A Workflows

Navigating the complexities of mergers and acquisitions demands precision and speed.

From initial due diligence to integration planning and compliance reviews, M&A teams juggle countless documents, analyses, and deadlines. AI prompts are reshaping how these challenges are tackled.

With AI, teams can now:

- Quickly identify key financial and legal insights

- Generate detailed deal summaries and integration plans from minimal input

- Extract critical points from dense contracts and regulatory filings

- Transform scattered notes into clear action items, timelines, or risk assessments

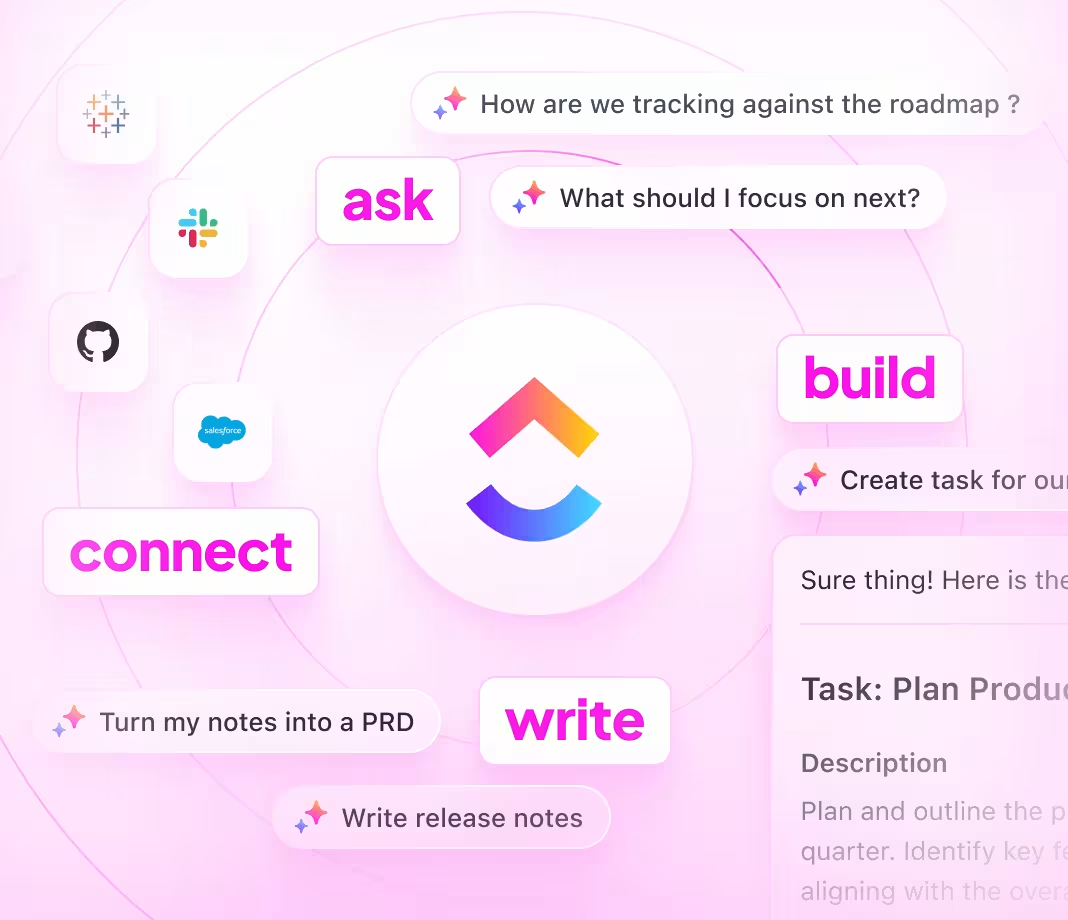

Embedded within familiar tools—such as documents, dashboards, and project trackers—AI in platforms like ClickUp Brain acts as a strategic partner, converting complex data into structured, executable plans.

Discover Why ClickUp Brain Stands Apart

Conventional AI Platforms

- Constantly toggling between apps to collect details

- Reiterating your objectives with every query

- Responses that miss the mark on your needs

- Hunting through multiple systems for a single document

- Interacting with AI that lacks initiative

- Manually switching among different AI engines

- Merely another add-on in your browser

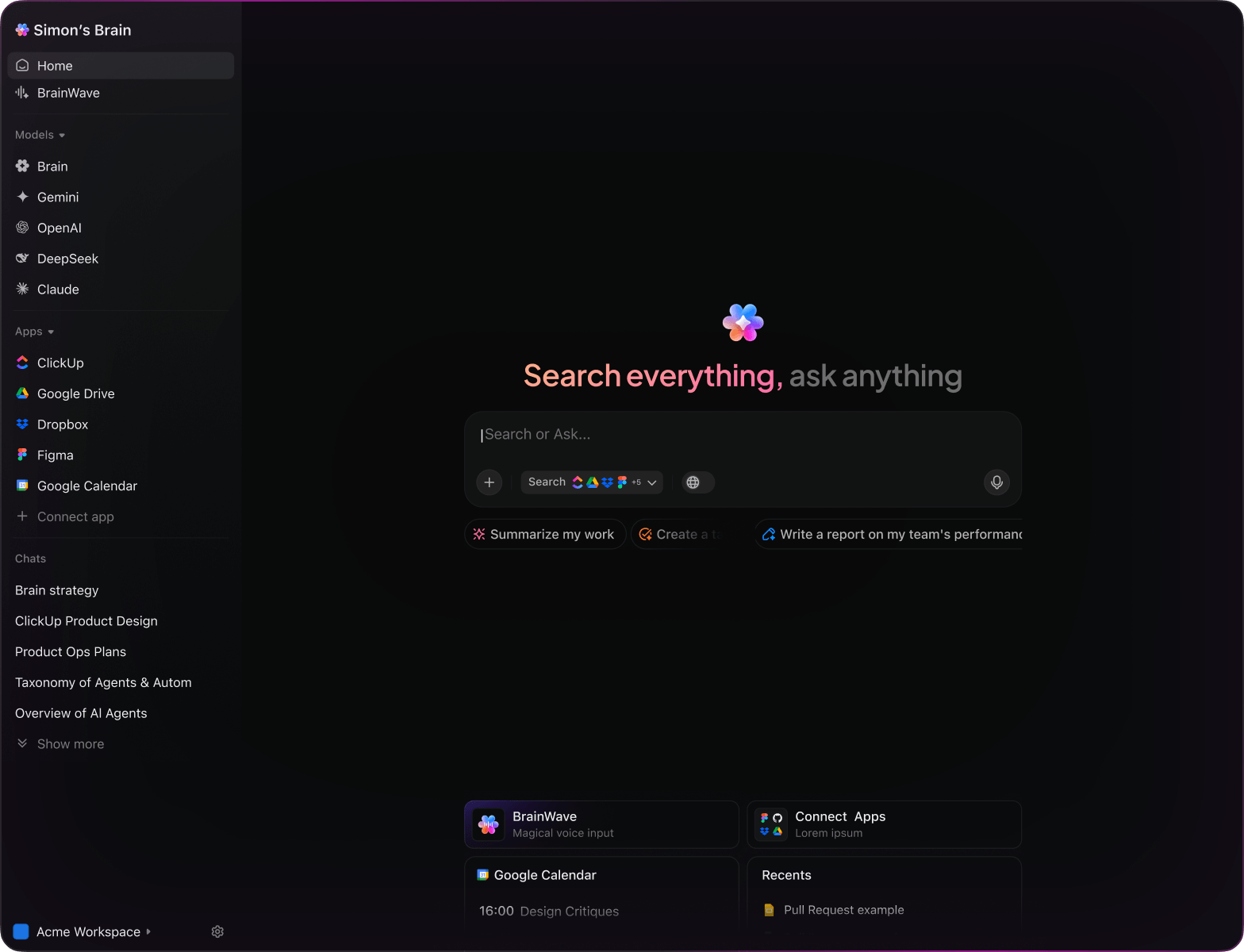

ClickUp Brain

- Deeply connected to your M&A tasks, files, and team progress

- Retains your negotiation history and strategic aims

- Delivers precise, context-driven guidance

- Searches seamlessly across all your resources

- Supports hands-free commands with Talk to Text

- Automatically selects the optimal AI model: GPT, Claude, Gemini

- Dedicated Mac & Windows app engineered for efficiency

15 Essential AI Prompts for Mergers & Acquisitions

Identify 5 strategic acquisition targets in the fintech sector based on the ‘Q2 Market Analysis’ report.

ClickUp Brain Behavior: Analyzes linked documents to highlight promising companies matching specified criteria.

What are the current valuation multiples for SaaS companies under $100M revenue in North America?

ClickUp Brain Behavior: Aggregates data from internal financial reports; Brain Max can supplement with relevant external market data.

Draft a due diligence checklist focused on intellectual property risks, referencing ‘IP Audit Guidelines’ and prior deal notes.

ClickUp Brain Behavior: Extracts key points from linked files to produce a structured, actionable checklist.

Summarize financial performance benchmarks comparing Company A and Company B using the ‘Financials Q3’ document.

ClickUp Brain Behavior: Pulls tabular and narrative data from internal sources to create a concise comparative summary.

List top regulatory compliance challenges in cross-border M&A deals, referencing legal briefs and compliance reports.

ClickUp Brain Behavior: Reviews internal documents to identify recurring compliance issues and their implications.

From the ‘Integration Planning’ document, generate a phased timeline for post-merger activities.

ClickUp Brain Behavior: Extracts milestones and organizes them into a clear, time-bound project plan.

Summarize 3 emerging trends in M&A financing from recent market analysis and industry reports.

ClickUp Brain Behavior: Identifies patterns and key insights from linked research materials.

From the ‘Stakeholder Feedback Q1’ report, summarize main concerns regarding cultural integration.

ClickUp Brain Behavior: Analyzes survey data and feedback notes to highlight prevalent themes and sentiments.

Write concise communication templates for announcing merger milestones using the tone guidelines in ‘CorporateVoice.pdf’.

ClickUp Brain Behavior: Adapts style references from the document to generate professional messaging samples.

Summarize recent changes in antitrust regulations and their potential effects on deal approvals.

ClickUp Brain Behavior: Reviews linked compliance documents and public updates to provide a clear overview.

Generate a risk assessment matrix for technology integration, referencing ‘Tech Due Diligence’ files.

ClickUp Brain Behavior: Extracts risk factors and organizes them into a structured evaluation tool.

Create a checklist for environmental due diligence based on EPA guidelines and internal audit reports.

ClickUp Brain Behavior: Identifies key compliance points and formats them into an actionable task list.

Compare employee retention strategies post-merger across recent deals using HR analysis documents.

ClickUp Brain Behavior: Summarizes comparative data into an easy-to-digest format highlighting best practices.

What integration challenges have arisen in recent acquisitions within the healthcare sector?

ClickUp Brain Behavior: Synthesizes issues from internal case studies, feedback, and project retrospectives.

Summarize key operational gaps identified during due diligence in Southeast Asia market entries.

ClickUp Brain Behavior: Extracts and prioritizes findings from survey responses, audit notes, and project documentation.

AI Prompts Tailored for Mergers & Acquisitions with ClickUp Brain

ChatGPT Prompts for M&A Teams

Gemini Prompts for M&A Strategy

Perplexity Prompts for M&A Insights

ClickUp Brain Prompts for M&A Execution

Transform Initial Thoughts Into Clear Strategies

- Convert scattered notes into polished acquisition plans swiftly.

- Generate innovative approaches by analyzing previous deal data.

- Build custom templates that accelerate every merger process.

Brain Max Boost: Quickly access historical deal documents, stakeholder feedback, and financial models to fuel your next acquisition strategy.

Accelerate Deal Execution and Integration

- Break down intricate negotiations into manageable tasks.

- Transform due diligence insights into actionable assignments.

- Automatically compile deal summaries and integration plans—no extra effort.

Brain Max Boost: Instantly access historical transaction data, asset comparisons, or compliance notes across all deals.

How AI Prompts Enhance Every Phase of M&A Planning

Create Strategic Deal Scenarios Quickly

Teams explore diverse acquisition options swiftly, enabling informed strategy choices without delay.