Top AI Prompts for Managing Cash Flow

Harness AI Prompts to Master Cash Flow Management

Managing your company's cash flow isn't just about tracking numbers—it's about anticipating challenges and making informed decisions.

From forecasting expenses to monitoring receivables and optimizing payment schedules, effective cash flow management requires juggling multiple data points and deadlines. AI prompts are now a vital tool in this process.

Finance teams rely on AI to:

- Quickly identify cash flow trends and potential bottlenecks

- Generate accurate forecasts and budget scenarios with minimal effort

- Summarize financial reports and payment terms clearly

- Transform scattered notes into structured action plans, reminders, or follow-ups

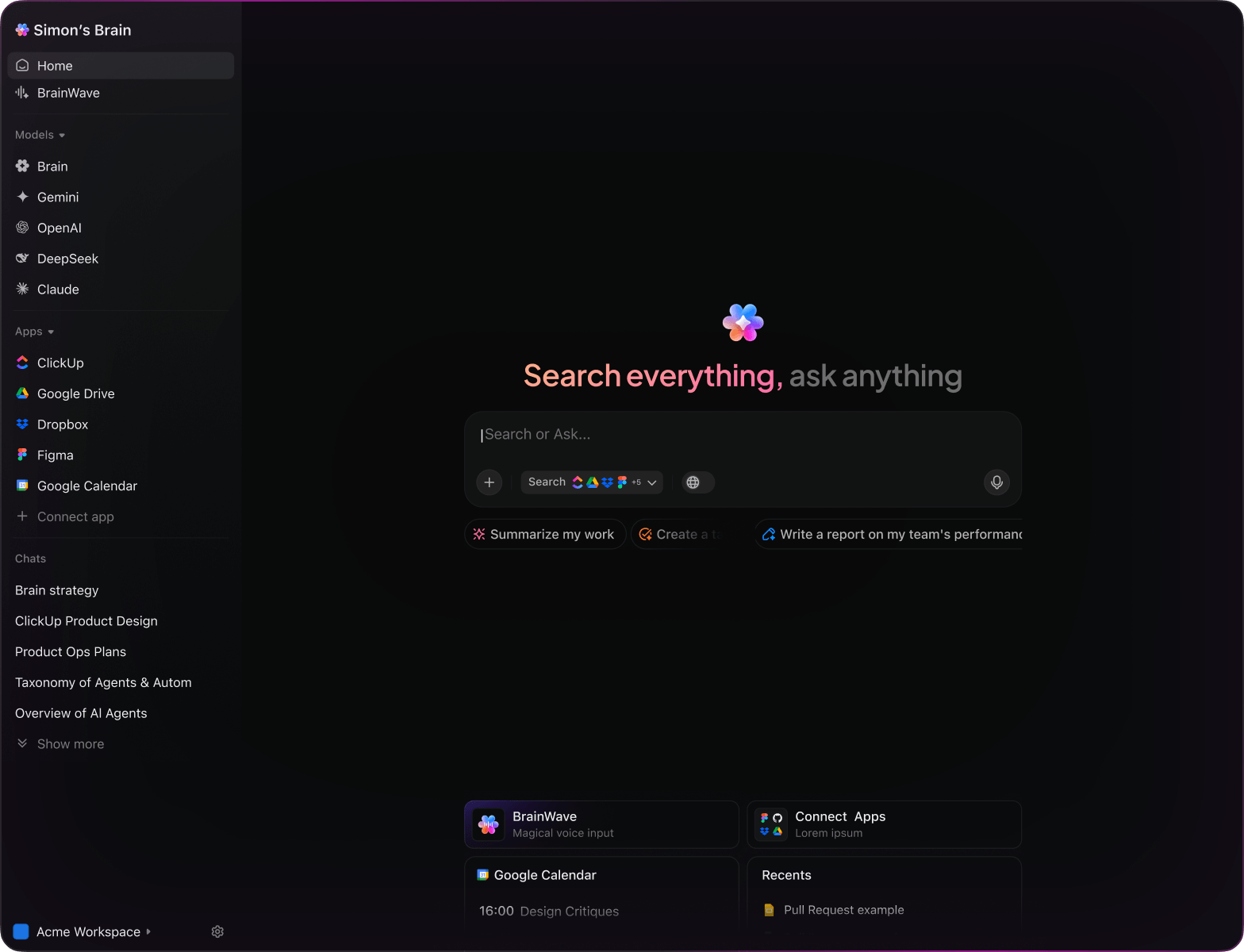

Integrated into daily tools like spreadsheets, dashboards, and task managers, AI in platforms such as ClickUp Brain goes beyond simple assistance. It actively organizes your financial insights into clear, manageable tasks that keep your cash flow healthy and predictable.

Why ClickUp Brain Stands Out

Conventional AI Platforms

- Constantly toggling between apps to collect info

- Repeating your objectives with every query

- Responses that miss your specific needs

- Hunting through numerous tools to locate a single document

- Engaging with AI that only processes input passively

- Manually switching among different AI models

- Merely another add-on in your browser

ClickUp Brain

- Deeply connected to your projects, documents, and team communications

- Tracks your progress and priorities over time

- Provides insightful, context-aware guidance

- Searches across all your integrated platforms instantly

- Allows hands-free commands with Talk to Text

- Automatically selects the optimal AI model: GPT, Claude, Gemini

- Dedicated desktop app for Mac & Windows designed for efficiency

15 Essential AI Prompts for Managing Cash Flow with ClickUp Brain

List 5 effective cash inflow approaches tailored for a small retail company, based on the ‘Q2 Financial Overview’ document.

ClickUp Brain Behavior: Analyzes financial reports and sales data to suggest practical revenue-boosting ideas.

Summarize popular cost-saving measures adopted by mid-sized service companies in 2024, referencing internal expense reports and market analyses.

ClickUp Brain Behavior: Combines insights from company records and industry data to highlight actionable expense management tactics.

Create a detailed cash flow projection template suitable for seasonal enterprises, using notes from ‘Seasonal Sales Patterns’ and past forecasts.

ClickUp Brain Behavior: Extracts key variables and historical data to build a customizable forecasting framework.

Summarize differences in payment terms and their cash flow implications from contracts with Vendor A and Vendor B, using the ‘Supplier Agreements’ folder.

ClickUp Brain Behavior: Reviews contract details and financial notes to produce a clear comparison report.

Identify and explain the five most critical liquidity ratios for cash flow evaluation, referencing finance textbooks and internal training materials.

ClickUp Brain Behavior: Scans educational content and company guides to compile definitions and usage contexts.

From the ‘Finance Team SOP’ document, create a step-by-step checklist for conducting monthly cash flow reviews.

ClickUp Brain Behavior: Extracts procedural steps and organizes them into a clear, actionable task list.

Outline three software solutions that automate cash flow monitoring, based on recent tech evaluations and user feedback.

ClickUp Brain Behavior: Gathers data from product reviews and internal assessments to highlight key features and benefits.

Analyze survey results to identify frequent issues clients face with invoicing and payment processes.

ClickUp Brain Behavior: Detects recurring themes and compiles a summary of pain points and suggestions.

Craft polite yet firm email templates for reminding clients about overdue invoices, using tone guidelines from ‘Communication Style Guide.pdf’.

ClickUp Brain Behavior: Adapts tone and style references to generate professional and effective message drafts.

Outline key tax law updates for 2025 and their potential impact on cash flow management, referencing government releases and internal memos.

ClickUp Brain Behavior: Synthesizes regulatory documents and internal notes to present clear implications.

Develop recommendations for maintaining optimal cash reserves, based on industry benchmarks and financial best practices.

ClickUp Brain Behavior: Extracts relevant standards and formulates actionable advice for reserve management.

From risk management documents, produce a checklist identifying potential cash flow interruption scenarios and mitigation steps.

ClickUp Brain Behavior: Identifies risk factors and organizes them into a structured evaluation tool.

Summarize cash flow strategies used by key competitors, using competitive intelligence reports and financial disclosures.

ClickUp Brain Behavior: Condenses comparative data into an easy-to-understand format highlighting strengths and weaknesses.

Identify emerging forecasting techniques favored by startups since 2023, based on research papers and industry surveys.

ClickUp Brain Behavior: Integrates findings from multiple sources to present trend insights.

Extract and prioritize user feedback regarding billing system ease-of-use from surveys and support tickets in the ‘Client Feedback’ folder.

ClickUp Brain Behavior: Analyzes comments to highlight common usability issues and improvement opportunities.

AI Prompts for Managing Cash Flow with ClickUp Brain

Prompts for ChatGPT

Prompts for Gemini

Prompts for Perplexity

Prompts for ClickUp Brain

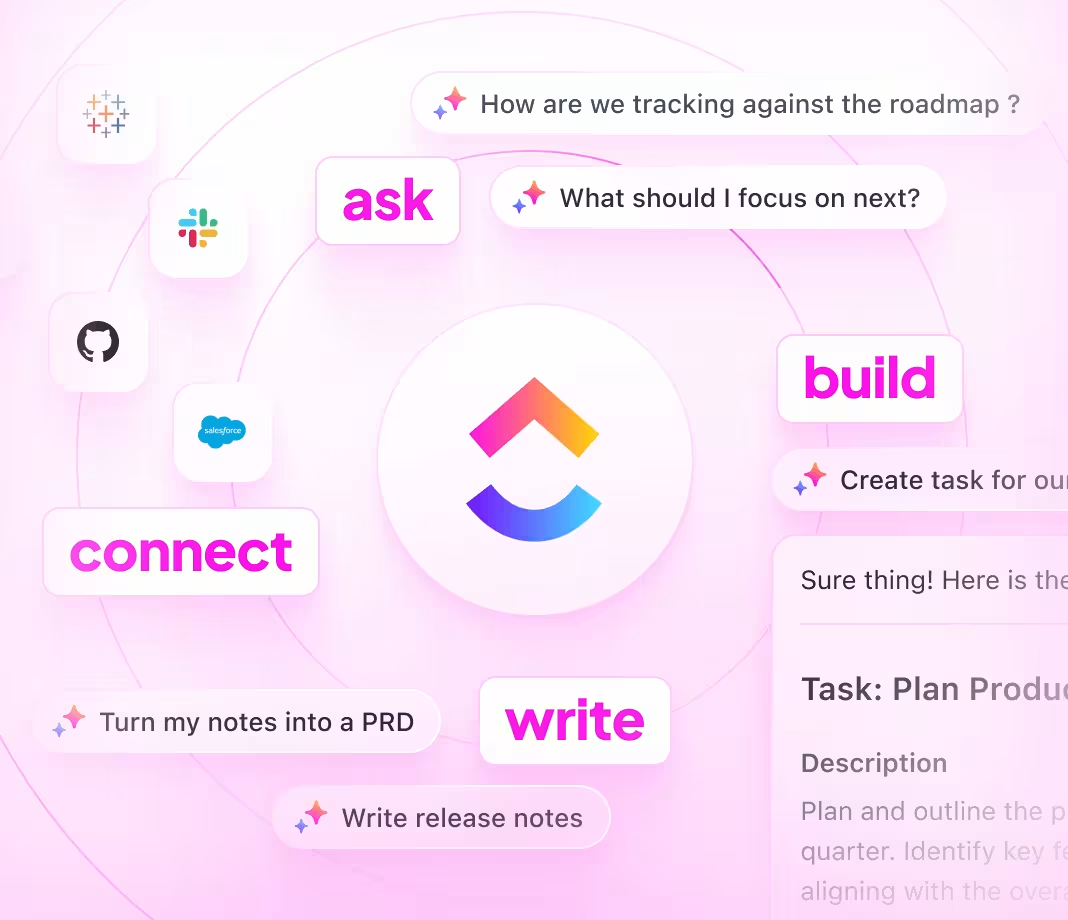

Transform Initial Thoughts Into Clear Plans

- Convert scattered notes into polished financial strategies swiftly.

- Generate innovative cash flow solutions by analyzing previous reports.

- Build adaptable templates that accelerate your budgeting cycles.

Brain Max Boost: Quickly access historical budgets, transaction records, and financial insights to guide your upcoming cash flow plans.

Accelerate Cash Flow Management

- Break down financial meetings into precise, actionable tasks.

- Transform cash flow insights into assignable workflows.

- Automatically create summaries and financial snapshots without extra effort.

Brain Max Boost: Instantly access historical cash data, payment trends, or budget notes across your financial projects.

How AI Prompts Elevate Every Phase of Cash Flow Management

Quickly Forecast Cash Flow Scenarios

Finance teams explore multiple cash flow projections rapidly, enabling proactive adjustments and reducing uncertainty.

Enhance Financial Decision-Making

Drive informed choices, minimize liquidity risks, and align spending with business priorities effectively.

Identify Cash Shortfalls Early

Detect potential funding gaps ahead of time, avoid emergency borrowing, and maintain steady operations.

Align Departments Around Cash Goals

Facilitates transparent communication, harmonizes budgeting efforts, and accelerates consensus among finance, sales, and operations.

Unlock Innovative Cash Strategies

Encourages creative financing solutions, optimizes working capital, and supports sustainable growth.

Integrated AI Support Within ClickUp

Transforms AI insights into actionable tasks, keeping your cash flow management on track every day.