Top AI Prompts for Smarter Investing

Revolutionizing Investment Strategies with AI Prompts

Crafting successful investment portfolios goes beyond numbers—it demands insight and precision.

From market analysis to risk assessment, asset allocation, and compliance monitoring, investment management encompasses numerous complex elements—and a wealth of data, reports, and deadlines. This is where AI prompts prove invaluable.

Investment teams leverage AI to:

- Quickly identify market trends and relevant financial indicators

- Generate detailed investment proposals and portfolio summaries with ease

- Interpret regulatory updates and compliance documents swiftly

- Transform scattered research notes into clear action plans and task lists

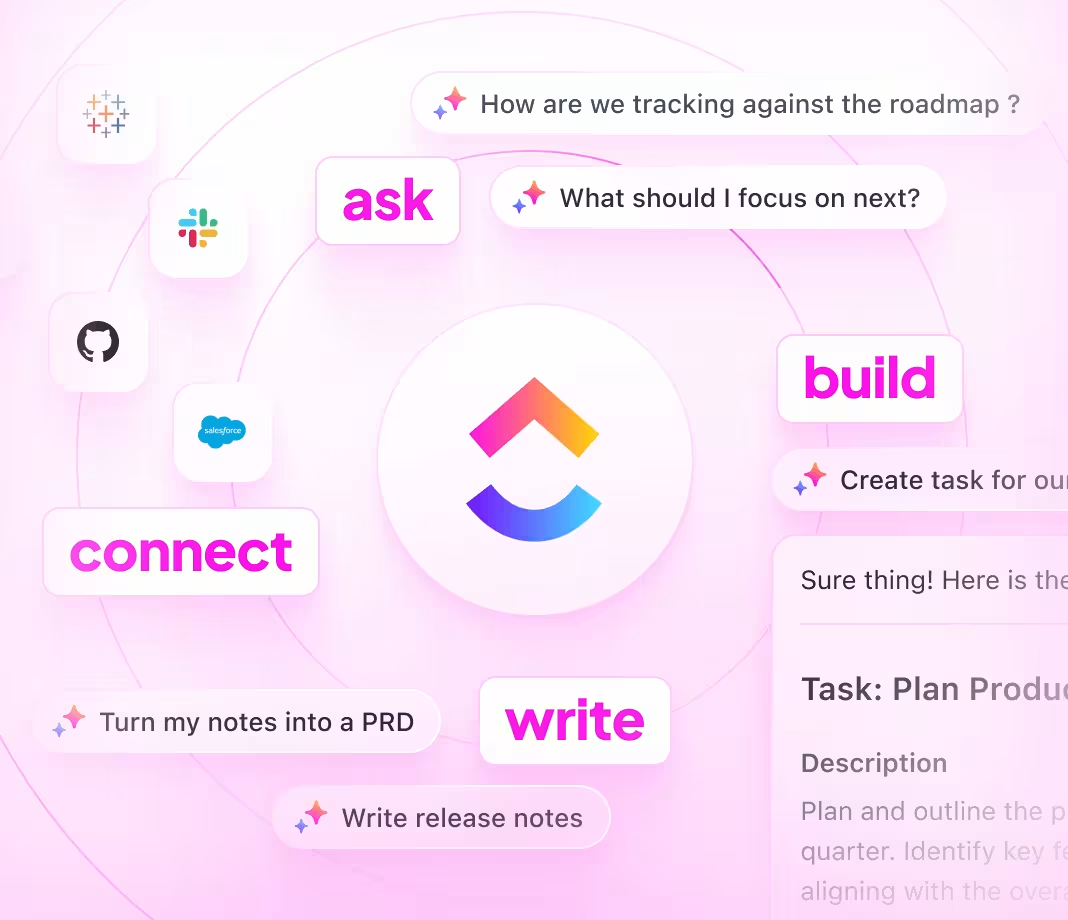

Integrated into daily platforms—such as documents, dashboards, and project trackers—AI evolves from a mere helper to a strategic partner. In tools like ClickUp Brain, it seamlessly converts your insights into structured, executable investment plans.

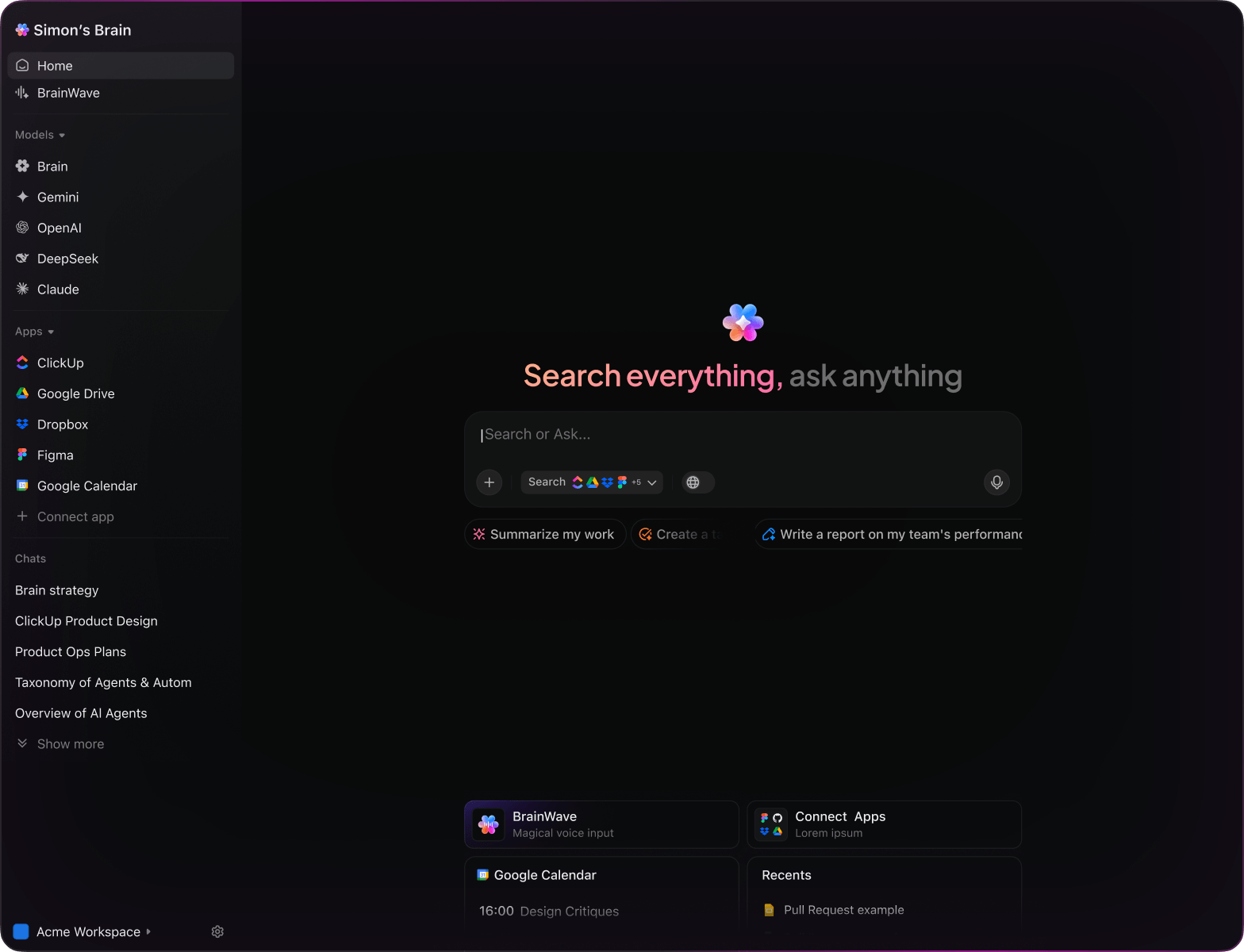

Why ClickUp Brain Stands Out

Standard AI Platforms

- Constantly toggling between apps to collect info

- Repeating investment objectives with every query

- Receiving generic, irrelevant advice

- Hunting through multiple platforms for one report

- Interacting with AI that only processes input

- Manually switching among different AI engines

- Merely another add-on in your browser

ClickUp Brain

- Deeply connected to your investment tasks, notes, and team insights

- Tracks your portfolio history and strategy goals

- Provides tailored, actionable investment guidance

- Searches across all your financial tools instantly

- Supports hands-free input with Talk to Text

- Automatically selects the optimal AI model: GPT, Claude, Gemini

- Dedicated native app for Mac & Windows—optimized for performance

15 Powerful AI Prompts for Smarter Investing

Identify 5 promising growth sectors for technology stocks based on the ‘Market Trends Q1 2024’ report.

ClickUp Brain Behavior: Analyzes linked market research documents to highlight emerging sectors with high potential.

What portfolio diversification approaches are popular among millennial investors in the US?

ClickUp Brain Behavior: Gathers insights from internal surveys and financial reports; Brain Max can supplement with relevant public data if accessible.

Create a detailed investment thesis focused on sustainable energy funds, referencing ‘Sustainability Report 2023’ and prior analyst notes.

ClickUp Brain Behavior: Extracts key points and compiles a structured thesis document from linked files.

Summarize risk and return benchmarks between popular index funds and ETFs using our ‘Q2 Investment Analysis’ document.

ClickUp Brain Behavior: Pulls quantitative and qualitative data from internal reports to present a clear comparison.

Identify leading dividend stocks with consistent yields, referencing recent earnings reports and market analysis notes.

ClickUp Brain Behavior: Scans financial documents to list stocks with strong dividend performance and stability indicators.

From the ‘IPO Evaluation Criteria’ document, produce a comprehensive checklist for assessing new public offerings.

ClickUp Brain Behavior: Extracts evaluation factors and formats them into an actionable checklist within a task or document.

Highlight three key fintech innovations influencing investment platforms based on post-2023 research and technology reviews.

ClickUp Brain Behavior: Identifies recurring themes and innovations from linked research and analysis files.

From the ‘Gen Z Investor Survey 2024’, summarize main preferences for mobile trading app features.

ClickUp Brain Behavior: Reviews survey data to extract common design and functionality preferences among young investors.

Write concise and motivating UX copy for a retirement savings tracker, guided by the tone outlined in ‘BrandVoice.pdf’.

ClickUp Brain Behavior: Uses tone guidelines to generate friendly and clear interface text variations.

Summarize recent regulatory updates impacting crypto assets and how they influence portfolio strategies.

ClickUp Brain Behavior: Reviews compliance documents and public updates to provide a clear overview of new rules.

Create detailed criteria for evaluating Environmental, Social, and Governance (ESG) scores, referencing internal research and industry standards.

ClickUp Brain Behavior: Extracts scoring methodologies and compiles them into a practical guideline checklist.

Using ‘Emerging Markets Risk Report’ and portfolio data, generate a checklist to evaluate investment risks.

ClickUp Brain Behavior: Identifies key risk factors and organizes them into a structured task list by category.

Analyze and summarize sustainability efforts among top mutual funds using competitive analysis documents.

ClickUp Brain Behavior: Condenses comparisons into an easy-to-read format highlighting key differences and strengths.

Synthesize recent advancements in robo-advisor technology and algorithm updates from internal research and reports.

ClickUp Brain Behavior: Extracts trend data and summarizes key innovations influencing automated investing.

Summarize main user experience challenges reported in Asia-Pacific investment apps, focusing on navigation, features, and support.

ClickUp Brain Behavior: Prioritizes feedback themes from surveys, support tickets, and user reviews to inform improvements.

AI Prompts for Investing with ClickUp Brain

Prompts for ChatGPT

Prompts for Gemini

Prompts for Perplexity

Prompts for ClickUp Brain

Transform Initial Thoughts Into Solid Plans

- Quickly convert scattered notes into polished investment strategies.

- Generate innovative ideas by analyzing previous portfolio data.

- Build customizable templates that accelerate your financial projects.

Brain Max Boost: Effortlessly explore historical investment reports, market feedback, and research documents to fuel your upcoming plans.

Accelerate Investment Strategy Execution

- Break down intricate market analyses into straightforward tasks.

- Transform investment insights into actionable assignments.

- Automatically create performance summaries and portfolio updates without extra effort.

Brain Max Boost: Instantly access historical trade data, asset comparisons, or market trend analyses across your portfolios.

How AI Prompts Elevate Every Phase of Investment Planning

Create Winning Investment Ideas Fast

Investors explore diverse opportunities quickly, make informed choices, and avoid analysis paralysis.