Top AI Prompts Tailored for Banking Teams

AI Prompts Revolutionizing Banking Workflows

Banking today extends far beyond transactions—it’s about managing complex processes efficiently.

From customer onboarding to risk assessment, compliance monitoring, and loan processing, banking teams juggle numerous tasks, documents, and deadlines. AI prompts are now pivotal in simplifying these workflows.

Banking professionals leverage AI to:

- Quickly identify market trends and regulatory updates

- Generate detailed reports, credit analyses, and customer communications with ease

- Interpret dense compliance guidelines and financial policies

- Transform unstructured data into clear action plans, checklists, or task assignments

Integrated within familiar tools such as documents, dashboards, and project trackers, AI in ClickUp Brain acts as a proactive partner—turning complex banking inputs into streamlined, manageable tasks.

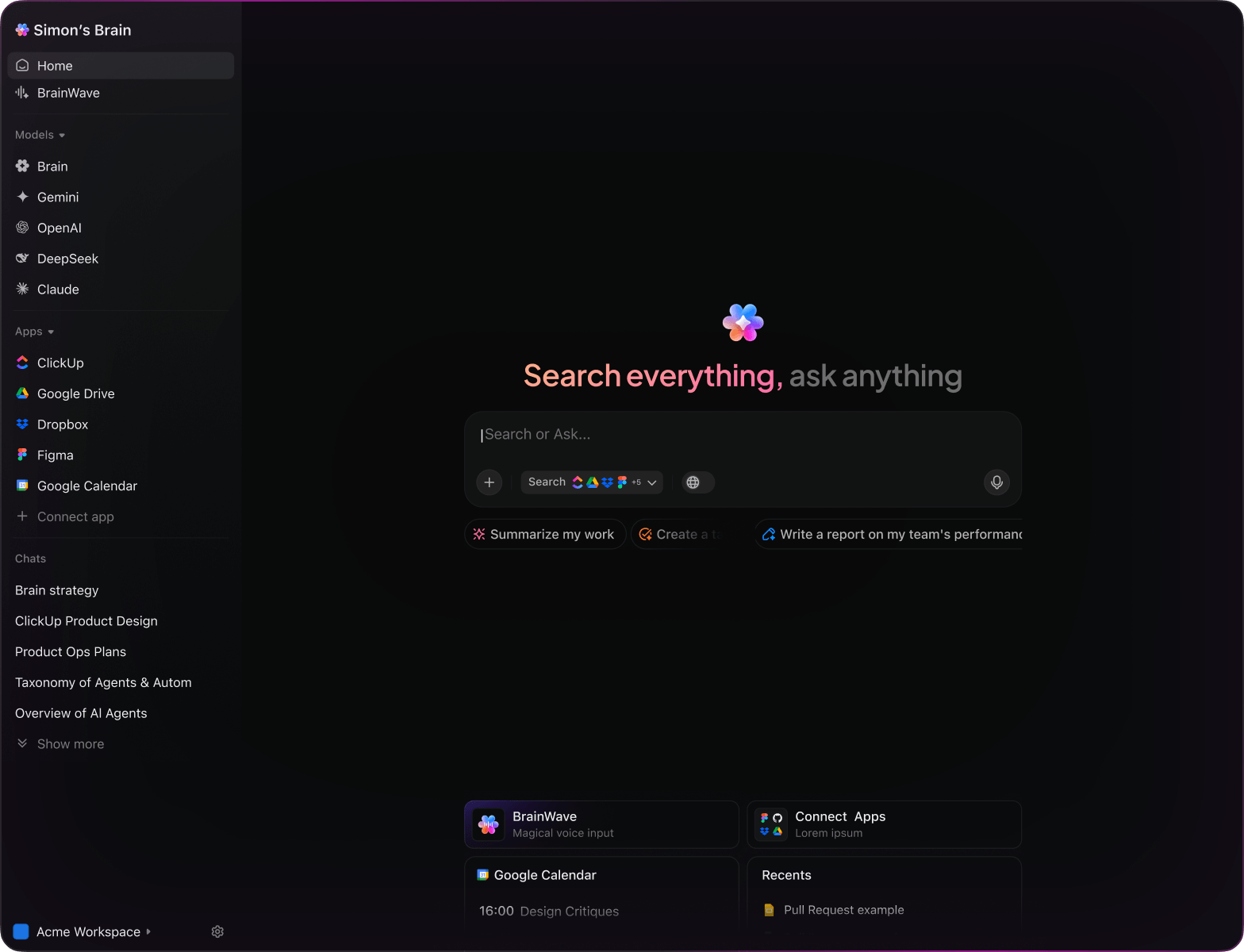

Why ClickUp Brain Stands Out in Banking

Conventional AI Platforms

- Constantly toggling between apps to collect data

- Repeating your banking objectives with each query

- Receiving generic, irrelevant suggestions

- Hunting through multiple systems for a single document

- Interacting with AI that lacks proactive insights

- Manually switching between different AI engines

- Merely another add-on without integration

ClickUp Brain

- Deeply integrated with your banking tasks, files, and communications

- Tracks your project history and strategic aims

- Delivers precise, context-aware guidance

- Searches seamlessly across all your banking tools

- Enables hands-free input with voice commands

- Automatically selects the optimal AI engine: GPT, Claude, Gemini

- Native desktop apps for Mac & Windows optimized for performance

15 Essential AI Prompts for Banking Teams Using ClickUp Brain

List 5 innovative digital banking features tailored for retail customers, based on the ‘Q1 2024 Innovation Report’.

ClickUp Brain Behavior: Analyzes linked documents to extract emerging feature ideas and customer preferences.

What are the leading security protocols implemented in fintech applications under $50M valuation in North America?

ClickUp Brain Behavior: Gathers insights from internal security assessments; Brain Max can supplement with public regulatory updates if available.

Create a comprehensive compliance checklist for Anti-Money Laundering (AML) updates, referencing the ‘AML 2024 Guidelines’ and prior audit reports.

ClickUp Brain Behavior: Extracts key regulatory points and audit notes to produce a structured compliance task list.

Summarize differences in loan approval criteria between Bank A and Bank B using the ‘Loan Policies 2024’ document.

ClickUp Brain Behavior: Reviews policy documents and presents a clear side-by-side comparison.

Identify top customer engagement channels favored by retail banking clients, referencing CRM data and recent marketing studies.

ClickUp Brain Behavior: Scans internal reports to highlight effective communication platforms and strategies.

From the ‘Credit Risk Assessment’ document, produce a detailed template for evaluating credit portfolios.

ClickUp Brain Behavior: Extracts risk factors and assessment criteria to build a structured evaluation form.

Outline 3 key mobile banking user experience trends identified in post-2023 customer feedback and design reviews.

ClickUp Brain Behavior: Detects recurring themes and design innovations from linked user research.

From the ‘Gen Z Banking Survey 2024’, summarize main preferences for app features and usability.

ClickUp Brain Behavior: Analyzes survey data to extract common desires and pain points among younger users.

Write friendly and clear onboarding messages for new users, guided by the tone outlined in ‘BrandVoice.pdf’.

ClickUp Brain Behavior: References tone guidelines to create engaging and approachable interface text.

Summarize critical updates in financial compliance regulations for 2025 and their potential impact on product offerings.

ClickUp Brain Behavior: Reviews internal compliance briefs; Brain Max can incorporate public regulatory announcements if linked.

Develop placement and content guidelines for transaction alert notifications, referencing regional compliance documents.

ClickUp Brain Behavior: Extracts regulatory requirements and best practices to form a notification standards checklist.

Build a fraud detection checklist using insights from the ‘2024 Fraud Audit’ and transaction monitoring data.

ClickUp Brain Behavior: Identifies key indicators and organizes them into actionable monitoring tasks.

Summarize sustainability efforts such as green financing and carbon footprint reduction across top banks using internal analysis docs.

ClickUp Brain Behavior: Condenses comparative data into an easy-to-digest summary or table.

Highlight recent trends in AI-powered customer service tools and chatbot implementations in banking since 2023.

ClickUp Brain Behavior: Synthesizes findings from research notes, pilot studies, and market reports.

Extract key usability issues and feature requests from Southeast Asia mobile banking feedback folders.

ClickUp Brain Behavior: Prioritizes user-reported challenges and suggestions from surveys, support tickets, and focus groups.

AI Prompts for Banking with ClickUp Brain

ChatGPT Banking Prompts

Gemini Banking Prompts

Perplexity Banking Prompts

ClickUp Brain Banking Prompts

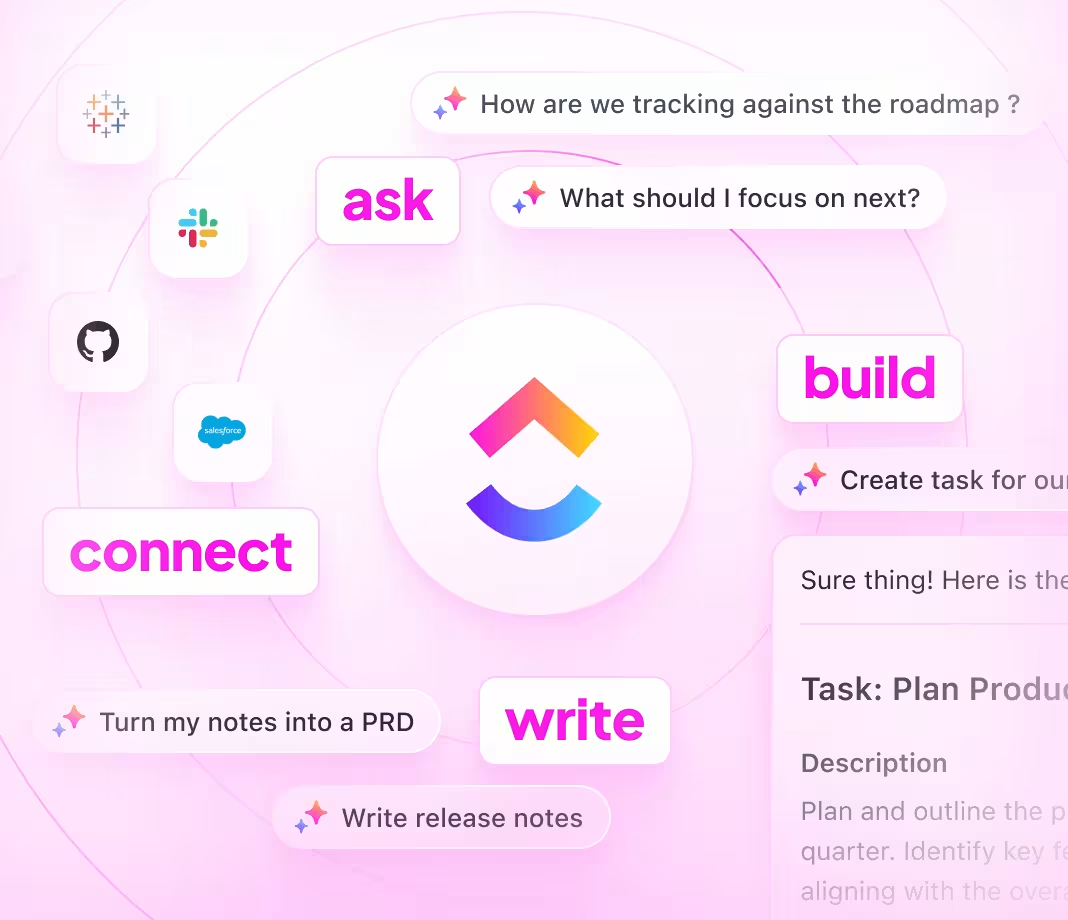

Transform Initial Thoughts into Polished Plans

- Convert scattered notes into detailed project outlines swiftly.

- Generate innovative ideas by leveraging historical project data.

- Develop standardized templates to accelerate each banking initiative.

Brain Max Boost: Quickly access previous workflows, client feedback, and documentation to fuel your upcoming banking strategies.

Accelerate Banking Project Transitions

- Break down intricate banking strategies into straightforward tasks.

- Transform meeting insights into actionable assignments.

- Automatically create comprehensive handover documents without extra effort.

Brain Max Boost: Quickly access historical transaction data, policy details, or compliance records across teams.

How AI Prompts Elevate Every Phase of Banking Innovation

Instantly Craft Innovative Banking Solutions

Bankers explore fresh strategies quickly, make informed choices, and prevent decision bottlenecks.

Enhance Risk Management and Compliance

Improve regulatory adherence, reduce operational risks, and develop services customers trust.

Identify Issues Before They Escalate

Minimizes expensive compliance failures, boosts service quality, and accelerates product launches.

Align Teams Across Departments Effortlessly

Strengthens communication, removes misunderstandings, and speeds approvals between finance, legal, and IT.

Drive Breakthrough Financial Innovations

Ignite creative banking products, pioneer next-level services, and maintain competitive advantage.

Deeply Integrate AI Within ClickUp Workflows

Transforms AI insights into actionable tasks that move banking projects forward efficiently.