Task Management for Private Equity Firms

Task Management Software Tailored for Private Equity Success

Unify deal tracking, portfolio oversight, and team collaboration in one platform designed to keep your private equity operations transparent and on target.

Trusted by the world’s leading businesses

The Case for Smarter Management

Why Private Equity Firms Demand Precision in Task Management

Without a dedicated system, managing deals and portfolio operations becomes fragmented and error-prone — slowing decision-making and risking losses.

- Complex deal timelines become blurred — making it difficult to track progress from sourcing to exit.

- Data silos hinder due diligence — critical information scattered across emails, spreadsheets, and drives.

- Investor reporting lacks clarity — inconsistent updates and missed deadlines damage credibility.

- Team collaboration is disjointed — unclear responsibilities and version confusion stall deal momentum.

- Compliance risks increase — missed regulatory deadlines and audit trails leave firms exposed.

- Portfolio monitoring lacks transparency — performance metrics and action items get lost in the noise.

- Resource allocation becomes inefficient — overlapping tasks and bottlenecks are hard to spot.

- Communication breakdowns slow progress — scattered notes and informal chats cause misalignment.

Traditional vs ClickUp

Where Conventional Tools Fall Short for Private Equity

Discover how ClickUp delivers clarity and control beyond spreadsheets and emails.

Conventional Tools

- Tasks scattered across emails, spreadsheets, and meetings

- Deal documents and notes stored in isolated folders

- Manual tracking increases risk of errors

- Responsibility and updates often unclear

- Deadlines for filings and reporting easily missed

- Investor communication fragmented and reactive

ClickUp Task Management

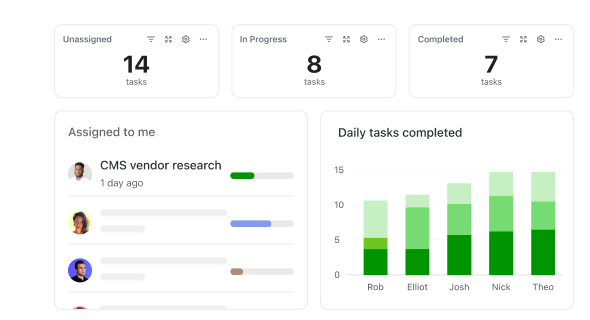

- Centralized task lists with real-time progress tracking

- Unified document storage linked to deals and portfolios

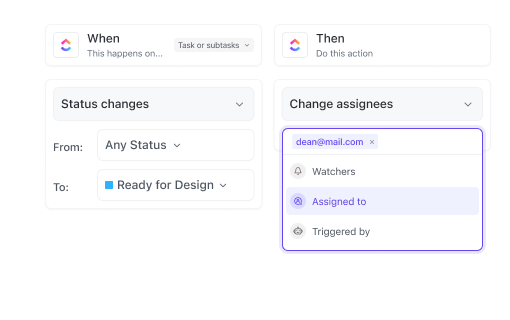

- Automated workflows reduce manual errors

- Clear task ownership and instant notifications

- Integrated calendars and reminders for critical deadlines

- Collaborative dashboards for investor reporting and team updates

Use Cases

Unlocking Efficiency: How Task Management Software Supports Private Equity Firms

Explore practical applications that reduce complexity and accelerate deal cycles.

Consolidating Deal Data Across Teams and Systems

ClickUp centralizes all deal-related documents, financial models, and notes, making critical information instantly accessible to all stakeholders.

Maintaining Audit Trails for Compliance and Reporting

Every task, comment, and update is logged with timestamps, ensuring transparent histories for regulatory reviews and investor audits.

Streamlining Due Diligence Processes with Checklists

Standardized templates guide teams through due diligence steps, reducing oversights and accelerating evaluations.

Coordinating Cross-Functional Teams Seamlessly

Assign tasks and set dependencies between investment, legal, and operations teams to keep deal progress synchronized.

Tracking Investor Communications and Deliverables

Manage schedules for reports, calls, and updates with automated reminders to maintain strong investor relationships.

Monitoring Portfolio Company Performance Metrics

Centralize KPIs and action items from portfolio companies to proactively identify risks and opportunities.

Avoiding Missed Regulatory Deadlines

Automated workflows and alerts ensure all filings and compliance tasks are completed on time.

Reducing Redundancies in Deal Documentation

ClickUp’s version control and document linking prevent duplication and confusion across teams.

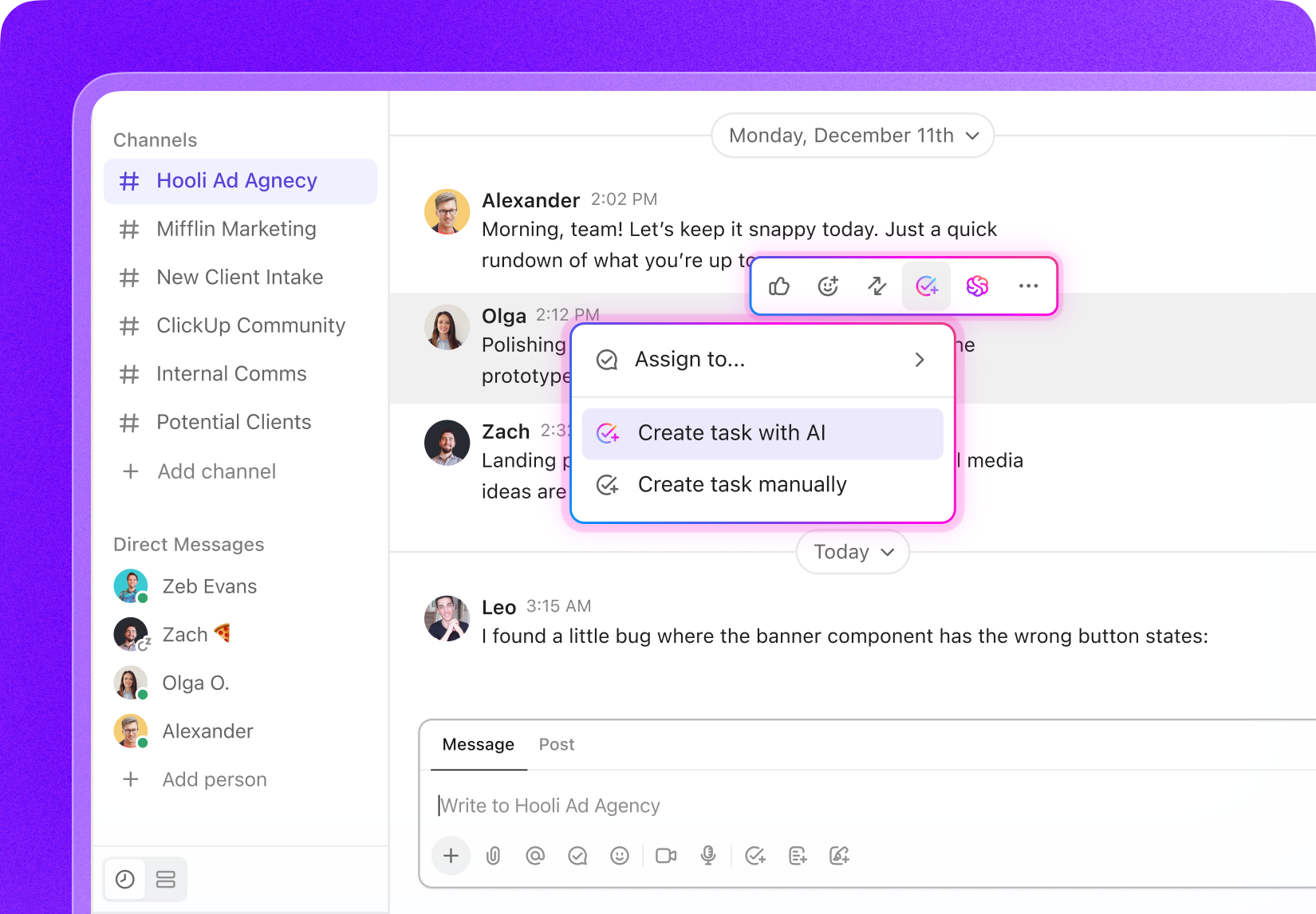

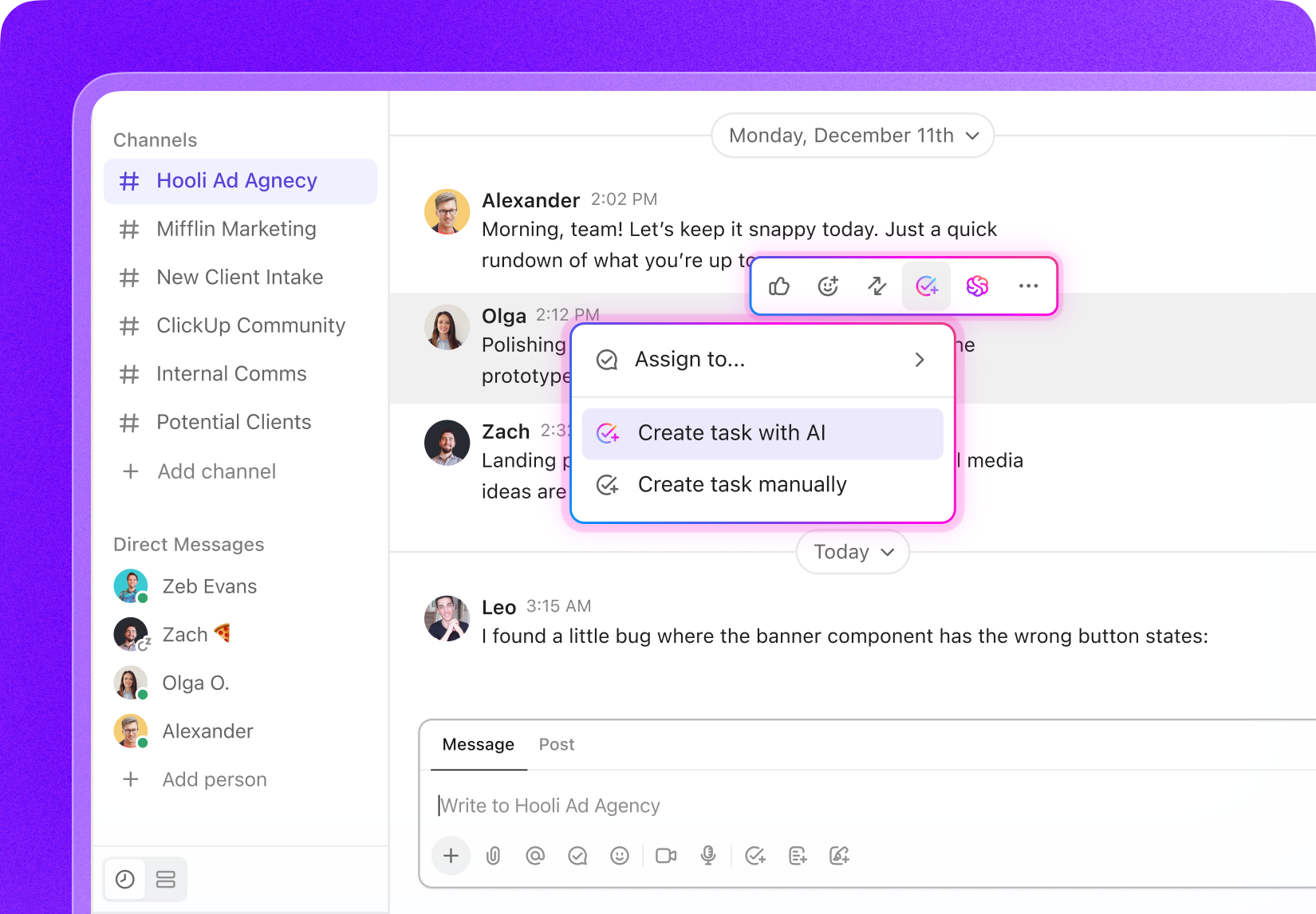

Transforming Meeting Notes into Actionable Tasks

Convert discussions from investment committee meetings into clear, assigned tasks with deadlines.

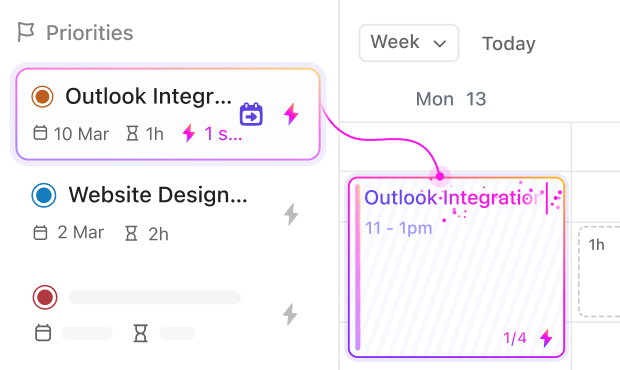

Elevate Every Phase of Your Deal Lifecycle

From sourcing to exit, maintain control and visibility over every task and milestone.

Key Beneficiaries

Who Benefits Most from ClickUp in Private Equity Firms

Designed for teams that value precision, transparency, and speed in deal execution.

Investment Professionals

Keep deal pipelines organized, due diligence thorough, and approvals flowing without bottlenecks.

Portfolio Operations Teams

Track performance initiatives, coordinate cross-company projects, and streamline reporting to stakeholders.

Compliance and Legal Teams

Manage regulatory filings, document control, and audit trails with clear workflows and reminders.

How ClickUp Empowers Private Equity Firms

Optimize Task Management Across Your Firm

Replace fragmented tools with one platform that supports every deal and portfolio activity.

Centralize Everything

Store literature, datasets, protocols, drafts, and grant docs in one workspace — no more scattered files.

Plan Research in Phases

Break projects into proposal, literature review, experiments, analysis, and writing with task lists and Gantt timelines.

Standardize Experiments & Fieldwork

Use templates and checklists for repeatable, error-free lab or field procedures.

Collaborate Across Teams

Assign tasks to co-authors, lab members, or collaborators. Shared boards and dashboards keep everyone aligned.

Turn Meetings Into Actionable Tasks

Convert supervisor or lab meetings into tasks with owners, checklists, and deadlines.

Stay on Top of Deadlines & Funding

Track grants, conferences, and submissions with automated reminders and calendars.

Ready to Organize Your Entire Deal Workflow?

Reduce errors, enhance collaboration, and focus on value creation.