Top AI Prompts for Trading Success

AI Prompts Revolutionizing Trading Team Workflows

Navigating the fast-paced world of trading demands more than sharp instincts—it requires seamless coordination behind the scenes.

From market analysis and strategy development to risk assessment and compliance monitoring, trading teams juggle countless variables alongside numerous reports, alerts, and deadlines. This is where AI prompts make a significant impact.

Trading teams leverage AI to:

- Quickly identify market patterns and relevant financial news

- Generate trade plans, risk models, and portfolio summaries with minimal effort

- Interpret complex regulatory updates and compliance documents

- Transform meeting notes into clear action items, checklists, or task assignments

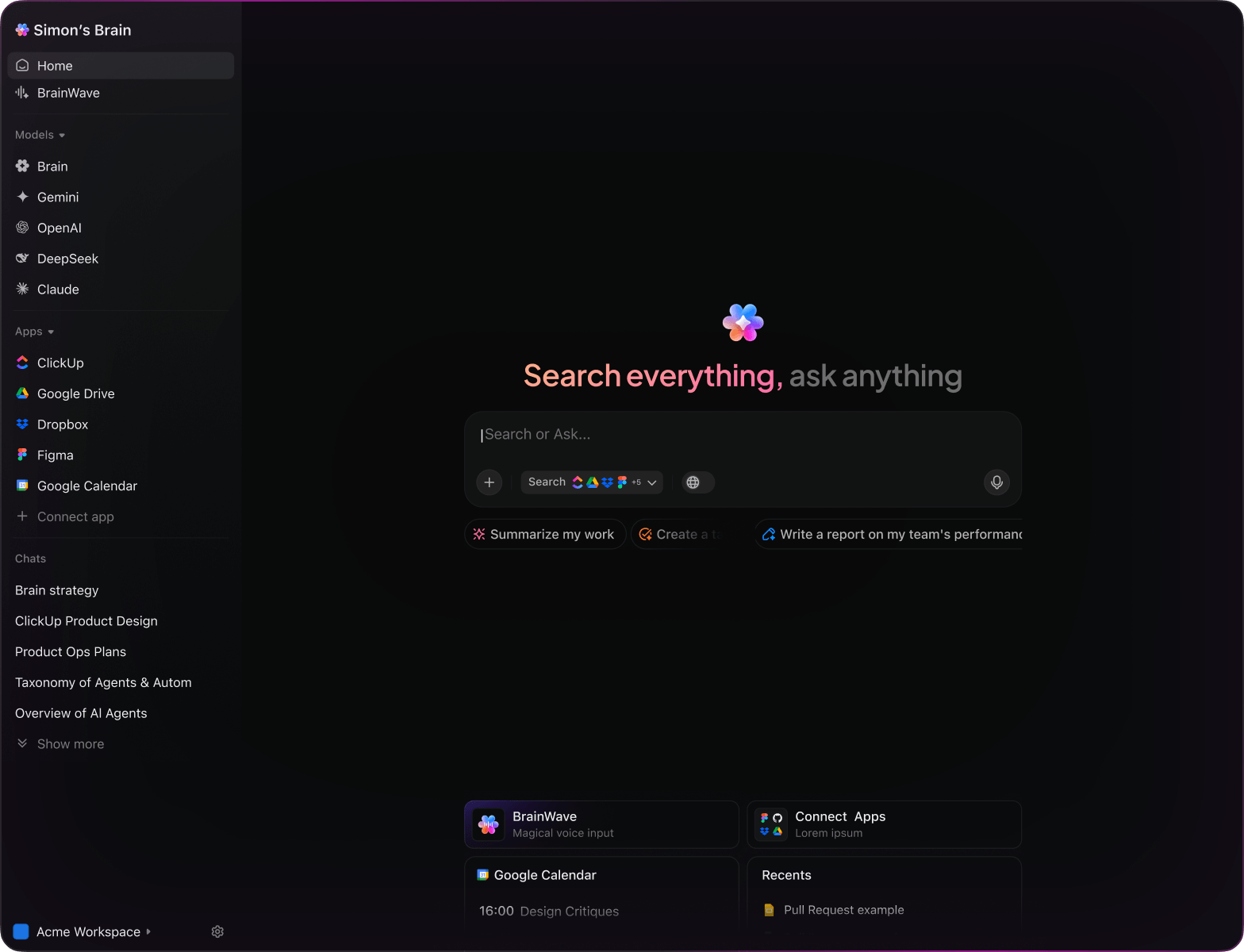

Integrated within daily tools—such as documents, dashboards, and task trackers—AI evolves beyond a simple helper. In solutions like ClickUp Brain, it operates seamlessly to convert strategic insights into structured, executable workflows.

Discover Why ClickUp Brain Stands Out

Conventional AI Solutions

- Constantly toggling between platforms to collect information

- Repeating your trading objectives with every query

- Receiving generic, irrelevant suggestions

- Hunting through multiple apps to locate a single document

- Interacting with AI that only processes input without action

- Manually switching between different AI models

- Merely another add-on in your browser

ClickUp Brain

- Instantly understands your trading tasks, notes, and team communications

- Keeps track of your past activities and trading strategies

- Provides detailed, context-aware guidance

- Searches all your trading resources in one place

- Allows voice commands with Talk to Text

- Automatically selects the ideal AI model: GPT, Claude, Gemini

- Dedicated Mac & Windows app designed for efficiency

15 Essential AI Prompts for Trading Teams

List 5 innovative trading approaches for emerging markets, based on the ‘Q2 Market Trends’ report.

ClickUp Brain Behavior: Analyzes linked documents to extract strategy themes and market insights for actionable ideas.

What are the leading technical indicators used in short-term forex trading in Asia?

ClickUp Brain Behavior: Gathers and summarizes data from internal analysis and can integrate public sources with Brain Max.

Create a comprehensive risk management outline for cryptocurrency portfolios referencing ‘Crypto Risk Guidelines’ and past trade logs.

ClickUp Brain Behavior: Pulls key points and historical data from documents to build a structured risk plan.

Summarize performance differences between Algorithm A and Algorithm B using the ‘Algo Performance Q1’ dataset.

ClickUp Brain Behavior: Extracts quantitative and qualitative data to produce a clear comparative summary.

Identify main drivers of price changes in commodities markets, referencing recent research and analyst notes.

ClickUp Brain Behavior: Scans documents to highlight recurring factors and their impact on volatility.

From the ‘Trade Compliance Manual’, create a detailed checklist ensuring adherence to regulatory standards.

ClickUp Brain Behavior: Converts compliance criteria into an actionable task list or document checklist.

Highlight 3 recent developments in algorithmic trading from post-2023 research and industry reports.

ClickUp Brain Behavior: Identifies patterns and innovations from linked documents and summarizes key trends.

From the ‘Trader UX Survey 2024’, summarize preferred features and usability feedback for trading dashboards.

ClickUp Brain Behavior: Analyzes survey data to extract common themes and user experience insights.

Write concise, clear alerts for risk notifications using tone guidelines from ‘CommunicationStyle.pdf’.

ClickUp Brain Behavior: Uses tone references to generate multiple copy options tailored for trader clarity and urgency.

Outline key updates in derivatives regulations for 2025 and their implications on trading strategies.

ClickUp Brain Behavior: Reviews compliance documents and public updates to provide a focused summary.

Generate placement and sizing standards for trade signal indicators on trading platforms, referencing regional compliance docs.

ClickUp Brain Behavior: Extracts technical specifications and regulatory notes to form a compliance checklist.

From ‘System Resilience Reports’ and platform documentation, build a checklist for stress testing trading systems.

ClickUp Brain Behavior: Identifies test parameters and organizes them into a structured task list by test category.

Analyze sustainability initiatives like green investments across top trading firms using competitive intelligence reports.

ClickUp Brain Behavior: Summarizes comparative data into a clear, digestible format such as tables or briefs.

What UI/UX trends have emerged in mobile trading applications since 2023?

ClickUp Brain Behavior: Synthesizes insights from research notes, app reviews, and design documents.

Summarize major usability challenges reported by traders in the Asia-Pacific region, focusing on platform features and workflows.

ClickUp Brain Behavior: Extracts and ranks user feedback from surveys, support tickets, and feedback forms.

AI Prompts for Trading with ClickUp Brain

ChatGPT Trading Prompts

Gemini Trading Prompts

Perplexity Trading Prompts

ClickUp Brain Trading Prompts

Transform Trading Ideas Into Clear Strategies

- Convert scattered trading notes into detailed strategy plans quickly.

- Generate innovative trade setups by analyzing historical market data.

- Build customizable templates to accelerate your trading workflows.

Brain Max Boost: Effortlessly explore previous trade analyses, market feedback, and performance charts to guide your next move.

Accelerate Your Trading Workflow

- Break down market analysis into precise, executable strategies.

- Transform trading insights into actionable orders seamlessly.

- Generate performance summaries and trade logs automatically—no extra effort.

Brain Max Boost: Instantly access historical trade data, asset comparisons, or market indicators across portfolios.

How AI Prompts Elevate Every Phase of Trading Strategy

Instantly Craft Profitable Trade Ideas

Traders explore diverse strategies quickly, make informed choices, and avoid analysis paralysis.

Enhance Decision-Making Accuracy

Reduce risks, optimize trade setups, and align strategies with market trends and compliance.

Spot Errors Before They Impact Results

Minimizes costly mistakes, improves trade execution quality, and shortens reaction time.

Align Teams Around Clear Trading Goals

Improves communication, prevents misunderstandings, and accelerates consensus among analysts and traders.

Drive Innovation in Trading Approaches

Ignites creative strategies, fosters next-level tactics, and keeps you competitive.

Integrated AI Support Within ClickUp

Transforms AI insights into actionable tasks that advance your trading projects efficiently.