AI Tax Audit Preparation

Top AI Prompts for Tax Audit Readiness

Simplify audit tasks, organize critical documents, and boost your team's confidence with ClickUp AI tailored for tax audits.

Trusted by the world’s leading businesses

AI in Tax Audit Readiness

AI Prompts Revolutionizing Tax Audit Preparation

Preparing for a tax audit involves more than just gathering receipts—it demands meticulous organization and precise documentation.

From compiling financial records to cross-checking compliance and coordinating with auditors, tax audit preparation requires managing numerous details and deadlines. AI prompts are now playing a crucial role in simplifying this process.

Tax teams leverage AI to:

- Quickly identify relevant tax codes and audit triggers

- Generate detailed audit response drafts with minimal effort

- Extract key points from complex tax legislation and reports

- Transform scattered notes into clear action plans, checklists, or follow-up tasks

Integrated within familiar tools like documents, boards, and task trackers, AI in platforms such as ClickUp Brain acts as a proactive partner—turning raw data into structured, manageable workflows.

ClickUp Brain vs Conventional Solutions

Why ClickUp Brain Stands Out

Integrated and context-smart, ClickUp Brain lets you focus on action, not explanation.

Conventional AI Platforms

- Constantly toggling between apps to collect info

- Repeating your objectives with every query

- Receiving generic, irrelevant feedback

- Hunting through multiple platforms for a single document

- Interacting with AI that only processes commands

- Manually switching between different AI engines

- Merely a browser add-on without deep integration

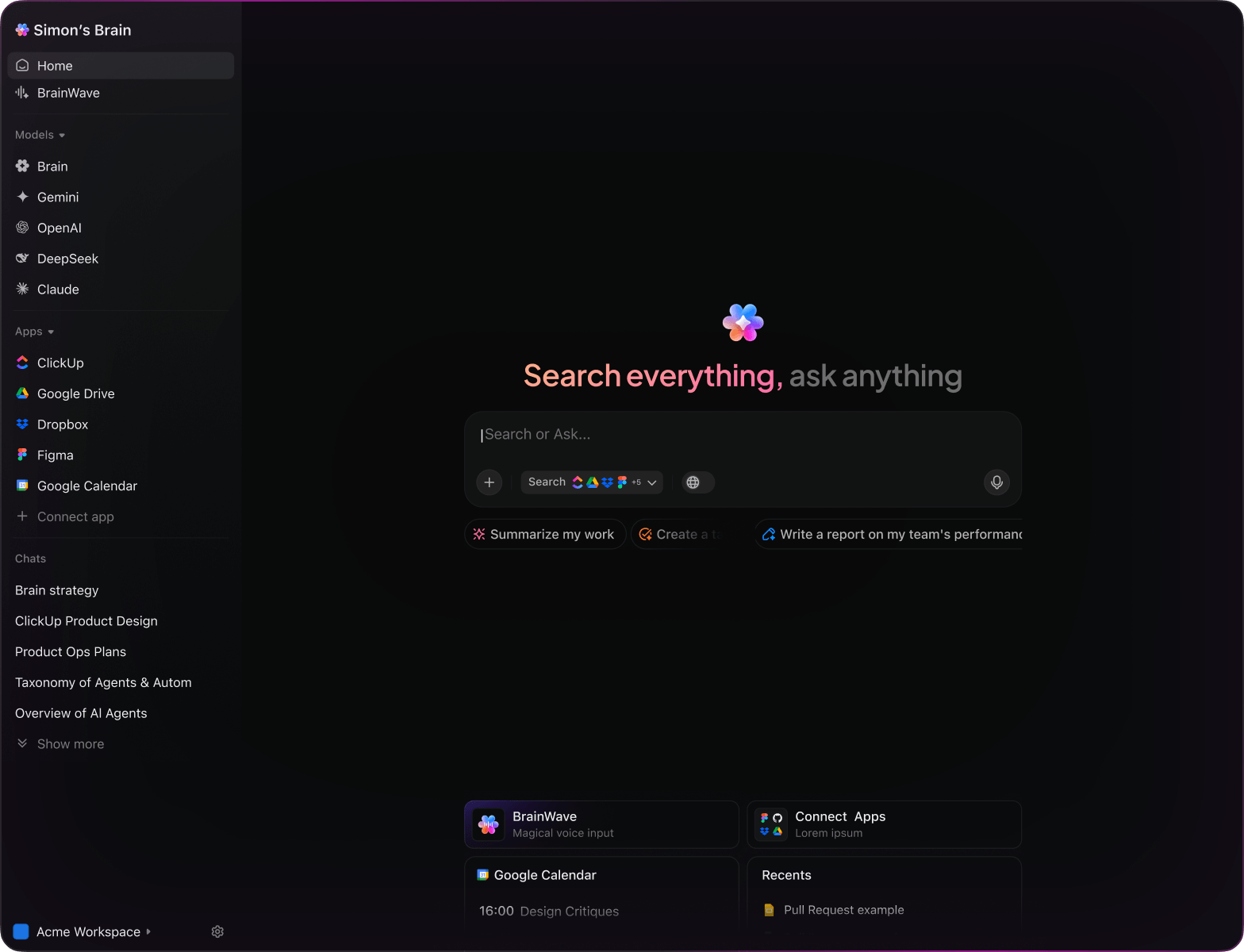

ClickUp Brain

- Instantly understands your projects, documents, and team progress

- Keeps track of your past work and targets

- Provides detailed, practical guidance

- Searches seamlessly across all your resources

- Supports voice commands through Talk to Text

- Automatically selects the optimal AI model: GPT, Claude, Gemini

- Dedicated Mac & Windows app designed for efficiency

Tax Audit Preparation Prompts

15 Essential AI Prompts for Tax Audit Readiness

Simplify your audit prep—organize documents, identify risks, and ensure compliance effortlessly.

Identify 5 key risk areas in the ‘2023 Corporate Tax Filing’ document that require audit focus.

ClickUp Brain Behavior: Analyzes the linked file to highlight sections with potential audit concerns and risk indicators.

What recent changes in tax regulations affect small business deductions under $50K?

ClickUp Brain Behavior: Reviews internal tax updates and can incorporate public regulatory data with Brain Max for comprehensive insights.

Draft a checklist for document submission based on IRS guidelines and our ‘Audit Prep Procedures’ notes.

ClickUp Brain Behavior: Extracts relevant compliance steps and formats a clear, actionable checklist for audit readiness.

Summarize discrepancies found between reported expenses and bank statements in the ‘Q4 Financial Review’ doc.

ClickUp Brain Behavior: Pulls data from financial records and highlights inconsistencies for audit follow-up.

List common documentation requirements for R&D tax credits, referencing our tax code summaries and client files.

ClickUp Brain Behavior: Scans internal resources to compile a detailed list of necessary supporting documents.

From the ‘Payroll Tax Compliance’ doc, generate a task list for verifying employee tax withholdings.

ClickUp Brain Behavior: Identifies verification steps and organizes them into a structured workflow within ClickUp.

Summarize 3 emerging audit trends in digital asset reporting from recent IRS guidance and industry reports.

ClickUp Brain Behavior: Extracts key points and patterns from linked documents to inform audit strategy adjustments.

From the ‘Client Feedback Q1’ doc, summarize common concerns about audit preparedness and documentation.

ClickUp Brain Behavior: Reviews survey data and feedback to identify recurring themes and areas needing attention.

Write clear, reassuring client communication templates for audit notification letters using our tone guidelines in ‘ComplianceTone.pdf’.

ClickUp Brain Behavior: Adapts tone and style from the guide to create professional yet approachable messaging drafts.

Summarize key updates in the 2024 IRS audit procedures and their implications for our tax teams.

ClickUp Brain Behavior: Condenses regulatory documents to highlight procedural changes and recommended responses.

Generate a timeline and task list for audit document collection, referencing client-specific deadlines and compliance rules.

ClickUp Brain Behavior: Extracts scheduling requirements and organizes them into a clear, actionable plan.

Create a compliance checklist for state-level tax audits using the ‘State Audit Guidelines’ folder and recent case studies.

ClickUp Brain Behavior: Compiles relevant criteria into a structured checklist tailored to jurisdictional requirements.

Compare audit risk factors across industries like manufacturing, retail, and tech using our internal risk assessment reports.

ClickUp Brain Behavior: Summarizes and contrasts risk profiles to guide audit prioritization and resource allocation.

What documentation best practices have emerged for remote workforce tax audits since 2022?

ClickUp Brain Behavior: Synthesizes insights from recent studies, internal notes, and regulatory updates.

Summarize common errors found in client tax returns from the ‘Audit Findings’ folder and suggest corrective actions.

ClickUp Brain Behavior: Extracts patterns from audit reports and prioritizes issues for resolution workflows.

Prepare Tax Audits Efficiently with ClickUp Brain

Cut down on redundant tasks, unify your audit team, and produce precise reports using AI-driven processes.

LLMs vs. Workflow Intelligence: How ClickUp Brain Simplifies Tax Audits

Discover How ChatGPT, Gemini, Perplexity, and ClickUp Brain Tackle Tax Audit Preparation Prompts

Prompts for ChatGPT

- Outline a 5-step checklist summarizing key tax documents needed for audit readiness.

- Compose an email template to notify clients about upcoming audit requirements clearly and professionally.

- Generate 3 alternative audit response strategies tailored for small business tax scenarios.

- Draft a detailed workflow for gathering and verifying financial records before an IRS audit.

- Compare recent audit cases and summarize common compliance issues to avoid in future filings.

Prompts for Gemini

- Propose 3 different audit risk assessment models based on company size and industry.

- List innovative ways to organize tax records digitally to enhance audit efficiency.

- Create a mood board description for an audit preparation dashboard focusing on clarity and usability.

- Suggest optimal team roles and responsibilities for managing a tax audit and rank by impact.

- Develop a comparison table of audit software tools highlighting features, ease of use, and integration.

Prompts for Perplexity

- Identify 5 common tax audit triggers and rank them by likelihood.

- Provide a comparison of documentation standards across different tax jurisdictions.

- Summarize recent trends in IRS audit procedures and their implications for businesses.

- Generate a list of 5 best practices for maintaining audit-ready financial records and rank by effectiveness.

- Compare outcomes of various audit defense strategies and highlight top lessons learned.

Prompts for ClickUp Brain

- Transform this client correspondence into clear audit preparation tasks with deadlines.

- Summarize tax team meeting notes and assign follow-up actions with responsible members.

- Review annotated financial statements and generate a checklist of items needing compliance verification.

- Create a prioritized task list from this cross-department discussion on audit document collection.

- Summarize interview transcripts from tax consultants and generate actionable audit readiness tasks in ClickUp.

Why Choose ClickUp

Transform Initial Thoughts into Audit-Ready Plans

- Convert scattered audit notes into comprehensive reports swiftly.

- Generate new strategies by analyzing previous audit findings.

- Develop standardized templates to accelerate each audit cycle.

Brain Max Boost: Quickly access past audit records, team comments, and documentation to guide your upcoming review.

Why Choose ClickUp

Accelerate Your Tax Audit Prep Process

- Break down intricate audit requirements into straightforward tasks.

- Transform audit notes into actionable assignments for your team.

- Automatically produce comprehensive audit summaries and checklists without extra effort.

Brain Max Boost: Instantly access historical audit records, document comparisons, or compliance decisions across all cases.

AI Advantages

How AI Prompts Enhance Every Phase of Tax Audit Prep

AI prompts accelerate analysis and empower more accurate, confident audit readiness.

Quickly Develop Comprehensive Audit Plans

Audit teams outline thorough strategies faster, identify key focus areas, and prevent overlooked details.

Improve Compliance and Risk Assessment

Make informed evaluations, reduce exposure to penalties, and prepare documentation regulators expect.

Identify Issues Early to Avoid Penalties

Detect discrepancies sooner, minimize costly corrections, and ensure smoother audit outcomes.

Align Teams with Clear, Shared Objectives

Enhances communication, removes confusion, and accelerates consensus among finance, legal, and compliance.

Drive Continuous Improvement in Audit Processes

Encourages innovative approaches, refines workflows, and keeps your team proactive and prepared.

Integrated AI Support Within ClickUp Workflows

Transforms AI insights into actionable tasks, keeping audit projects moving efficiently forward.

Speed Up Your Tax Audit Prep

Cut down mistakes, simplify collaboration, and generate insightful reports using AI support.