AI Quantitative Investment

Top AI Prompts for Quantitative Investing

Enhance your investment models, automate data analysis, and elevate your trading strategies with ClickUp Brain.

Trusted by the world’s leading businesses

AI in Quantitative Investing

AI Prompts Revolutionizing Quantitative Investment Workflows

Crafting winning investment strategies isn't only about market data—it's about orchestrating complex analytics and execution behind the scenes.

From data gathering and model development to backtesting and portfolio optimization, quantitative investment teams juggle numerous datasets, algorithms, and deadlines. AI prompts are now indispensable in managing this complexity.

Investment teams leverage AI to:

- Quickly identify market patterns and relevant financial indicators

- Generate initial algorithmic trading models with minimal manual coding

- Digest vast regulatory and compliance documents efficiently

- Transform raw research notes into structured reports, task lists, or development sprints

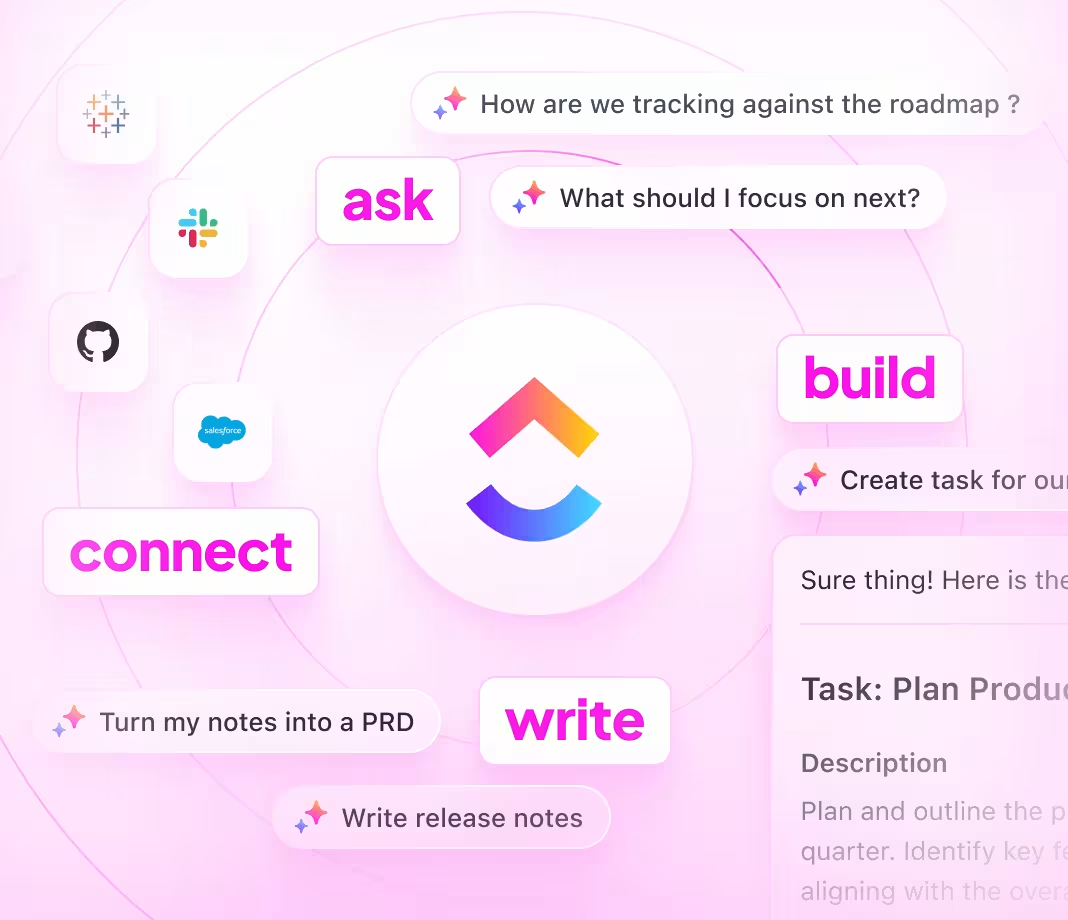

Integrated within familiar tools—such as documents, dashboards, and project trackers—AI in platforms like ClickUp Brain acts as a silent partner, converting analytical insights into clear, executable plans.

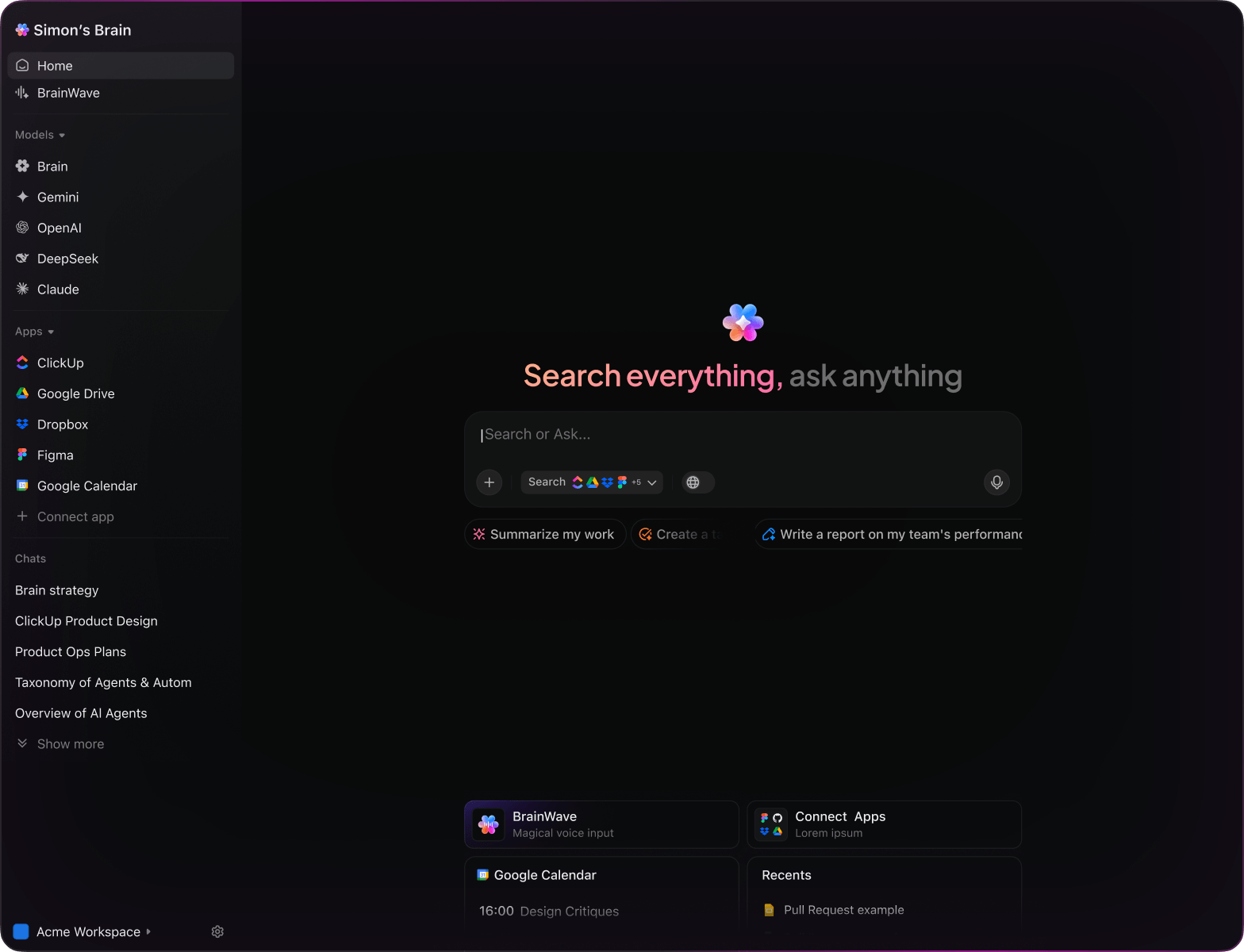

ClickUp Brain Compared to Conventional Solutions

Why ClickUp Brain Stands Apart

ClickUp Brain integrates seamlessly, understands your context deeply, and acts swiftly—letting you focus on investing, not explaining.

Conventional AI Platforms

- Constantly toggling between apps to collect data

- Reiterating your investment objectives with every query

- Receiving generic, irrelevant insights

- Hunting through multiple platforms to locate a single report

- Interacting with AI that only processes input without initiative

- Manually switching between different AI engines

- Merely another add-on without deep integration

ClickUp Brain

- Instantly accesses your portfolios, strategies, and team communications

- Tracks your past analyses and investment goals

- Provides detailed, context-driven recommendations

- Offers a consolidated search across all your investment documents

- Supports hands-free commands with Talk to Text

- Automatically selects the optimal AI model: GPT, Claude, Gemini

- Dedicated desktop app for Mac & Windows optimized for performance

AI Prompts for Quantitative Investment

15 Essential AI Prompts for Quantitative Investment Strategies

Optimize your investment models—data analysis, strategy development, and risk management simplified.

Identify 5 promising factor models for equity portfolios based on the ‘Q1 Market Analysis’ report.

ClickUp Brain Behaviour: Analyzes document content to extract and suggest relevant factor models aligned with current market trends.

What are the latest algorithmic trading patterns gaining traction in US mid-cap stocks?

ClickUp Brain Behavior: Integrates insights from internal research and, if enabled, supplements with external market data for comprehensive analysis.

Draft a strategy outline for a momentum-based trading approach referencing ‘Momentum Strategy Notes’ and recent backtest results.

ClickUp Brain Behavior: Collates key points and performance metrics from linked files to generate a structured strategy summary.

Summarize risk metrics comparison between Value and Growth portfolios using data from the ‘Risk Assessment Q2’ document.

ClickUp Brain Behavior: Extracts quantitative data and narrative insights to present a clear risk profile comparison.

List top quantitative indicators used in high-frequency trading, citing R&D reports and vendor specifications.

ClickUp Brain Behavior: Reviews internal documents to identify frequently referenced indicators and their effectiveness notes.

From the ‘Backtesting Validation’ document, generate a checklist for model robustness testing.

ClickUp Brain Behavior: Detects key validation steps and formats them into an actionable checklist within a task or document.

Summarize 3 emerging machine learning techniques in portfolio optimization from recent research papers.

ClickUp Brain Behavior: Extracts and synthesizes recurring themes and innovative methods from linked academic and internal studies.

From the ‘Investor Sentiment Survey Q1’ document, summarize key behavioral trends affecting trading decisions.

ClickUp Brain Behavior: Analyzes survey data to highlight predominant sentiment patterns and their implications.

Compose clear and engaging client communication templates explaining quantitative strategy benefits, using tone guidelines from ‘CommunicationStyle.pdf’.

ClickUp Brain Behavior: Adapts tone and style references to produce varied, user-friendly message drafts.

Summarize regulatory updates impacting algorithmic trading compliance for 2025 and their implications.

ClickUp Brain Behavior: Reviews internal compliance documents and, if available, public regulatory sources to provide concise summaries.

Generate guidelines for data handling and storage compliance referencing GDPR and SEC regulations in our workspace.

ClickUp Brain Behavior: Extracts key regulatory requirements and formats them into a practical compliance checklist.

Create a checklist for stress testing quantitative models using scenarios from ‘Stress Test Framework’ and recent market events.

ClickUp Brain Behavior: Identifies critical stress factors and organizes them into a structured testing plan.

Compare sustainability metrics integration in investment models across BlackRock, Vanguard, and State Street using competitive analysis docs.

ClickUp Brain Behavior: Summarizes comparative data into an accessible format highlighting key differences and approaches.

What quantitative trends are shaping ESG investing strategies since 2023?

ClickUp Brain Behavior: Synthesizes insights from internal reports, market analyses, and uploaded research papers.

Summarize key portfolio diversification challenges identified in Asia-Pacific market feedback folders.

ClickUp Brain Behavior: Extracts and prioritizes issues reported through surveys, client feedback, and support tickets.

Optimize Investment Strategies with ClickUp Brain

Cut down on redundant tasks, unify your analysts, and produce superior quantitative models using AI-driven workflows.

AI Prompts Tailored for Quantitative Investment Strategies with ClickUp Brain

Discover How ChatGPT, Gemini, Perplexity, and ClickUp Brain Enhance Quantitative Finance Workflows

ChatGPT Investment Strategy Prompts

- Outline a 5-step quantitative model focusing on momentum indicators and risk management.

- Compose investor communication highlighting portfolio diversification and algorithmic trading benefits.

- Generate 3 alternative factor models for equity selection and explain their predictive strengths.

- Draft a detailed workflow for backtesting a multi-asset trading strategy using historical data.

- Compare recent algorithmic strategies and summarize key performance metrics for optimization.

Gemini Quantitative Analysis Prompts

- Propose 3 portfolio allocation models incorporating ESG criteria based on recent market data.

- List innovative risk assessment techniques tailored for high-frequency trading environments.

- Create a thematic investment strategy mood board emphasizing sector rotation and macro factors.

- Suggest optimal parameter settings for a volatility forecasting model and rank by accuracy.

- Develop a comparative table of quantitative strategies focusing on Sharpe ratio, drawdown, and turnover.

Perplexity Financial Research Prompts

- Identify 5 emerging quantitative investment trends and evaluate their potential impact.

- Provide a comparative analysis of machine learning algorithms used in stock price prediction.

- Summarize regulatory changes affecting algorithmic trading and their implications.

- Generate a list of 5 data sources for alternative financial metrics and rank by reliability.

- Review recent academic papers on factor investing and extract actionable insights for strategy refinement.

ClickUp Brain for Quantitative Teams

- Transform this strategy review discussion into prioritized development and research tasks.

- Summarize quantitative model validation meeting notes and assign follow-up actions with deadlines.

- Analyze annotated backtest reports and generate a checklist of model improvements for the engineering team.

- Create a task list from cross-department collaboration on data pipeline enhancements, including urgency levels.

- Summarize client feedback on portfolio performance and generate actionable tasks for strategy adjustment in ClickUp.

Why ClickUp Works for You

Transform Initial Thoughts Into Solid Plans

- Convert scattered notes into polished investment models swiftly.

- Generate innovative strategies by analyzing historical market data.

- Develop adaptable templates that accelerate your trading workflows.

Brain Max Boost: Quickly access previous analyses, market feedback, and strategy documents to fuel your next investment approach.

Why Choose ClickUp

Accelerate Your Investment Strategy Execution

- Break down intricate market analyses into precise, executable tasks.

- Transform research insights into actionable investment plans.

- Automatically compile performance summaries and strategy reports without extra effort.

Brain Max Boost: Instantly access historical trade data, asset correlations, and model parameters across portfolios.

AI Advantages

How AI Prompts Elevate Quantitative Investment Strategies

AI prompts accelerate analysis and unlock sharper, data-driven investment decisions.

Instantly Craft Robust Models

Quant analysts explore diverse strategies quickly, refine hypotheses efficiently, and avoid analysis bottlenecks.

Enhance Decision Accuracy

Improve portfolio choices, reduce exposure to risk, and align investments with market dynamics and compliance standards.

Identify Flaws Early in Development

Minimize costly errors in backtesting, enhance model reliability, and speed up deployment timelines.

Align Teams Across Research and Trading

Facilitates clear communication, prevents misunderstandings, and accelerates consensus among quants, traders, and risk managers.

Drive Cutting-Edge Strategy Innovation

Inspire novel algorithm designs, explore emerging data sources, and maintain a competitive edge in markets.

Integrated Workflow Powered by ClickUp Brain

Transforms AI insights into actionable tasks, ensuring strategies evolve from concept to execution seamlessly.

Enhance Your Quantitative Investment Workflow

Minimize mistakes, simplify collaboration, and generate insightful analysis with AI-powered support.