AI Wealth Planning

Top AI Prompts for Personal Wealth Goals

Plan smarter, organize finances effortlessly, and reach your wealth milestones faster with ClickUp Brain.

Trusted by the world’s leading businesses

AI Empowering Personal Finance

Harness AI Prompts to Elevate Your Wealth Management

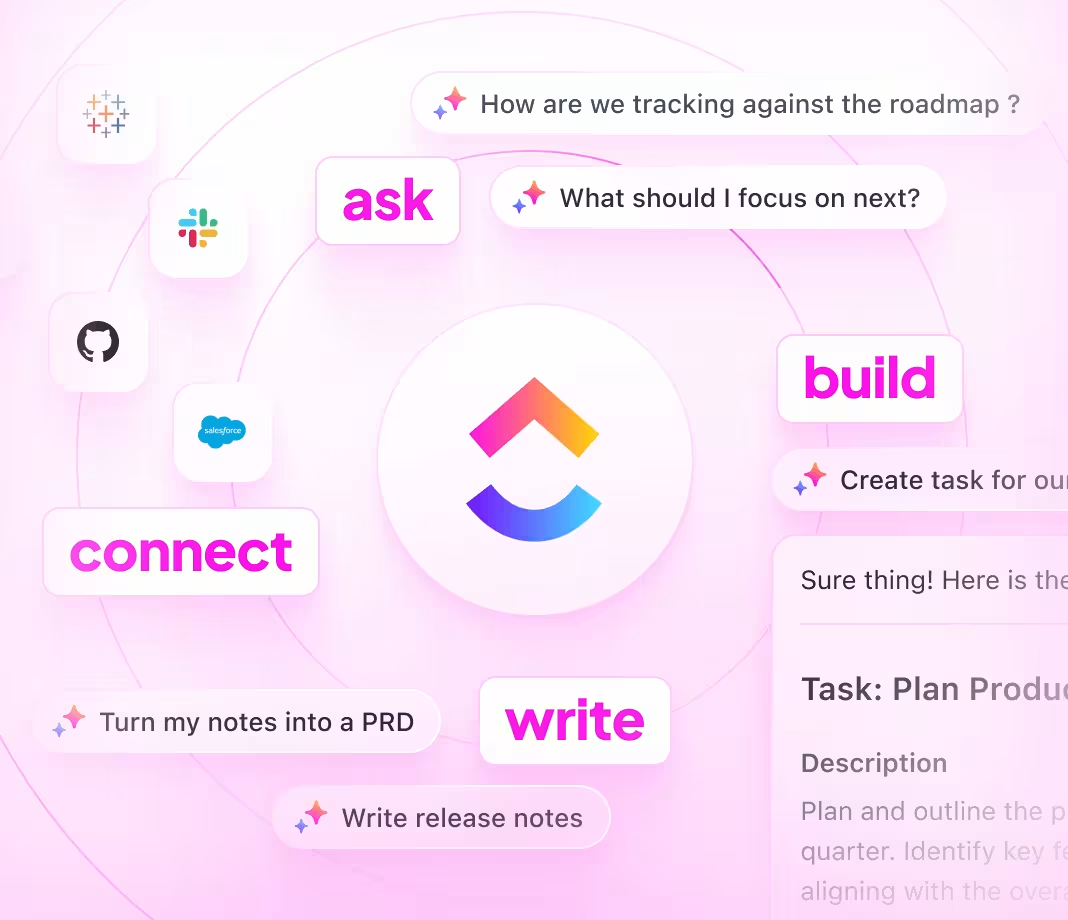

Managing your personal wealth is more than tracking numbers—it's about crafting a clear path to your financial future.

From setting budgets and investment plans to monitoring expenses and tax strategies, personal finance involves juggling numerous details and decisions. AI prompts are now a vital tool in simplifying this complexity.

Individuals leverage AI to:

- Quickly identify spending patterns and saving opportunities

- Generate tailored investment summaries and portfolio insights

- Decode complex financial documents and tax guidelines

- Transform scattered notes into organized budgets, goals, or action plans

Integrated into daily tools like notes, spreadsheets, and task lists, AI in platforms such as ClickUp Brain acts as your financial co-pilot—turning your ideas into clear, manageable steps toward wealth growth.

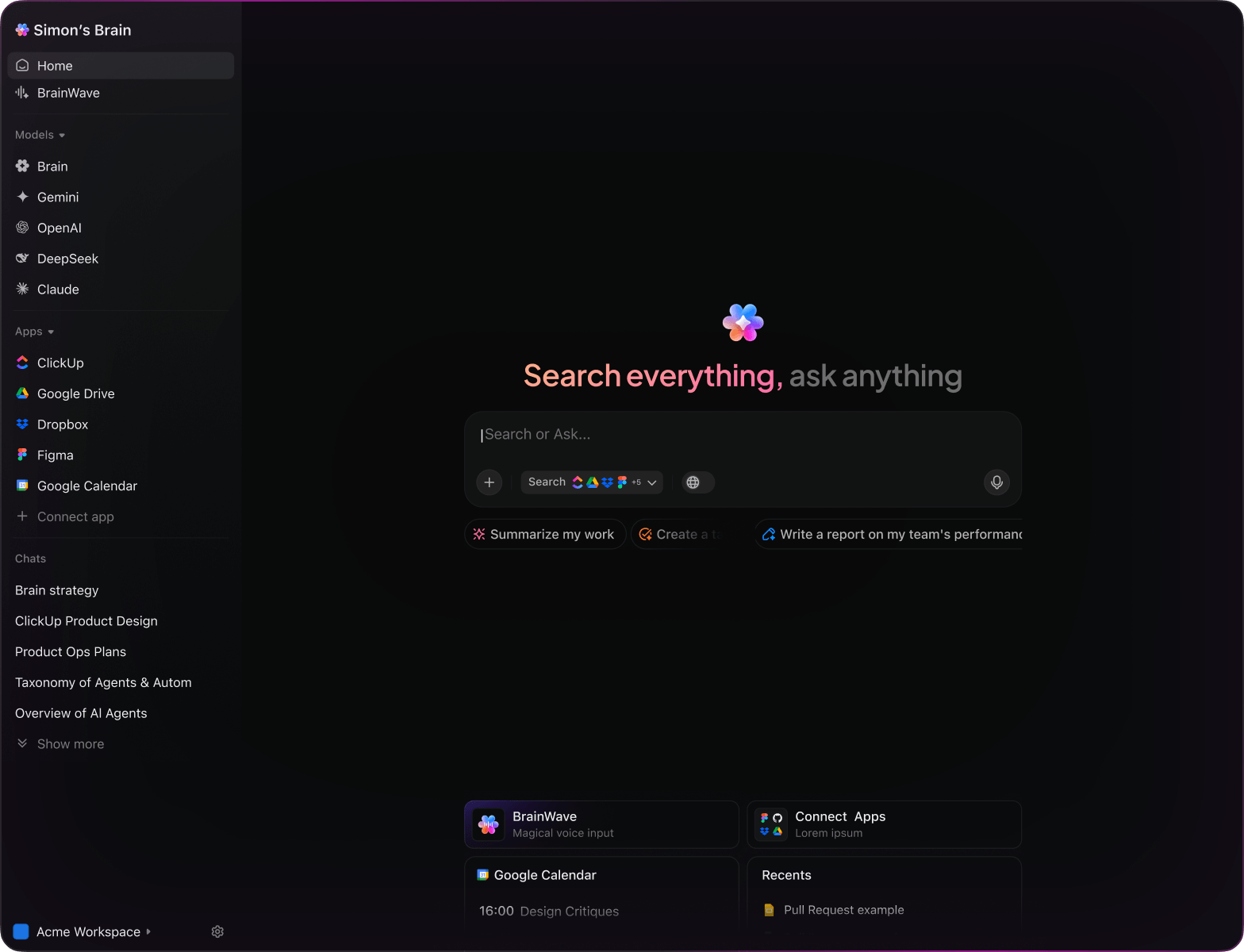

ClickUp Brain vs Conventional Solutions

Why ClickUp Brain Excels in Wealth Management

ClickUp Brain integrates seamlessly, understands your financial context, and acts swiftly—so you focus on growing your wealth, not explaining it.

Common AI Wealth Tools

- Constantly toggling between apps to collect financial data

- Repeating your investment goals with every query

- Receiving generic advice that misses your personal situation

- Hunting through multiple platforms to locate one document

- Interacting with AI that only processes commands

- Manually switching between different AI models

- Merely a browser add-on without deep integration

ClickUp Brain

- Deeply connected to your portfolios, budgets, and financial plans

- Remembers your past strategies and evolving objectives

- Provides tailored, actionable financial insights

- Centralized search across all your wealth management tools

- Hands-free operation with voice commands

- Automatically selects the optimal AI model: GPT, Claude, Gemini

- Dedicated desktop app for Mac & Windows designed for efficiency

Prompts for Personal Wealth Management

15 Essential AI Prompts for Wealth Planning with ClickUp Brain

Simplify your financial goals—track, analyze, and optimize your wealth strategies effortlessly.

Identify 5 diverse investment approaches tailored for a moderate-risk portfolio, based on the ‘Q2 Market Trends’ document.

ClickUp Brain Behavior: Analyzes the linked report to highlight key investment themes and strategy ideas.

Discover trending budgeting techniques used by millennials in North America through internal survey data.

ClickUp Brain Behavior: Gathers insights from research files; Brain Max can supplement with current public financial studies if accessible.

Create a detailed savings strategy focusing on building an emergency reserve, referencing ‘Savings Guidelines’ and past financial plans.

ClickUp Brain Behavior: Extracts relevant guidelines and notes from documents to compose a structured savings plan.

Summarize differences between Roth IRA and Traditional IRA considering the latest tax regulations from the ‘Retirement Tax Update’ doc.

ClickUp Brain Behavior: Pulls data from internal tax documents to provide a clear comparative overview.

Identify leading ESG funds based on performance metrics and analyst reports in our financial research folder.

ClickUp Brain Behavior: Reviews documents to compile a list of top sustainable funds with key performance notes.

From the ‘Financial Review Protocol’ doc, create a task list covering all essential steps for quarterly wealth assessments.

ClickUp Brain Behavior: Recognizes review criteria and formats them into an actionable checklist within a task or document.

Extract key features and user preferences from recent fintech reports and user feedback collected post-2023.

ClickUp Brain Behavior: Identifies patterns and highlights notable trends from linked research materials.

Analyze survey data from ‘Investor UX Study Q1’ to highlight preferred features and pain points in mobile trading apps.

ClickUp Brain Behavior: Reviews survey responses to pinpoint common themes and user expectations.

Write concise, motivating text for a debt reduction dashboard, following the tone guidelines in ‘BrandVoice.pdf’.

ClickUp Brain Behavior: References style documents to suggest compelling and clear interface language.

Review recent compliance updates impacting crypto assets from the ‘Crypto Compliance 2025’ document and explain implications.

ClickUp Brain Behavior: Synthesizes regulatory content to outline key changes and their effects on portfolio management.

Using internal financial models and ‘Retirement Planning Standards’ docs, create parameters for estimating retirement cash flow.

ClickUp Brain Behavior: Extracts formulas and assumptions to build a comprehensive guideline checklist.

From ‘Investment Risk Framework’ files, develop a structured list of criteria to evaluate potential asset risks.

ClickUp Brain Behavior: Identifies risk factors and organizes them into a clear, actionable checklist format.

Summarize cost structures and service features of leading robo-advisory platforms using our competitive analysis docs.

ClickUp Brain Behavior: Condenses comparative data into an easy-to-read summary or table format.

Analyze recent studies and internal reports to identify key financial habits and preferences among Gen Z investors.

ClickUp Brain Behavior: Synthesizes findings from research notes and uploaded trend analyses.

Extract and prioritize frequent issues reported in the ‘Client Budgeting Feedback’ folder, focusing on obstacles and improvement areas.

ClickUp Brain Behavior: Aggregates user feedback to spotlight main pain points and actionable insights.

Plan Your Financial Future with ClickUp Brain

Cut down on guesswork, unify your financial team, and create smarter wealth strategies using AI-driven workflows.

Personal Wealth Management Goals with ClickUp Brain

Discover how ClickUp Brain enhances your financial planning and wealth strategies

Prompts for ChatGPT

- Outline a 5-step plan to optimize your monthly budget focusing on savings and investments.

- Craft persuasive messaging for a retirement fund emphasizing security and growth.

- Suggest 3 diversified investment portfolios tailored for moderate risk tolerance.

- Develop a detailed workflow for tracking and adjusting personal financial goals quarterly.

- Compare recent spending patterns and highlight key areas to improve cash flow management.

Prompts for Gemini

- Design 3 user-friendly dashboard layouts for personal finance tracking based on user feedback.

- Propose innovative ways to visualize net worth growth focusing on clarity and motivation.

- Create a mood board description for a financial app interface emphasizing trust and simplicity.

- Recommend budgeting categories for a family of four and prioritize them by impact on savings.

- Build a comparison chart of different savings account options highlighting interest rates and fees.

Prompts for Perplexity

- Identify 5 effective strategies for reducing debt and rank them by ease of implementation.

- Summarize current trends in sustainable investing and their potential returns.

- Analyze global economic indicators and their influence on personal wealth management.

- List 5 practical tips for emergency fund planning and evaluate their importance.

- Compare various retirement planning methods and extract top lessons for long-term security.

Prompts for ClickUp Brain

- Transform this client feedback into clear action items for financial advisors.

- Condense meeting notes on portfolio reviews and assign follow-up tasks with deadlines.

- Evaluate annotated budget reports and generate a checklist for necessary adjustments.

- Compile a task list from cross-department discussions on wealth management tools, prioritizing key features.

- Summarize client interviews on financial goals and create actionable tasks for personalized planning in ClickUp.

How ClickUp Supports

Transform Your Wealth Plans Into Clear Strategies

- Convert scattered thoughts into detailed financial plans quickly.

- Generate new investment ideas by analyzing your financial history.

- Build customizable templates to accelerate your wealth management process.

Brain Max Boost: Effortlessly explore previous budgets, goals, and financial documents to guide your next money move.

Why ClickUp Works for You

Accelerate Your Wealth Planning Process

- Break down complicated financial strategies into manageable tasks.

- Transform your wealth goals into actionable, assignable steps.

- Automatically create progress summaries and financial snapshots without lifting a finger.

Brain Max Boost: Instantly access historical investment data, portfolio analyses, or budget decisions across your financial plans.

AI Advantages

How AI Prompts Elevate Every Phase of Wealth Planning

AI prompts accelerate insights and empower smarter, more confident financial strategies.

Create Tailored Wealth Plans Quickly

Financial advisors explore personalized strategies swiftly, make informed choices, and avoid decision fatigue.

Enhance Investment Decisions with Confidence

Reduce uncertainty, optimize portfolios, and align plans with client goals and compliance standards.

Identify Risks Before They Impact You

Minimizes costly financial errors, improves portfolio resilience, and accelerates response times.

Align Your Team Around Clear Objectives

Strengthens communication, prevents misunderstandings, and accelerates consensus among advisors and clients.

Drive Innovative Financial Solutions

Inspires creative approaches, uncovers new opportunities, and keeps your strategies competitive.

Integrated AI Workflows Within ClickUp

Transforms AI insights into actionable tasks, ensuring your wealth management plans progress smoothly.

Achieve Your Wealth Goals Faster

Minimize mistakes, simplify financial planning, and generate insightful strategies with AI support.