AI Municipal Bond Insights

Top AI Prompts for Municipal Bond Analysis

Enhance your bond evaluations, simplify complex data, and elevate your investment strategies with ClickUp Brain.

Trusted by the world’s leading businesses

AI in Municipal Bond Analysis

AI Prompts Revolutionizing Municipal Bond Analysis

Navigating the complexities of municipal bond markets requires precision and clarity.

From initial credit evaluations to risk assessments, compliance reviews, and portfolio monitoring, municipal bond analysis demands managing vast data and tight deadlines. AI prompts are now key to streamlining these tasks.

Analysts leverage AI to:

- Quickly identify relevant market trends and issuer information

- Generate detailed credit reports and risk summaries with less manual effort

- Interpret regulatory documents and compliance requirements efficiently

- Transform scattered data into clear, prioritized action items and checklists

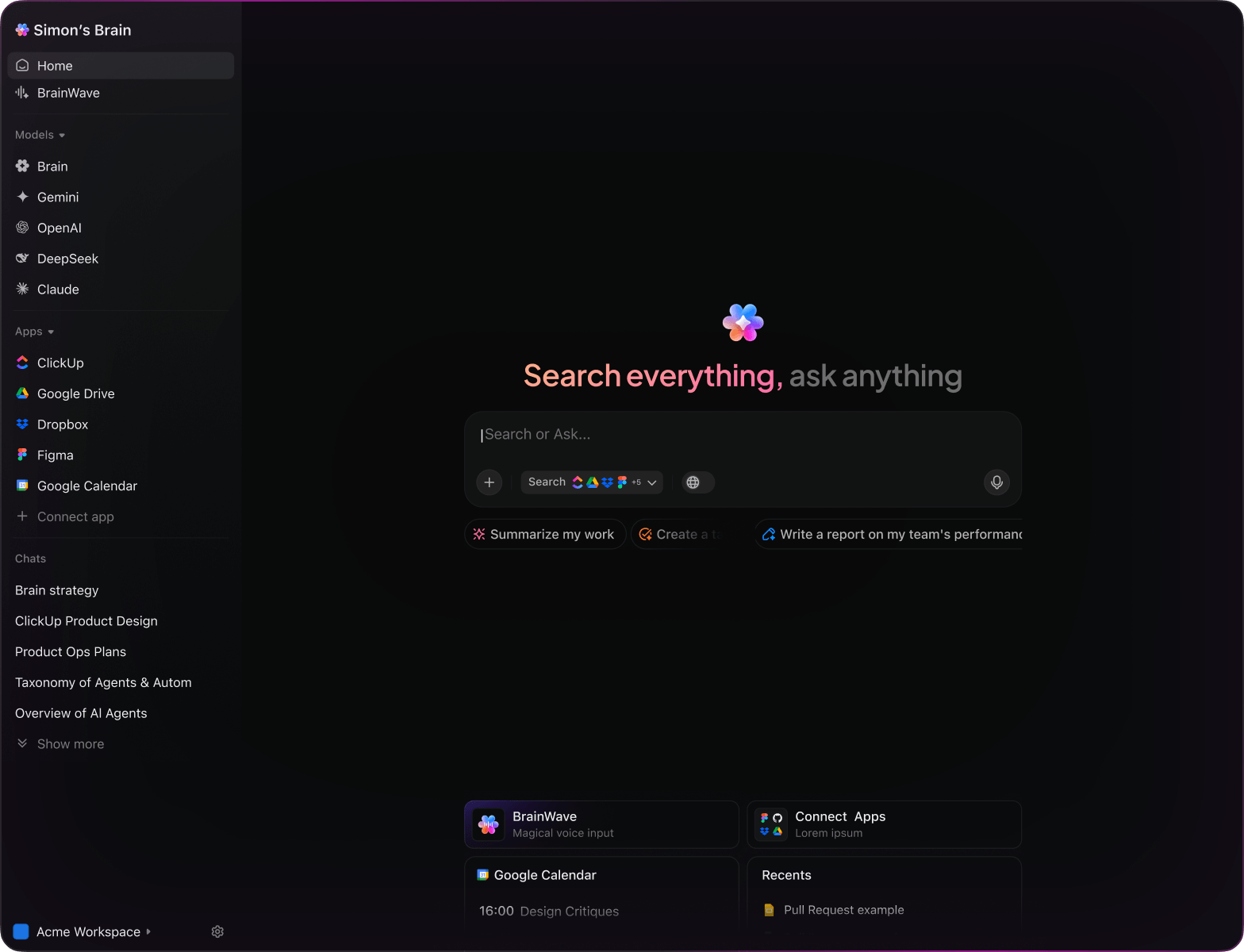

Integrated within familiar tools like documents, dashboards, and project trackers, AI in platforms such as ClickUp Brain goes beyond assistance—it organizes insights into structured, manageable workflows.

ClickUp Brain Compared to Conventional Solutions

Why ClickUp Brain Excels in Municipal Bond Analysis

ClickUp Brain integrates seamlessly with your workflow, understands your context deeply, and empowers you to focus on insights, not setup.

Standard AI Platforms

- Constantly toggling between apps to collect data

- Repeating your analysis objectives with every query

- Receiving generic, non-specific feedback

- Hunting through numerous software to locate documents

- Interacting with AI that lacks proactive engagement

- Manually switching among different AI engines

- Merely an add-on in your browser

ClickUp Brain

- Instantly accesses your bond portfolios, reports, and team notes

- Retains your previous analyses and investment criteria

- Delivers precise, context-driven recommendations

- Searches across all your financial tools in one place

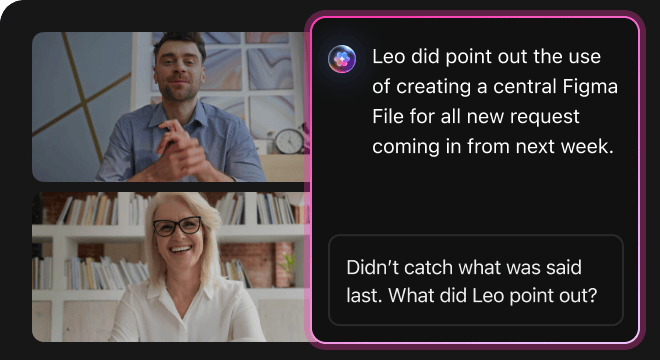

- Supports hands-free input with voice commands

- Automatically selects the optimal AI model: GPT, Claude, Gemini

- Dedicated desktop app for Mac & Windows optimized for performance

Municipal Bond Analysis Prompts

15 Essential AI Prompts for Municipal Bond Analysis

Enhance your bond research—data synthesis, risk assessment, and regulatory insights simplified.

Identify 5 potential yield curve shifts affecting California muni bonds, based on the ‘Q2 Market Outlook’ report.

ClickUp Brain Behavior: Analyzes linked market reports to outline plausible yield curve movements and their implications.

Analyze recent credit rating changes among mid-tier municipal issuers in the Midwest.

ClickUp Brain Behavior: Aggregates insights from internal rating updates; Brain Max can supplement with external credit agency data when available.

Compile key details and risk factors for a Texas green bond, referencing ‘Issuer Profile’ and prior deal notes.

ClickUp Brain Behavior: Extracts relevant issuer data and previous analyses to create a structured investment summary.

Compare debt service coverage ratios of ‘District A’ and ‘District B’ bonds using the ‘Annual Financials’ document.

ClickUp Brain Behavior: Pulls financial metrics from linked documents and provides a concise comparative overview.

Identify common protective covenants from recent municipal bond agreements, referencing deal summaries and legal notes.

ClickUp Brain Behavior: Scans internal documents to highlight recurring covenant types and their investor benefits.

From the ‘SEC Disclosure Update’ doc, create a task list ensuring bond compliance.

ClickUp Brain Behavior: Extracts regulatory requirements and formats them into actionable compliance steps.

Highlight key ESG considerations from 2024 research and rating agency reports.

ClickUp Brain Behavior: Identifies patterns and significant ESG trends impacting municipal credit evaluations.

Analyze survey data to reveal investor priorities regarding bond maturities.

ClickUp Brain Behavior: Extracts and synthesizes recurring themes from survey feedback and investor commentary.

Craft user-friendly disclosure statements using the tone guidelines in ‘ComplianceVoice.pdf’.

ClickUp Brain Behavior: Adapts regulatory language to a straightforward style, offering multiple phrasing options.

Outline recent tax law amendments affecting municipal bond interest and investor returns.

ClickUp Brain Behavior: Reviews linked tax documents and summarizes critical changes and compliance implications.

From internal templates and ‘Rating Agency Prep’ docs, create layout and content standards.

ClickUp Brain Behavior: Extracts best practices and formatting rules to ensure consistent, effective presentations.

Using US market data and internal risk reports, build a detailed evaluation checklist.

ClickUp Brain Behavior: Identifies key risk factors and organizes them into a structured review format.

Summarize green project commitments and funding sources from competitive analysis files.

ClickUp Brain Behavior: Synthesizes issuer sustainability efforts into a clear, comparative summary.

Analyze recent developments and market shifts in bond insurance products.

ClickUp Brain Behavior: Extracts insights from industry reports and internal notes to highlight evolving practices.

Identify recurring issues related to bond structure, liquidity, and credit from regional investor surveys.

ClickUp Brain Behavior: Prioritizes and consolidates feedback from multiple sources to inform strategy adjustments.

Accelerate Municipal Bond Insights with ClickUp Brain

Cut down on redundant tasks, unify your analysts, and produce superior bond evaluations through AI-enhanced workflows.

LLMs vs. Workflow Intelligence: ClickUp Brain Empowers Municipal Bond Analysis

Discover How ChatGPT, Gemini, Gemini, and Perplexity Tackle Municipal Bond Analysis Prompts

ChatGPT Prompts

- Condense these municipal bond issuance reports into a 5-point investment summary highlighting risk factors.

- Compose investor briefing notes for a new bond series focusing on credit quality, yield, and maturity.

- Generate 3 alternative bond structuring scenarios and explain their impact on portfolio diversification.

- Outline a step-by-step workflow for assessing bond ratings and market trends.

- Compare the last 3 municipal bond offerings and summarize key investor feedback for future issues.

Gemini Prompts

- Develop 3 alternative risk assessment models for municipal bonds based on recent fiscal data.

- List innovative strategies for bond portfolio optimization emphasizing tax benefits.

- Create a mood board description for bond market sentiment highlighting economic indicators and investor confidence.

- Suggest allocation strategies for a diversified municipal bond portfolio and rank by risk-adjusted returns.

- Build a comparison table for three bond types focusing on yield, duration, and credit risk.

Perplexity Prompts

- Identify 5 emerging trends in municipal bond markets and evaluate their potential impact.

- Provide a comparison of credit rating methodologies for municipal bonds, emphasizing reliability and transparency.

- Summarize global regulatory changes affecting municipal bond issuance and investor protections.

- Generate a list of 5 innovative financing structures in municipal bonds and rank by market adoption.

- Analyze past municipal bond defaults and extract 3 key lessons for risk management.

ClickUp Brain Prompts

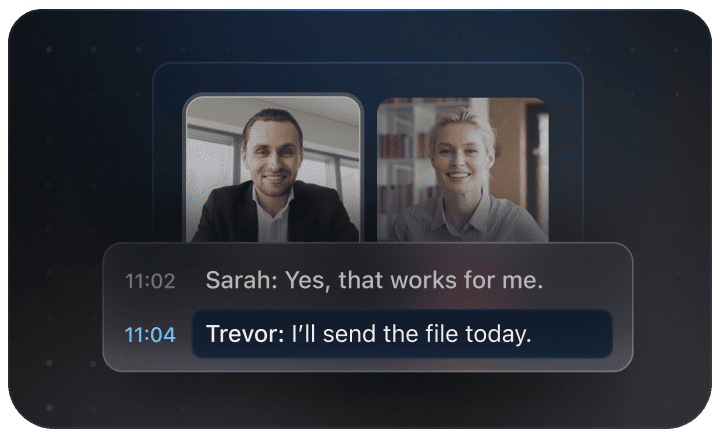

- Transform this analyst discussion into prioritized tasks for credit evaluation and compliance review.

- Summarize meeting minutes from bond committee sessions and assign follow-up actions with deadlines.

- Review annotated financial statements and generate a checklist of items needing further audit or clarification.

- Create a task list from cross-department collaboration on bond issuance strategies, including priority rankings.

- Summarize investor feedback transcripts on bond performance and produce actionable tasks for portfolio adjustments in ClickUp.

Why ClickUp Works

Transform Initial Thoughts into Polished Plans

- Convert scattered notes into detailed bond analysis reports swiftly.

- Generate innovative strategies by reviewing historical municipal bond data.

- Build adaptable templates that accelerate your financial reviews.

Brain Max Boost: Effortlessly access previous bond evaluations, market feedback, and financial documents to guide your upcoming analysis.

How ClickUp Supports You

Accelerate Municipal Bond Analysis Workflow

- Break down intricate bond details into straightforward tasks.

- Transform analyst insights into assignable action items.

- Automatically produce comprehensive reports and summary briefs without extra effort.

Brain Max Boost: Instantly access historical bond data, issuer comparisons, or regulatory notes across portfolios.

AI Advantages

How AI Prompts Enhance Every Phase of Municipal Bond Analysis

AI prompts accelerate insights and empower sharper, more confident bond evaluations.

Quickly Develop Insightful Bond Scenarios

Analysts explore diverse bond structures rapidly, refine forecasts, and avoid analysis bottlenecks.

Improve Investment Decisions with Confidence

Enhance decision accuracy, reduce exposure, and align portfolios with regulatory standards and investor goals.

Identify Risks Before They Escalate

Minimizes expensive misjudgments, boosts report accuracy, and accelerates deal closure timelines.

Align Teams Across Finance and Compliance

Strengthens communication, prevents misunderstandings, and accelerates consensus among analysts, underwriters, and legal teams.

Drive Innovative Bond Strategies

Inspires creative structuring, supports cutting-edge financial products, and keeps your offerings competitive.

Integrated AI Support Within ClickUp

Transforms AI-generated insights into actionable tasks, ensuring your bond projects advance efficiently.

Enhance Municipal Bond Analysis

Minimize mistakes, simplify collaboration, and generate insightful reports with AI-powered support.