A new era of humans, with AI Super Agents™

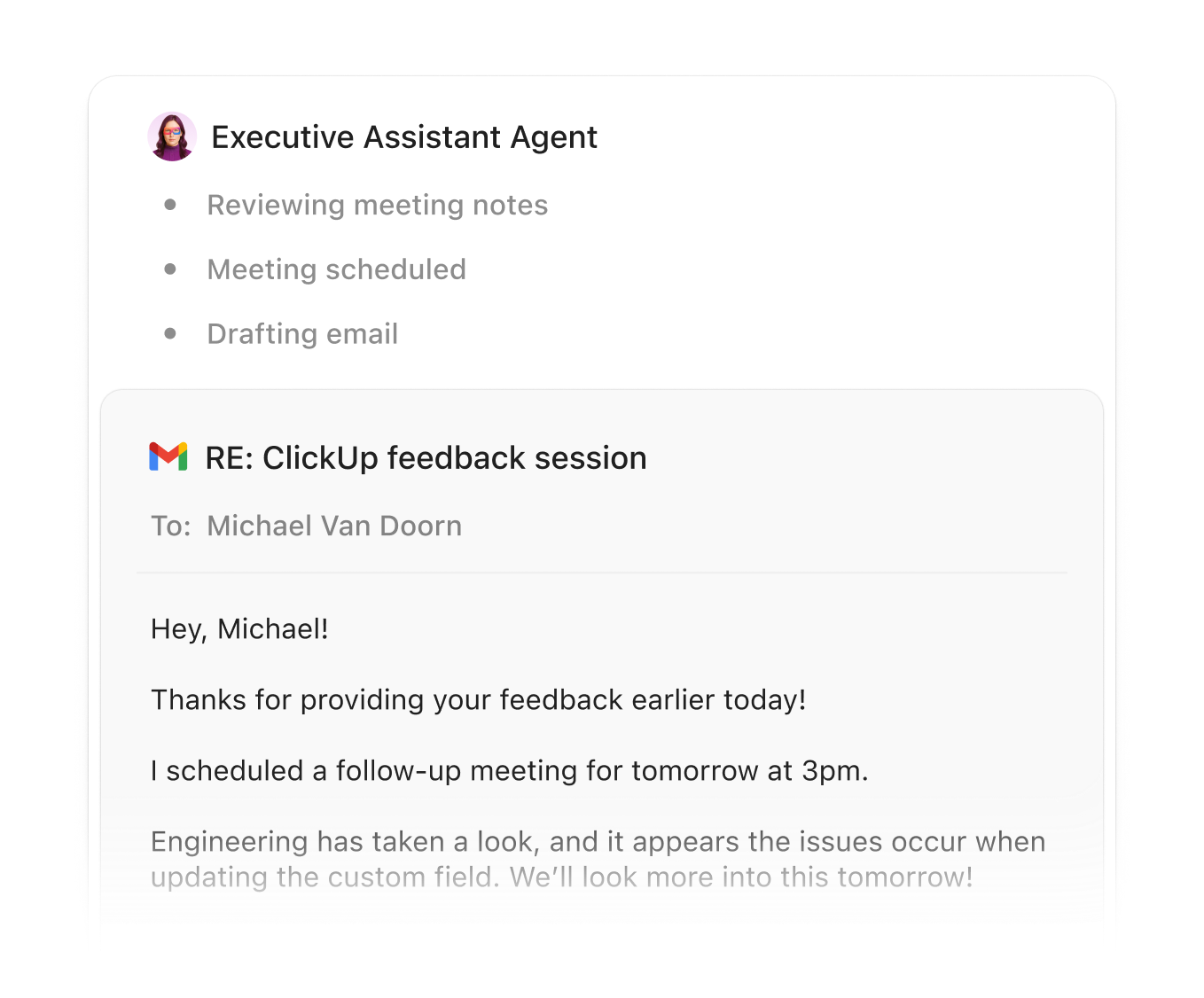

They're just like humans

Maximize human productivity with agentic teammates - @mention, assign tasks, & message directly. Choose when, how, and what they work on - always improving with infinite knowledge & memory.

They're just like humans

Maximize human productivity with agentic teammates - @mention, assign tasks, & message directly. Choose when, how, and what they work on - always improving with infinite knowledge & memory.

Agents for

everything

The world's only infinite agent catalog where anyone can create and customize agents for any type of work imaginable.

async function deployAgent(config) {

const agent = await Agent.create({

name: config.name,

model: "gpt-4-turbo",

tools: config.tools,

memory: new VectorMemory(),

});

agent.on("task", async (task) => {

const plan = await agent.plan(task);

const results = [];

for (const step of plan.steps) {

const result = await agent.execute(step);

results.push(result);

await agent.learn(step, result);

}

return agent.summarize(results);

});

return agent.deploy();

}async function deployAgent(config) {

const agent = await Agent.create({

name: config.name,

model: "gpt-4-turbo",

tools: config.tools,

memory: new VectorMemory(),

});

agent.on("task", async (task) => {

const plan = await agent.plan(task);

const results = [];

for (const step of plan.steps) {

const result = await agent.execute(step);

results.push(result);

await agent.learn(step, result);

}

return agent.summarize(results);

});

return agent.deploy();

}

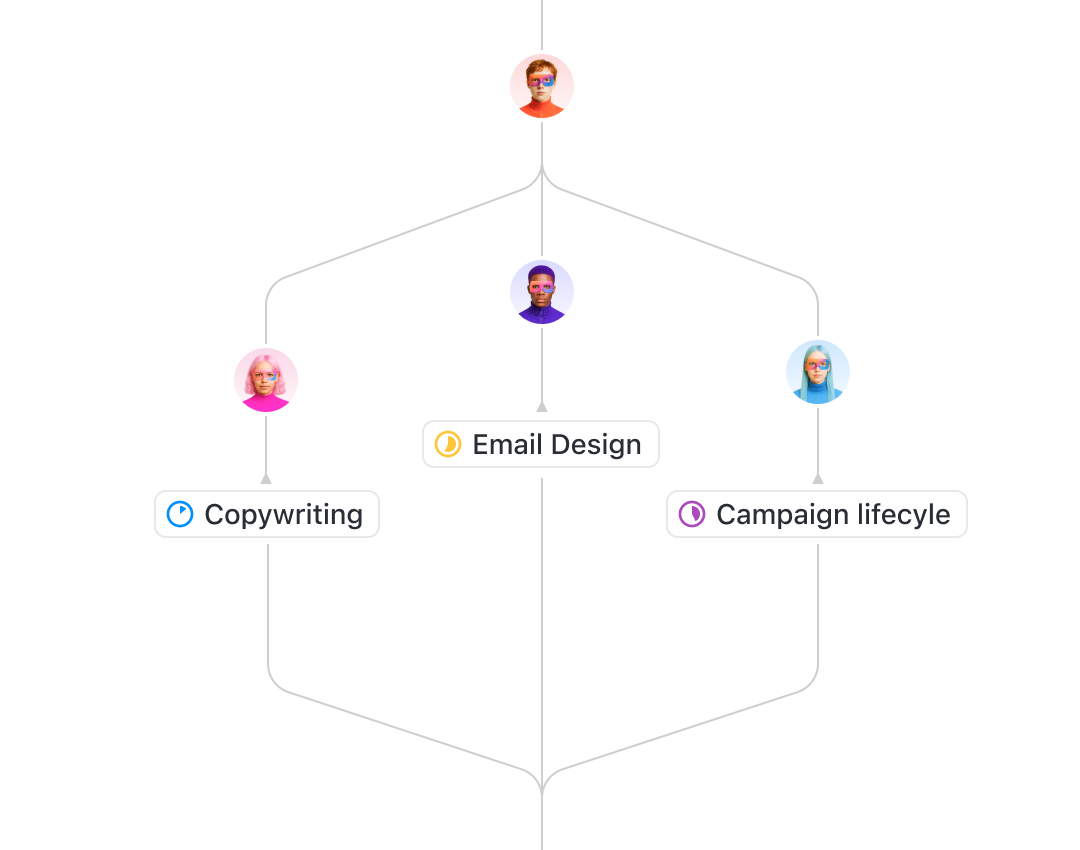

One prompt spins up an entire team

Your goals, workflows, and frustrations - automatically delegated to a team of agents.

Do more than

humanly possible

"The holy grail of what enterprises are chasing - this is a game changer for work productivity."

— Jay Hack, CEO of Codegen

The only agents that work like humans - with infinite skills

Overview

Central hub guiding new team members through company culture, tools, processes, and key resources to ensure smooth onboarding and productivity

- ✉️ Letter from the CEO

- 💬 Company Story

Collaborate alongside humans

Just like a highly skilled teammate

Managed by humans

Agents have managers

Become superhuman,

with Super Agents.

But works like

superheroes

They leverage artificial intelligence to make informed decisions, and execute actions to achieve specific goals.

- 01Memory

- 02Knowledge

- 03Collaboration

- 04Skills

- 05Autonomous

- 06Ambient

- 07Feedback

Memory

AI agents are sophisticated software entities designed to operate autonomously within digital environments.

Agents have episodic memory, agent preferences memory, short-term memory and long-term memory

Knowledge

Access vast databases of information and learn from every interaction.

Collaboration

Work seamlessly with humans and other AI agents to achieve complex goals.

Skills

Execute hundreds of specialized tasks with precision and consistency.

Autonomous

Operate independently, making decisions and taking actions without constant oversight.

Ambient

Run quietly in the background, always ready to assist when needed.

Feedback

Learn and improve from every interaction and outcome.

Proprietary Agentic Technology

"Our custom platform uses contextual engagement, orchestration, and fine-tuning to provide maximum human productivity."

— Zeb Evans, CEO

Agent Analytics

Measure productivity across teams, monitor trends, and spot your top performers.

Ambient Awareness

Instantly respond to your questions - giving you accurate, context-aware answers.

Live Intelligence

Actively monitors all context to capture & update knowledgebases for people, teams, projects, decisions, updates, and more.

Infinite Knowledge

Proprietary real-time syncing engine with world-class retrieval from fine-tuned embeddings. Enterprise search from infinite connected knowledge.

Search from 50+ Apps

Preserved

syncing engine

BrainGPT

Proprietary models, architecture, and evals.

Optimized Orchestration

Route to the best models from intent.

Self-Learning

Continuous learning and improvement.

Human-level Memory

Short, Long-Term, & Episodic Memory.

Sub-Agent Architecture

Multi-agent collaboration and delegation.

Deep Research & Compression

Research optimally from compressed context.

Agentic User Security

Completely proprietary AI user data model compatible with all enterprise security systems, and familiar to all humans.

Audit everything

Extraordinary alignment with humans with advanced execution.

New task

New task

Marketing Backlog

Marketing Backlog

Sprint Planning

Sprint Planning

Project In Progress

Project In Progress

Team Updates

Team Updates

Bug Fixes

Bug Fixes

Data Sync

Data Sync

Weekly Stats

Weekly Stats

New task

New task

Marketing Backlog

Marketing Backlog

Sprint Planning

Sprint Planning

Project In Progress

Project In Progress

Team Updates

Team Updates

Bug Fixes

Bug Fixes

Data Sync

Data Sync

Weekly Stats

Weekly StatsZero data retention. Zero training.

More secure than using OpenAI, Gemini directly.

Reflection

Advanced execution loops that ensure Agents constantly reflect on work they're doing.

When we optimize, you save $

When our teams save on AI costs, we pass them onto you. When sudden increases in AI costs occur as a result of new models or other changes, we subsidize the cost so you don't see any sudden increases on credit usage.

Try Super

Agents today