Transform your investment strategy with Portfolio Rebalancer AI Agents, optimizing asset allocation and maximizing returns effortlessly. Harness the power of the ClickUp Brain to ensure your portfolio remains aligned with your financial goals, making data-driven decisions easier than ever!

Portfolio Rebalancer AI Agent: Your Financial Friend

Wondering how to make your investments work smarter, not harder? Enter the Portfolio Rebalancer AI Agent, your digital ally in managing a balanced investment portfolio. These AI agents specialize in adjusting asset allocations to ensure your investments align with your financial goals and risk appetite. Think of them as your virtual financial advisors, ready to automate complex tasks and optimize outcomes with precision.

Types of AI Agents for Portfolio Rebalancing

- Competitor Analysis Agents: Monitor investment trends and provide competitive insights so you can make informed decisions.

- Task Automation Agents: Handle routine tasks like tracking assets and executing transactions, saving you time and effort.

- Risk Assessment Agents: Evaluate market risks and suggest reallocation strategies to safeguard investments.

How Portfolio Rebalancer AI Agents Work

Imagine a scenario where your stocks have shot up, skewing the balance of your investment portfolio towards equities, shifting from your initial 60/40 equity to bond allocation to a now-riskier 70/30 split. A Portfolio Rebalancer AI Agent would quickly detect this imbalance. Acting on preset rules or dynamic analysis, it might suggest selling some of the equities and buying bonds to restore your desired allocation.

These agents don't stop there. By constantly scanning market conditions, they can anticipate fluctuations and recommend adjustments even before significant changes occur, helping to protect against downturns. It's like having a financial advisor that's always on duty, ensuring your investments consistently align with your financial objectives and risk tolerance.

Benefits of Using AI Agents for Portfolio Rebalancer

Maximize efficiency and success with AI Agents designed for portfolio rebalancing. Here's how they can redefine your investment management:

Real-Time Analysis and Decision Making

- AI Agents process vast amounts of financial data instantly. This real-time analysis allows for quick adjustments to keep your portfolio aligned with investment goals and market conditions.

Risk Reduction

- Utilizing sophisticated algorithms, AI Agents assess market volatility and predict potential risks. This proactive approach helps in avoiding adverse financial events and ensures your investments are safeguarded.

Cost Efficiency

- By automating routine tasks, AI Agents reduce the need for manual interventions in your portfolio management, resulting in significant cost savings on operation expenditures.

Portfolio Optimization

- These agents continuously evaluate your investment mix, suggesting adjustments to enhance returns while maintaining targeted risk levels, thus optimizing your portfolio’s performance.

Enhanced Productivity

- Free from time-consuming manual tasks, your team can focus on strategic decision-making and client relationship building. AI agents handle the heavy lifting, boosting overall productivity.

Incorporating AI Agents into your portfolio management not only streamlines operations but also propels your business towards higher growth and stability.

Portfolio Rebalancer AI Agent: Your Investment Sidekick

Managing a successful investment portfolio requires precision, time, and great decision-making skills. An AI agent designed for portfolio rebalancing can take a lot off your shoulders. Let's break down how our AI agents can help you maintain an optimal investment strategy:

Automated Rebalancing

- Schedule rebalancing at regular intervals to maintain your desired asset mix without lifting a finger.

- Receive alerts when your portfolio drifts too far from your target allocation.

Risk Management

- Adjust asset allocation based on real-time risk analysis.

- Balance investments to hedge against market volatility.

Goal Alignment

- Align your portfolio with specific investment goals, whether that's growth, income, or preservation of capital.

- Modify strategies dynamically as your financial goals change.

Tax Efficiency

- Optimize rebalancing to minimize capital gains taxes.

- Use tax-loss harvesting strategies automatically.

Performance Analysis

- Analyze historical data to predict future performance patterns.

- Get insights into how different rebalancing strategies would have performed in the past.

Market Insights

- Stay ahead with AI-driven predictions on market trends.

- Receive updates and recommendations based on recent economic events.

Diversification Strategies

- Identify opportunities to diversify and reduce concentrated risk.

- Suggest investments in underrepresented sectors or assets.

Custom Alerts & Notifications

- Get real-time notifications for significant market movements affecting your portfolio.

- Receive performance summaries and actionable recommendations.

An AI Agent for portfolio rebalancing is like having a pair of extra hands, ensuring your investments are always in tip-top shape. Let the tech do the heavy lifting while you enjoy the peace of mind knowing your portfolio is perfectly balanced.

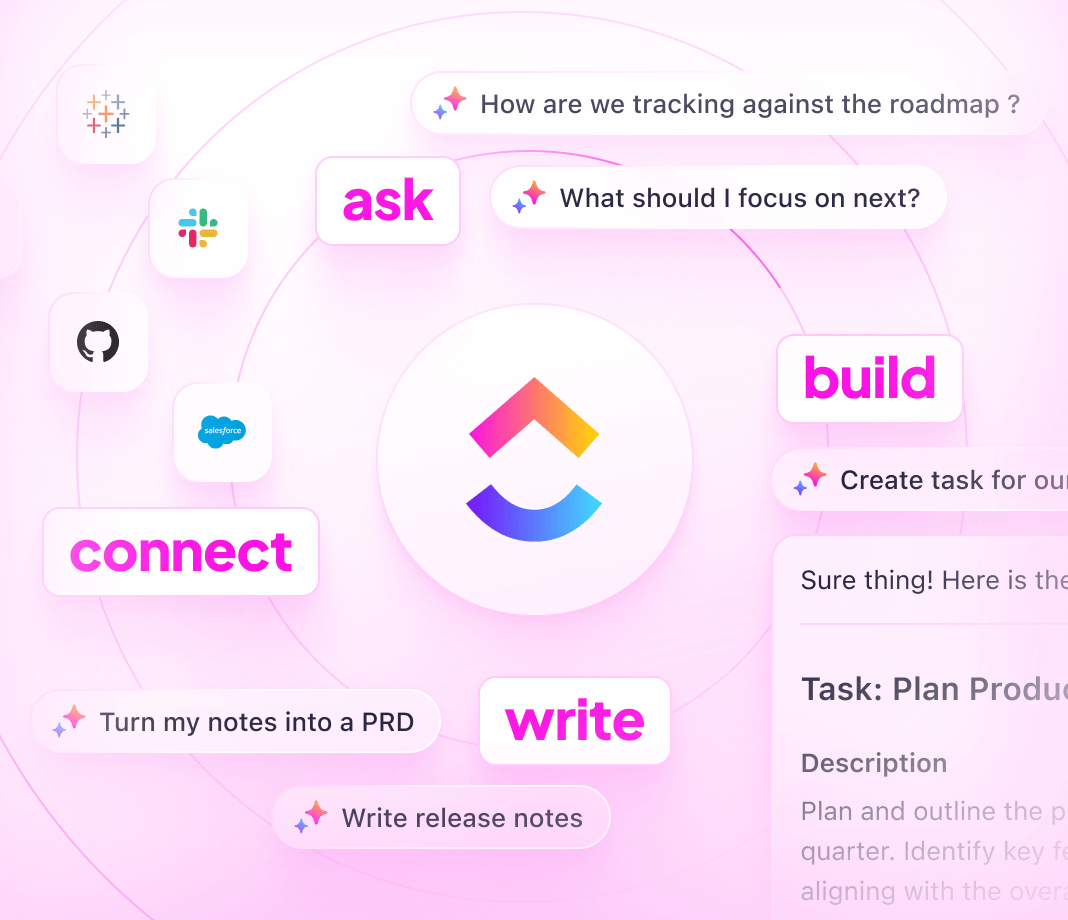

Unlock the Potential of ClickUp Brain Chat Agents in Your Workspace

ClickUp Brain Chat Agents are here to revolutionize the way you interact within your ClickUp Workspace! With their unique ability to adapt, interact, and proactively support your team, these Agents are the secret to smoother workflows and increased efficiency.

How Can Chat Agents Benefit Your Workspace?

Instant Assistance with Answers Agent

Imagine a virtual assistant ready to jump in whenever someone asks a question about your product, services, or organization. The Answers Agent is your go-to for automating responses in team chats. Simply set it up with the right knowledge sources, and watch as it answers queries in real-time, saving everyone precious time.Efficiency Boost with Triage Agent

The Triage Agent is a game-changer for managing tasks arising from chat interactions. It smartly identifies conversations that require follow-up tasks and ensures they’re connected to relevant chat threads. No more missing out on actionable insights or losing context—this Agent keeps everyone in the loop and on track.Customizable and Adaptable Agents

Need something more tailored? You can create a Chat Agent from scratch or customize prebuilt Agents to suit your specific needs. Whether it’s tweaking the criteria for task identification or specifying particular knowledge bases for answers, flexibility is at your fingertips.

Autonomous, Reactive, and Proactive

ClickUp Chat Agents are not just static tools—they're designed to adapt to the ever-changing dynamics of your environment:

- Autonomy: Set them up, and they’ll take charge, making informed decisions based on guidelines and accessible data.

- Reactivity: Stay responsive with Agents that perceive and adjust to changes instantly.

- Proactivity: Beyond reacting, they initiate actions to achieve your team’s goals efficiently.

Integrate with Connected Search Apps

Enhance your Agents' capabilities by linking them with Connected Search apps like Google Drive, SharePoint, and Confluence. They'll pull in relevant information from these sources, making them even more effective in their roles.

A Nod to the Portfolio Rebalancer AI Agent Use Case

While specific features related to Portfolio Rebalancer aren't detailed yet, think of how an Answers or Triage Agent could support similar objectives—like answering FAQs about current priorities or ensuring shifts in resource allocation are tracked through relevant tasks.

Get started with ClickUp Brain Chat Agents and watch your team soar to new heights of productivity. 🚀

Certainly! Here's the Markdown formatted content:

Navigating Challenges with Portfolio Rebalancer AI Agents

AI Agents offer impressive tools for portfolio rebalancing, revolutionizing how we optimize investments. While the potential is immense, successful implementation requires addressing certain challenges and considerations. Let's explore common pitfalls and solutions to make the most of your AI-driven rebalancer.

Common Challenges and Considerations

Data Quality and Availability

- Challenge: AI Agents rely heavily on accurate and comprehensive data. Poor data quality can lead to misguided rebalancing decisions.

- Solution: Ensure access to reliable data sources. Regularly update datasets and perform quality checks to maintain accuracy.

Algorithm Bias

- Challenge: AI systems can inadvertently develop biases, leading to skewed investment recommendations.

- Solution: Implement fairness reviews and conduct stress tests to identify potential biases. Continuously refine algorithms based on diverse datasets to mitigate this risk.

Market Volatility

- Challenge: Rapid market changes can outpace AI Agents' adjustment capabilities, especially if they're tuned to historical data.

- Solution: Enhance AI with real-time data analysis and develop strategies that incorporate both short-term and long-term market conditions.

Complexity of AI Models

- Challenge: Sophisticated algorithms may become too complex, leading to difficulties in understanding their decision-making processes.

- Solution: Focus on transparency by using explainable AI (XAI) techniques. Regular audits and user training can ensure clarity in decision-making.

Human Intervention

- Challenge: Sole reliance on AI can lead to oversight. Human intuition and expertise are crucial in complex scenarios.

- Solution: Maintain a balance between automation and human oversight. Create protocols for human review, especially in uncertain market conditions.

Regulatory Compliance

- Challenge: Regulatory landscapes are constantly evolving, impacting automated financial tools.

- Solution: Stay updated on compliance requirements and integrate legal checks within the AI system. Collaborating with legal experts can aid in navigating these landscapes.

By thoughtfully addressing these challenges, AI Agents can become an invaluable ally in crafting well-balanced, adaptive portfolios. Open dialogue, regular evaluations, and continuous learning are key to harnessing the full potential of AI in portfolio management. Let's leverage technology, enhance decision-making, and achieve greater financial agility together!