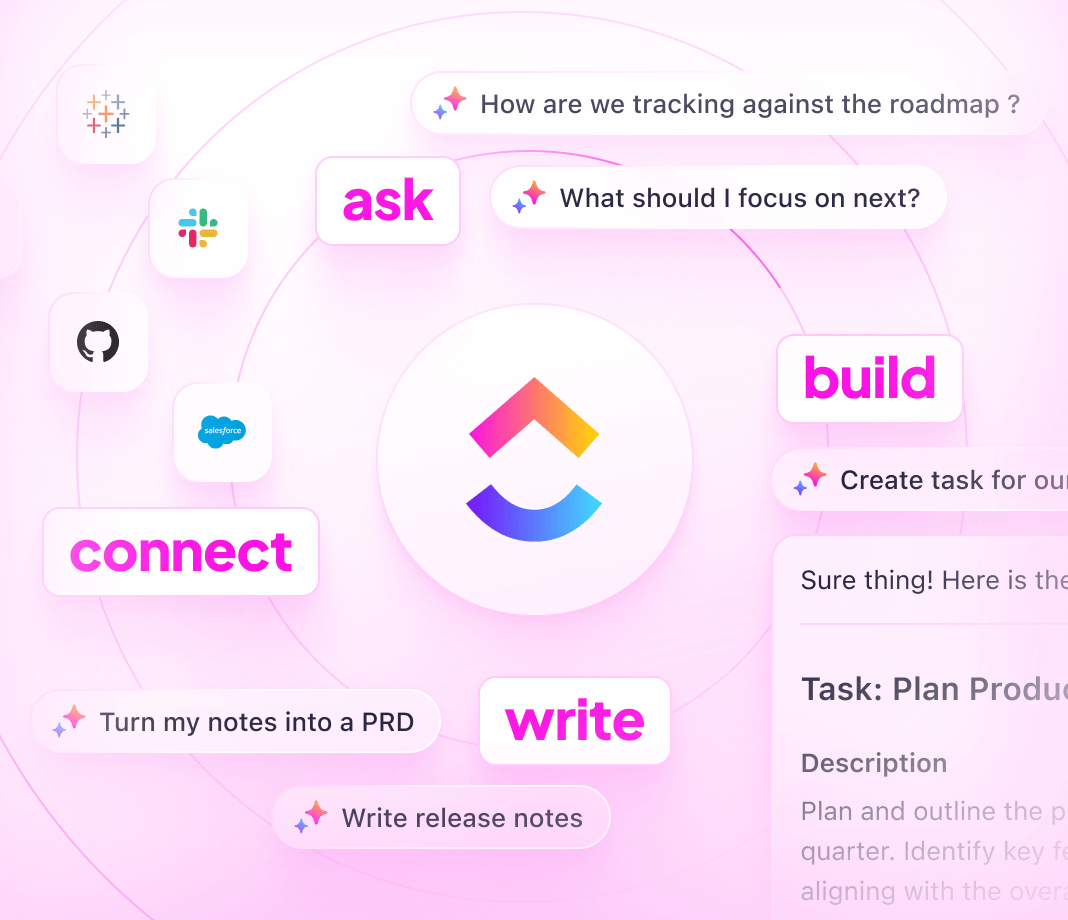

Transform the way you manage mortgages with AI Agents, your smart and effortless solution for calculating monthly payments, interest rates, and loan terms efficiently. Let ClickUp Brain be your trusted partner, streamlining the process and ensuring accuracy every step of the way.

How AI Agents Work for Mortgage Calculators

AI Agents in the mortgage calculation realm are like your personal math whizzes but without all the late-night study sessions. They streamline the complex process of loan calculations, interest rates, and payment schedules, transforming what used to take hours into a matter of seconds. These agents bring their A-game to facilitate efficient, accurate, and hassle-free mortgage management, making homebuying a smoother ride.

Types of AI Agents in Mortgage Calculations

- Competitor Analysis Agents: Compare market rates and offers from various lenders, ensuring you have the best deal at your fingertips.

- Data Analysis Agents: Monitor financial trends and provide insights on interest rate fluctuations.

- Task Automation Agents: Automate calculations of payments, interest, and amortization schedules, freeing your time and brain space.

- Personalized Recommendation Agents: Tailor suggestions based on individual financial situations, offering bespoke advice on mortgage options.

Putting AI Agents to Work

Imagine you're sitting down to figure out your monthly mortgage payment for your dream home. Instead of poring over spreadsheets and pulling out your calculator, an AI agent can do the heavy lifting for you. By inputting a few details—interest rate, loan amount, and term—your AI agent quickly crunches the numbers and delivers a precise monthly payment estimate. Need a more comprehensive breakdown? No problem! The same agent can analyze different scenarios, like adjusting the loan term or varying interest rates, so you can see exactly how each change affects your payments.

Moreover, suppose you're curious about how different lending offers stack up. A competitor analysis AI agent springs into action by compiling and comparing options from different lenders, making sure that you're never in the dark about your best financial move. With these AI allies in your corner, navigating the numerical labyrinth of mortgages becomes not just easier, but also empowering.

Benefits of Using AI Agents for Mortgage Calculator

Looking for efficiency, accuracy, and a competitive edge in the mortgage process? You've come to the right place! AI Agents can profoundly transform how mortgage calculations are handled. Here are some key benefits:

1. Enhanced Accuracy and Precision

- Eliminate Human Error: AI Agents offer unparalleled precision in calculations, ensuring accurate results every time.

- Complex Computations Simplified: Easily handle complex mortgage computations, adjusting parameters like interest rates, down payments, and loan terms in a flash.

2. Time-Saving Automation

- Quick Calculations: AI Agents process mortgage calculations faster than any human, freeing up valuable time for your team.

- Automated Updates: Automatically update interest rates and loan terms as they change in real time, ensuring calculations are always current.

3. Improved Customer Experience

- Instant Gratification: Customers receive immediate feedback on loan details, empowering them to make informed decisions quickly.

- Personalized Guidance: AI can tailor recommendations and insights based on specific customer data, offering a bespoke experience.

4. Cost Efficiency

- Reduce Overhead Costs: By automating routine tasks, AI Agents cut down on the need for extensive staffing, leading to significant savings.

- Optimize Resource Allocation: Redirect human resources to focus on complex problem-solving and customer relationship management.

5. Strategic Business Insights

- Data-Driven Decisions: Leverage AI to analyze customer interactions and preferences, providing actionable insights to refine business strategies.

- Predictive Analytics: Anticipate market trends and customer needs, staying a step ahead in competitive environments.

With AI Agents as your backstage support, mortgage calculations are not only simpler but also smarter—making your business more agile, responsive, and customer-centric. Harness the potential of AI and redefine your mortgage processes today!

Harness AI Agents for Mortgage Calculations

AI Agents are transforming mortgage calculations, making them faster, smarter, and more accurate. Here’s a look at how you can leverage AI Agents to simplify complex mortgage processes:

Instant Mortgage Calculations

- Quickly calculate monthly mortgage payments with just a few inputs.

- Automatically adjust calculations based on fluctuating interest rates.

Real-Time Interest Rate Updates

- Access up-to-the-minute interest rates from multiple financial institutions.

- Provide clients with the most current and competitive mortgage options.

Personalized Loan Scenarios

- Tailor mortgage options based on individual client profiles.

- Offer clients various financing scenarios to suit their unique needs.

Comparative Analysis

- Compare multiple mortgage products in seconds to find the best fit.

- Generate side-by-side comparisons to simplify client decision-making.

Amortization Schedules

- Automatically generate detailed amortization schedules for transparency.

- Provide clear breakdowns of principal and interest over the loan term.

Affordability Analysis

- Evaluate a client's financial situation to calculate affordable mortgage ranges.

- Analyze income, debts, and expenses to tailor suitable mortgage options.

Predictive Insights

- Leverage historical data to forecast potential mortgage rate changes.

- Analyze trends to advise clients on optimal times to lock in rates.

User-Friendly Interfaces

- Employ intuitive designs to guide users seamlessly through the mortgage process.

- Simplify complex data inputs with straightforward prompts and guides.

24/7 Client Support

- Offer around-the-clock assistance for mortgage-related queries.

- Use AI chatbots for immediate responses and follow-up on client inquiries.

Automated Documentation

- Streamline the documentation process by auto-filling required forms.

- Reduce errors and speed up approval with automated checks and submissions.

Utilizing AI Agents in mortgage calculations brings precision, efficiency, and ease to an otherwise intricate process. Make informed decisions faster and cater to your clients' needs with confidence!

Supercharge Your ClickUp Workspace with Chat Agents

Ready to transform your Workspace with a little AI magic? Meet ClickUp Brain's Chat Agents, your friendly AI sidekicks, designed to make work feel like less work. They're here to help you automate, adapt, and ace your productivity goals.

Why Use Chat Agents?

Imagine having an assistant who never sleeps, always stays focused, and knows your Workspace inside and out. That's what Chat Agents bring to the table.

- Autonomy: They operate independently, making decisions based on their environment and instructions.

- Reactivity: Chat Agents are like your super-alert office buddy, perceiving and reacting to changes in real-time.

- Proactivity: They don’t wait on you; they take charge to achieve goals.

- Interaction: Seamlessly blend with your team, interacting with Workspace items and responding to Chat messages.

- Goal-oriented: Driven by clear objectives, they streamline decision-making.

- Customizable: Tailor them with predefined prompts to suit your needs.

Types of Chat Agents and Their Use Cases

Chat Agents come in different flavors, each with unique talents:

Answers Agent

Got a flood of questions hitting your team chat about your product or services? Let the Answers Agent swoop in. It transforms those repetitive queries into opportunities for automation, drawing from specified knowledge sources. Save time and keep the conversational ball rolling smoothly.

Triage Agent

Worried about tasks slipping through the cracks? The Triage Agent ensures no action item gets left behind. It diligently scans Chats, connecting relevant threads to tasks, and keeps everyone on the same page. Your virtual taskmaster ensures your to-do list doesn’t spiral into chaos.

Create Your Own Agent

Feeling creative? Design a Chat Agent from scratch to perform actions that align perfectly with your team's unique workflow requirements.

Relating to the Mortgage Calculator Use Case

If you're coordinating a mortgage calculator feature project within your team, leverage these agents to stay organized. Consider using the Triage Agent to ensure every calculation feedback session or technical query spins off into a tracked task, so your revolutionary calculator feature launches without a hitch.

In essence, ClickUp Brain's Chat Agents offer not just workflows – they offer a way to redefine how your team collaborates and communicates. So, why not let a bit of AI into your Workspace? Your productivity will thank you.

Certainly! Here's some information on challenges and considerations for using AI Agents in mortgage calculations:

Navigating Challenges with AI Agents for Mortgage Calculations

Using AI agents to streamline mortgage calculations can be a game-changer, but it's essential to address some hurdles you might encounter. Here’s a look at potential pitfalls and actionable strategies to overcome them:

Common Pitfalls

Data Accuracy

- Challenge: Inaccurate input data can lead to incorrect mortgage calculations.

- Solution: Implement robust validation checks to ensure data entry is precise. Educate users on the importance of input accuracy.

Complex Regulatory Landscapes

- Challenge: Mortgage regulations vary by region and change frequently, which can complicate calculations.

- Solution: Continuously update the AI with the latest regulatory information and check calculations against local policies to ensure compliance.

User Trust

- Challenge: Users may be skeptical about relying solely on AI for financial decisions.

- Solution: Build transparency into the AI by explaining how calculations are made and allow users to cross-verify results manually.

Algorithm Bias

- Challenge: AI agents might inadvertently reflect biases present in the training data.

- Solution: Regularly audit and refine the data and algorithms to ensure fairness and equitable outcomes for all users.

Technical Limitations

- Challenge: AI systems may struggle with nuanced scenarios outside their programming scope.

- Solution: Include a fallback mechanism that refers complex queries to human experts when necessary.

Considerations for Effective Use

User Education:

- Provide clear instructions and examples to guide users, ensuring they know how to input data correctly and interpret results.

Continuous Learning:

- Keep the AI agent learning with real-time data updates and feedback loops from user interactions to improve its accuracy and usability.

Integration with Experts:

- Position AI agents as complementary tools alongside mortgage experts, not replacements. They excel in computations but should guide users to expert advice for complex decisions.

Feedback Mechanism:

- Establish a straightforward process for users to provide feedback on the AI’s performance, enabling continuous improvement.

Navigating the world of mortgage calculations with AI agents requires careful consideration of these potential challenges. By focusing on accuracy, compliance, transparency, and user education, you can enhance efficiency while offering a reliable tool for users.

Feel free to use this structured guide as you journey through the integration of AI agents into mortgage calculations. It's all about creating more user-friendly, effective solutions!