Sync your time into ClickUp.

Connect your favorite time tracking app to ClickUp to sync time tracked directly within ClickUp. Integrate your time tracking with Toggl, Harvest, and many more of today's most popular time tracking apps.

Track, analyze, and optimize your time effortlessly with the best time tracking software for Wealth Managers using ClickUp. Gain valuable insights into your team's productivity, allocate resources effectively, and improve project efficiency with our powerful time tracking tools. Sign up now to streamline your workflow and take your wealth management business to the next level with ClickUp.

Free forever.

No credit card.

Trusted by the world’s leading businesses

Connect your favorite time tracking app to ClickUp to sync time tracked directly within ClickUp. Integrate your time tracking with Toggl, Harvest, and many more of today's most popular time tracking apps.

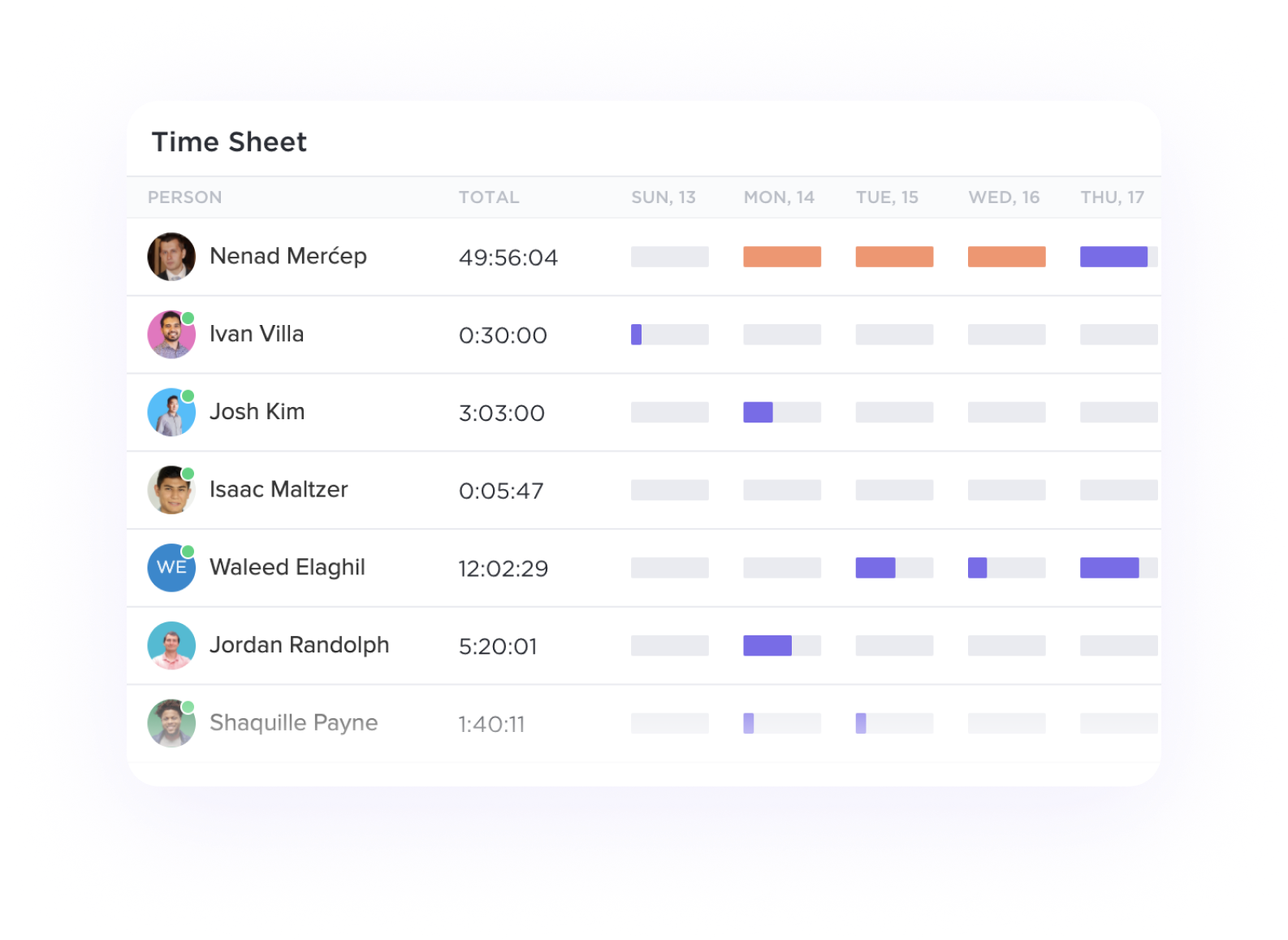

View your time tracked by day, week, month, or any custom range with detailed time sheets. Show time totals grouped by dates and see individual tasks and time entries for a deeper look at where time was spent.

Wealth managers often provide personalized services to clients, including financial planning, investment advice, and portfolio management. Time Tracking software allows wealth managers to accurately track the time spent on each client, ensuring that they are fairly compensated for their services and can also optimize their time allocation for maximum productivity.

The financial services industry is heavily regulated, and wealth managers need to adhere to various compliance requirements. Time Tracking software can help in documenting and reporting time spent on compliance-related activities, ensuring that all regulatory obligations are met and providing a clear audit trail if needed.

Wealth managers may have special projects or requests from clients that require dedicated time and attention. Time Tracking software enables wealth managers to create specific project codes or categories, track time spent on these projects, and ensure accurate billing or reporting for these additional services.

By tracking time spent on different tasks, clients, or projects, Time Tracking software provides valuable insights into how wealth managers allocate their time. This analysis can help in identifying areas where time is being underutilized, optimizing time management strategies, and improving overall performance and profitability.

Wealth managers often bill clients based on the time spent on their accounts or projects. Time Tracking software ensures accurate billing by recording all billable hours and activities, providing transparent reports to clients, and reducing disputes over invoices. This transparency builds trust with clients and enhances the billing process efficiency.

Time Tracking data can be used for forecasting future workloads, resource planning, and setting realistic client expectations. By understanding historical time data, wealth managers can better estimate the time required for similar tasks in the future, allocate resources efficiently, and ensure that client needs are met in a timely manner.

Time tracking software can help wealth managers in managing clients' portfolios more effectively by providing accurate records of time spent on different tasks, allowing for better billing accuracy, improved productivity, and enhanced client communication and transparency.

Yes, integrating wealth management tools with time tracking software can streamline workflows by providing a comprehensive view of time spent on financial activities, enhancing productivity, and enabling accurate billing and reporting for clients.

Key features of time tracking software for wealth managers include client project tracking, billable hours monitoring, expense tracking, integrated invoicing, and customizable reporting. Benefits include accurate billing, improved productivity, better client insights, and streamlined financial management.