Sync your time into ClickUp.

Connect your favorite time tracking app to ClickUp to sync time tracked directly within ClickUp. Integrate your time tracking with Toggl, Harvest, and many more of today's most popular time tracking apps.

Track every minute of your work effortlessly with the leading time tracking software for Corporate Finance Advisors, all integrated seamlessly with ClickUp. Stay organized, boost productivity, and never miss a billable hour again. Join the thousands of professionals who trust our solution to streamline their time management and focus on what truly matters.

Free forever.

No credit card.

Trusted by the world’s leading businesses

Connect your favorite time tracking app to ClickUp to sync time tracked directly within ClickUp. Integrate your time tracking with Toggl, Harvest, and many more of today's most popular time tracking apps.

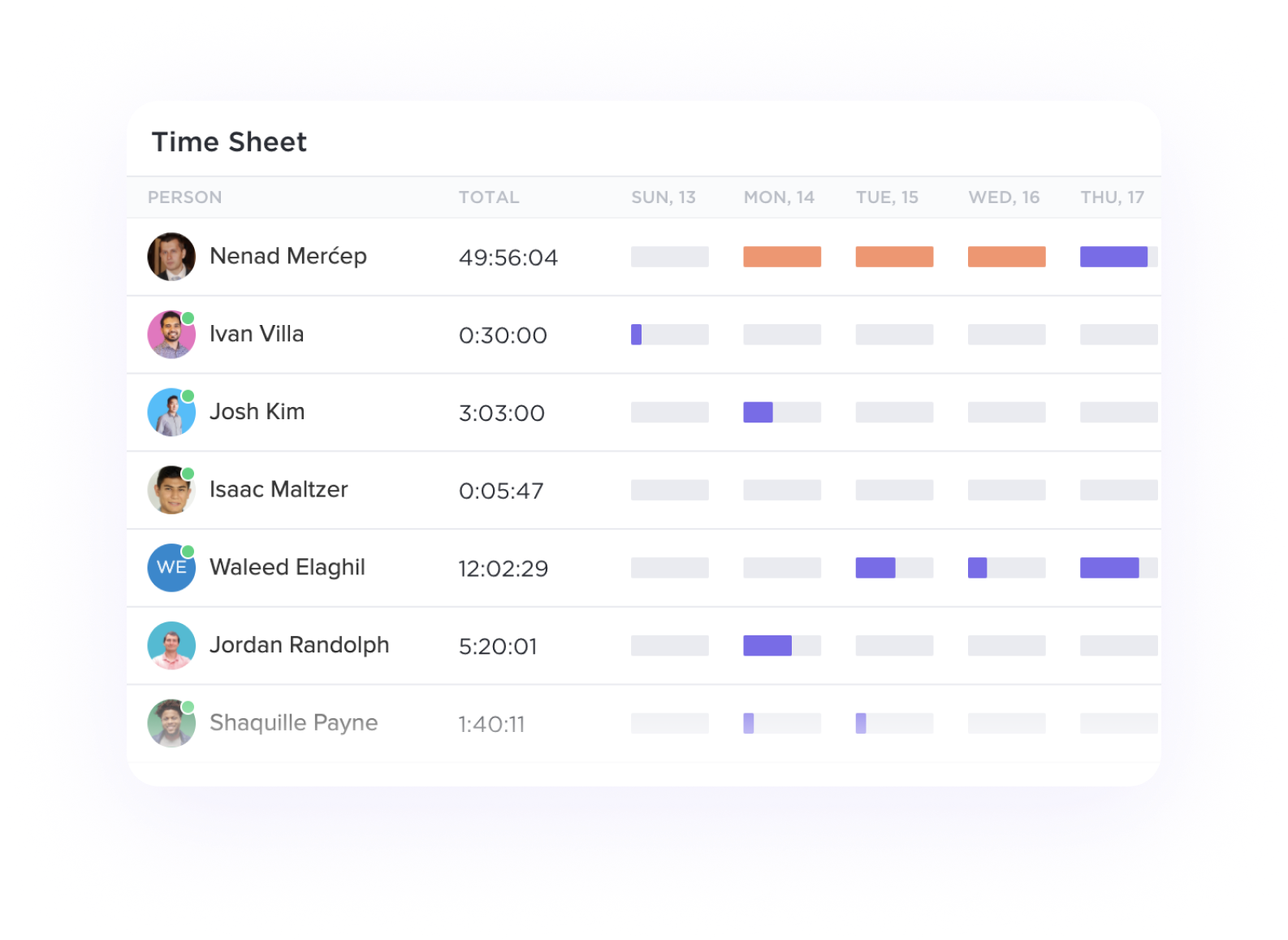

View your time tracked by day, week, month, or any custom range with detailed time sheets. Show time totals grouped by dates and see individual tasks and time entries for a deeper look at where time was spent.

Corporate finance advisors often work on multiple projects simultaneously. Time tracking tools can help them allocate time efficiently across projects by providing insights into how much time is spent on each task. This data can assist in prioritizing tasks, optimizing project schedules, and ensuring timely delivery.

Accurate time tracking is crucial for corporate finance advisors when billing clients for services rendered. By using time tracking tools, advisors can easily log billable hours, generate detailed invoices based on time spent on specific tasks, and provide transparent billing information to clients. This ensures fair compensation for the services provided.

Time tracking tools can help corporate finance advisors assess their productivity and performance. By monitoring how time is allocated throughout the day, advisors can identify inefficiencies, track progress on deliverables, and make data-driven decisions to improve productivity. This information can also be valuable during performance evaluations and goal setting.

Corporate finance advisors often work within project budgets and timelines. Time tracking tools can assist in monitoring actual time spent on tasks compared to the estimated time, helping advisors stay within budget constraints. By tracking time against project budgets, advisors can make informed decisions to optimize resource allocation and prevent budget overruns.

Effective time management is essential for corporate finance advisors to juggle multiple tasks and deadlines efficiently. Time tracking tools can help advisors prioritize tasks based on time-sensitive projects, deadlines, or client requirements. By tracking time spent on each task, advisors can allocate time more effectively, meet deadlines, and deliver high-quality work consistently.

Corporate finance advisors often work on multiple projects simultaneously, making it crucial to track time spent on each task accurately. Time Tracking software enables advisors to monitor and analyze their time allocation, identify inefficiencies, and prioritize tasks effectively to ensure timely project delivery.

With various projects running concurrently, it can be challenging for advisors to monitor progress, deadlines, and resource allocation. Time Tracking software provides real-time updates on project statuses, task completion rates, and potential bottlenecks, helping advisors stay on top of project timelines and deliverables.

Accurately billing clients for the time spent on different tasks and projects is essential for financial advisors. Time Tracking software automates the process of tracking billable hours, ensuring that clients are invoiced correctly based on actual work done. This transparency builds trust with clients and minimizes billing disputes.

Time Tracking software can reveal patterns of productivity and inefficiency within workflows. By analyzing time data, advisors can identify areas for improvement, eliminate time-wasting activities, and implement strategies to boost overall productivity. This data-driven approach empowers advisors to work more efficiently and effectively.

In the finance industry, maintaining accurate records of time spent on client projects is crucial for regulatory compliance and audit purposes. Time Tracking software creates a detailed audit trail of activities, timestamps, and project timelines, ensuring that advisors can demonstrate compliance with industry standards and client requirements.

Time Tracking software allows corporate finance advisors to assess how resources are allocated across different projects and clients. By analyzing time data, advisors can identify underutilized resources, allocate them more effectively, and ensure that each project receives the necessary attention and expertise for successful outcomes.

Time tracking software helps corporate finance advisors improve productivity and efficiency by providing accurate insights into time spent on tasks, facilitating better resource allocation, identifying inefficiencies, and enabling streamlined workflow management.

Yes, time tracking software often includes features such as project billing rates, expense tracking, client invoicing, and detailed time and expense reports that are tailored for corporate finance advisors to accurately track billable hours and expenses for client projects.

Yes, time tracking software can integrate with financial management software and project management software to streamline processes, improve accuracy in billing and reporting, and enhance overall efficiency for corporate finance advisors.