Task Management for Tax Experts

Task Management Software Tailored for Tax Professionals

Organize client accounts, monitor filing deadlines, collaborate with your team effortlessly, and gain full visibility on every tax project stage.

Trusted by the best

Managing Tax Tasks Effectively

Why Tax Professionals Need Robust Task Management

Handling tax workflows without a dedicated system results in missed deadlines, scattered client data, and growing complexity — turning routine filings into stressful challenges.

- Filing deadlines overlap — making it tough to prioritize client returns and extensions.

- Client documents get misplaced — important tax forms and receipts are scattered or lost.

- Regulatory changes cause confusion — keeping up with tax code updates is overwhelming.

- Team coordination suffers — unclear task ownership leads to duplicated or missed work.

- Audit preparation feels chaotic — gathering records across clients becomes time-consuming.

- Progress tracking is unclear — tax season milestones can slip without visibility.

- Communication breaks down — emails and calls make collaboration inefficient.

- Resource allocation is tricky — balancing workload during peak season is a constant struggle.

Traditional Methods vs ClickUp

Why Traditional Tax Management Falls Short

Discover how ClickUp delivers clarity and control where old methods falter.

Conventional Methods

- Tasks scattered in spreadsheets, emails, and sticky notes

- Client records disorganized and hard to access

- Manual tracking prone to errors and missed deadlines

- Team roles unclear leading to duplicated efforts

- Compliance updates easily overlooked

- Communication lost across platforms

ClickUp Task Management

- Unified task lists with statuses and priorities

- Secure client document storage with easy retrieval

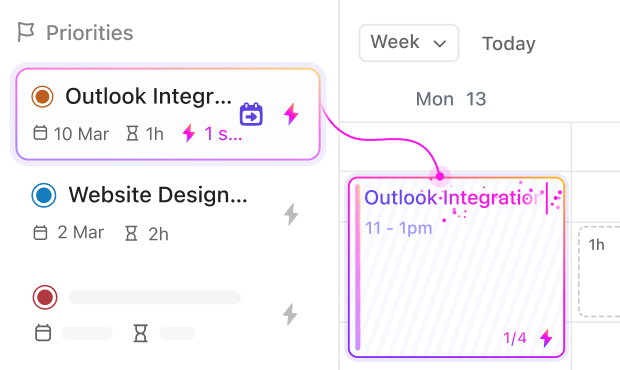

- Automated deadline reminders and calendar syncing

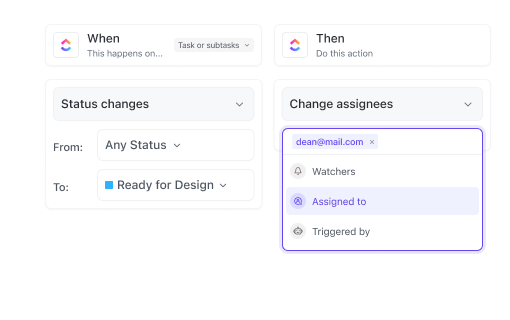

- Clear task ownership with real-time collaboration

- Integrated compliance checklists and updates

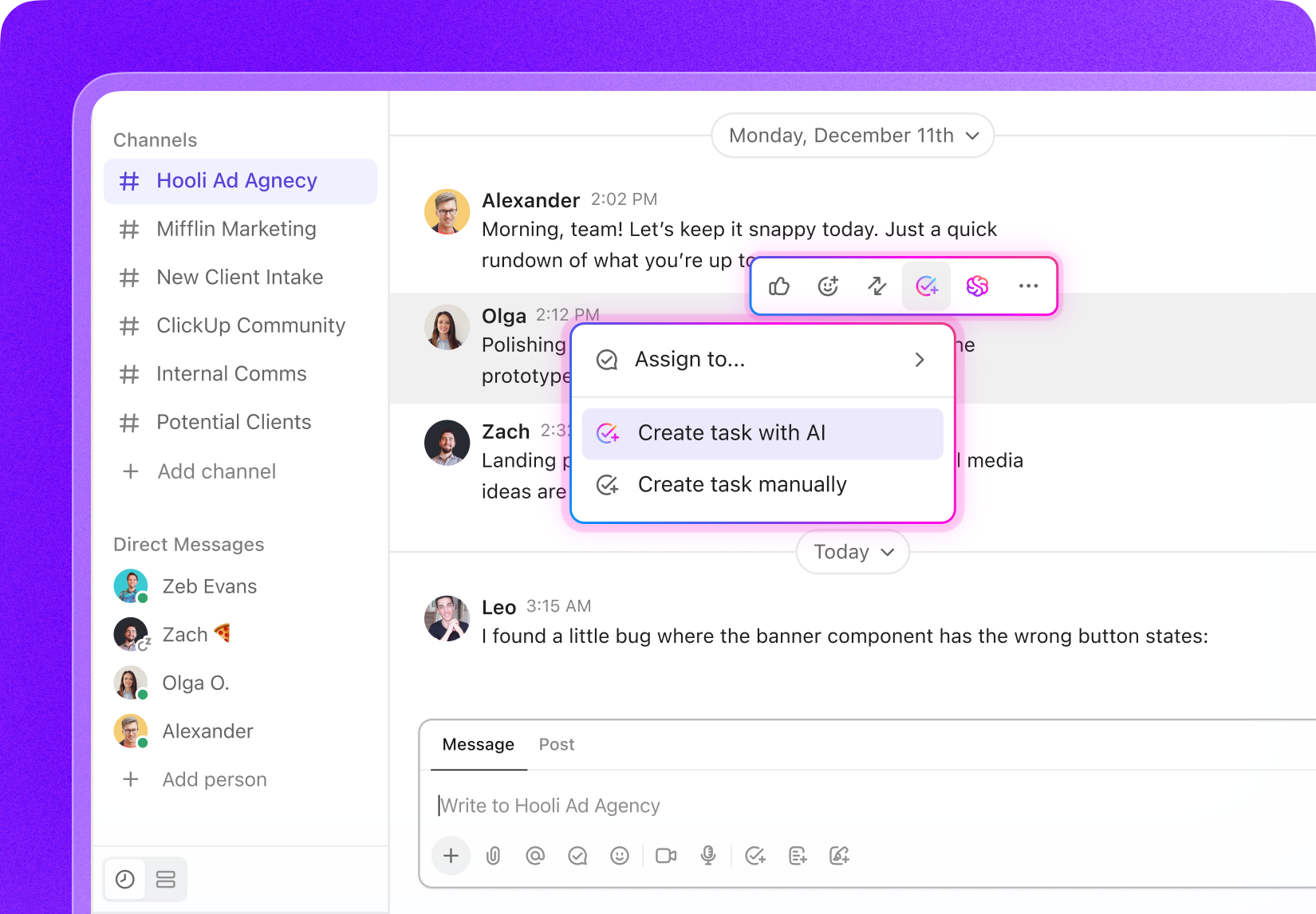

- Centralized communication within tasks

Use Cases

Unlocking Task Management Benefits for Tax Professionals

See how focused task tracking eliminates confusion and streamlines tax workflows.

#UseCase1

Consolidating Client Data Across Teams

All client information—from receipts to tax forms—is stored securely in ClickUp, accessible to authorized team members at any time.

#UseCase2

Maintaining Complete Audit Trails

ClickUp tracks every action and document linked to a client, ensuring full transparency and readiness for audits.

#UseCase3

Managing Ever-Changing Tax Regulations

Stay updated with compliance checklists and alerts integrated into workflows, so regulatory changes never catch you off guard.

#UseCase4

Ensuring Timely Tax Filings Without Overlaps

Utilize dependencies and reminders to prioritize returns and extensions, preventing last-minute rushes.

#UseCase5

Coordinating Team Assignments During Peak Seasons

Assign tasks clearly with deadlines and progress tracking to balance workload and avoid bottlenecks.

#UseCase6

Streamlining Client Communication and Feedback

Centralize messages, notes, and approvals within tasks to keep client interactions organized and actionable.

#UseCase7

Tracking Multi-Client Projects Seamlessly

Manage complex engagements involving multiple entities with customizable views and filters.

#UseCase8

Reducing Data Entry Errors with Templates

Use reusable task templates for common filings to ensure accuracy and consistency.

#UseCase9

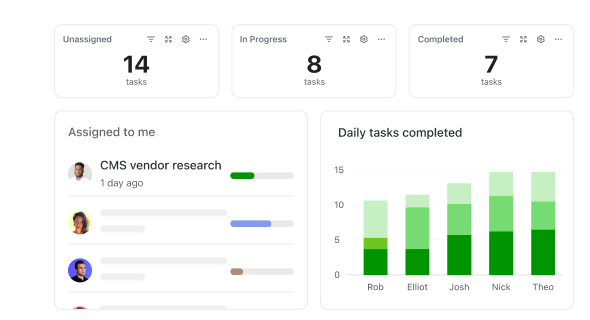

Preparing Reports Effortlessly

Generate progress reports and deadlines at a glance using dashboards and automated summaries.

Key Beneficiaries

Who Gains the Most from ClickUp Task Management

Designed for tax professionals seeking a comprehensive workspace to manage complex tax projects.

If you’re an Individual Tax Consultant

ClickUp keeps your client data consolidated, deadlines clear, and communications streamlined so you can focus on delivering expert advice without administrative stress.

If you’re Part of a Tax Firm Team

Coordinate assignments, track progress across multiple clients, and ensure compliance seamlessly during high-demand periods without losing oversight.

If you’re a Corporate Tax Manager

Manage internal tax projects, collaborate with departments, and prepare filings with precision through customizable workflows and real-time updates.

How ClickUp Empowers Tax Professionals

Optimize Every Step of Your Tax Workflow

Manage clients, filings, and compliance effortlessly in one platform.

Centralize Everything

Store literature, datasets, protocols, drafts, and grant docs in one workspace — no more scattered files.

Plan Research in Phases

Break projects into proposal, literature review, experiments, analysis, and writing with task lists and Gantt timelines.

Standardize Experiments & Fieldwork

Use templates and checklists for repeatable, error-free lab or field procedures.

Collaborate Across Teams

Assign tasks to co-authors, lab members, or collaborators. Shared boards and dashboards keep everyone aligned.

Turn Meetings Into Actionable Tasks

Convert supervisor or lab meetings into tasks with owners, checklists, and deadlines.

Stay on Top of Deadlines & Funding

Track grants, conferences, and submissions with automated reminders and calendars.