Task Management Software Tailored for Financial Advisors

Why Financial Advisors Require Specialized Task Management

Handling client portfolios and regulatory requirements without an organized system causes missed opportunities, fragmented information, and increased stress.

- Complex client timelines become blurred — making it difficult to track meetings, reviews, and follow-ups.

- Investment research gets disorganized — insights and data scattered across platforms hamper decision-making.

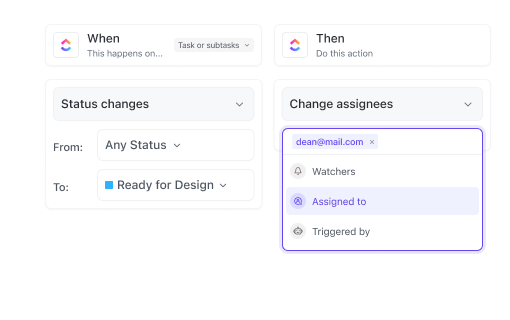

- Compliance deadlines risk being overlooked — missing filings or disclosures can lead to penalties.

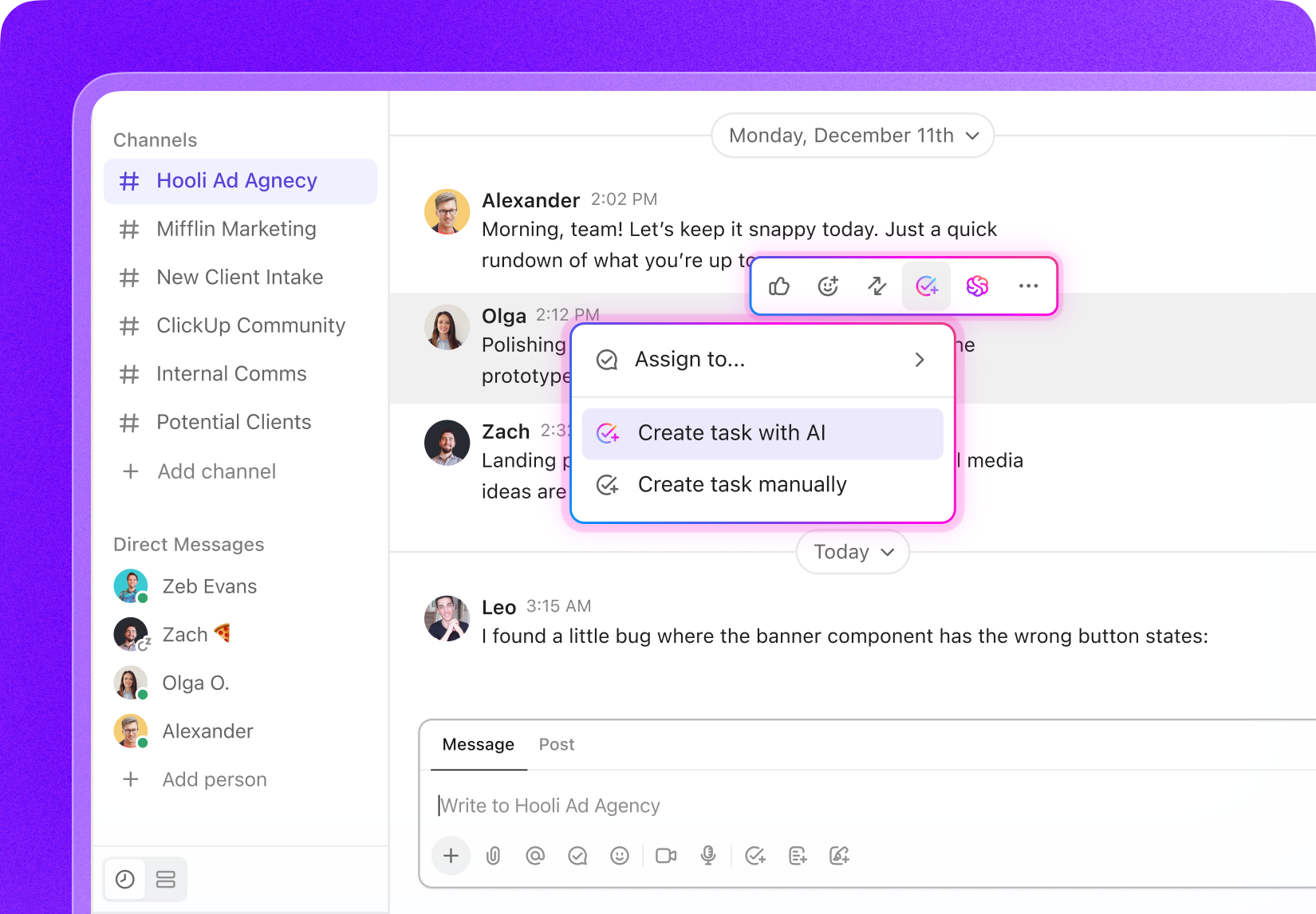

- Team communication falters — unclear responsibilities and scattered messages delay client responses.

- Critical client actions slip through — without reminders, important calls and document submissions get delayed.

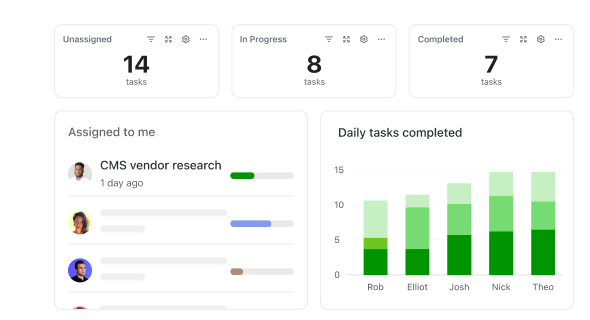

- Progress tracking feels opaque — it’s hard to gauge portfolio updates or task completions.

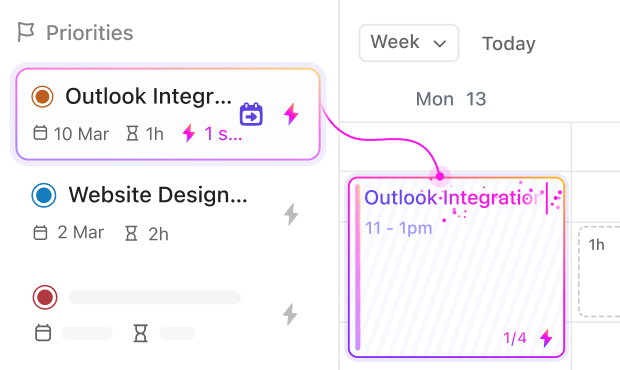

- Resource scheduling conflicts emerge — overlapping appointments and workloads reduce efficiency.

- Manual processes increase errors — juggling spreadsheets and emails invites mistakes and delays.

Why Traditional Task Methods Fall Short for Financial Advisors

Traditional Methods

- Tasks spread across emails, calendars, and notes

- Investment research stored in disconnected files

- Compliance tracked manually, prone to errors

- Collaboration limited by email threads and phone calls

- Deadlines managed with basic reminders

- Client information scattered and hard to access

ClickUp Task Management

- Centralized task hub with clear priorities and deadlines

- Organized research with tags, files, and notes linked to tasks

- Automated compliance checklists and deadline alerts

- Real-time team collaboration with assigned roles and comments

- Integrated calendars syncing client meetings and submissions

- Searchable client profiles and document attachments

How Task Management Software Empowers Financial Advisors

Consolidating Client Data and Communications

Ensuring Compliance with Regulatory Deadlines

Streamlining Portfolio Review Processes

Managing Client Meeting Schedules and Follow-ups

Coordinating Team Responsibilities Across Clients

Tracking Investment Research and Market Analysis

Avoiding Missed Renewal Dates and Contract Deadlines

Preventing Duplicate Client Tasks and Requests

Turning Client Feedback into Actionable Plans

Who Benefits Most from ClickUp’s Task Management in Finance

If you’re an Independent Financial Advisor

Stay organized with client appointments, investment strategies, and compliance tasks — all in one place without juggling multiple tools.

If you’re Part of a Financial Advisory Firm

Coordinate team workloads, share market research, and standardize client communications efficiently across your entire firm.

If you’re a Wealth Management Team Leader

Oversee portfolio reviews, delegate tasks, and monitor progress with real-time dashboards that keep your team aligned and informed.

How ClickUp Organizes Every Aspect of Financial Advisory

Manage client portfolios, compliance, and team collaboration without switching tools.

Centralize Everything

Plan Research in Phases

Break projects into proposal, literature review, experiments, analysis, and writing with task lists and Gantt timelines.

Standardize Experiments & Fieldwork

Collaborate Across Teams

Assign tasks to co-authors, lab members, or collaborators. Shared boards and dashboards keep everyone aligned.