Task Management Tailored for Banking Professionals

Task Management Software Designed Specifically for Banks

Centralize your banking tasks, monitor project milestones, collaborate effortlessly across departments, and maintain full transparency over every phase of your operations.

Trusted by the best

The Challenge of Managing Banking Operations

Why Banks Require Specialized Task Management Solutions

Handling banking projects without a robust task system invites errors, delays, and fragmented information—turning routine operations into complex hurdles.

- Complex regulatory timelines cause compliance risks — making it difficult to track approvals and filings.

- Loan processing involves multiple stakeholders — leading to miscommunication and redundant steps.

- Fraud detection requires coordinated responses — with scattered alerts and unresolved tasks.

- Client onboarding slows down — due to disjointed workflows and manual handoffs.

- Audit preparations become stressful — missing documentation and unclear responsibilities.

- Communication gaps create service delays — emails and messages get lost among teams.

- Resource allocation is inefficient — overlapping workloads and conflicting schedules.

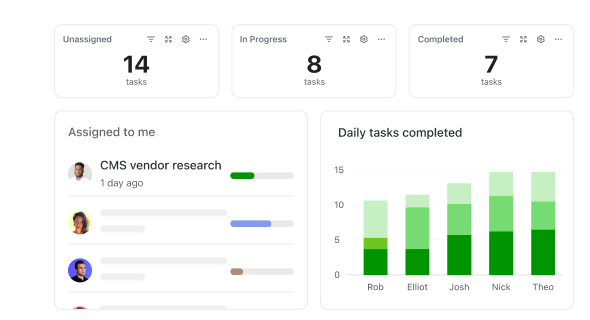

- Progress tracking is opaque — making it hard to identify bottlenecks or delays.

Conventional Banking vs ClickUp

Why Traditional Banking Operations Fall Short

Discover how ClickUp delivers clarity and control that legacy systems can't match.

Traditional Banking Methods

- Tasks spread across emails, spreadsheets, and informal notes

- Loan and compliance documents disorganized

- Manual tracking prone to errors and delays

- Limited visibility on team responsibilities

- Deadlines for regulatory filings often missed

- Communication fragmented across channels

ClickUp Task Management

- Unified task hub with clear priorities and statuses

- Structured document management with easy access

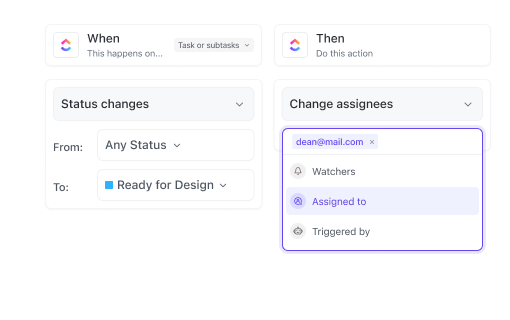

- Automated workflows reduce manual errors

- Transparent ownership and real-time updates

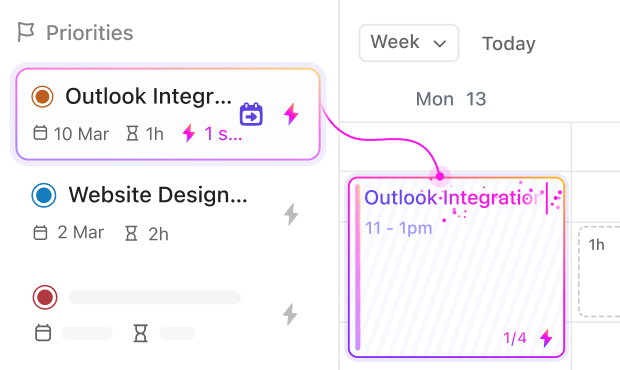

- Calendar sync and automated reminders for all deadlines

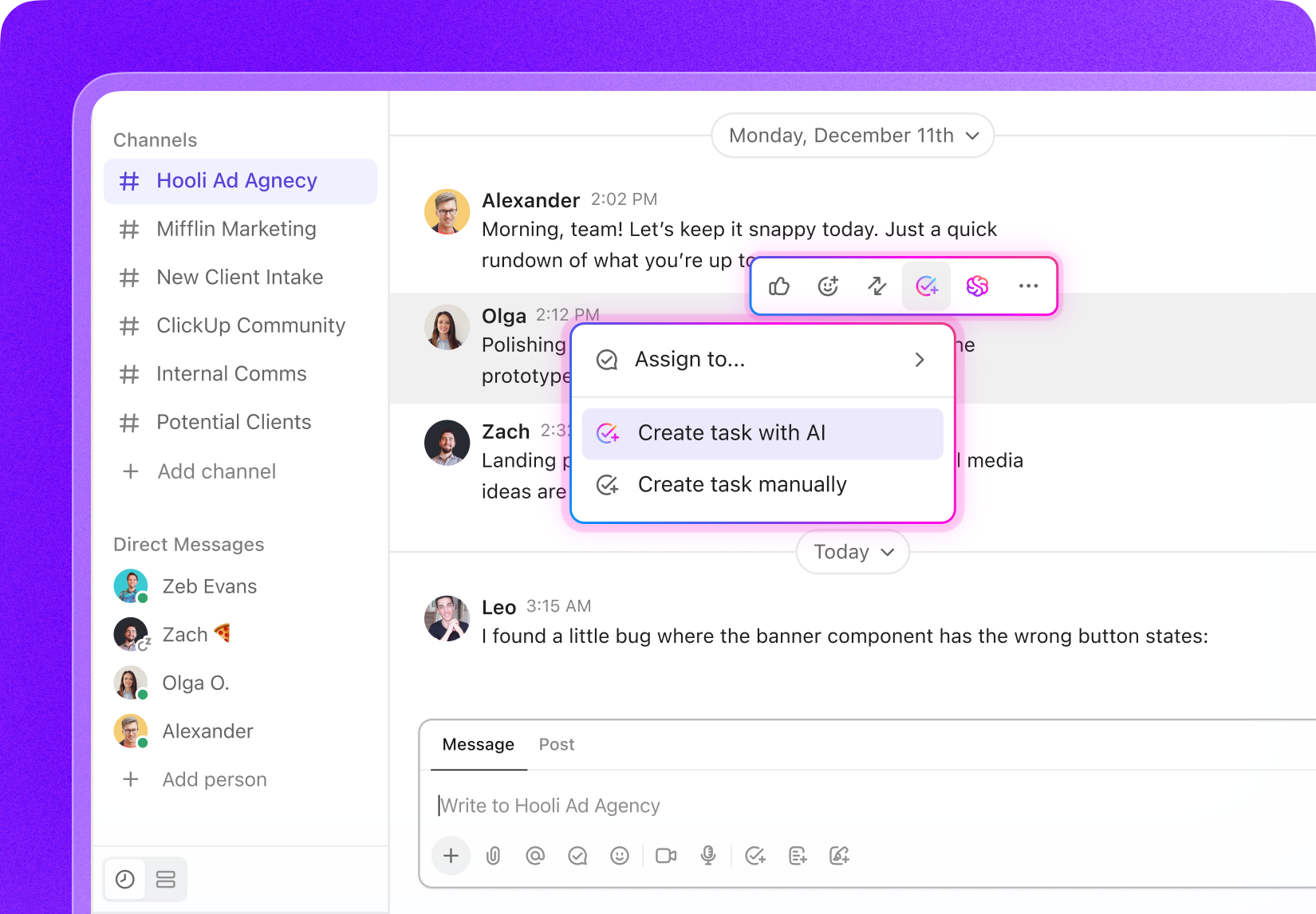

- Centralized communication with threaded comments

Use Cases

How Task Management Software Empowers Banks to Excel

See how task automation and visibility reduce errors and boost team efficiency.

#UseCase1

Consolidating Client Information Across Departments

Customer data, loan applications, and compliance documents are centralized—ClickUp attaches relevant files to tasks ensuring everyone accesses accurate information.

#UseCase2

Maintaining an Audit-Ready Trail of Transactions and Approvals

ClickUp logs every task update, comment, and file attachment, creating a transparent, verifiable timeline for audits and regulatory reviews.

#UseCase3

Coordinating Fraud Investigation Teams Efficiently

Real-time collaboration with task assignments and comment threads keeps investigations focused and ensures no leads fall through the cracks.

#UseCase4

Standardizing Loan Processing Protocols

Templates, checklists, and dependencies in ClickUp help maintain consistency and compliance throughout loan approvals and disbursements.

#UseCase5

Tracking Compliance and Regulatory Deadlines

Custom workflows and automated reminders keep your team ahead of filings, risk assessments, and policy updates to avoid penalties.

#UseCase6

Mapping Complex Transaction Approvals

ClickUp’s custom statuses and dependencies visualize multi-step approvals, ensuring smooth handoffs and accountability.

#UseCase7

Managing Multi-Branch Project Timelines

Oversee initiatives across branches with Gantt charts and shared dashboards that provide instant insight into progress and resource needs.

#UseCase8

Preventing Duplication in Customer Service Requests

Track tickets as tasks with tags and filters to avoid repeated follow-ups and improve response times.

#UseCase9

Turning Client Meetings into Actionable Plans

Convert conversation points into assigned tasks with deadlines, ensuring follow-through and enhanced client satisfaction.

Key Beneficiaries

Who Benefits Most from ClickUp in Banking

Designed for banking professionals seeking streamlined task oversight and collaboration.

If you’re a Compliance Officer

ClickUp helps you track regulatory requirements, deadlines, and audits with automated alerts to ensure full compliance without stress.

If you’re a Loan Processor

Manage loan workflows with templates, clear task assignments, and real-time progress updates to speed approvals and reduce errors.

If you’re a Branch Manager

Coordinate multi-team projects, resource allocation, and customer service tasks across branches to ensure operational excellence.

How ClickUp Supports Banks

How ClickUp Streamlines Banking Task Management

Handle compliance, loans, audits, and customer relations seamlessly.

Centralize Everything

Store literature, datasets, protocols, drafts, and grant docs in one workspace — no more scattered files.

Plan Research in Phases

Break projects into proposal, literature review, experiments, analysis, and writing with task lists and Gantt timelines.

Standardize Experiments & Fieldwork

Use templates and checklists for repeatable, error-free lab or field procedures.

Collaborate Across Teams

Assign tasks to co-authors, lab members, or collaborators. Shared boards and dashboards keep everyone aligned.

Turn Meetings Into Actionable Tasks

Convert supervisor or lab meetings into tasks with owners, checklists, and deadlines.

Stay on Top of Deadlines & Funding

Track grants, conferences, and submissions with automated reminders and calendars.