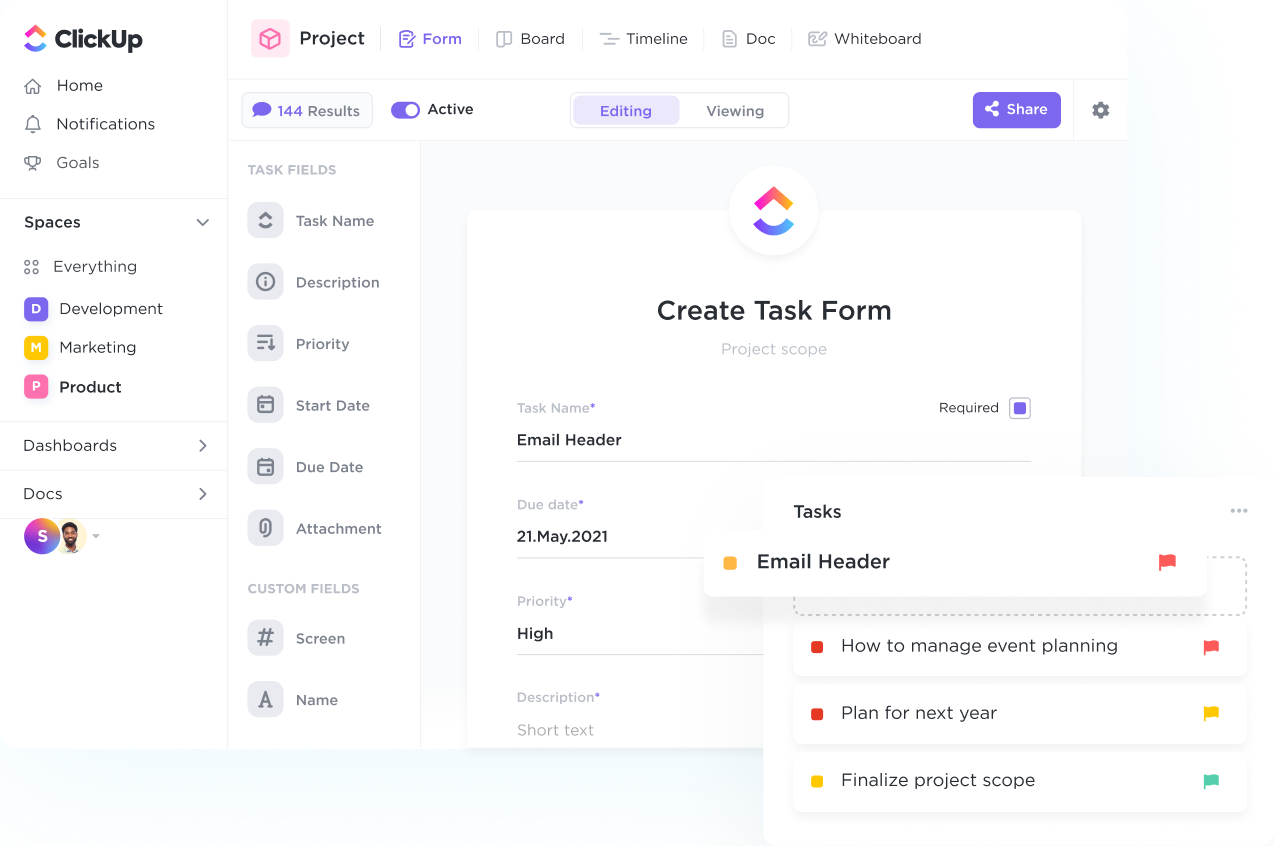

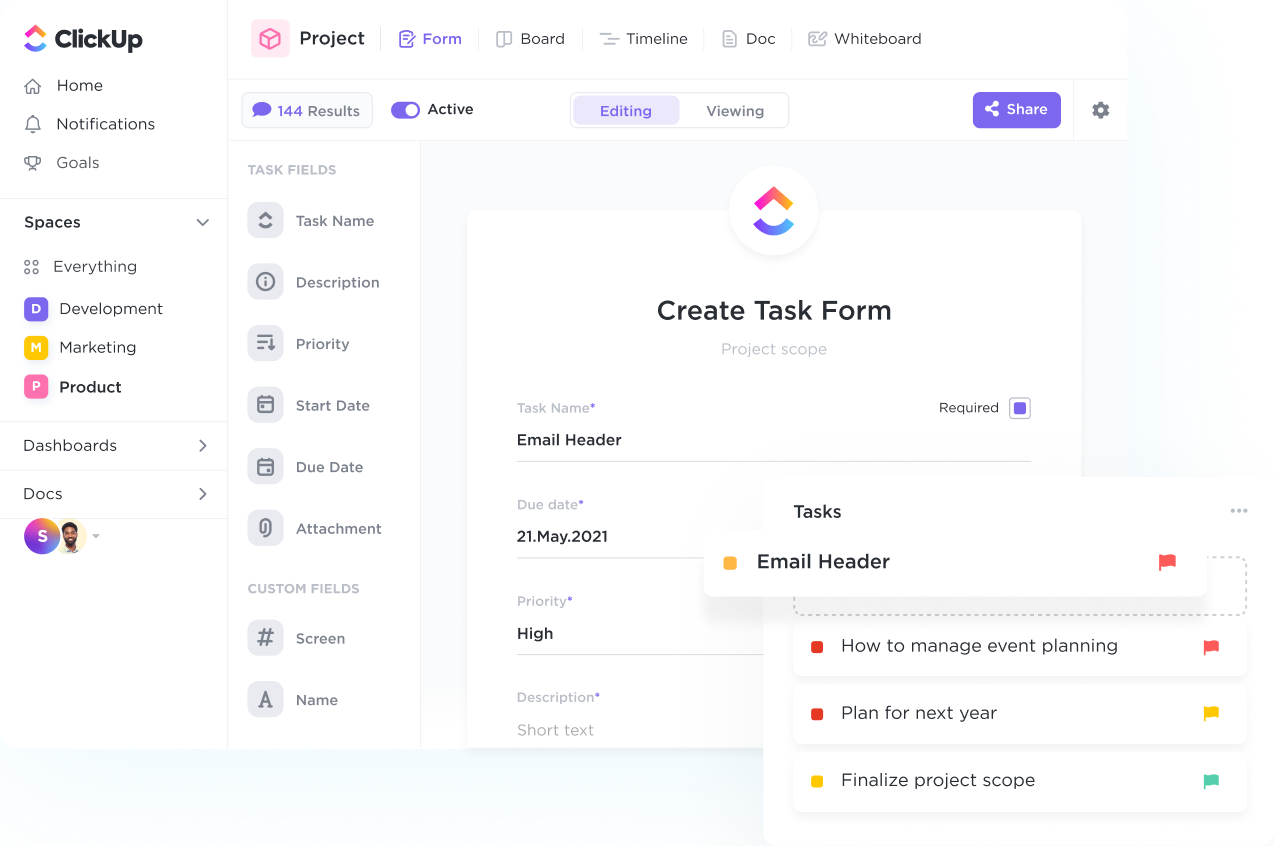

Onboard customers and collect info in a snap.

Streamline your intake process, organize response data, and automatically create tasks with custom branded Forms powered by conditional logic.

Transform the way Wealth Managers manage client relationships with ClickUp's tailored CRM system. Streamline communication, track client interactions, and enhance productivity all in one platform. Say goodbye to scattered data and hello to a centralized solution designed to help Wealth Managers succeed.

Free forever.

No credit card.

Trusted by the world’s leading businesses

Streamline your intake process, organize response data, and automatically create tasks with custom branded Forms powered by conditional logic.

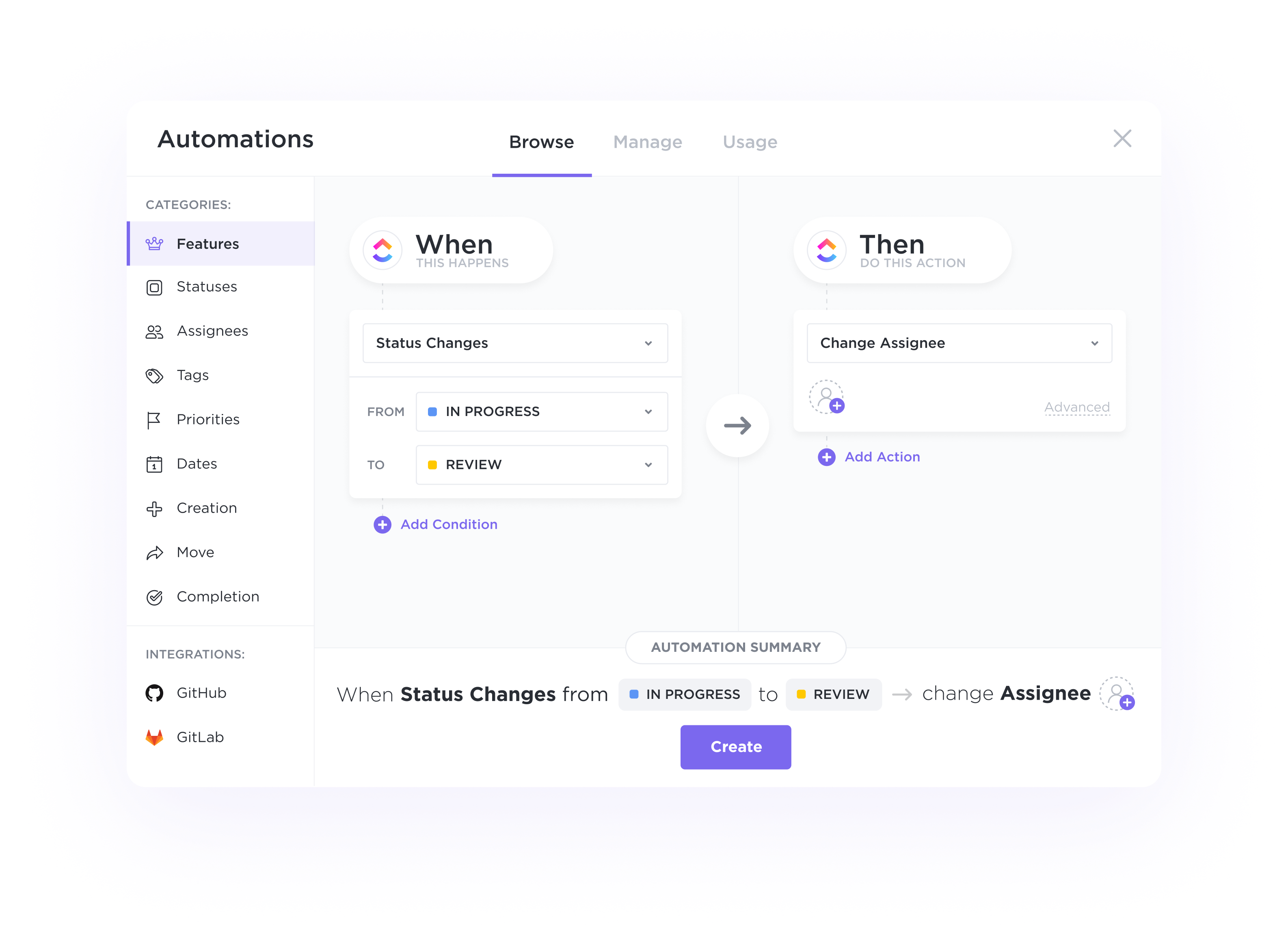

Automatically assign tasks for each stage of your pipeline, trigger status updates based on activity, and switch priorities to alert your team on where to focus next.

CRMs can help wealth managers capture leads from various sources, qualify them based on specific criteria such as investable assets or financial goals, and track their progress through the client acquisition process.

Wealth managers can use CRMs to visualize where potential clients are in the sales process, helping them prioritize high-value opportunities and efficiently move clients through the pipeline towards conversion.

CRMs enable wealth managers to analyze client behavior, track investment preferences, and generate reports on client portfolios. This data-driven approach helps in providing personalized investment recommendations and improving client satisfaction.

With a centralized CRM database, wealth managers can store detailed client information, track interactions, and manage relationships effectively. This ensures that all team members have access to up-to-date client data for personalized service delivery.

CRMs can automate routine tasks such as client onboarding, investment account reviews, and compliance processes. By streamlining workflows, wealth managers can focus more on strategic client relationships and less on administrative tasks.

CRM software helps wealth managers improve client relationships and enhance customer service by centralizing client information, tracking interactions, and providing insights that enable personalized communication, timely follow-ups, and tailored financial advice.

CRM software for wealth managers often includes features such as portfolio management tools, client communication tracking, financial goal tracking, risk assessment capabilities, and compliance monitoring functionalities to help manage client relationships effectively in the wealth management industry.

CRM software can assist wealth managers in efficiently tracking and managing investment portfolios and financial transactions by centralizing client data, providing real-time updates on portfolio performance, and facilitating communication with clients regarding investment strategies and opportunities.