Analyze data for customer insights.

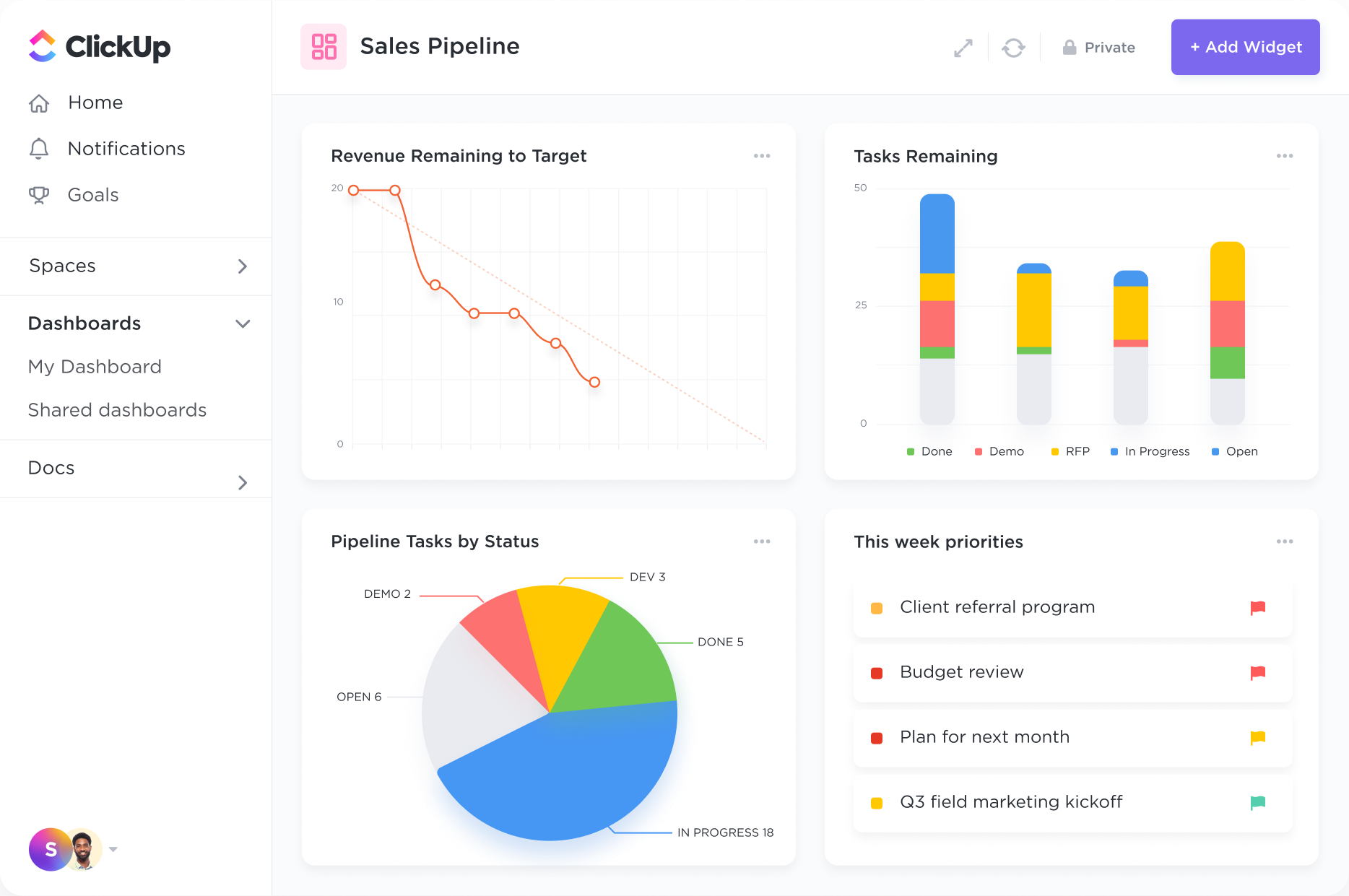

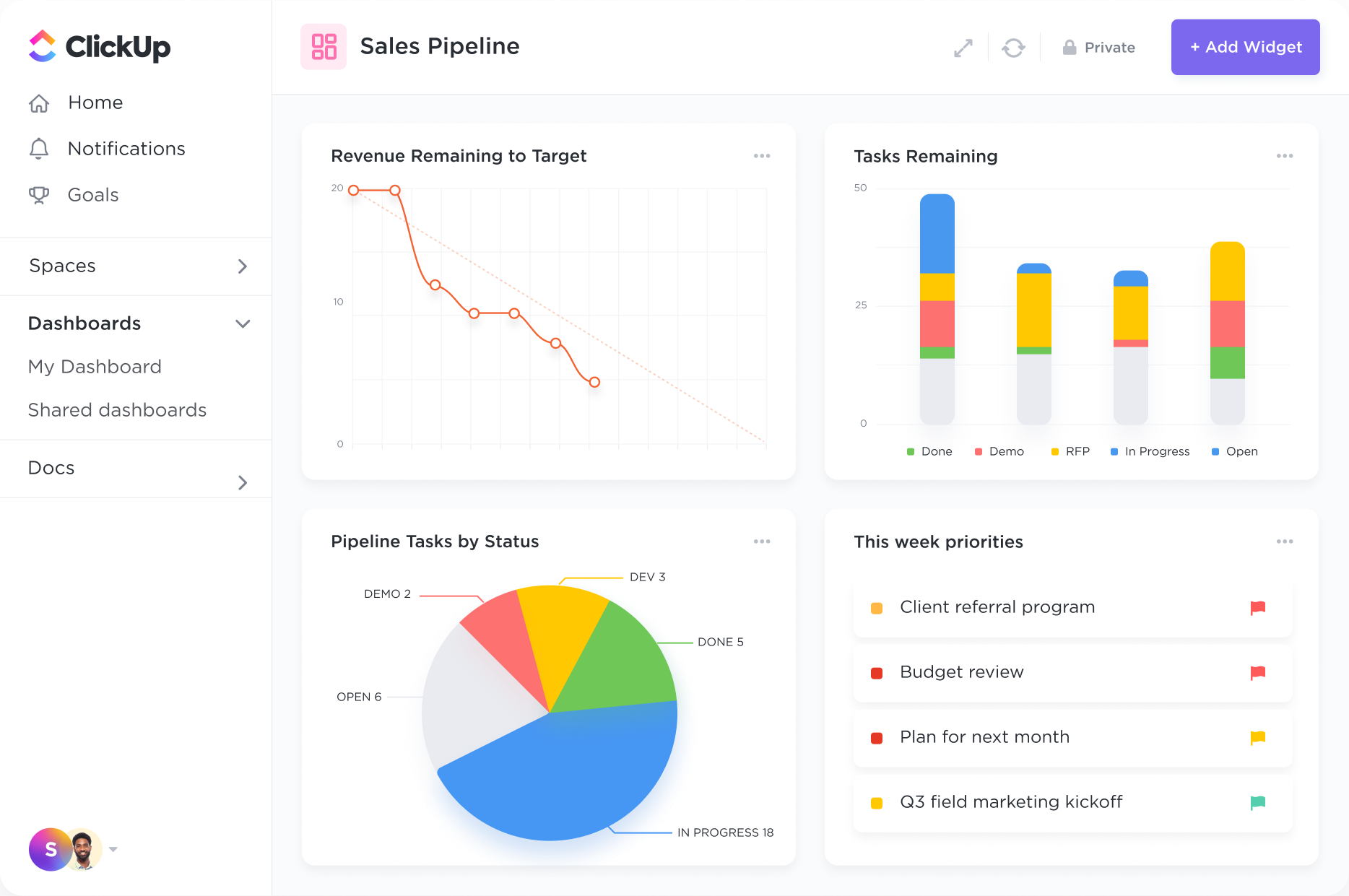

Create high-level views to monitor customer lifetime value, average deal sizes, and more. ClickUp's 50+ Dashboard widgets make it easy to visualize all of your customer data in one place.

Optimize client interactions, streamline workflow, and boost productivity with ClickUp's customizable CRM system specifically designed for Tax Professionals. Say goodbye to scattered data and missed opportunities as you centralize client information, track deadlines, and manage tasks effortlessly. Empower your team to deliver top-notch service and stay ahead of the competition with ClickUp's intuitive CRM platform.

Free forever.

No credit card.

Trusted by the world’s leading businesses

Create high-level views to monitor customer lifetime value, average deal sizes, and more. ClickUp's 50+ Dashboard widgets make it easy to visualize all of your customer data in one place.

Eliminate silos and fast-track communication by integrating your emails with ClickUp. Collaborate on deals, send project updates to clients, and onboard customers with a single email hub.

Key features of CRM software for tax professionals include client data organization, task and deadline management, document storage, communication tracking, and reporting capabilities. These features help tax professionals streamline client interactions, manage deadlines efficiently, store important documents securely, track all communication history, and generate insightful reports for better decision-making.

CRM software can help tax professionals by centralizing client information, tracking interactions, storing important documents, scheduling appointments, and sending reminders for key deadlines or follow-ups, enhancing client relationships and improving overall organization and efficiency.

Yes, CRM software can integrate with tax preparation software to streamline the tax filing process by allowing for easier data sharing, improved accuracy, and increased efficiency in managing client information for tax purposes.