Analyze data for customer insights.

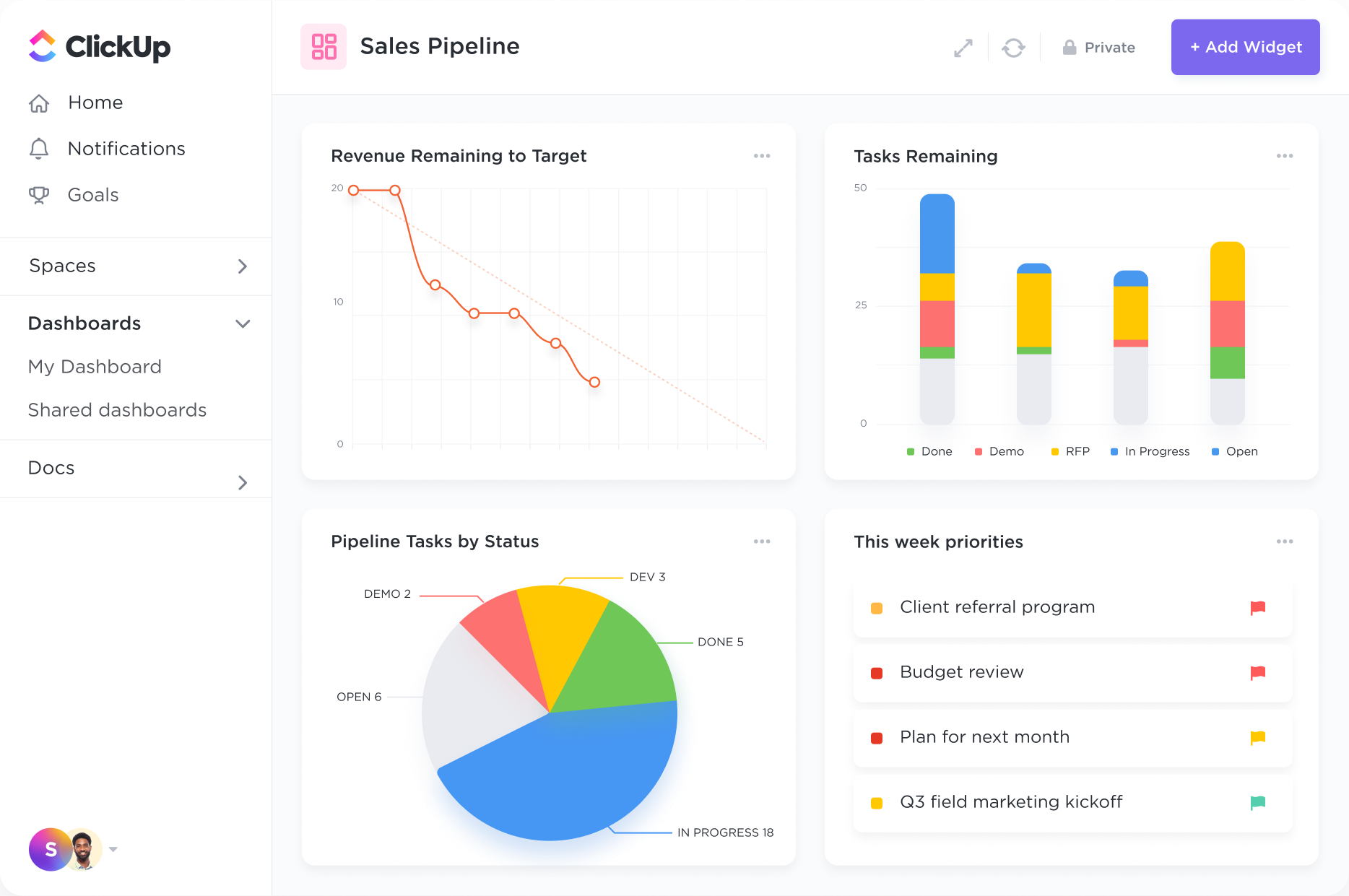

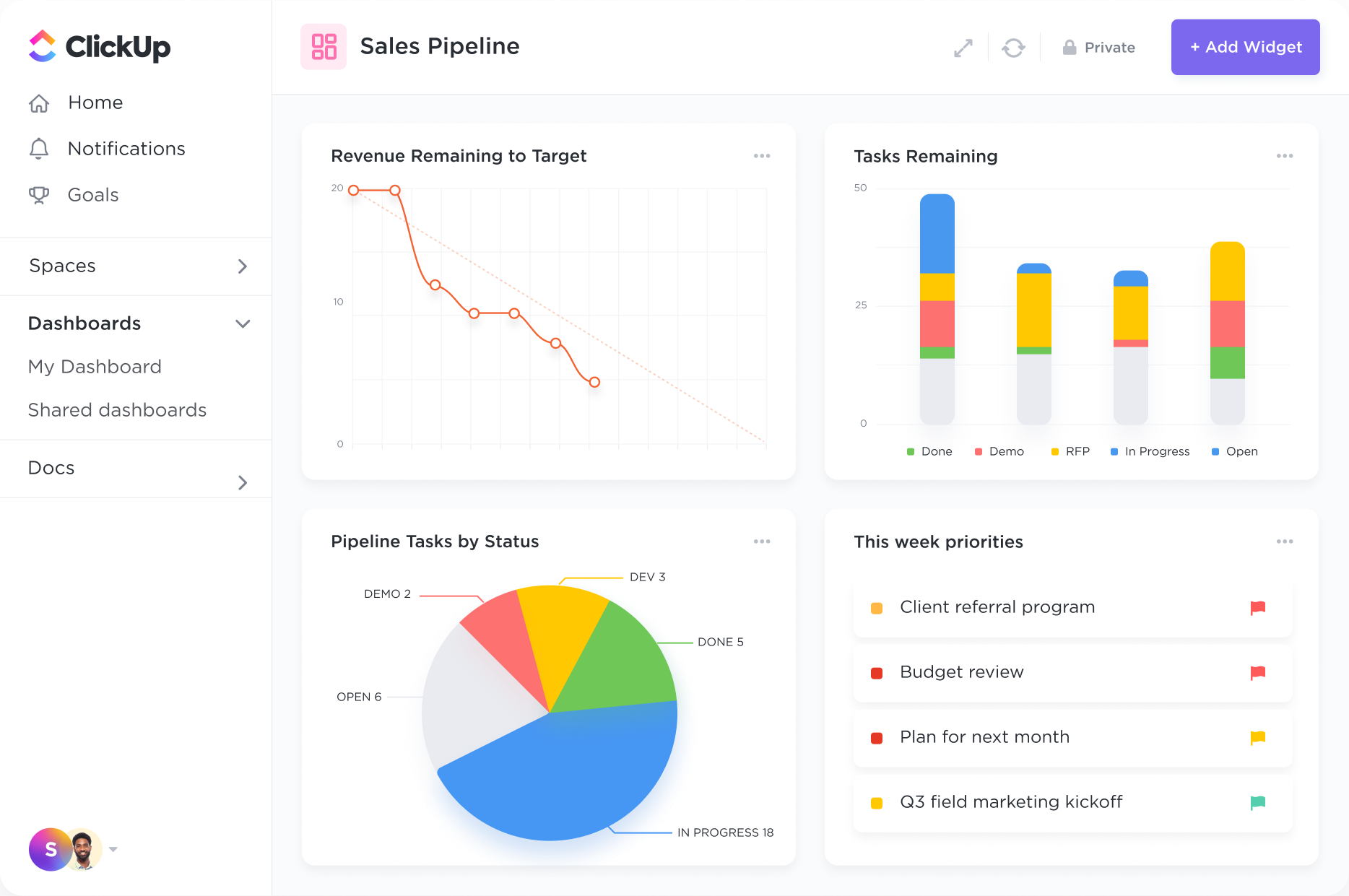

Create high-level views to monitor customer lifetime value, average deal sizes, and more. ClickUp's 50+ Dashboard widgets make it easy to visualize all of your customer data in one place.

Supercharge your Private Equity Firm with a customized CRM system powered by ClickUp. Streamline your deal flow, track investor communications, and optimize your fundraising efforts all in one place. Take your client relationships to the next level with ClickUp's intuitive platform designed specifically for Private Equity Firms.

Free forever.

No credit card.

Trusted by the world’s leading businesses

Create high-level views to monitor customer lifetime value, average deal sizes, and more. ClickUp's 50+ Dashboard widgets make it easy to visualize all of your customer data in one place.

Eliminate silos and fast-track communication by integrating your emails with ClickUp. Collaborate on deals, send project updates to clients, and onboard customers with a single email hub.

Private equity firms can use CRMs to efficiently manage their deal flow. This includes tracking potential investment opportunities, monitoring the progress of deals, and ensuring timely follow-ups with stakeholders. By centralizing all deal-related information in a CRM, firms can streamline their deal flow processes, prioritize high-potential opportunities, and ultimately make more informed investment decisions.

CRMs can also be instrumental in managing relationships with investors in private equity firms. By capturing and organizing investor information, communication history, and preferences, firms can personalize their interactions, provide timely updates on investments, and ensure compliance with regulatory requirements. Additionally, CRMs can help track fundraising efforts, investor commitments, and distributions, enhancing transparency and trust with investors.

Private equity firms can leverage CRMs to effectively manage their portfolio of investments. By maintaining a comprehensive database of portfolio companies, financial performance data, and key metrics, firms can track the performance of each investment, identify areas for value creation, and make strategic decisions to optimize portfolio returns. CRMs can also facilitate collaboration among team members working on different aspects of portfolio management, ensuring alignment and efficiency.

CRMs play a crucial role in streamlining the due diligence process for private equity firms. By storing due diligence documents, checklists, and timelines in a centralized CRM system, firms can ensure that all relevant information is easily accessible, track the progress of due diligence tasks, and meet critical deadlines. Moreover, CRMs can facilitate collaboration with external advisors, legal teams, and other stakeholders involved in the due diligence process, enhancing communication and coordination.

CRM software helps private equity firms by centralizing deal data, tracking interactions with potential targets, and providing analytics to prioritize leads. This streamlines deal sourcing, enhances due diligence by organizing information, and improves collaboration among team members, leading to more efficient decision-making.

Private equity firms should look for CRM software that offers robust deal pipeline management, investor relations tracking, fund performance analysis, secure data storage, document management, customizable reporting, integration with financial tools, and compliance management capabilities to effectively manage and grow their investments.

CRM software can assist private equity firms in enhancing investor relations and fundraising efforts by centralizing investor data, tracking interactions, and providing insights to tailor communication strategies, ultimately fostering stronger relationships and optimizing fundraising activities.