Build the perfect customer database.

Create your ideal system to store and analyze contacts, customers, and deals. Add links between tasks, documents, and more to easily track all your related work.

Optimize your customer relationships with ClickUp's CRM software customized for Mutual Fund Distributors. Streamline your sales process, track client interactions, and boost productivity with our user-friendly platform. Take your client management to the next level and grow your business efficiently with ClickUp's tailored CRM solution.

Free forever.

No credit card.

Trusted by the world’s leading businesses

Create your ideal system to store and analyze contacts, customers, and deals. Add links between tasks, documents, and more to easily track all your related work.

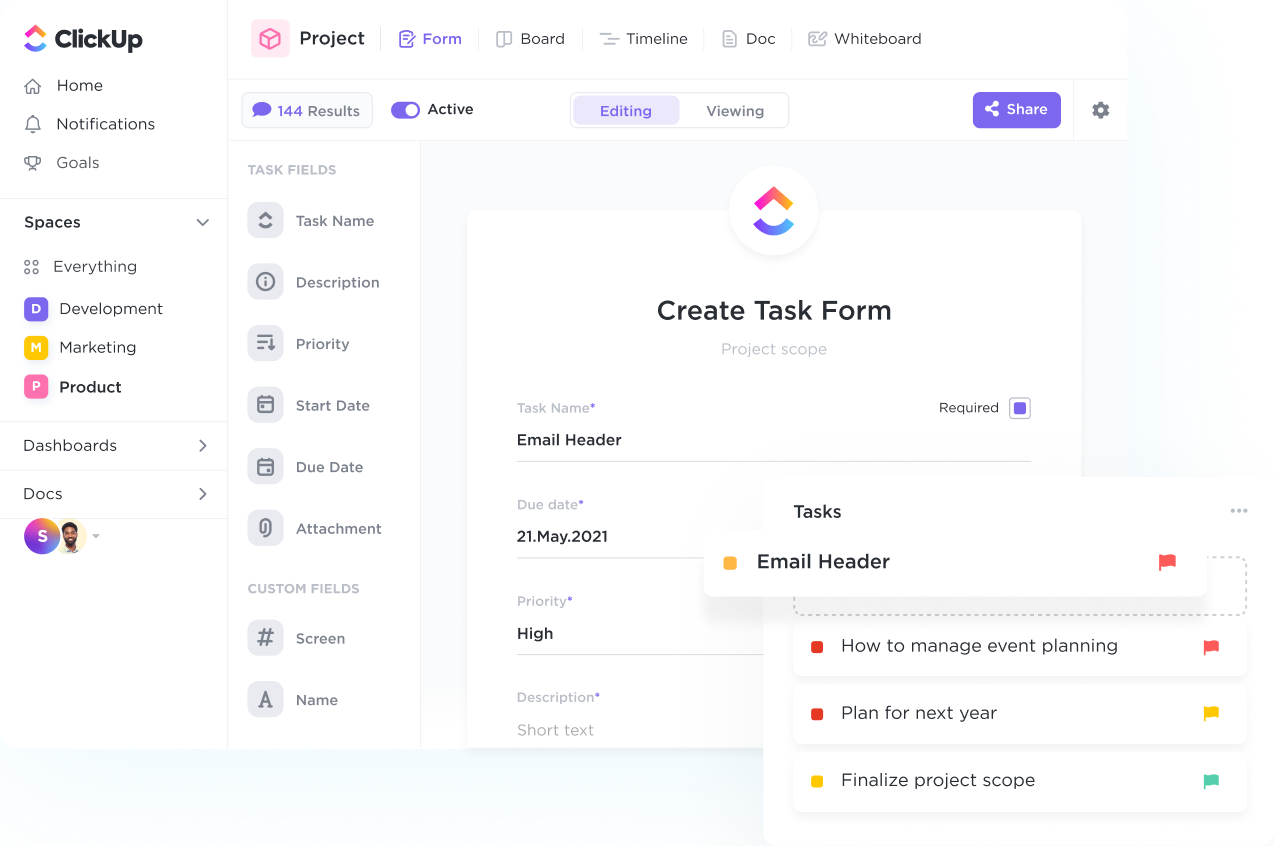

Streamline your intake process, organize response data, and automatically create tasks with custom branded Forms powered by conditional logic.

CRM software offers features such as contact management, lead tracking, activity reminders, client profiling, communication tracking, and reporting tools to help mutual fund distributors manage client relationships more effectively.

CRM software helps mutual fund distributors by centralizing client investment information, tracking performance data, providing insights into client behavior and preferences, enabling personalized investment recommendations, and facilitating efficient communication for better client service and retention.

Yes, CRM software can integrate with investment platforms and financial planning tools to streamline mutual fund distribution processes, enabling efficient data sharing, automated workflows, and improved client management for financial advisors and distributors.