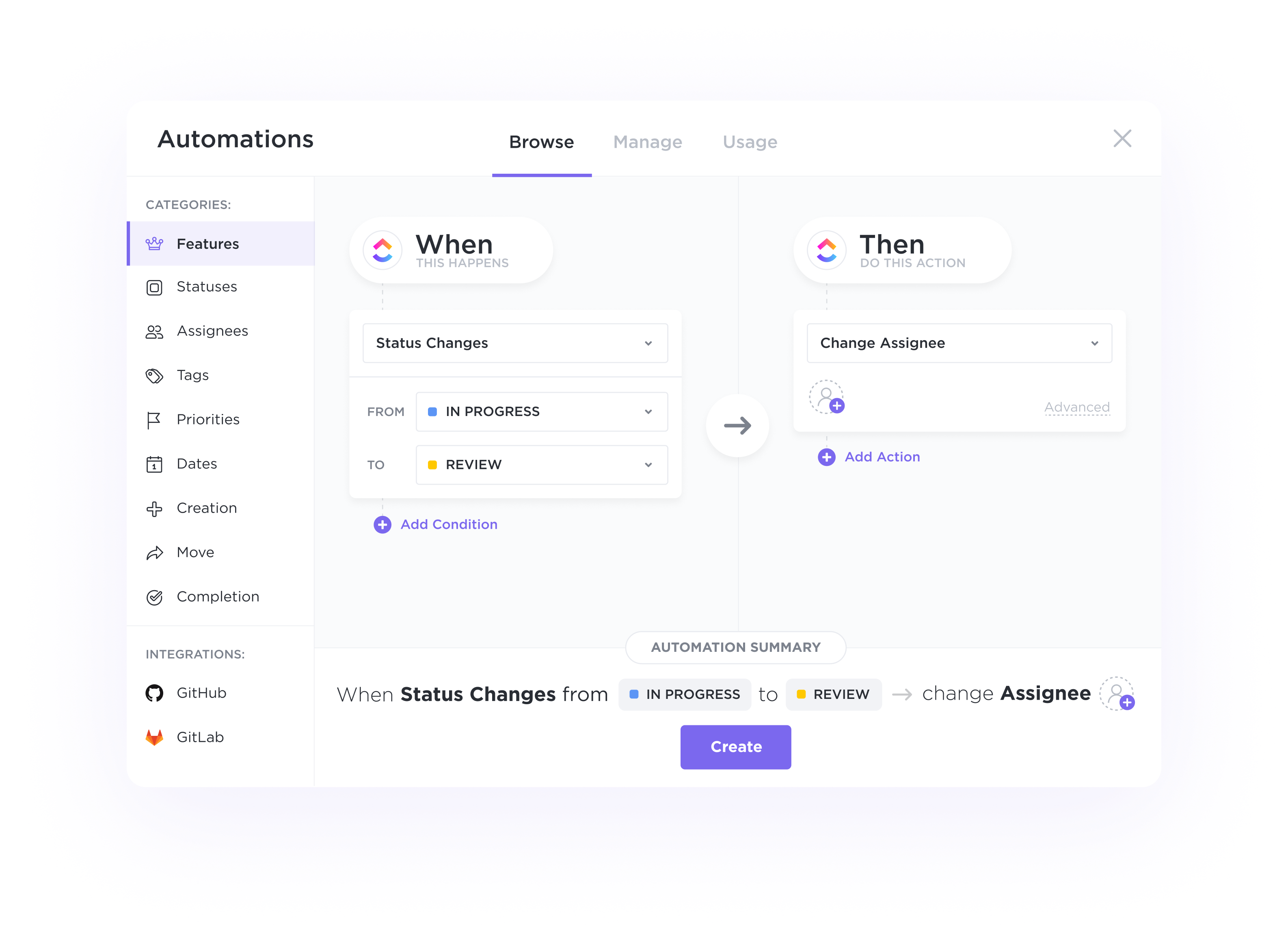

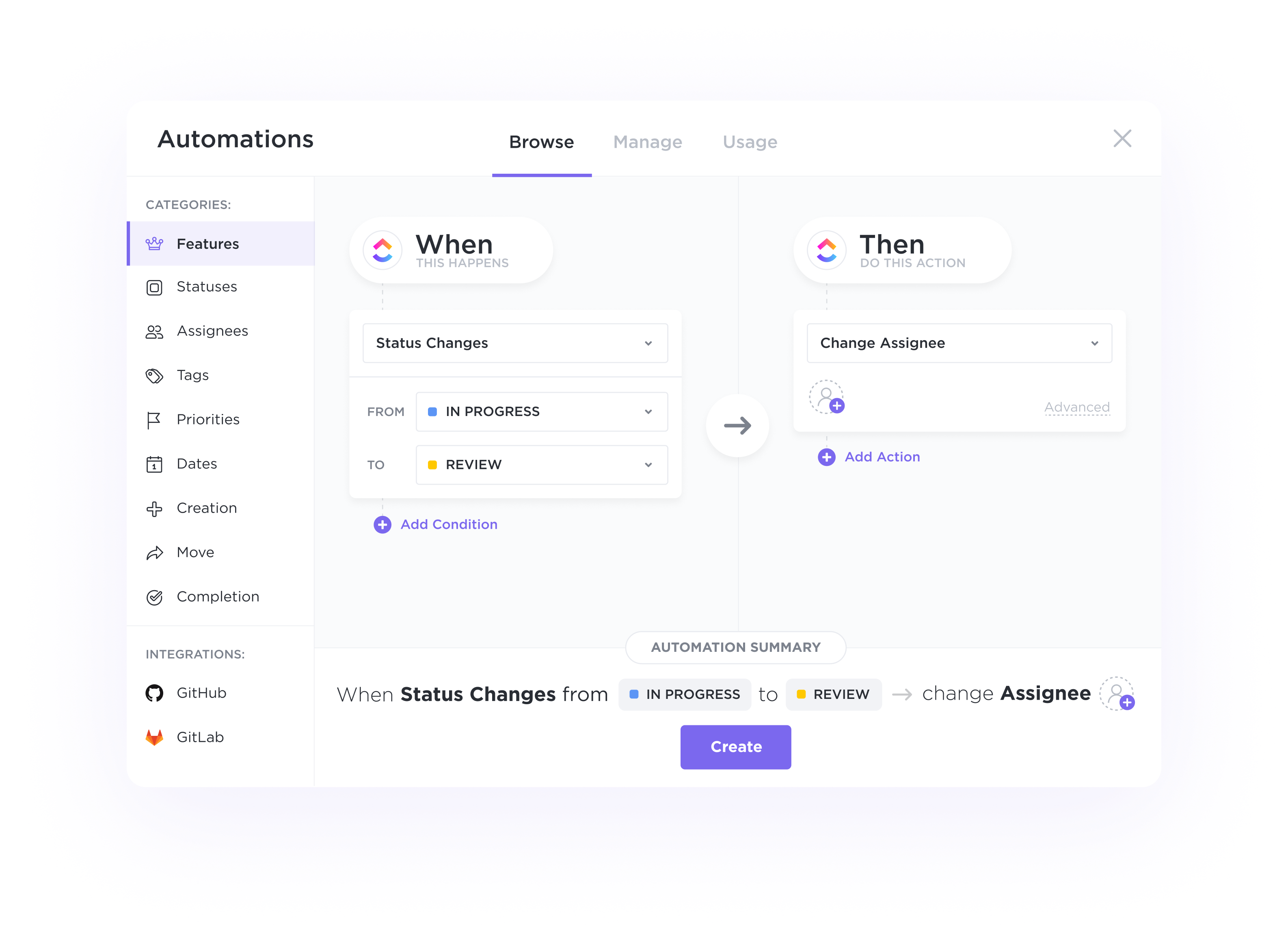

Automate handoffs, status updates, and more.

Automatically assign tasks for each stage of your pipeline, trigger status updates based on activity, and switch priorities to alert your team on where to focus next.

Streamline your loan officer workflow with a customized CRM system powered by ClickUp. Organize client information, track leads, and manage communications all in one place. Boost productivity and strengthen client relationships with our user-friendly platform designed specifically for loan officers. Try ClickUp now to revolutionize your CRM experience.

Free forever.

No credit card.

Trusted by the world’s leading businesses

Automatically assign tasks for each stage of your pipeline, trigger status updates based on activity, and switch priorities to alert your team on where to focus next.

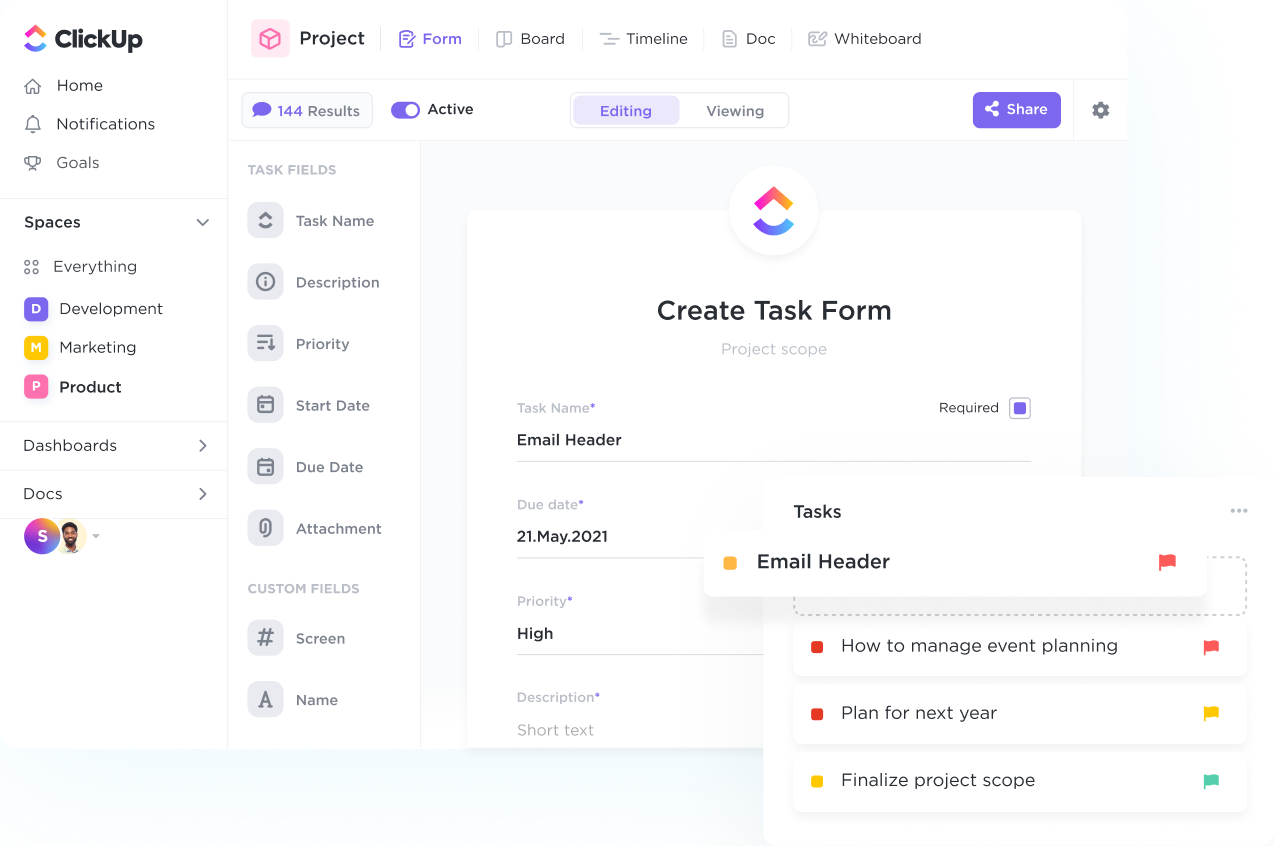

Streamline your intake process, organize response data, and automatically create tasks with custom branded Forms powered by conditional logic.

Loan officers can use CRMs to efficiently capture and track leads from various sources such as websites, referrals, and campaigns. By scoring leads based on criteria like credit score, income level, and loan amount, loan officers can prioritize their efforts on the most promising prospects. This helps in nurturing leads through the loan application process and ultimately closing deals faster.

CRMs provide loan officers with a visual representation of their pipeline, showing where each potential borrower stands in the loan approval process. This visual overview helps loan officers focus on hot leads, identify bottlenecks in the pipeline, and strategize on moving deals forward. By having a clear picture of the pipeline, loan officers can better forecast future loan approvals and optimize their sales efforts.

Using CRMs, loan officers can analyze customer behavior patterns, preferences, and interactions with the lending institution. By tracking metrics like loan application completion rates, customer satisfaction scores, and conversion rates, loan officers can gain valuable insights into customer needs and tailor their services accordingly. Real-time data visualization tools also enable loan officers to make informed decisions and drive business growth.

CRMs help loan officers maintain a centralized database of customer and prospect information, ensuring that all team members have access to up-to-date customer details. By logging interactions like loan inquiries, follow-ups, and loan approval statuses, loan officers can have a comprehensive view of the customer journey. Relationship mapping features in CRMs also assist in identifying key contacts within an account, facilitating personalized and targeted loan offerings.

Loan officers can streamline their loan approval processes by automating routine tasks such as sending follow-up emails, scheduling appointments, and generating loan documents. Alerts and notifications in CRMs ensure that critical activities like loan document submissions and regulatory compliance deadlines are not overlooked. By automating workflows, loan officers can improve efficiency, reduce errors, and provide a seamless borrowing experience for customers.

CRM software can help loan officers streamline their workflow and improve efficiency by centralizing customer information, automating repetitive tasks, providing reminders for follow-ups, and offering insights for better customer engagement and lead management.

Loan officers should look for CRM software with robust contact management capabilities, automated communication tools, lead tracking functionality, task and pipeline management features, integration with loan origination systems, and customizable reporting options to effectively manage client relationships.

Yes, CRM software for loan officers can integrate with other tools and systems commonly used in the mortgage industry, such as loan origination software and credit reporting agencies. This integration streamlines the loan application process, improves data accuracy, and enhances customer communication and relationship management.