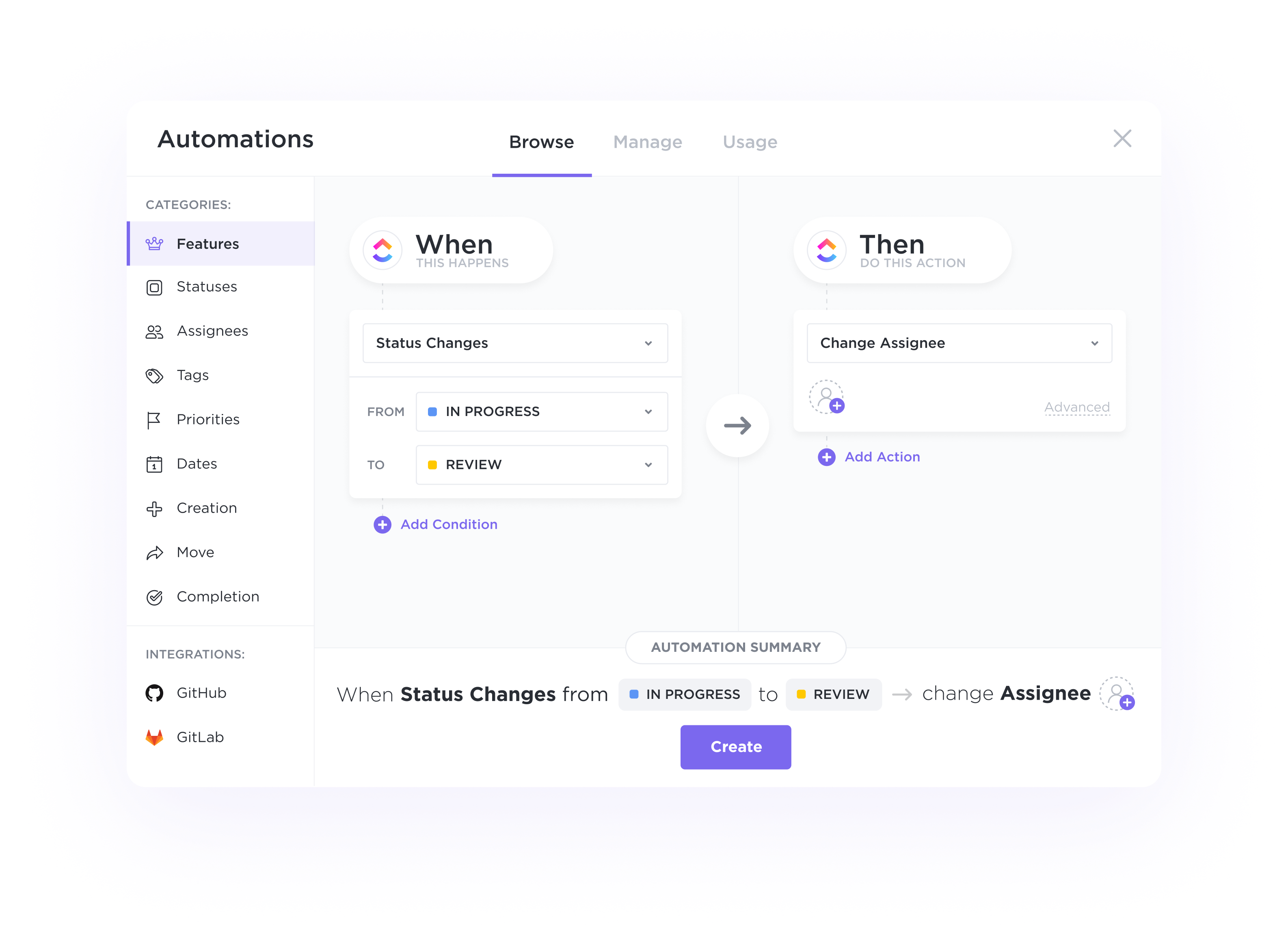

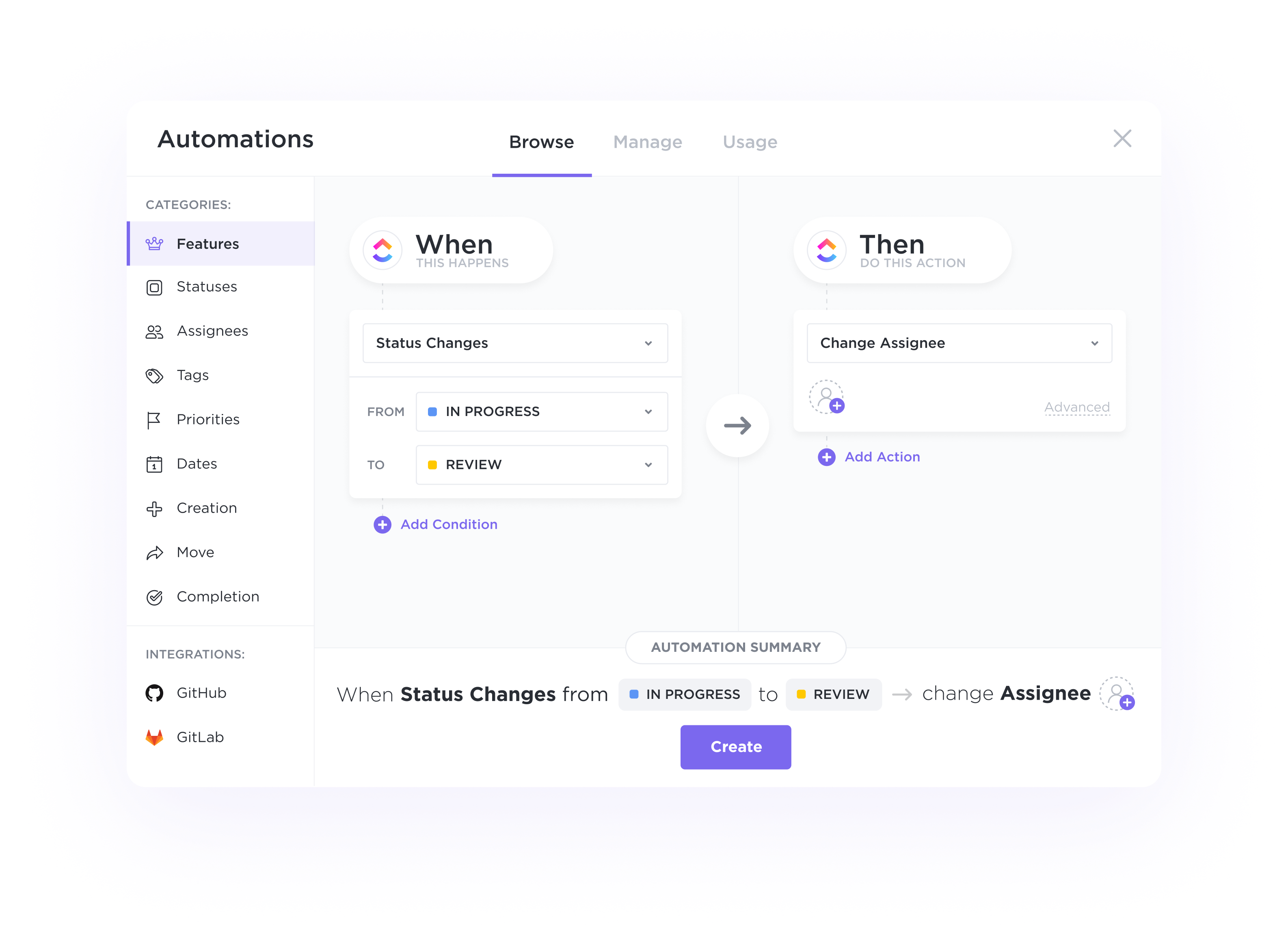

Automate handoffs, status updates, and more.

Automatically assign tasks for each stage of your pipeline, trigger status updates based on activity, and switch priorities to alert your team on where to focus next.

Supercharge your efficiency and boost your sales with our CRM software designed specifically for Life Insurance Agents. With ClickUp, you can streamline your client interactions, track leads effortlessly, and close deals faster than ever before. Say goodbye to scattered data and missed opportunities - revolutionize your workflow today!

Free forever.

No credit card.

Trusted by the world’s leading businesses

Automatically assign tasks for each stage of your pipeline, trigger status updates based on activity, and switch priorities to alert your team on where to focus next.

Manage everything from sales pipelines, customer engagement, and orders with ClickUp's 10+ highly flexible views. Easily track and manage your accounts on a List, Kanban Board, Table view, and more.

CRMs can assist life insurance agents in capturing leads from various sources, evaluating their potential based on specific criteria, and guiding them through the sales process.

By providing a visual representation of where potential sales are in the pipeline, CRMs help life insurance agents prioritize hot leads and focus on conversions, improving efficiency and sales outcomes.

Utilizing historical data, CRMs can predict future sales trends for life insurance agents, aiding in goal setting, resource allocation, and strategic planning.

CRMs enable life insurance agents to track and analyze customer behavior, preferences, and interactions, allowing for personalized and targeted marketing strategies to enhance customer satisfaction and retention.

With centralized databases, CRMs ensure that life insurance agents have access to up-to-date information on customers and prospects, facilitating personalized interactions and relationship building.

CRMs can automate routine tasks, such as sending renewal reminders or follow-up emails, streamlining processes for life insurance agents and enhancing productivity.

CRM software offers features such as lead management, policy tracking, automated follow-ups, customer communication history, and performance analytics, which can greatly benefit life insurance agents by improving lead generation, increasing customer retention, streamlining policy management, and providing insights for targeted marketing strategies.

CRM software can help life insurance agents streamline their lead management and follow-up process by organizing and prioritizing leads, automating follow-up tasks, tracking interactions, and providing insights for more personalized communication, ultimately increasing efficiency and closing rates.

Yes, some CRM software solutions are designed to integrate with life insurance carrier systems, allowing for real-time access to policy details and client information, enhancing efficiency and customer service in the insurance industry.