Onboard customers and collect info in a snap.

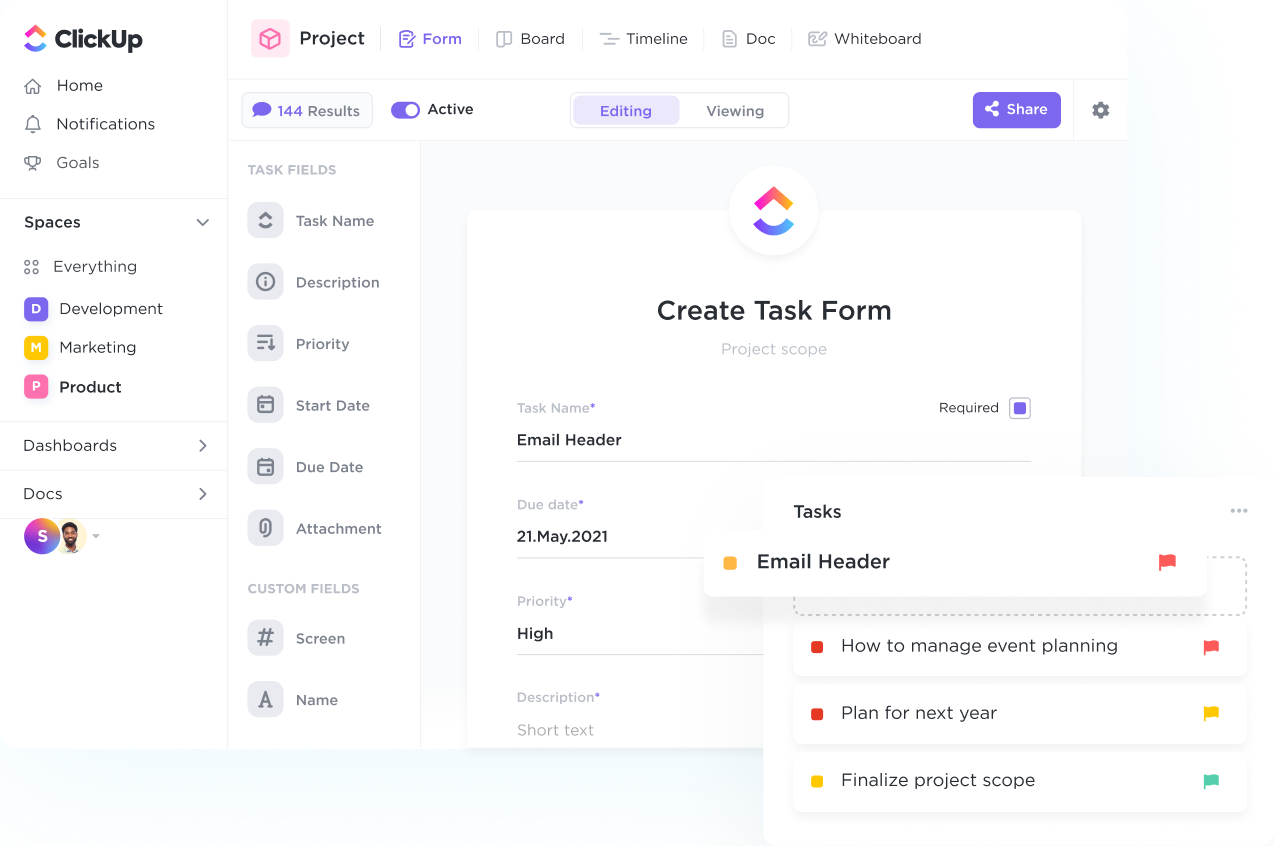

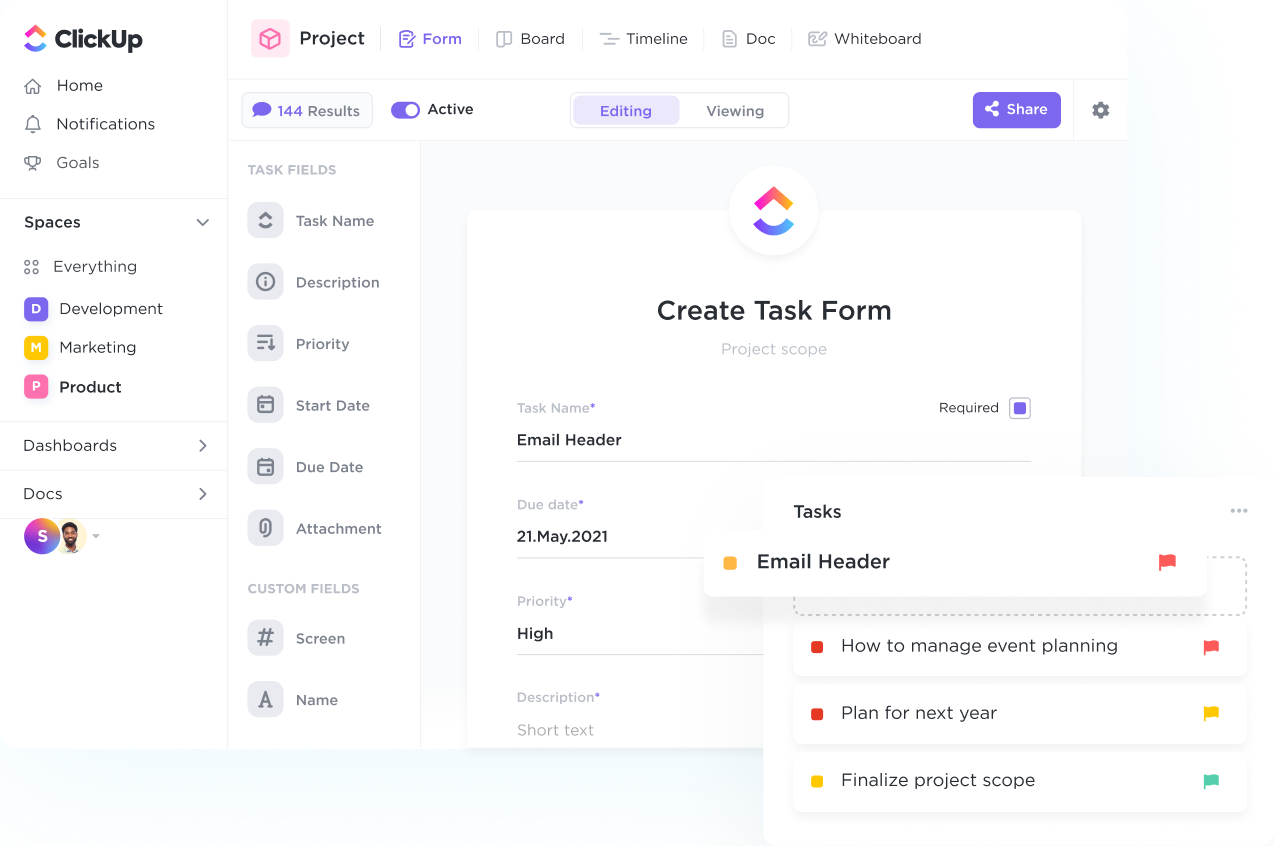

Streamline your intake process, organize response data, and automatically create tasks with custom branded Forms powered by conditional logic.

Streamline your client interactions and boost productivity with a customized CRM system designed for Investment Managers using ClickUp. Take control of your contacts, track interactions, and manage deals seamlessly all in one place. Elevate your customer relationships and drive growth by leveraging the power of ClickUp's intuitive platform tailored to meet your specific needs.

Free forever.

No credit card.

Trusted by the world’s leading businesses

Streamline your intake process, organize response data, and automatically create tasks with custom branded Forms powered by conditional logic.

Manage everything from sales pipelines, customer engagement, and orders with ClickUp's 10+ highly flexible views. Easily track and manage your accounts on a List, Kanban Board, Table view, and more.

CRM software offers features for investment managers like tracking client portfolios, managing investor relationships, monitoring market trends, and facilitating compliance with regulations.

CRM software can help investment managers streamline their client onboarding process by automating tasks, organizing client information in one central location, providing a structured workflow for onboarding steps, and enabling efficient communication with clients throughout the process.

Yes, CRM software can integrate with investment management tools and platforms to provide a comprehensive solution, allowing for centralized data management, streamlined workflows, and improved client communication and relationship management.